Capital

QFBvvS

QFBvvS

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ArthVeda <strong>Capital</strong> Fact Sheet<br />

Market Insights Sheet<br />

<strong>Capital</strong><br />

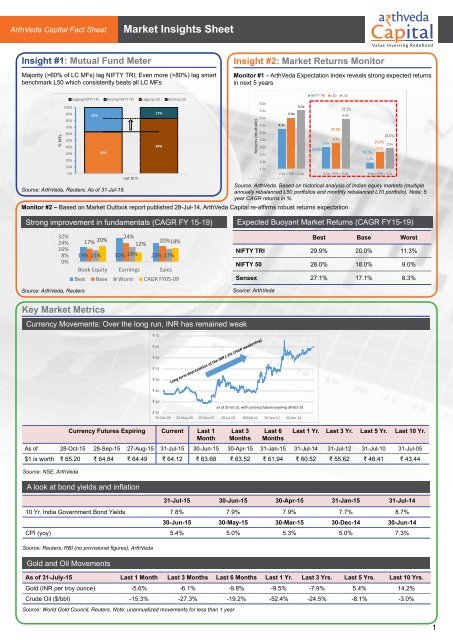

Insight #1: Mutual Fund Meter<br />

Majority (>60% of LC MFs) lag NIFTY TRI; Even more (>80%) lag smart<br />

benchmark L50 which consistently beats all LC MFs<br />

Insight #2: Market Returns Monitor<br />

Monitor #1 – ArthVeda Expectation Index reveals strong expected returns<br />

in next 5 years<br />

% MFs<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Lagging NIFTY TRI Beating NIFTY TRI Lagging L50 Beating L50<br />

37%<br />

63%<br />

17%<br />

83%<br />

1 Last 10 Yr.<br />

2<br />

Source: ArthVeda. Based on historical analysis of Indian equity markets (multiple<br />

Source: ArthVeda, Reuters. As of 31-Jul-15.<br />

annually rebalanced L50 portfolios and monthly rebalanced L10 portfolio). Note: 5<br />

year CAGR returns in %.<br />

Monitor #2 – Based on Market Outlook report published 28-Jul-14, ArthVeda <strong>Capital</strong> re-affirms robust returns expectation<br />

Returns (multiple)<br />

6.0x<br />

5.5x<br />

5.0x<br />

4.5x<br />

4.0x<br />

3.5x<br />

3.0x<br />

2.5x<br />

2.0x<br />

1.5x<br />

4.3x<br />

5.0x<br />

5.5x<br />

NIFTY TRI L50 L10<br />

24.6%<br />

27.0%<br />

3.3x<br />

3.0x<br />

37.5%<br />

4.9x<br />

21.6%<br />

2.9x<br />

2.7x<br />

14.1%<br />

1.9x<br />

24.0%<br />

2.0x < P/B < 2.5x 2.5x < P/B < 3.0x 3.0x < P/B < 3.5x<br />

Strong improvement in fundamentals (CAGR FY 15-19)<br />

Expected Buoyant Market Returns (CAGR FY15-19)<br />

32%<br />

24%<br />

16%<br />

8%<br />

0%<br />

17% 20%<br />

24%<br />

12%<br />

20% 18%<br />

19% 15% 30% 19% 23% 17%<br />

Book Equity Earnings Sales<br />

Best Base Worst CAGR FY05-09<br />

Best Base Worst<br />

NIFTY TRI 29.9% 20.0% 11.3%<br />

NIFTY 50 28.0% 18.0% 9.0%<br />

Sensex 27.1% 17.1% 8.3%<br />

Source: ArthVeda, Reuters<br />

Source: ArthVeda<br />

Key Market Metrics<br />

Currency Movements: Over the long run, INR has remained weak<br />

₹ 70<br />

₹ 65<br />

₹ 60<br />

₹ 55<br />

₹ 50<br />

₹ 45<br />

Source: NSE, ArthVeda<br />

Currency Futures Expiring Current Last 1<br />

Month<br />

A look at bond yields and inflation<br />

Source: Reuters, RBI (no provisional figures), ArthVeda<br />

Source: World Gold Council, Reuters. Note: unannualized movements for less than 1 year<br />

Last 3<br />

Months<br />

Last 6<br />

Months<br />

Last 1 Yr. Last 3 Yr. Last 5 Yr. Last 10 Yr.<br />

As of 28-Oct-15 28-Sep-15 27-Aug-15 31-Jul-15 30-Jun-15 30-Apr-15 31-Jan-15 31-Jul-14 31-Jul-12 31-Jul-10 31-Jul-05<br />

$1 is worth ₹ 65.20 ₹ 64.84 ₹ 64.49 ₹ 64.12 ₹ 63.68 ₹ 63.52 ₹ 61.94 ₹ 60.52 ₹ 55.62 ₹ 46.41 ₹ 43.44<br />

31-Jul-15 30-Jun-15 30-Apr-15 31-Jan-15 31-Jul-14<br />

10 Yr. India Government Bond Yields 7.8% 7.9% 7.9% 7.7% 8.7%<br />

30-Jun-15 30-May-15 30-Mar-15 30-Dec-14 30-Jun-14<br />

CPI (yoy) 5.4% 5.0% 5.3% 5.0% 7.3%<br />

Gold and Oil Movements<br />

₹ 40<br />

as of 31-Jul-15, with currency futures expiring 28-Oct-15<br />

₹ 35<br />

29-Oct-04 29-May-06 29-Dec-07 29-Jul-09 28-Feb-11 30-Sep-12 30-Apr-14<br />

As of 31-July-15 Last 1 Month Last 3 Months Last 6 Months Last 1 Yr. Last 3 Yrs. Last 5 Yrs. Last 10 Yrs.<br />

Gold (INR per troy ounce) -5.6% -6.1% -9.8% -9.5% -7.9% 5.4% 14.2%<br />

Crude Oil ($/bbl) -15.3% -27.3% -19.2% -52.4% -24.5% -8.1% -3.0%<br />

1