DIGEST

DIGEST Issue - 01 October 2013 - DSG

DIGEST Issue - 01 October 2013 - DSG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

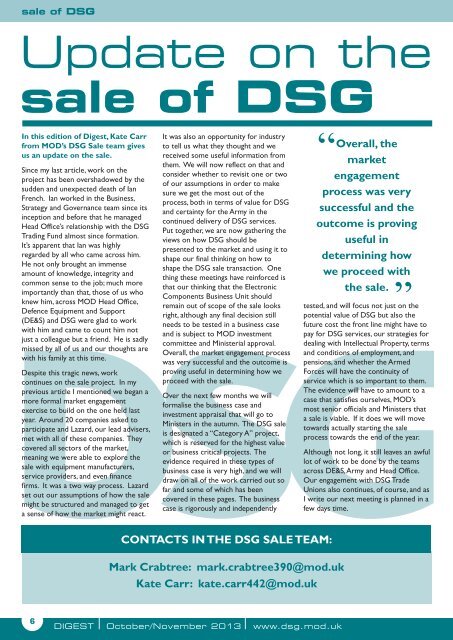

sale of DSG<br />

Update on the<br />

sale of DSG<br />

In this edition of Digest, Kate Carr<br />

from MOD’s DSG Sale team gives<br />

us an update on the sale.<br />

Since my last article, work on the<br />

project has been overshadowed by the<br />

sudden and unexpected death of Ian<br />

French. Ian worked in the Business,<br />

Strategy and Governance team since its<br />

inception and before that he managed<br />

Head Office’s relationship with the DSG<br />

Trading Fund almost since formation.<br />

It’s apparent that Ian was highly<br />

regarded by all who came across him.<br />

He not only brought an immense<br />

amount of knowledge, integrity and<br />

common sense to the job; much more<br />

importantly than that, those of us who<br />

knew him, across MOD Head Office,<br />

Defence Equipment and Support<br />

(DE&S) and DSG were glad to work<br />

with him and came to count him not<br />

just a colleague but a friend. He is sadly<br />

missed by all of us and our thoughts are<br />

with his family at this time.<br />

Despite this tragic news, work<br />

continues on the sale project. In my<br />

previous article I mentioned we began a<br />

more formal market engagement<br />

exercise to build on the one held last<br />

year. Around 20 companies asked to<br />

participate and Lazard, our lead advisers,<br />

met with all of these companies. They<br />

covered all sectors of the market,<br />

meaning we were able to explore the<br />

sale with equipment manufacturers,<br />

service providers, and even finance<br />

firms. It was a two way process. Lazard<br />

set out our assumptions of how the sale<br />

might be structured and managed to get<br />

a sense of how the market might react.<br />

It was also an opportunity for industry<br />

to tell us what they thought and we<br />

received some useful information from<br />

them. We will now reflect on that and<br />

consider whether to revisit one or two<br />

of our assumptions in order to make<br />

sure we get the most out of the<br />

process, both in terms of value for DSG<br />

and certainty for the Army in the<br />

continued delivery of DSG services.<br />

Put together, we are now gathering the<br />

views on how DSG should be<br />

presented to the market and using it to<br />

shape our final thinking on how to<br />

shape the DSG sale transaction. One<br />

thing these meetings have reinforced is<br />

that our thinking that the Electronic<br />

Components Business Unit should<br />

remain out of scope of the sale looks<br />

right, although any final decision still<br />

needs to be tested in a business case<br />

and is subject to MOD investment<br />

committee and Ministerial approval.<br />

Overall, the market engagement process<br />

was very successful and the outcome is<br />

proving useful in determining how we<br />

proceed with the sale.<br />

Over the next few months we will<br />

formalise the business case and<br />

investment appraisal that will go to<br />

Ministers in the autumn. The DSG sale<br />

is designated a “Category A” project,<br />

which is reserved for the highest value<br />

or business critical projects. The<br />

evidence required in these types of<br />

business case is very high, and we will<br />

draw on all of the work carried out so<br />

far and some of which has been<br />

covered in these pages. The business<br />

case is rigorously and independently<br />

“<br />

Overall, the<br />

market<br />

engagement<br />

process was very<br />

successful and the<br />

outcome is proving<br />

useful in<br />

determining how<br />

we proceed with<br />

the sale.<br />

”<br />

tested, and will focus not just on the<br />

potential value of DSG but also the<br />

future cost the front line might have to<br />

pay for DSG services, our strategies for<br />

dealing with Intellectual Property, terms<br />

and conditions of employment, and<br />

pensions, and whether the Armed<br />

Forces will have the continuity of<br />

service which is so important to them.<br />

The evidence will have to amount to a<br />

case that satisfies ourselves, MOD’s<br />

most senior officials and Ministers that<br />

a sale is viable. If it does we will move<br />

towards actually starting the sale<br />

process towards the end of the year.<br />

Although not long, it still leaves an awful<br />

lot of work to be done by the teams<br />

across DE&S, Army and Head Office.<br />

Our engagement with DSG Trade<br />

Unions also continues, of course, and as<br />

I write our next meeting is planned in a<br />

few days time.<br />

CONTACTS IN THE DSG SALE TEAM:<br />

Mark Crabtree: mark.crabtree390@mod.uk<br />

Kate Carr: kate.carr442@mod.uk<br />

6<br />

<strong>DIGEST</strong> October/November 2013 www.dsg.mod.uk