International

gaining altitude is a steep and rapid climb requiring decisive action ...

gaining altitude is a steep and rapid climb requiring decisive action ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

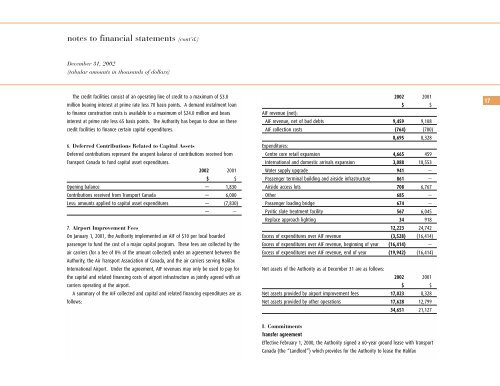

notes to financial statements (cont’d.)<br />

December 31, 2002<br />

(tabular amounts in thousands of dollars)<br />

The credit facilities consist of an operating line of credit to a maximum of $3.0<br />

million bearing interest at prime rate less 70 basis points. A demand instalment loan<br />

to finance construction costs is available to a maximum of $24.0 million and bears<br />

interest at prime rate less 65 basis points. The Authority has begun to draw on these<br />

credit facilities to finance certain capital expenditures.<br />

6. Deferred Contributions Related to Capital Assets<br />

Deferred contributions represent the unspent balance of contributions received from<br />

Transport Canada to fund capital asset expenditures.<br />

2002 2001<br />

$ $<br />

Opening balance — 1,830<br />

Contributions received from Transport Canada — 6,000<br />

Less: amounts applied to capital asset expenditures — (7,830)<br />

— —<br />

7. Airport Improvement Fees<br />

On January 1, 2001, the Authority implemented an AIF of $10 per local boarded<br />

passenger to fund the cost of a major capital program. These fees are collected by the<br />

air carriers (for a fee of 8% of the amount collected) under an agreement between the<br />

Authority, the Air Transport Association of Canada, and the air carriers serving Halifax<br />

<strong>International</strong> Airport. Under the agreement, AIF revenues may only be used to pay for<br />

the capital and related financing costs of airport infrastructure as jointly agreed with air<br />

carriers operating at the airport.<br />

A summary of the AIF collected and capital and related financing expenditures are as<br />

follows:<br />

2002 2001<br />

$ $<br />

AIF revenue (net):<br />

AIF revenue, net of bad debts 9,459 9,108<br />

AIF collection costs (764) (780)<br />

8,695 8,328<br />

Expenditures:<br />

Centre core retail expansion 4,665 459<br />

<strong>International</strong> and domestic arrivals expansion 3,088 10,553<br />

Water supply upgrade 941 —<br />

Passenger terminal building and airside infrastructure 861 —<br />

Airside access lots 708 6,767<br />

Other 685 —<br />

Passenger loading bridge 674 —<br />

Pyritic slate treatment facility 567 6,045<br />

Replace approach lighting 34 918<br />

12,223 24,742<br />

Excess of expenditures over AIF revenue (3,528) (16,414)<br />

Excess of expenditures over AIF revenue, beginning of year (16,414) —<br />

Excess of expenditures over AIF revenue, end of year (19,942) (16,414)<br />

Net assets of the Authority as at December 31 are as follows:<br />

2002 2001<br />

$ $<br />

Net assets provided by airport improvement fees 17,023 8,328<br />

Net assets provided by other operations 17,628 12,799<br />

34,651 21,127<br />

17<br />

8. Commitments<br />

Transfer agreement<br />

Effective February 1, 2000, the Authority signed a 60-year ground lease with Transport<br />

Canada (the “Landlord”) which provides for the Authority to lease the Halifax