the global financial crisis: can islamic finance help? - Institute of ...

the global financial crisis: can islamic finance help? - Institute of ...

the global financial crisis: can islamic finance help? - Institute of ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NEWHORIZON Muharrum–Rabi Al Awwal 1430<br />

ANALYSIS<br />

Naveen Raza, head <strong>of</strong> Islamic <strong>finance</strong> at<br />

Cru Investment Management. These are<br />

also <strong>the</strong> objectives <strong>of</strong> <strong>the</strong> ethical and socially<br />

responsible investment movement in <strong>the</strong><br />

conventional world. Raza is looking to<br />

promote <strong>the</strong> synergies between <strong>the</strong> two<br />

banking models, saying: ‘I think <strong>the</strong> future<br />

<strong>of</strong> Islamic <strong>finance</strong> lies in <strong>the</strong> overlap between<br />

Islamic and ethical investing. If we<br />

want our industry to grow <strong>the</strong>n we need<br />

to start tapping into an audience which<br />

goes beyond <strong>the</strong> borders <strong>of</strong> <strong>the</strong> Islamic<br />

world.’<br />

Mufti Mohammed Zubair Butt, chairman<br />

<strong>of</strong> <strong>the</strong> Al Qalam Shari’ah Scholars Panel,<br />

<strong>the</strong> first ever UK-based panel <strong>of</strong> Shari’ah<br />

scholars, agrees, saying: ‘Islamic <strong>finance</strong> is<br />

socially responsible <strong>finance</strong>. It is designed<br />

to come to <strong>the</strong> market and promote <strong>the</strong><br />

public interest.’ He thinks <strong>the</strong>re are some<br />

things in common between <strong>the</strong> understanding<br />

<strong>of</strong> ethical <strong>finance</strong> and Islamic <strong>finance</strong>,<br />

for example, both forms avoid investment<br />

in gambling, prostitution and alcohol. ‘But<br />

<strong>the</strong> main difference, <strong>of</strong> course, is <strong>the</strong> Islamic<br />

prohibition on interest-based transactions<br />

and interest-based <strong>finance</strong>. As far as conventional<br />

ethical schemes are concerned this<br />

doesn’t even register.’ The effect <strong>of</strong> interestbased<br />

lending, Butt thinks, ‘is that conventional<br />

banks gear <strong>the</strong>ir project financing<br />

decisions on <strong>the</strong> creditworthiness <strong>of</strong> <strong>the</strong><br />

borrower, as opposed to Islamic banking<br />

where <strong>the</strong> viability <strong>of</strong> <strong>the</strong> project is <strong>the</strong><br />

main concern because <strong>the</strong> bank itself is a<br />

partner’. The outcome is that <strong>the</strong> Islamic<br />

system must exclude investing in interestbased<br />

products or companies that deal<br />

with <strong>the</strong>m such as banks and <strong>finance</strong><br />

companies.<br />

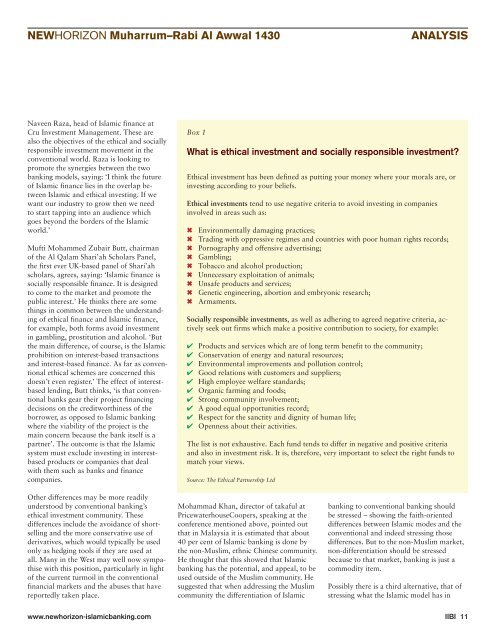

Box 1<br />

What is ethical investment and socially responsible investment?<br />

Ethical investment has been defined as putting your money where your morals are, or<br />

investing according to your beliefs.<br />

Ethical investments tend to use negative criteria to avoid investing in companies<br />

involved in areas such as:<br />

✖<br />

✖<br />

✖<br />

✖<br />

✖<br />

✖<br />

✖<br />

✖<br />

✖<br />

Environmentally damaging practices;<br />

Trading with oppressive regimes and countries with poor human rights records;<br />

Pornography and <strong>of</strong>fensive advertising;<br />

Gambling;<br />

Tobacco and alcohol production;<br />

Unnecessary exploitation <strong>of</strong> animals;<br />

Unsafe products and services;<br />

Genetic engineering, abortion and embryonic research;<br />

Armaments.<br />

Socially responsible investments, as well as adhering to agreed negative criteria, actively<br />

seek out firms which make a positive contribution to society, for example:<br />

✔ Products and services which are <strong>of</strong> long term benefit to <strong>the</strong> community;<br />

✔ Conservation <strong>of</strong> energy and natural resources;<br />

✔ Environmental improvements and pollution control;<br />

✔ Good relations with customers and suppliers;<br />

✔ High employee welfare standards;<br />

✔ Organic farming and foods;<br />

✔ Strong community involvement;<br />

✔ A good equal opportunities record;<br />

✔ Respect for <strong>the</strong> sanctity and dignity <strong>of</strong> human life;<br />

✔ Openness about <strong>the</strong>ir activities.<br />

The list is not exhaustive. Each fund tends to differ in negative and positive criteria<br />

and also in investment risk. It is, <strong>the</strong>refore, very important to select <strong>the</strong> right funds to<br />

match your views.<br />

Source: The Ethical Partnership Ltd<br />

O<strong>the</strong>r differences may be more readily<br />

understood by conventional banking’s<br />

ethical investment community. These<br />

differences include <strong>the</strong> avoidance <strong>of</strong> shortselling<br />

and <strong>the</strong> more conservative use <strong>of</strong><br />

derivatives, which would typically be used<br />

only as hedging tools if <strong>the</strong>y are used at<br />

all. Many in <strong>the</strong> West may well now sympathise<br />

with this position, particularly in light<br />

<strong>of</strong> <strong>the</strong> current turmoil in <strong>the</strong> conventional<br />

<strong>financial</strong> markets and <strong>the</strong> abuses that have<br />

reportedly taken place.<br />

Mohammad Khan, director <strong>of</strong> takaful at<br />

PricewaterhouseCoopers, speaking at <strong>the</strong><br />

conference mentioned above, pointed out<br />

that in Malaysia it is estimated that about<br />

40 per cent <strong>of</strong> Islamic banking is done by<br />

<strong>the</strong> non-Muslim, ethnic Chinese community.<br />

He thought that this showed that Islamic<br />

banking has <strong>the</strong> potential, and appeal, to be<br />

used outside <strong>of</strong> <strong>the</strong> Muslim community. He<br />

suggested that when addressing <strong>the</strong> Muslim<br />

community <strong>the</strong> differentiation <strong>of</strong> Islamic<br />

banking to conventional banking should<br />

be stressed – showing <strong>the</strong> faith-oriented<br />

differences between Islamic modes and <strong>the</strong><br />

conventional and indeed stressing those<br />

differences. But to <strong>the</strong> non-Muslim market,<br />

non-differentiation should be stressed<br />

because to that market, banking is just a<br />

commodity item.<br />

Possibly <strong>the</strong>re is a third alternative, that <strong>of</strong><br />

stressing what <strong>the</strong> Islamic model has in<br />

www.newhorizon-<strong>islamic</strong>banking.com IIBI 11