the global financial crisis: can islamic finance help? - Institute of ...

the global financial crisis: can islamic finance help? - Institute of ...

the global financial crisis: can islamic finance help? - Institute of ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANALYSIS<br />

NEWHORIZON January–March 2009<br />

Balance sheet analysis:<br />

Islamic vs. conventional<br />

Hennie van Greuning (left) and Zamir Iqbal (right), senior advisor and lead investment <strong>of</strong>ficer<br />

respectively at The World Bank Treasury in <strong>the</strong> US, and <strong>the</strong> authors <strong>of</strong> ‘Risk Analysis for Islamic<br />

Banks’, compare <strong>the</strong> balance sheet structures <strong>of</strong> Islamic banks and <strong>the</strong>ir conventional counterparts.<br />

The goal <strong>of</strong> <strong>financial</strong> risk management<br />

is to maximise <strong>the</strong> value <strong>of</strong> a <strong>financial</strong> institution<br />

as determined by its level <strong>of</strong> pr<strong>of</strong>itability<br />

and risk. Since risk is inherent in<br />

banking and unavoidable, <strong>the</strong> task <strong>of</strong> <strong>the</strong><br />

risk manager is to manage <strong>the</strong> different<br />

types <strong>of</strong> risk at acceptable levels to achieve<br />

optimal pr<strong>of</strong>itability. Doing so requires <strong>the</strong><br />

continual identification, quantification,<br />

and monitoring <strong>of</strong> risk exposures, which<br />

in turn demands sound policies, adequate<br />

organisation, efficient processes, skilled<br />

analysts and elaborate computerised information<br />

systems. In addition, risk management<br />

requires <strong>the</strong> capacity to anticipate<br />

changes and to act in such a way that a<br />

bank’s business <strong>can</strong> be structured and<br />

restructured to pr<strong>of</strong>it from <strong>the</strong> changes<br />

or at least to minimise losses. Regulatory<br />

authorities should not prescribe how<br />

business is conducted; instead, <strong>the</strong>y should<br />

maintain prudent oversight <strong>of</strong> a bank by<br />

evaluating <strong>the</strong> risk composition <strong>of</strong> its assets<br />

and by insisting that an adequate amount<br />

<strong>of</strong> capital and reserves is available to safeguard<br />

solvency.<br />

Although <strong>the</strong> approaches to risk management<br />

are diverse, a good starting point is<br />

to undertake a top-down approach starting<br />

with <strong>the</strong> balance sheet. One <strong>can</strong>not underestimate<br />

<strong>the</strong> importance <strong>of</strong> understanding <strong>the</strong><br />

structure and composition <strong>of</strong> <strong>the</strong> balance<br />

sheet <strong>of</strong> a <strong>financial</strong> institution.<br />

It is critical to assess <strong>the</strong> ways in which a<br />

bank’s risk managers and analysts <strong>can</strong><br />

analyse <strong>the</strong> structure <strong>of</strong> balance sheets and<br />

income statements, as well as individual<br />

balance sheet items with specific risk aspects<br />

so that <strong>the</strong> interaction between various<br />

types <strong>of</strong> risk is understood to ensure that<br />

<strong>the</strong>y are not evaluated in isolation. The<br />

relative share <strong>of</strong> various balance sheet<br />

components – assets and liabilities – is a<br />

good indication <strong>of</strong> <strong>the</strong> levels and types <strong>of</strong><br />

risk to which a bank is exposed.<br />

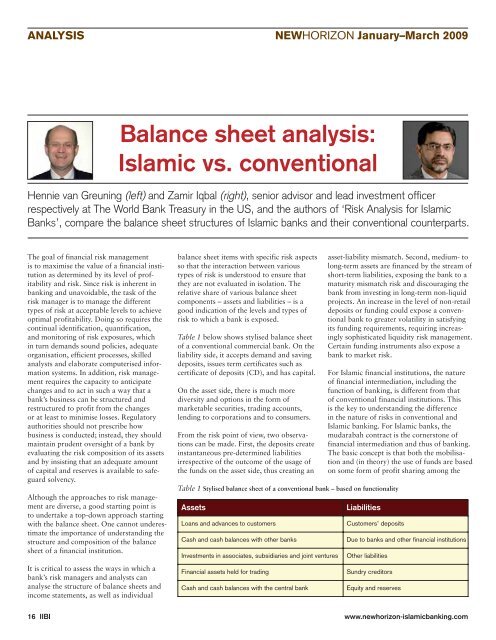

Table 1 below shows stylised balance sheet<br />

<strong>of</strong> a conventional commercial bank. On <strong>the</strong><br />

liability side, it accepts demand and saving<br />

deposits, issues term certificates such as<br />

certificate <strong>of</strong> deposits (CD), and has capital.<br />

On <strong>the</strong> asset side, <strong>the</strong>re is much more<br />

diversity and options in <strong>the</strong> form <strong>of</strong><br />

marketable securities, trading accounts,<br />

lending to corporations and to consumers.<br />

From <strong>the</strong> risk point <strong>of</strong> view, two observations<br />

<strong>can</strong> be made. First, <strong>the</strong> deposits create<br />

instantaneous pre-determined liabilities<br />

irrespective <strong>of</strong> <strong>the</strong> outcome <strong>of</strong> <strong>the</strong> usage <strong>of</strong><br />

<strong>the</strong> funds on <strong>the</strong> asset side, thus creating an<br />

asset-liability mismatch. Second, medium- to<br />

long-term assets are <strong>finance</strong>d by <strong>the</strong> stream <strong>of</strong><br />

short-term liabilities, exposing <strong>the</strong> bank to a<br />

maturity mismatch risk and discouraging <strong>the</strong><br />

bank from investing in long-term non-liquid<br />

projects. An increase in <strong>the</strong> level <strong>of</strong> non-retail<br />

deposits or funding could expose a conventional<br />

bank to greater volatility in satisfying<br />

its funding requirements, requiring increasingly<br />

sophisticated liquidity risk management.<br />

Certain funding instruments also expose a<br />

bank to market risk.<br />

Table 1 Stylised balance sheet <strong>of</strong> a conventional bank – based on functionality<br />

Assets<br />

Loans and advances to customers<br />

Cash and cash balances with o<strong>the</strong>r banks<br />

Investments in associates, subsidiaries and joint ventures<br />

Financial assets held for trading<br />

Cash and cash balances with <strong>the</strong> central bank<br />

For Islamic <strong>financial</strong> institutions, <strong>the</strong> nature<br />

<strong>of</strong> <strong>financial</strong> intermediation, including <strong>the</strong><br />

function <strong>of</strong> banking, is different from that<br />

<strong>of</strong> conventional <strong>financial</strong> institutions. This<br />

is <strong>the</strong> key to understanding <strong>the</strong> difference<br />

in <strong>the</strong> nature <strong>of</strong> risks in conventional and<br />

Islamic banking. For Islamic banks, <strong>the</strong><br />

mudarabah contract is <strong>the</strong> cornerstone <strong>of</strong><br />

<strong>financial</strong> intermediation and thus <strong>of</strong> banking.<br />

The basic concept is that both <strong>the</strong> mobilisation<br />

and (in <strong>the</strong>ory) <strong>the</strong> use <strong>of</strong> funds are based<br />

on some form <strong>of</strong> pr<strong>of</strong>it sharing among <strong>the</strong><br />

Liabilities<br />

Customers’ deposits<br />

Due to banks and o<strong>the</strong>r <strong>financial</strong> institutions<br />

O<strong>the</strong>r liabilities<br />

Sundry creditors<br />

Equity and reserves<br />

16 IIBI www.newhorizon-<strong>islamic</strong>banking.com