Tending the Flock - Index Funds Advisors

Tending the Flock - Index Funds Advisors

Tending the Flock - Index Funds Advisors

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Tending</strong> <strong>the</strong> <strong>Flock</strong>: Shepherding Catholic Retirement Plans<br />

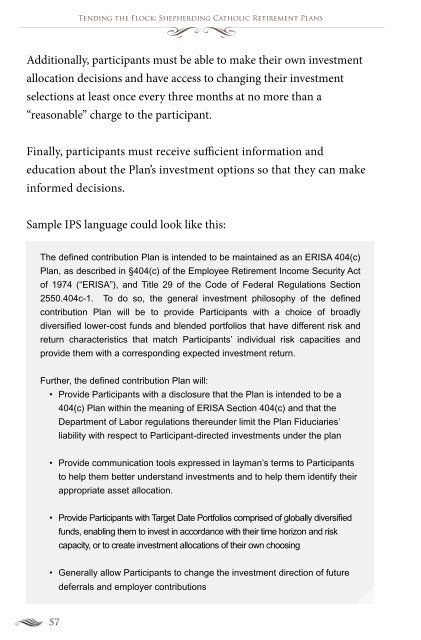

Additionally, participants must be able to make <strong>the</strong>ir own investment<br />

allocation decisions and have access to changing <strong>the</strong>ir investment<br />

selections at least once every three months at no more than a<br />

“reasonable” charge to <strong>the</strong> participant.<br />

Finally, participants must receive sufficient information and<br />

education about <strong>the</strong> Plan’s investment options so that <strong>the</strong>y can make<br />

informed decisions.<br />

Sample IPS language could look like this:<br />

The defi ned contribution Plan is intended to be maintained as an ERISA 404(c)<br />

Plan, as described in §404(c) of <strong>the</strong> Employee Retirement Income Security Act<br />

of 1974 (“ERISA”), and Title 29 of <strong>the</strong> Code of Federal Regulations Section<br />

2550.404c-1. To do so, <strong>the</strong> general investment philosophy of <strong>the</strong> defi ned<br />

contribution Plan will be to provide Participants with a choice of broadly<br />

diversifi ed lower-cost funds and blended portfolios that have different risk and<br />

return characteristics that match Participants’ individual risk capacities and<br />

provide <strong>the</strong>m with a corresponding expected investment return.<br />

Fur<strong>the</strong>r, <strong>the</strong> defi ned contribution Plan will:<br />

• Provide Participants with a disclosure that <strong>the</strong> Plan is intended to be a<br />

404(c) Plan within <strong>the</strong> meaning of ERISA Section 404(c) and that <strong>the</strong><br />

Department of Labor regulations <strong>the</strong>reunder limit <strong>the</strong> Plan Fiduciaries’<br />

liability with respect to Participant-directed investments under <strong>the</strong> plan<br />

• Provide communication tools expressed in layman’s terms to Participants<br />

to help <strong>the</strong>m better understand investments and to help <strong>the</strong>m identify <strong>the</strong>ir<br />

appropriate asset allocation.<br />

• Provide Participants with Target Date Portfolios comprised of globally diversified<br />

funds, enabling <strong>the</strong>m to invest in accordance with <strong>the</strong>ir time horizon and risk<br />

capacity, or to create investment allocations of <strong>the</strong>ir own choosing<br />

• Generally allow Participants to change <strong>the</strong> investment direction of future<br />

deferrals and employer contributions<br />

57

![IFA 12-Step Brochure [PDF] - Index Funds Advisors](https://img.yumpu.com/53876242/1/185x260/ifa-12-step-brochure-pdf-index-funds-advisors.jpg?quality=85)