S079p

S079p

S079p

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

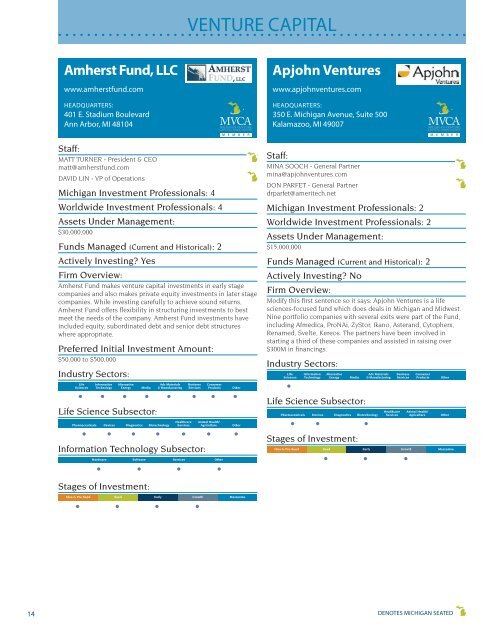

VENTURE CAPITAL<br />

Amherst Fund, LLC<br />

www.amherstfund.com<br />

HEADQUARTERS:<br />

401 E. Stadium Boulevard<br />

Ann Arbor, MI 48104<br />

Apjohn Ventures<br />

www.apjohnventures.com<br />

HEADQUARTERS:<br />

350 E. Michigan Avenue, Suite 500<br />

Kalamazoo, MI 49007<br />

M E M B E R M E M B E R<br />

Staff:<br />

MATT TURNER - President & CEO<br />

matt@amherstfund.com<br />

DAVID LIN - VP of Operations<br />

Michigan Investment Professionals: 4<br />

Worldwide Investment Professionals: 4<br />

Assets Under Management:<br />

$30,000,000<br />

Funds Managed (Current and Historical): 2<br />

Actively Investing? Yes<br />

Firm Overview:<br />

Amherst Fund makes venture capital investments in early stage<br />

companies and also makes private equity investments in later stage<br />

companies. While investing carefully to achieve sound returns,<br />

Amherst Fund offers flexibility in structuring investments to best<br />

meet the needs of the company. Amherst Fund investments have<br />

included equity, subordinated debt and senior debt structures<br />

where appropriate.<br />

Preferred Initial Investment Amount:<br />

$50,000 to $500,000<br />

Industry Sectors:<br />

Life Information Alternative Adv Materials Business Consumer<br />

Sciences Technology Energy Media & Manufacturing Services Products Other<br />

Life Science Subsector:<br />

Healthcare Animal Health/<br />

Pharmaceuticals Devices Diagnostics Biotechnology Services Agriculture Other<br />

Information Technology Subsector:<br />

Hardware Software Services Other<br />

Staff:<br />

MINA SOOCH - General Partner<br />

mina@apjohnventures.com<br />

DON PARFET - General Partner<br />

drparfet@ameritech.net<br />

Michigan Investment Professionals: 2<br />

Worldwide Investment Professionals: 2<br />

Assets Under Management:<br />

$15,000,000<br />

Funds Managed (Current and Historical): 2<br />

Actively Investing? No<br />

Firm Overview:<br />

Modify this first sentence so it says: Apjohn Ventures is a life<br />

sciences-focused fund which does deals in Michigan and Midwest.<br />

Nine portfolio companies with several exits were part of the Fund,<br />

including Afmedica, ProNAi, ZyStor, Ikano, Asterand, Cytopherx,<br />

Renamed, Svelte, Kereos. The partners have been involved in<br />

starting a third of these companies and assisted in raising over<br />

$300M in financings.<br />

Industry Sectors:<br />

Life Information Alternative Adv Materials Business Consumer<br />

Sciences Technology Energy Media & Manufacturing Services Products Other<br />

Life Science Subsector:<br />

Healthcare Animal Health/<br />

Pharmaceuticals Devices Diagnostics Biotechnology Services Agriculture Other<br />

Stages of Investment:<br />

Idea & Pre-Seed Seed Early Growth Mezzanine<br />

Stages of Investment:<br />

Idea & Pre-Seed Seed Early Growth Mezzanine<br />

14 DENOTES MICHIGAN SEATED