S079p

S079p

S079p

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

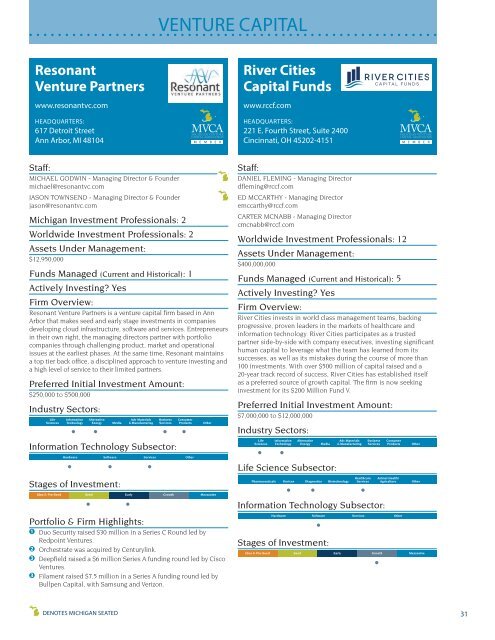

VENTURE CAPITAL<br />

Resonant<br />

Venture Partners<br />

www.resonantvc.com<br />

HEADQUARTERS:<br />

617 Detroit Street<br />

Ann Arbor, MI 48104<br />

River Cities<br />

Capital Funds<br />

www.rccf.com<br />

HEADQUARTERS:<br />

221 E. Fourth Street, Suite 2400<br />

Cincinnati, OH 45202-4151<br />

M E M B E R M E M B E R<br />

Staff:<br />

MICHAEL GODWIN - Managing Director & Founder<br />

michael@resonantvc.com<br />

JASON TOWNSEND - Managing Director & Founder<br />

jason@resonantvc.com<br />

Michigan Investment Professionals: 2<br />

Worldwide Investment Professionals: 2<br />

Assets Under Management:<br />

$12,950,000<br />

Funds Managed (Current and Historical): 1<br />

Actively Investing? Yes<br />

Firm Overview:<br />

Resonant Venture Partners is a venture capital firm based in Ann<br />

Arbor that makes seed and early stage investments in companies<br />

developing cloud infrastructure, software and services. Entrepreneurs<br />

in their own right, the managing directors partner with portfolio<br />

companies through challenging product, market and operational<br />

issues at the earliest phases. At the same time, Resonant maintains<br />

a top tier back office, a disciplined approach to venture investing and<br />

a high level of service to their limited partners.<br />

Preferred Initial Investment Amount:<br />

$250,000 to $500,000<br />

Industry Sectors:<br />

Life Information Alternative Adv Materials Business Consumer<br />

Sciences Technology Energy Media & Manufacturing Services Products Other<br />

Information Technology Subsector:<br />

Hardware Software Services Other<br />

Stages of Investment:<br />

Idea & Pre-Seed Seed Early Growth Mezzanine<br />

Portfolio & Firm Highlights:<br />

1 Duo Security raised $30 million in a Series C Round led by<br />

Redpoint Ventures.<br />

2 Orchestrate was acquired by Centurylink.<br />

3 Deepfield raised a $6 million Series A funding round led by Cisco<br />

Ventures.<br />

3 Filament raised $7.5 million in a Series A funding round led by<br />

Bullpen Capital, with Samsung and Verizon.<br />

Staff:<br />

DANIEL FLEMING - Managing Director<br />

dfleming@rccf.com<br />

ED MCCARTHY - Managing Director<br />

emccarthy@rccf.com<br />

CARTER MCNABB - Managing Director<br />

cmcnabb@rccf.com<br />

Worldwide Investment Professionals: 12<br />

Assets Under Management:<br />

$400,000,000<br />

Funds Managed (Current and Historical): 5<br />

Actively Investing? Yes<br />

Firm Overview:<br />

River Cities invests in world class management teams, backing<br />

progressive, proven leaders in the markets of healthcare and<br />

information technology. River Cities participates as a trusted<br />

partner side-by-side with company executives, investing significant<br />

human capital to leverage what the team has learned from its<br />

successes, as well as its mistakes during the course of more than<br />

100 investments. With over $500 million of capital raised and a<br />

20-year track record of success, River Cities has established itself<br />

as a preferred source of growth capital. The firm is now seeking<br />

investment for its $200 Million Fund V.<br />

Preferred Initial Investment Amount:<br />

$7,000,000 to $12,000,000<br />

Industry Sectors:<br />

Life Information Alternative Adv Materials Business Consumer<br />

Sciences Technology Energy Media & Manufacturing Services Products Other<br />

Life Science Subsector:<br />

Healthcare Animal Health/<br />

Pharmaceuticals Devices Diagnostics Biotechnology Services Agriculture Other<br />

Information Technology Subsector:<br />

Hardware Software Services Other<br />

Stages of Investment:<br />

Idea & Pre-Seed Seed Early Growth Mezzanine<br />

DENOTES MICHIGAN SEATED<br />

31