S079p

S079p

S079p

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

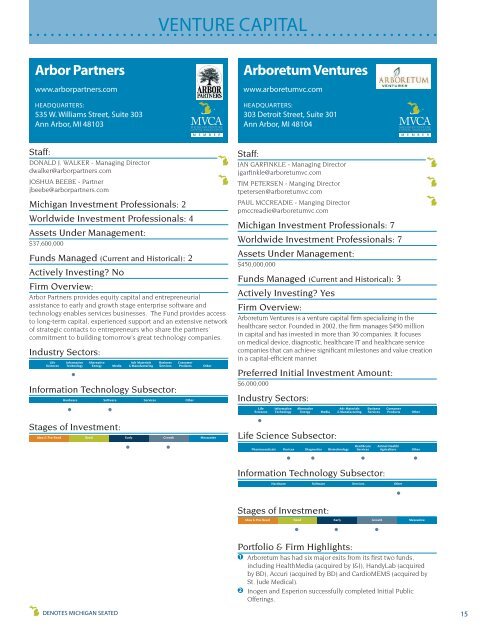

VENTURE CAPITAL<br />

Arbor Partners<br />

www.arborpartners.com<br />

HEADQUARTERS:<br />

535 W. Williams Street, Suite 303<br />

Ann Arbor, MI 48103<br />

Arboretum Ventures<br />

www.arboretumvc.com<br />

HEADQUARTERS:<br />

303 Detroit Street, Suite 301<br />

Ann Arbor, MI 48104<br />

M E M B E R M E M B E R<br />

Staff:<br />

DONALD J. WALKER - Managing Director<br />

dwalker@arborpartners.com<br />

JOSHUA BEEBE - Partner<br />

jbeebe@arborpartners.com<br />

Michigan Investment Professionals: 2<br />

Worldwide Investment Professionals: 4<br />

Assets Under Management:<br />

$37,600,000<br />

Funds Managed (Current and Historical): 2<br />

Actively Investing? No<br />

Firm Overview:<br />

Arbor Partners provides equity capital and entrepreneurial<br />

assistance to early and growth stage enterprise software and<br />

technology enables services businesses. The Fund provides access<br />

to long-term capital, experienced support and an extensive network<br />

of strategic contacts to entrepreneurs who share the partners’<br />

commitment to building tomorrow’s great technology companies.<br />

Industry Sectors:<br />

Life Information Alternative Adv Materials Business Consumer<br />

Sciences Technology Energy Media & Manufacturing Services Products Other<br />

Information Technology Subsector:<br />

Hardware Software Services Other<br />

Stages of Investment:<br />

Idea & Pre-Seed Seed Early Growth Mezzanine<br />

Staff:<br />

JAN GARFINKLE - Managing Director<br />

jgarfinkle@arboretumvc.com<br />

TIM PETERSEN - Manging Director<br />

tpetersen@arboretumvc.com<br />

PAUL MCCREADIE - Manging Director<br />

pmccreadie@arboretumvc.com<br />

Michigan Investment Professionals: 7<br />

Worldwide Investment Professionals: 7<br />

Assets Under Management:<br />

$450,000,000<br />

Funds Managed (Current and Historical): 3<br />

Actively Investing? Yes<br />

Firm Overview:<br />

Arboretum Ventures is a venture capital firm specializing in the<br />

healthcare sector. Founded in 2002, the firm manages $450 million<br />

in capital and has invested in more than 30 companies. It focuses<br />

on medical device, diagnostic, healthcare IT and healthcare service<br />

companies that can achieve significant milestones and value creation<br />

in a capital-efficient manner.<br />

Preferred Initial Investment Amount:<br />

$6,000,000<br />

Industry Sectors:<br />

Life Information Alternative Adv Materials Business Consumer<br />

Sciences Technology Energy Media & Manufacturing Services Products Other<br />

Life Science Subsector:<br />

Healthcare Animal Health/<br />

Pharmaceuticals Devices Diagnostics Biotechnology Services Agriculture Other<br />

Information Technology Subsector:<br />

Hardware Software Services Other<br />

Stages of Investment:<br />

Idea & Pre-Seed Seed Early Growth Mezzanine<br />

Portfolio & Firm Highlights:<br />

1 Arboretum has had six major exits from its first two funds,<br />

including HealthMedia (acquired by J&J), HandyLab (acquired<br />

by BD), Accuri (acquired by BD) and CardioMEMS (acquired by<br />

St. Jude Medical).<br />

2 Inogen and Esperion successfully completed Initial Public<br />

Offerings.<br />

DENOTES MICHIGAN SEATED<br />

15