Responsible Property Investment 2008 - Henderson Global Investors

Responsible Property Investment 2008 - Henderson Global Investors

Responsible Property Investment 2008 - Henderson Global Investors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2008</strong> report <strong>Responsible</strong> <strong>Property</strong> <strong>Investment</strong><br />

4<br />

<strong>Henderson</strong>’s Sustainability Portfolio Analysis<br />

ASSESSING THE SUSTAINABILITY PERFORMANCE AND RISK EXPOSURE OF OUR PORTFOLIO<br />

Our major endeavour in <strong>2008</strong> was to undertake a<br />

detailed survey of all the environmental and socioeconomic<br />

features of the properties in eight of our<br />

funds and assess their exposure to sustainabilityrelated<br />

risks.<br />

We developed and carried out an extensive Sustainability<br />

Portfolio Analysis (SPA), enabling us to identify areas of risk<br />

and opportunity at both a property and fund level. We now<br />

have risk profiles for each fund and detailed property<br />

improvement plans, which will inform our fund strategies<br />

for 2009.<br />

• 161 properties took part, each answering 78<br />

questions contained in the <strong>Henderson</strong> SPA audit<br />

• 97% of the properties (156 sites) were visited<br />

and assessed during the process<br />

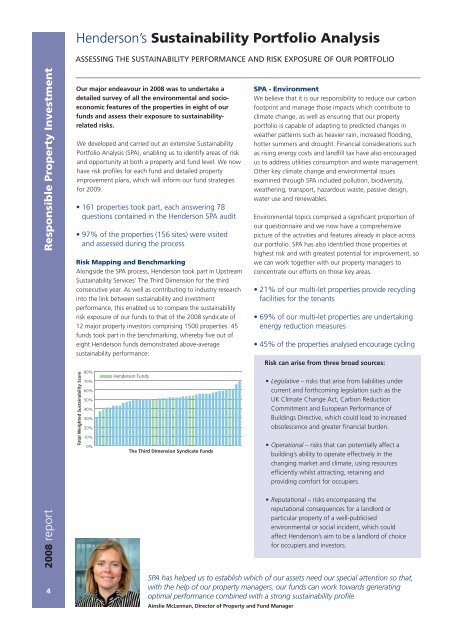

Risk Mapping and Benchmarking<br />

Alongside the SPA process, <strong>Henderson</strong> took part in Upstream<br />

Sustainability Services’ The Third Dimension for the third<br />

consecutive year. As well as contributing to industry research<br />

into the link between sustainability and investment<br />

performance, this enabled us to compare the sustainability<br />

risk exposure of our funds to that of the <strong>2008</strong> syndicate of<br />

12 major property investors comprising 1500 properties. 45<br />

funds took part in the benchmarking, whereby five out of<br />

eight <strong>Henderson</strong> funds demonstrated above-average<br />

sustainability performance:<br />

Total Weighted Sustainability Score<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

<strong>Henderson</strong> Funds<br />

The Third Dimension Syndicate Funds<br />

SPA - Environment<br />

We believe that it is our responsibility to reduce our carbon<br />

footprint and manage those impacts which contribute to<br />

climate change, as well as ensuring that our property<br />

portfolio is capable of adapting to predicted changes in<br />

weather patterns such as heavier rain, increased flooding,<br />

hotter summers and drought. Financial considerations such<br />

as rising energy costs and landfill tax have also encouraged<br />

us to address utilities consumption and waste management.<br />

Other key climate change and environmental issues<br />

examined through SPA included pollution, biodiversity,<br />

weathering, transport, hazardous waste, passive design,<br />

water use and renewables.<br />

Environmental topics comprised a significant proportion of<br />

our questionnaire and we now have a comprehensive<br />

picture of the activities and features already in place across<br />

our portfolio. SPA has also identified those properties at<br />

highest risk and with greatest potential for improvement, so<br />

we can work together with our property managers to<br />

concentrate our efforts on those key areas.<br />

• 21% of our multi-let properties provide recycling<br />

facilities for the tenants<br />

• 69% of our multi-let properties are undertaking<br />

energy reduction measures<br />

• 45% of the properties analysed encourage cycling<br />

Risk can arise from three broad sources:<br />

• Legislative – risks that arise from liabilities under<br />

current and forthcoming legislation such as the<br />

UK Climate Change Act, Carbon Reduction<br />

Commitment and European Performance of<br />

Buildings Directive, which could lead to increased<br />

obsolescence and greater financial burden.<br />

• Operational – risks that can potentially affect a<br />

building’s ability to operate effectively in the<br />

changing market and climate, using resources<br />

efficiently whilst attracting, retaining and<br />

providing comfort for occupiers.<br />

• Reputational – risks encompassing the<br />

reputational consequences for a landlord or<br />

particular property of a well-publicised<br />

environmental or social incident, which could<br />

affect <strong>Henderson</strong>’s aim to be a landlord of choice<br />

for occupiers and investors.<br />

SPA has helped us to establish which of our assets need our special attention so that,<br />

with the help of our property managers, our funds can work towards generating<br />

optimal performance combined with a strong sustainability profile<br />

Ainslie McLennan, Director of <strong>Property</strong> and Fund Manager