Henderson European Focus Fund - Henderson Global Investors

Henderson European Focus Fund - Henderson Global Investors

Henderson European Focus Fund - Henderson Global Investors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Henderson</strong> <strong>European</strong> <strong>Focus</strong> <strong>Fund</strong><br />

Monthly Commentary<br />

August 2007 will certainly not be forgotten in a hurry. The month saw significant volatility brought about by<br />

escalating sub-prime woes, intervention by Central Banks, significant deleveraging and mixed macroeconomic data.<br />

Most stock exchanges had erased their year-to-date gains by mid-month, only to bounce back on supportive<br />

comments and liquidity injections from central banks. The surprise 50bp (.5% basis point) cut in the Federal<br />

Reserve’s discount rate was the most significant calming influence on equity markets. Retail sales and business<br />

sentiment surveys in Germany were strong. Conversely inflation in the UK came in lower than expected, led down<br />

by discounting in the retail sector.<br />

In terms of sectors, there was a clear shift into more defensive areas of the market, with Telecoms, Consumer<br />

Staples and Utilities outperforming, while Financials, Energy and Consumer Discretionary struggled.<br />

The <strong>Fund</strong> underperformed the benchmark over the month. We believe negative contributors were largely a<br />

reflection of the broader market backdrop rather than stock-specific issues. Within the Materials sector, several of<br />

the <strong>Fund</strong>’s holdings were victims of the reduction in investors’ risk appetite and the general tendency to take profits<br />

in stocks that have had strong recent runs. Examples include Lundin Mining and gold miner, Centamin. Within the<br />

Energy sector, exploration company Urals Energy was down after cutting its production forecasts for 2007.<br />

Positives during the month included Hellenic Telecoms (OTE). The shares were up following strong first-half net<br />

profits from mobile subsidiary, Cosmote, and further speculation of a take-over of the company following the Greek<br />

Government’s divestment of a 10.7% stake. German drugs and chemicals group, Bayer, was also up on rumours<br />

that Swiss group Novartis was poised to make an offer for the company.<br />

During the month we initiated a position in Dutch bank ABN Amro. We felt the shares had been overly sold off<br />

during the month’s volatility. With the share price underpinned by offers from the RBS consortium and Barclays, we<br />

believed the risks were firmly on the upside.<br />

The biggest question remains whether current financial market concerns could spill over into the broader economy.<br />

Although the general economy is perhaps less buoyant than at the beginning of 2007 it still remains strong for the<br />

time being with many companies poised to produce good results. We believe valuations in the market are still<br />

attractive, with some very good yield opportunities, so in our view, there is still upside potential once we have a<br />

more settled environment.<br />

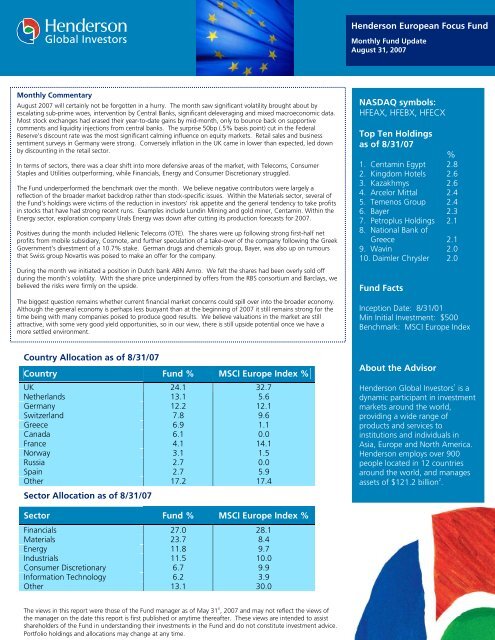

Country Allocation as of 8/31/07<br />

Country <strong>Fund</strong> % MSCI Europe Index %<br />

UK 24.1 32.7<br />

Netherlands 13.1 5.6<br />

Germany 12.2 12.1<br />

Switzerland 7.8 9.6<br />

Greece 6.9 1.1<br />

Canada 6.1 0.0<br />

France 4.1 14.1<br />

Norway 3.1 1.5<br />

Russia 2.7 0.0<br />

Spain 2.7 5.9<br />

Other 17.2 17.4<br />

Sector Allocation as of 8/31/07<br />

Sector <strong>Fund</strong> % MSCI Europe Index %<br />

Financials 27.0 28.1<br />

Materials 23.7 8.4<br />

Energy 11.8 9.7<br />

Industrials 11.5 10.0<br />

Consumer Discretionary 6.7 9.9<br />

Information Technology 6.2 3.9<br />

Other 13.1 30.0<br />

The views in this report were those of the <strong>Fund</strong> manager as of May 31 st<br />

, 2007 and may not reflect the views of<br />

the manager on the date this report is first published or anytime thereafter. These views are intended to assist<br />

shareholders of the <strong>Fund</strong> in understanding their investments in the <strong>Fund</strong> and do not constitute investment advice.<br />

Portfolio holdings and allocations may change at any time.<br />

<strong>Henderson</strong> <strong>European</strong> <strong>Focus</strong> <strong>Fund</strong><br />

<strong>Henderson</strong> <strong>Global</strong> <strong>Fund</strong>s<br />

Monthly <strong>Fund</strong> Update<br />

August 31, 2007<br />

Monthly <strong>Fund</strong> Update<br />

February 28, 2006<br />

NASDAQ symbols:<br />

HFEAX, HFEBX, HFECX<br />

Top Ten Holdings<br />

as of 8/31/07<br />

1. Centamin Egypt<br />

%<br />

2.8<br />

2. Kingdom Hotels 2.6<br />

3. Kazakhmys 2.6<br />

4. Arcelor Mittal 2.4<br />

5. Temenos Group 2.4<br />

6. Bayer 2.3<br />

7. Petroplus Holdings 2.1<br />

8. National Bank of<br />

Greece 2.1<br />

9. Wavin 2.0<br />

10. Daimler Chrysler 2.0<br />

<strong>Fund</strong> Facts<br />

Inception Date: 8/31/01<br />

Min Initial Investment: $500<br />

Benchmark: MSCI Europe Index<br />

About the Advisor<br />

<strong>Henderson</strong> <strong>Global</strong> <strong>Investors</strong> 1<br />

is a<br />

dynamic participant in investment<br />

markets around the world,<br />

providing a wide range of<br />

products and services to<br />

institutions and individuals in<br />

Asia, Europe and North America.<br />

<strong>Henderson</strong> employs over 900<br />

people located in 12 countries<br />

around the world, and manages<br />

assets of $121.2 billion 2<br />

.

Performance<br />

<strong>European</strong> <strong>Focus</strong><br />

Class A at NAV<br />

<strong>European</strong> <strong>Focus</strong><br />

Class A w/ sales<br />

charge<br />

MSCI Europe<br />

Index<br />

Lipper <strong>European</strong><br />

Region <strong>Fund</strong>s<br />

Average<br />

Returns For More greater Information<br />

than 1-year are annualized and all returns include the reinvestment of<br />

dividends and capital gains. Performance results reflect expense subsidies and waivers in<br />

effect during the periods shown. Absent these waivers, results would have been less<br />

favorable. The MSCI Europe Index is a market-capitalization weighted index of<br />

approximately 500 stocks traded in 15 <strong>European</strong> markets. You cannot invest directly in an<br />

index or average. The FTSE 100 Index is a share index of the 100 most highly capitalized<br />

companies listed on the London Stock Exchange.<br />

1<br />

<strong>Henderson</strong> <strong>Global</strong> <strong>Investors</strong> is the name under which various subsidiaries of <strong>Henderson</strong> Group plc, a UK limited company, provide investment products and<br />

services.<br />

2 As of December 31, 2006<br />

1 Month YTD 1 Year<br />

* With certain limited exceptions, the <strong>Henderson</strong> <strong>European</strong> <strong>Focus</strong> <strong>Fund</strong> will be soft closing to new investors after July 31, 2007 as described in the<br />

prospectus.<br />

International investing involves certain risks and increased volatility not associated with investing solely in the U.S.<br />

These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial<br />

information or unfavorable political or legal developments. In addition, the <strong>Fund</strong> is non-diversified meaning it may<br />

invest in a limited geographic area or in a smaller number of issuers. As such, investing in the <strong>Fund</strong> may involve<br />

greater risk and volatility than investing in a more diversified fund. The <strong>Fund</strong> may also invest in securities issued by<br />

smaller companies, which typically involves greater risk than investing in larger companies.<br />

Not FDIC insured – Not Bank Guaranteed – May lose money.<br />

As of 8/31/07 As of 6/31/07<br />

Since<br />

Inception<br />

1 Year 5 Year<br />

Since<br />

Inception<br />

-2.62 % 8.84 % 28.87% 30.21% 38.55% 31.70% 32.18%<br />

-8.22% 2.59% 21.45% 28.94% 30.59% 30.15% 30.85%<br />

-1.09% 9.34% 22.98% 14.16% 33.08% 19.26% 15.23%<br />

-0.89% 8.36% 22.24% 15.63% 31.66% 19.85% 16.82%<br />

The Lipper <strong>European</strong> <strong>Fund</strong>s Average is compiled by Lipper, Inc., which is an independent<br />

mutual fund rating service. Lipper returns do not take into effect sales charges.<br />

Performance data quoted represents past performance and is no guarantee of future<br />

results. Current performance may be lower or higher than the performance data quoted.<br />

Investment return and principal value will fluctuate so that an investor’s shares, when<br />

redeemed, may be worth more or less than original cost. For the most recent month-end<br />

performance, please call 1.866.443.6337 or visit the <strong>Fund</strong>’s website at<br />

www.hendersonglobalinvestors.com. Performance results with sales charges reflect the<br />

deduction of the maximum front-end sales charge of 5.75%. Performance presented at Net<br />

Asset Value (NAV) which does not include these sales charges would be lower if these<br />

charges were reflected. As stated in the current prospectus, the <strong>Fund</strong>’s annual operating<br />

expense ratio (gross) is 1.64%. Shares redeemed within 30 days may be subject to a 2.0%<br />

redemption fee.<br />

For More Information<br />

For additional information on any of the<br />

<strong>Henderson</strong> <strong>Global</strong> <strong>Fund</strong>s or to obtain a<br />

prospectus, please call 1.866.443.6337<br />

or visit our website at<br />

www.hendersonglobalinvestors.com<br />

Before investing you should carefully consider the <strong>Fund</strong>’s investment objectives, risks, charges and expenses. This and other<br />

information is in the prospectus, a copy of which may be obtained by calling 1.866.443.6337 or visiting the <strong>Fund</strong>’s website.<br />

Please read the prospectus carefully before investing.<br />

Foreside <strong>Fund</strong> Services, LLC, distributor. (9/07) HGF 133-07 SKU: EFF-UPDATE-0807