FiA_2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Ghana<br />

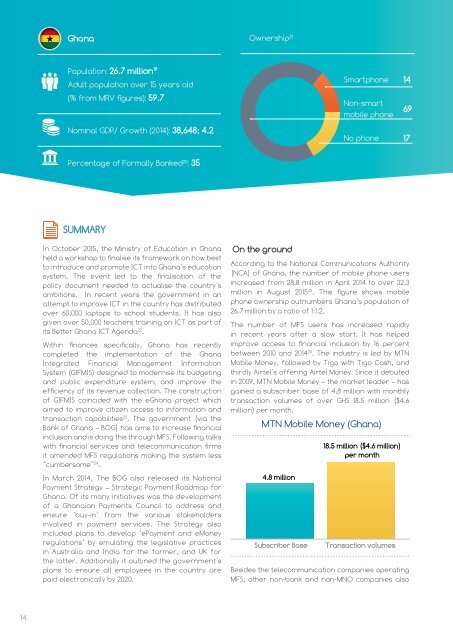

Ownership 21 Smartphone 14<br />

Population: 26.7 million 19<br />

Adult population over 15 years old<br />

(% from MRV figures): 59.7<br />

Non-smart<br />

mobile phone<br />

69<br />

Nominal GDP/ Growth (2014): 38,648; 4.2<br />

No phone 17<br />

Percentage of Formally Banked 20 : 35<br />

SUMMARY<br />

In October <strong>2015</strong>, the Ministry of Education in Ghana<br />

held a workshop to finalise its framework on how best<br />

to introduce and promote ICT into Ghana’s education<br />

system. The event led to the finalisation of the<br />

policy document needed to actualise the country’s<br />

ambitions. In recent years the government in an<br />

attempt to improve ICT in the country has distributed<br />

over 60,000 laptops to school students. It has also<br />

given over 50,000 teachers training on ICT as part of<br />

its Better Ghana ICT Agenda 22 .<br />

Within finances specifically, Ghana has recently<br />

completed the implementation of the Ghana<br />

Integrated Financial Management Information<br />

System (GIFMIS) designed to modernise its budgeting<br />

and public expenditure system; and improve the<br />

efficiency of its revenue collection. The construction<br />

of GIFMIS coincided with the eGhana project which<br />

aimed to improve citizen access to information and<br />

transaction capabilities 23 . The government (via the<br />

Bank of Ghana – BOG) has aims to increase financial<br />

inclusion and is doing this through MFS. Following talks<br />

with financial services and telecommunication firms<br />

it amended MFS regulations making the system less<br />

“cumbersome” 24 .<br />

In March 2014, The BOG also released its National<br />

Payment Strategy – Strategic Payment Roadmap for<br />

Ghana. Of its many initiatives was the development<br />

of a Ghanaian Payments Council to address and<br />

ensure ‘buy-in’ from the various stakeholders<br />

involved in payment services. The Strategy also<br />

included plans to develop ‘ePayment and eMoney<br />

regulations’ by emulating the legislative practices<br />

in Australia and India for the former, and UK for<br />

the latter. Additionally it outlined the government’s<br />

plans to ensure all employees in the country are<br />

paid electronically by 2020.<br />

On the ground<br />

According to the National Communications Authority<br />

(NCA) of Ghana, the number of mobile phone users<br />

increased from 28.8 million in April 2014 to over 32.3<br />

million in August <strong>2015</strong> 25 . This figure shows mobile<br />

phone ownership outnumbers Ghana’s population of<br />

26.7 million by a ratio of 1:1.2.<br />

The number of MFS users has increased rapidly<br />

in recent years after a slow start. It has helped<br />

improve access to financial inclusion by 16 percent<br />

between 2010 and 2014 26 . The industry is led by MTN<br />

Mobile Money, followed by Tigo with Tigo Cash, and<br />

thirdly Airtel’s offering Airtel Money. Since it debuted<br />

in 2009, MTN Mobile Money – the market leader – has<br />

gained a subscriber base of 4.8 million with monthly<br />

transaction volumes of over GHS 18.5 million ($4.6<br />

million) per month.<br />

MTN Mobile Money (Ghana)<br />

4.8 million<br />

Subscriber Base<br />

18.5 million ($4.6 million)<br />

per month<br />

Transaction volumes<br />

Besides the telecommunication companies operating<br />

MFS, other non-bank and non-MNO companies also<br />

14