You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

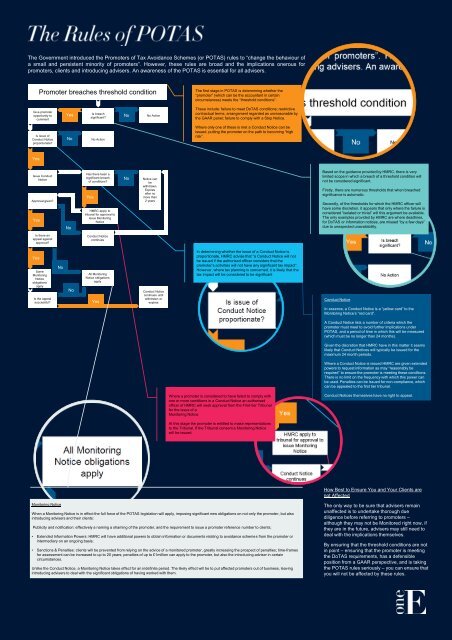

The Government introduced the Promoters <strong>of</strong> Tax Avoidance Schemes (or <strong>POTAS</strong>) rules to “change the behaviour <strong>of</strong><br />

a small and persistent minority <strong>of</strong> promoters”. However, these rules are broad and the implications onerous for<br />

promoters, clients and introducing advisers. An awareness <strong>of</strong> the <strong>POTAS</strong> is essential for all advisers.<br />

Promoter breaches threshold condition<br />

The first stage in <strong>POTAS</strong> is determining whether the<br />

“promoter” (which can be the accountant in certain<br />

circumstances) meets the “threshold conditions”.<br />

Give promoter<br />

opportunity to<br />

comment<br />

Yes<br />

Is breach<br />

significant?<br />

No<br />

No Action<br />

These include: failure to meet DoTAS conditions; restrictive<br />

contractual terms; arrangement regarded as unreasonable by<br />

the GAAR panel; failure to comply with a Stop Notice.<br />

Is issue <strong>of</strong><br />

Conduct Notice<br />

proportionate?<br />

No<br />

No Action<br />

Where only one <strong>of</strong> these is met a Conduct Notice can be<br />

issued, putting the promoter on the path to becoming “high<br />

risk”.<br />

Yes<br />

Issue Conduct<br />

Notice<br />

Approval given?<br />

Yes<br />

No<br />

Has there been a<br />

significant breach<br />

<strong>of</strong> conditions?<br />

Yes<br />

HMRC apply to<br />

tribunal for approval to<br />

issue Monitoring<br />

Notice<br />

No<br />

Notice can<br />

be<br />

withdrawn.<br />

Expires<br />

after no<br />

more than<br />

2 years<br />

Based on the guidance provided by HMRC, there is very<br />

limited scope in which a breach <strong>of</strong> a threshold condition will<br />

not be considered significant.<br />

Firstly, there are numerous thresholds that when breached<br />

significance is automatic.<br />

Secondly, <strong>of</strong> the thresholds for which the HMRC <strong>of</strong>ficer will<br />

have some discretion, it appears that only where the failure is<br />

considered “isolated or trivial” will this argument be available.<br />

The only examples provided by HMRC are where deadlines,<br />

for DoTAS or information notices, are missed “by a few days”<br />

due to unexpected unavailability.<br />

Is there an<br />

appeal against<br />

approval?<br />

Conduct Notice<br />

continues<br />

Yes<br />

Some<br />

Monitoring<br />

Notice<br />

obligations<br />

apply<br />

Is the appeal<br />

successful?<br />

No<br />

No<br />

All Monitoring<br />

Notice obligations<br />

apply<br />

Yes<br />

Conduct Notice<br />

continues until<br />

withdrawn or<br />

expires<br />

In determining whether the issue <strong>of</strong> a Conduct Notice is<br />

proportionate, HMRC advise that “a Conduct Notice will not<br />

be issued if the authorised <strong>of</strong>ficer considers that the<br />

promoterʼs activities will not have any significant tax impact”.<br />

However, where tax planning is concerned, it is likely that the<br />

tax impact will be considered to be significant<br />

Conduct Notice<br />

In essence, a Conduct Notice is a “yellow card” to the<br />

Monitoring Notice’s “red card”.<br />

A Conduct Notice lists a number <strong>of</strong> criteria which the<br />

promoter must meet to avoid further implications under<br />

<strong>POTAS</strong>, and a period <strong>of</strong> time in which this will be measured<br />

(which must be no longer than 24 months).<br />

Given the discretion that HMRC have in this matter it seems<br />

likely that Conduct Notices will typically be issued for the<br />

maximum 24 month periods.<br />

Where a Conduct Notice is issued HMRC are given extended<br />

powers to request information as may “reasonably be<br />

required” to ensure the promoter is meeting these conditions.<br />

There is no limit on the frequency with which this power can<br />

be used. Penalties can be issued for non-compliance, which<br />

can be appealed to the first tier tribunal.<br />

Where a promoter is considered to have failed to comply with<br />

one or more conditions in a Conduct Notice an authorised<br />

<strong>of</strong>ficer <strong>of</strong> HMRC will seek approval from the First-tier Tribunal<br />

for the issue <strong>of</strong> a<br />

Monitoring Notice.<br />

Conduct Notices themselves have no right to appeal.<br />

At this stage the promoter is entitled to make representations<br />

to the Tribunal. If the Tribunal consent a Monitoring Notice<br />

will be issued.<br />

How Best to Ensure You and Your Clients are<br />

not Affected<br />

Monitoring Notice<br />

When a Monitoring Notice is in effect the full force <strong>of</strong> the <strong>POTAS</strong> legislation will apply, imposing significant new obligations on not only the promoter, but also<br />

introducing advisers and their clients:<br />

Publicity and notification: effectively a naming a shaming <strong>of</strong> the promoter, and the requirement to issue a promoter reference number to clients;<br />

• Extended Information Powers: HMRC will have additional powers to obtain information or documents relating to avoidance schemes from the promoter or<br />

intermediary on an ongoing basis;<br />

• Sanctions & Penalties: clients will be prevented from relying on the advice <strong>of</strong> a monitored promoter, greatly increasing the prospect <strong>of</strong> penalties; time-frames<br />

for assessment can be increased to up to 20 years; penalties <strong>of</strong> up to £1million can apply to the promoter, but also the introducing adviser in certain<br />

circumstances.<br />

Unlike the Conduct Notice, a Monitoring Notice takes effect for an indefinite period. The likely effect will be to put affected promoters out <strong>of</strong> business, leaving<br />

introducing advisers to deal with the significant obligations <strong>of</strong> having worked with them.<br />

The only way to be sure that advisers remain<br />

unaffected is to undertake thorough due<br />

diligence before referring to promoters –<br />

although they may not be Monitored right now, if<br />

they are in the future, advisers may still need to<br />

deal with the implications themselves.<br />

By ensuring that the threshold conditions are not<br />

in point – ensuring that the promoter is meeting<br />

the DoTAS requirements, has a defensible<br />

position from a GAAR perspective, and is taking<br />

the <strong>POTAS</strong> rules seriously – you can ensure that<br />

you will not be affected by these rules.