The hedge fund centre on the move - Incisive Media

The hedge fund centre on the move - Incisive Media

The hedge fund centre on the move - Incisive Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE BVI AND CHINA<br />

Enter <strong>the</strong> Chinese drag<strong>on</strong> – via BVI<br />

States-based companies, says<br />

Santos (pictured below).<br />

“<str<strong>on</strong>g>The</str<strong>on</strong>g> business acquired by <strong>the</strong><br />

SPAC will be dependent <strong>on</strong> <strong>the</strong><br />

management team’s experience<br />

and c<strong>on</strong>tacts within a given sector.<br />

Smaller companies in emerging<br />

markets are attractive to management<br />

teams because of <strong>the</strong>ir<br />

growth potential and low acquisiti<strong>on</strong><br />

costs,” he says.<br />

“If a Special Purpose Acquisiti<strong>on</strong><br />

Company wants to acquire a<br />

business in China, it should have a<br />

management team, not <strong>on</strong>ly experienced<br />

in c<strong>on</strong>ducting business<br />

in China but also in <strong>the</strong> relevant<br />

sector of <strong>the</strong> target,” he explains.<br />

One feature of SPACs that has<br />

helped lure <str<strong>on</strong>g>hedge</str<strong>on</strong>g> <str<strong>on</strong>g>fund</str<strong>on</strong>g> investors,<br />

is that after <strong>the</strong> public offering, <strong>the</strong><br />

net proceeds are put in an interestbearing<br />

trust account with a thirdparty<br />

custodian.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> Special Purpose Acquisiti<strong>on</strong><br />

Companies cannot buy a<br />

company unless <strong>the</strong>y get approval<br />

from a majority of investors in <strong>the</strong><br />

vehicle — so <strong>the</strong> <str<strong>on</strong>g>fund</str<strong>on</strong>g>s are earning<br />

interest and <strong>the</strong> SPAC’s management<br />

can’t invest it in ano<strong>the</strong>r<br />

company without shareholder<br />

approval, which is important to<br />

investors, according to Santos.<br />

“Investors investing in SPACs<br />

find <strong>the</strong>m attractive because <strong>the</strong>y<br />

provide liquidity,” Maples & Calder’s<br />

Santos says.<br />

“Investments in SPACs feel<br />

<strong>the</strong>ir investment is protected as <strong>the</strong><br />

net proceeds of <strong>the</strong> initial public<br />

offering are held in an interestbearing<br />

trust account with such<br />

proceeds <strong>on</strong>ly being available to<br />

acquire a target business with <strong>the</strong><br />

prior approval of <strong>the</strong> shareholders.<br />

“Unless <strong>the</strong> investors vote<br />

favourably to acquire <strong>the</strong> acquisiti<strong>on</strong><br />

target within <strong>the</strong> Special<br />

Purpose Acquisiti<strong>on</strong> Company’s<br />

limited lifespan, investors are able<br />

to redeem <strong>the</strong>ir shares and have<br />

management pay <strong>the</strong>m back.<br />

“<str<strong>on</strong>g>The</str<strong>on</strong>g> end result is <strong>the</strong> Special<br />

Purpose Acquisiti<strong>on</strong> Company is<br />

liquidated if a target is not found<br />

within <strong>the</strong> given timeframe,”<br />

Santos says.<br />

Maples and Calder was <strong>the</strong> offshore<br />

counsel involved in setting<br />

up both <strong>the</strong> China Fortune Acquisiti<strong>on</strong><br />

Corp. and <strong>the</strong> China Discovery<br />

Acquisiti<strong>on</strong> Corp., which<br />

have been set up with a view to<br />

each targeting an operating business<br />

in China.<br />

VANILLA MASTER<br />

But <strong>the</strong>re also more plain vanillatypes<br />

of <str<strong>on</strong>g>fund</str<strong>on</strong>g> structures that are<br />

used for <str<strong>on</strong>g>hedge</str<strong>on</strong>g> <str<strong>on</strong>g>fund</str<strong>on</strong>g>s in <strong>the</strong> BVI.<br />

“We’re seeing side by side,<br />

master feeder, minimaster,<br />

umbrella <str<strong>on</strong>g>fund</str<strong>on</strong>g>s and all <strong>the</strong> usual<br />

<str<strong>on</strong>g>fund</str<strong>on</strong>g> structures that are typically<br />

used in offshore jurisdicti<strong>on</strong>s,”<br />

says Walkers’ de Vries.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> single class <str<strong>on</strong>g>fund</str<strong>on</strong>g>s which are<br />

set up with a single class of shares<br />

giving investors <strong>the</strong> opportunity<br />

“British Virgin Islands companies are big in China.<br />

It has become <strong>the</strong> jurisdicti<strong>on</strong> of choice for joint<br />

ventures between Chinese and US companies.”<br />

Robert Briant, C<strong>on</strong>yers Dill and Pearman<br />

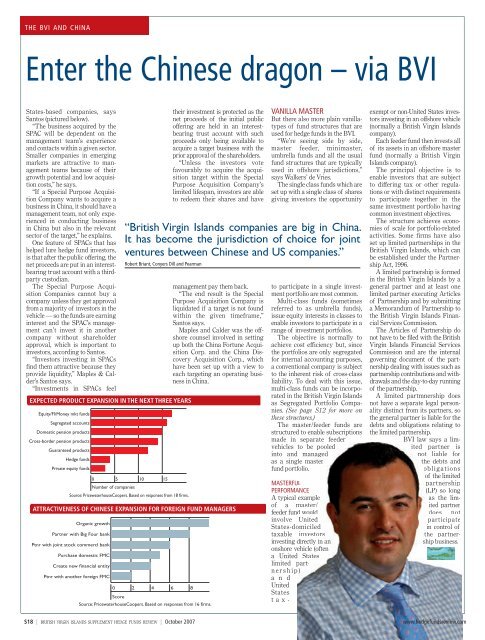

EXPECTED PRODUCT EXPANSION IN THE NEXT THREE YEARS<br />

�������������������������<br />

�������������������<br />

�������������������������<br />

�����������������������������<br />

�������������������<br />

�����������<br />

��������������������<br />

ATTRACTIVENESS OF CHINESE EXPANSION FOR FOREIGN FUND MANAGERS<br />

��������������<br />

��������������������������<br />

�����������������������������������<br />

���������������������<br />

��������������������������<br />

�����������������������������<br />

� � �� ��<br />

�������������������<br />

����������������������������������������������������������������<br />

�<br />

�����<br />

� � � �<br />

����������������������������������������������������������������<br />

to participate in a single investment<br />

portfolio are most comm<strong>on</strong>.<br />

Multi-class <str<strong>on</strong>g>fund</str<strong>on</strong>g>s (sometimes<br />

referred to as umbrella <str<strong>on</strong>g>fund</str<strong>on</strong>g>s),<br />

issue equity interests in classes to<br />

enable investors to participate in a<br />

range of investment portfolios.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> objective is normally to<br />

achieve cost efficiency but, since<br />

<strong>the</strong> portfolios are <strong>on</strong>ly segregated<br />

for internal accounting purposes,<br />

a c<strong>on</strong>venti<strong>on</strong>al company is subject<br />

to <strong>the</strong> inherent risk of cross-class<br />

liability. To deal with this issue,<br />

multi-class <str<strong>on</strong>g>fund</str<strong>on</strong>g>s can be incorporated<br />

in <strong>the</strong> British Virgin Islands<br />

as Segregated Portfolio Companies.<br />

(See page S12 for more <strong>on</strong><br />

<strong>the</strong>se structures.)<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> master/feeder <str<strong>on</strong>g>fund</str<strong>on</strong>g>s are<br />

structured to enable subscripti<strong>on</strong>s<br />

made in separate feeder<br />

vehicles to be pooled<br />

into and managed<br />

as a single master<br />

<str<strong>on</strong>g>fund</str<strong>on</strong>g> portfolio.<br />

MASTERFUL<br />

PERFORMANCE<br />

A typical example<br />

of a master/<br />

feeder <str<strong>on</strong>g>fund</str<strong>on</strong>g> would<br />

involve United<br />

States-domiciled<br />

taxable investors<br />

investing directly in an<br />

<strong>on</strong>shore vehicle (often<br />

a United States<br />

limited partn<br />

e r s h i p )<br />

a n d<br />

United<br />

States<br />

t a x -<br />

exempt or n<strong>on</strong>-United States investors<br />

investing in an offshore vehicle<br />

(normally a British Virgin Islands<br />

company).<br />

Each feeder <str<strong>on</strong>g>fund</str<strong>on</strong>g> <strong>the</strong>n invests all<br />

of its assets in an offshore master<br />

<str<strong>on</strong>g>fund</str<strong>on</strong>g> (normally a British Virgin<br />

Islands company).<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> principal objective is to<br />

enable investors that are subject<br />

to differing tax or o<strong>the</strong>r regulati<strong>on</strong>s<br />

or with distinct requirements<br />

to participate toge<strong>the</strong>r in <strong>the</strong><br />

same investment portfolio having<br />

comm<strong>on</strong> investment objectives.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> structure achieves ec<strong>on</strong>omies<br />

of scale for portfolio-related<br />

activities. Some firms have also<br />

set up limited partnerships in <strong>the</strong><br />

British Virgin Islands, which can<br />

be established under <strong>the</strong> Partnership<br />

Act, 1996.<br />

A limited partnership is formed<br />

in <strong>the</strong> British Virgin Islands by a<br />

general partner and at least <strong>on</strong>e<br />

limited partner executing Articles<br />

of Partnership and by submitting<br />

a Memorandum of Partnership to<br />

<strong>the</strong> British Virgin Islands Financial<br />

Services Commissi<strong>on</strong>.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> Articles of Partnership do<br />

not have to be filed with <strong>the</strong> British<br />

Virgin Islands Financial Services<br />

Commissi<strong>on</strong> and are <strong>the</strong> internal<br />

governing document of <strong>the</strong> partnership<br />

dealing with issues such as<br />

partnership c<strong>on</strong>tributi<strong>on</strong>s and withdrawals<br />

and <strong>the</strong> day-to-day running<br />

of <strong>the</strong> partnership.<br />

A limited partmnership does<br />

not have a separate legal pers<strong>on</strong>ality<br />

distinct from its partners, so<br />

<strong>the</strong> general partner is liable for <strong>the</strong><br />

debts and obligati<strong>on</strong>s relating to<br />

<strong>the</strong> limited partnership.<br />

BVI law says a limited<br />

partner is<br />

not liable for<br />

<strong>the</strong> debts and<br />

obligati<strong>on</strong>s<br />

of <strong>the</strong> limited<br />

partnership<br />

(LP) so l<strong>on</strong>g<br />

as <strong>the</strong> limited<br />

partner<br />

does not<br />

participate<br />

in c<strong>on</strong>trol of<br />

<strong>the</strong> partnership<br />

business.<br />

S18 | BRITISH VIRGIN ISLANDS SUPPLEMENT HEDGE FUNDS REVIEW | October 2007 www.<str<strong>on</strong>g>hedge</str<strong>on</strong>g><str<strong>on</strong>g>fund</str<strong>on</strong>g>sreview.com