Layton

Layton

Layton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Country<br />

Argentina<br />

Brazil<br />

Chile<br />

Colombia<br />

Mexico<br />

Peru<br />

Algeria<br />

Egypt<br />

Nigeria<br />

South<br />

Africa<br />

Telecom providers<br />

Telecom Argentina (TI), Movistar Argentina (TEF), Movicom (BLS), Claro<br />

(AMX),NIHD<br />

Vivo (Telefonica), TIM Brazil (TI), Claro Brazil (AMX), Oi (PT), NIHD, Other<br />

Movistar Chile (TEF), Entel Chile, Bellsouth (CHL), Claro Chile (AMX)<br />

Comcel (AMX), Movistar Colombia (TEF),Tigo Colombia (MICC)<br />

Telcel (AMX), Iusacell, Movistar Mexico (TEF), Unefon, NIHD<br />

Movistar Perú (TEF), Claro Perú (AMX) ,BellSouth, Nextel<br />

Djezzy, Mobilis, Ooredoo<br />

ECMS (Mobinil), Vodafone, Etisalat Egypt<br />

MTN, Airtel (Bharti), Globacom, Etisalat, Others<br />

Vodacom, MTN, Cell C, Telkom<br />

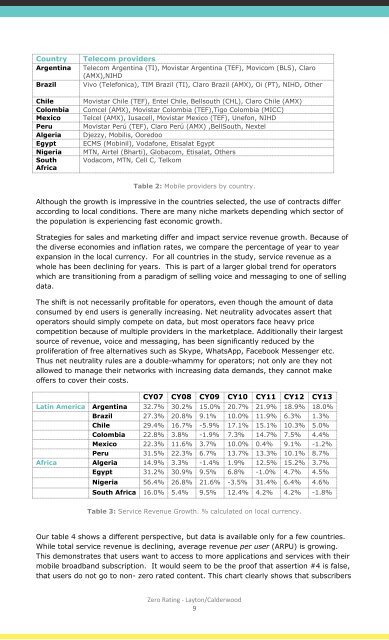

Table 2: Mobile providers by country.<br />

Although the growth is impressive in the countries selected, the use of contracts differ<br />

according to local conditions. There are many niche markets depending which sector of<br />

the population is experiencing fast economic growth.<br />

Strategies for sales and marketing differ and impact service revenue growth. Because of<br />

the diverse economies and inflation rates, we compare the percentage of year to year<br />

expansion in the local currency. For all countries in the study, service revenue as a<br />

whole has been declining for years. This is part of a larger global trend for operators<br />

which are transitioning from a paradigm of selling voice and messaging to one of selling<br />

data.<br />

The shift is not necessarily profitable for operators, even though the amount of data<br />

consumed by end users is generally increasing. Net neutrality advocates assert that<br />

operators should simply compete on data, but most operators face heavy price<br />

competition because of multiple providers in the marketplace. Additionally their largest<br />

source of revenue, voice and messaging, has been significantly reduced by the<br />

proliferation of free alternatives such as Skype, WhatsApp, Facebook Messenger etc.<br />

Thus net neutrality rules are a double-whammy for operators; not only are they not<br />

allowed to manage their networks with increasing data demands, they cannot make<br />

offers to cover their costs.<br />

CY07 CY08 CY09 CY10 CY11 CY12 CY13<br />

Latin America Argentina 32.7% 30.2% 15.0% 20.7% 21.9% 18.9% 18.0%<br />

Brazil 27.3% 20.8% 9.1% 10.0% 11.9% 6.3% 1.3%<br />

Chile 29.4% 16.7% -5.9% 17.1% 15.1% 10.3% 5.0%<br />

Colombia 22.8% 3.8% -1.9% 7.3% 14.7% 7.5% 4.4%<br />

Mexico 22.3% 11.6% 3.7% 10.0% 0.4% 9.1% -1.2%<br />

Peru 31.5% 22.3% 6.7% 13.7% 13.3% 10.1% 8.7%<br />

Africa Algeria 14.9% 3.3% -1.4% 1.9% 12.5% 15.2% 3.7%<br />

Egypt 31.2% 30.9% 9.5% 6.8% -1.0% 4.7% 4.5%<br />

Nigeria 56.4% 26.8% 21.6% -3.5% 31.4% 6.4% 4.6%<br />

South Africa 16.0% 5.4% 9.5% 12.4% 4.2% 4.2% -1.8%<br />

Table 3: Service Revenue Growth. % calculated on local currency.<br />

Our table 4 shows a different perspective, but data is available only for a few countries.<br />

While total service revenue is declining, average revenue per user (ARPU) is growing.<br />

This demonstrates that users want to access to more applications and services with their<br />

mobile broadband subscription. It would seem to be the proof that assertion #4 is false,<br />

that users do not go to non- zero rated content. This chart clearly shows that subscribers<br />

Zero Rating - <strong>Layton</strong>/Calderwood<br />

9