rare-earth elements - Hard Assets Rare Earths Investment Summit

rare-earth elements - Hard Assets Rare Earths Investment Summit

rare-earth elements - Hard Assets Rare Earths Investment Summit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

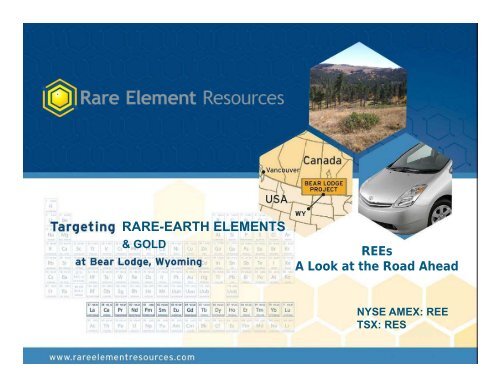

RARE-EARTH ELEMENTS<br />

& GOLD<br />

NYSE AMEX: REE<br />

TSX: RES<br />

REEs<br />

A Look at the Road Ahead<br />

NYSE AMEX: REE<br />

TSX: RES<br />

1

Disclaimer<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• The information contained herein, while obtained from sources which we believe are reliable, is not guaranteed as to<br />

its accuracy or completeness. The company is an exploration company and its mineral project has yet to be proven to<br />

be economic. Some references to geologic and technical information contained herein are historical or have been<br />

generated by external consultants who may or may not be QPs under NI 43-101 and are therefore not in accordance<br />

with the requirements under NI 43-101 or have to be prepared in accordance with a preliminary or final feasibility<br />

study. The content of this presentation is for information purposes only and does not constitute an offer to sell or a<br />

solicitation to purchase any securities referred to herein.<br />

• Forward-looking statements: This presentation includes certain forward-looking statements about future events<br />

and/or financial results which are forward-looking in nature and subject to risks and uncertainties. Forward-looking<br />

statements include without limitation, statements regarding the company’s plan, goals or objectives and future mineral<br />

projects, potential mineralization, resources and reserves, exploration results and future plans and objectives of <strong>Rare</strong><br />

Element Resources. Forward-looking statements can generally be identified by the use of forward-looking terminology<br />

such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, or “continue” or the negative thereof or<br />

variations thereon or similar terminology. There can be no assurance that such statements will prove to be accurate<br />

and actual results and future events could differ materially from those anticipated in such statements. Important<br />

factors that could cause actual results to differ materially from expectations include risks associated with permitting,<br />

mining generally, and pre-development stage projects in particular. Potential investors should conduct their own<br />

investigations as to the suitability of investing in securities of <strong>Rare</strong> Element Resources.<br />

• Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated and Inferred Resources<br />

This presentation uses the term “Inferred” Mineral Resources. U.S. investors are advised that while such terms are<br />

recognized and required by Canadian regulations, the Securities and Exchange Commission does not recognize them.<br />

“Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their<br />

economic and legal feasibility. It cannot be assumed that all or any part of an inferred resource will ever be upgraded<br />

to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or<br />

other economic studies. U.S. investors are also cautioned not to assume that all or any part of an Inferred Mineral<br />

Resource exists, or is economically or legally mineable.<br />

2

Current Status - REEs<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• China accounts for ~96% of the world’s current REE production<br />

• Currently believed to be operating at or near capacity<br />

• Reducing exports year-on-year<br />

• Attempted to acquire the two most advanced projects outside China<br />

• Potential importer of <strong>rare</strong> <strong>earth</strong>s in 5 - 6 years<br />

• Problem with lack of transparency in reserves and future plans<br />

• No significant non-Chinese supply sources currently available<br />

• Small and limited production - Russia, India, and California<br />

• Two <strong>rare</strong>-<strong>earth</strong> operations being constructed outside China:<br />

• Development-stage projects - production in late 2012 & 2013<br />

• Mt. Weld, W. Australia – Lynas Corporation<br />

• Mountain Pass, California – Molycorp<br />

• Others at earlier stages with longer lead times to production<br />

• New projects – technical, economic, and environmental hurdles<br />

3

Chinese Policies and Production<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• China wants to create major wind turbine, solar panel, and electric car industries<br />

Chinese Government Policy<br />

• Strategic value of REO well understood<br />

• Export quotas declining annually<br />

• -10% since 2004 to 59,600t in 2007<br />

• -6% to 56,900t in 2008<br />

• -12% to 50,100t in 2009<br />

• -40% to 30,300t in 2010<br />

• -7% ? to ~28,000 in 2011<br />

• Raised export tariffs to 15-25%<br />

• Key interest in maintaining long-term<br />

domestic supply for the Chinese<br />

manufacturing industry<br />

• Pressure high-tech companies that need<br />

these REE to relocate production to China<br />

Source: Metal-Pages<br />

Chinese Production Limits<br />

• Largest REO mine - Bayan Obo (50% of<br />

world supply) probably operating at or<br />

near capacity<br />

• REO is a by-product of iron mining<br />

• Future ore selection forecast to result in<br />

lower REO grades<br />

• Sichuan<br />

• Environmental issues<br />

• Underground mining<br />

• Jiangxi, Guangdong, Hunan, Fujian<br />

• Fragile resource due to over exploitation<br />

• Fragile environment due to mining methods<br />

• Limited reserves<br />

4

Looking Ahead at REE Market<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• China will account for a decreasing share of the world’s REE<br />

production<br />

• Lynas Corp. and Molycorp expected to be in production by 2012 /<br />

2013 and progressing to their stated capacities<br />

• Hurdles to other potential REE producers:<br />

• Decreasing prices as supply begins to meet demand<br />

• Grades and value per ore tonne for some deposits too low<br />

• Either high Nd-Pr grades or favorable HREE grades<br />

• Good metallurgy and high grade of mineral concentrate<br />

• Logistical and infrastructure challenges<br />

• Environmental challenges due to thorium content<br />

• Technology of REO separation<br />

• High capital costs of mine & plant construction<br />

5

Advanced-Stage Projects<br />

Being Evaluated<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Other projects with longer lead times to production:<br />

• Steenkampskraal, South Africa – Great Western<br />

• Bear Lodge, Wyoming – <strong>Rare</strong> Element<br />

• Nolans Bore, Australia – Arafura<br />

• Zandkopsdrift, South Africa – Frontier<br />

• Eldor, Quebec – Commerce<br />

• Sarfartoq, Greenland – Hudson<br />

• Nechalacho, NWT – Avalon<br />

• Strange Lake, Quebec – Quest<br />

• Kvanefjeld, Greenland – Greenland Minerals<br />

• Dubbo, Australia – Alkane<br />

• Bokan, Alaska – Ucore<br />

• Norra Karr, Sweden – Tasman<br />

• Kipawa (Zeus), Quebec – Matamec<br />

6

<strong>Rare</strong> Element Resources<br />

Why the Bear Lodge Project?<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• 2 nd highest grade <strong>rare</strong>-<strong>earth</strong> deposit in North America<br />

• Excellent distribution of <strong>elements</strong> (rich in Nd, Pr, Eu, Tb, Dy)<br />

• Simple low-cost metallurgical processing<br />

• Exceptional infrastructure<br />

Financial Information<br />

• 44.1M shares outstanding (47.9M FD)<br />

• Market cap of $240M<br />

• ~$63M in cash on hand, no debt<br />

• 52 week H/L of $17.92/$3.86<br />

• Insiders hold 5.8%<br />

7

<strong>Rare</strong> Element Resources Projects<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Bear Lodge Property, Wyoming, USA<br />

• Indicated <strong>Rare</strong>-Earth mineral resource (NI 43-101-compliant)<br />

• 4.9 million tons @ 3.77% REO (1)<br />

• Inferred <strong>Rare</strong>-Earth mineral resource (NI 43-101-compliant)<br />

• 17.8 million tons @ 3.03% REO (1)<br />

Preliminary Economic Assessment completed - 40% IRR<br />

• Carbonatite deposit - same type as Bayan Obo and Mountain Pass<br />

• Property 100% controlled & metallurgical process outlined<br />

Sundance Project, Wyoming, USA<br />

• Cripple Creek-style gold target<br />

• 947,000 oz inferred Au resource: 76 mm tons @ 0.0125 opt (2) (0.42 gpt)<br />

(NI 43-101 compliant)<br />

• Excellent potential for more resources of near-surface and higher grade gold<br />

(1) 1.5% REO cut-off-grade; prepared by Ore Reserves Engineering, June, 2011<br />

(2) 0.005 opt Au cut-off grade; prepared by Ore Reserves Engineering, March 2011<br />

8

Scoping Study Highlights<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Pricing basis - RE bulk concentrates<br />

Base Case<br />

3-year trailing average price<br />

($5.51/kg thru Aug 2010)<br />

Production rate 1,000 tpd<br />

Mine life 15 years (5M tons)<br />

Initial capital $87M<br />

Operating cost $213/ton<br />

LOM sustaining capital $88M<br />

REO recoveries to concentrates (23,700 tonnes conc.) 80%<br />

Annual tons REO in concentrates (10,300 tonnes REO) 11,400 tons<br />

Annual payable value of REO $143M<br />

Annual operating cash flow $50M<br />

Internal rate of return (IRR) 40%<br />

After tax LOM cash flow (undiscounted)<br />

After tax net present value (NPV)<br />

$598M<br />

10% discount rate $213M<br />

15% discount rate $131M<br />

Payback 3.1 years<br />

Concentrate prices: 3-year trend average $5.51/kg; 3.75-yr average $14.45/kg; current price of $38/kg<br />

Concentrates contain 42-45% REO (~43.5%)<br />

NI 43-101 Scoping Study (PEA) prepared by J.T. Boyd Company, November 2010<br />

9

Bear Lodge<br />

Location and Infrastructure<br />

Excellent Mining<br />

Infrastructure<br />

• Paved road within 2 miles of<br />

project<br />

• Low-cost power within 1 mile of<br />

project<br />

• 40 miles to nearest railhead<br />

• Skilled labor and water available<br />

• Favorable community<br />

acceptance; Major coal mining<br />

center 60 miles W<br />

• Top ranked mining jurisdiction (1)<br />

(1) Wyoming ranked as one of the top worldwide locations favorable for mining by the Fraser Institute<br />

NYSE AMEX: REE<br />

TSX: RES<br />

10

Bear Lodge<br />

<strong>Rare</strong>-<strong>Earths</strong> Overview<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• Contains “one of the largest deposits of disseminated (low-grade)<br />

<strong>rare</strong> <strong>earth</strong>s in North America” plus high-grade zones (US Geological<br />

Survey (2) ); USBM historic resource estimate<br />

• Indicated mineral resource - 4.9 mm tons @ 3.77% REO (1) of oxide,<br />

Inferred mineral resources of 17.8 mm tons @ 3.03% REO (1)<br />

including oxide zone of 11.6 mm tons @ 3.22% REO (NI 43-101)<br />

• Exploring for additional oxidized REE mineralization in the Bull Hill area<br />

carbonatites within 500 feet of surface<br />

• Low-cost simple metallurgical process for near-surface oxide<br />

mineralization; Pilot Plant in progress;<br />

• Preliminary Feasibility Study in progress<br />

(1) NI-43-101 compliant using 1.5% REO cut-off-grade; prepared by Ore Reserves<br />

Engineering, June 2011<br />

(2) US Geological Survey (Staatz, Professional Paper 1049-D, 1983)<br />

11

<strong>Rare</strong>-Earth Drilling<br />

NYSE AMEX: REE<br />

TSX: RES<br />

12

Bull Hill Area Drill Holes<br />

Carbon<br />

w/ HREE<br />

East Taylor<br />

w/ HREE<br />

Whitetail Ridge<br />

Resource HREE<br />

(USBM target)<br />

Target<br />

Bull Hill NW<br />

Resource<br />

Bull Hill West<br />

Bull Hill<br />

Bull Hill<br />

Resource<br />

NYSE AMEX: REE<br />

TSX: RES<br />

7 Target Areas<br />

Only Bull Hill<br />

well drilled<br />

Large areas of<br />

adjacent<br />

low-grade (1%)<br />

stockwork REE<br />

13

Dike-Swarm Section - Bull Hill<br />

Plug?<br />

Old holes<br />

Low-grade<br />

2008-11 holes<br />

High-grade<br />

REE in<br />

Dikes Low-grade<br />

Indicated Mineral Resource<br />

4.9 million tons @ 3.77% REO<br />

(compliant with NI 43-101)<br />

Plus Inferred Resources<br />

NYSE AMEX: REE<br />

TSX: RES<br />

14

2010 Drilling Results<br />

REE - Selected Intervals<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Hole Oxide/Non Thickness Total <strong>Rare</strong> Earth Oxides<br />

RES 09-21 oxide 93 ft 4.08%<br />

oxide 59 ft 8.79%<br />

oxide / trans. 96 ft 5.59%<br />

RES 10-01A oxide 97 ft 6.57% (step-off)<br />

RES 10-04 oxide / trans 163 ft 4.64% (step-off)<br />

RES 10-07 oxide 97 ft 8.43% (step-off)<br />

RES 10-19 oxide 58 ft 10.55% (step-off)<br />

RES 10-28 oxide 183 ft 3.55%<br />

RES 10-34 oxide 161 ft 4.10%<br />

RES 10-37 oxide 76 ft 10.01%<br />

RES 10-39 oxide 102 ft 4.20%<br />

oxide 99 ft 4.25%<br />

RES 10-62 oxide 179 ft 8.78% (step-off)<br />

15

2011 Drilling Results<br />

REE - Selected Intervals<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Hole Oxide/Non Thickness Total <strong>Rare</strong> Earth Oxides<br />

RES 11-10 WR oxide 32 ft 3.94% (step-off)<br />

oxide 44 ft 3.27% (step-off)<br />

oxide / trans 27 ft 4.68% (step-off)<br />

RES 11-17 oxide 58 ft 4.88% (step-off)<br />

RES 11-21 oxide 40 ft 3.21% (step-off)<br />

oxide / trans 115 ft 3.38% (step-off)<br />

RES 11-22 oxide 26 ft 4.17%<br />

oxide 64 ft 5.48%<br />

oxide / trans 79 ft 3.96%<br />

RES11-25 WR oxide 108 ft 3.81% (step-off)<br />

RES11-26 ET oxide 42 ft 4.15%<br />

RES11-26A ET oxide 19 ft 3.30%<br />

16

Bull Hill REE Mineralization -<br />

FMR Dikes & Veins<br />

This image cannot currently be displayed.<br />

Bull Hill Diatreme<br />

Breccia ~1%<br />

Low-grade REO<br />

NYSE AMEX: REE<br />

TSX: RES<br />

OXIDE Zone Mineralization - FMR<br />

with Bastnasite-group Minerals<br />

(light brown) High-grade REO<br />

17

Metallurgical Flowsheet<br />

Mineral<br />

Concentration<br />

(~ gravel wash plant)<br />

Preconcentrate<br />

90% recovery<br />

Chemical<br />

Concentration<br />

RE Carbonate<br />

Concentrate<br />

Overall 80% recovery<br />

(Oxide Mineralization)<br />

NYSE AMEX: REE<br />

TSX: RES<br />

18

Mineral Concentration<br />

Pilot Plant<br />

+ 1 inch<br />

Coarse Reject<br />

10m x 48m Fine Middling<br />

NYSE AMEX: REE<br />

TSX: RES<br />

1 inch x 10m Coarse Middling<br />

Pre-concentrate<br />

1 in x 10 m<br />

Recycle<br />

19

Chemical Concentration<br />

Pilot Plant<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Acid Addition Pre-concentrate Feed HCL Leaching<br />

Iron Hydroxide Precipitation REO Carbonate Precipitation Filtration<br />

20

Oxide Zone Distribution of REE<br />

<strong>Rare</strong>-Earth<br />

Element<br />

Wt-% Oxide<br />

Distribution (1)<br />

% Relative Value(2)<br />

Lanthanum 28.6% 19.6%<br />

Cerium 43.5% 15.3%<br />

Neodymium 17.2% 31.0%<br />

Praseodymium 4.9% 8.7%<br />

Samarium 2.6% 1.1%<br />

Europium 0.6% 17.1%<br />

Gadolinium 1.3% 0.8%<br />

Terbium 0.1% 2.7%<br />

Dysprosium 0.3% 3.0%<br />

Yttrium 0.8% 0.6%<br />

Total 99.9% 99.9%<br />

(1) From 43-101 resource estimation model of indicated category, ORE, June 2011<br />

(2) Based on 2010 average prices of REEs from January through August<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Bull Hill Deposit<br />

“Big 5” - most<br />

important and<br />

valuable<br />

<strong>elements</strong> for<br />

magnets – Nd,<br />

Pr, Tb, Dy & CFL<br />

–Eu, Tb<br />

23% of total<br />

distribution but<br />

over 62% of<br />

value<br />

21

Exploration Deposits & Targets<br />

HREE<br />

HREE<br />

Target?<br />

LREE<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Bear Lodge<br />

<strong>Rare</strong>-Earth<br />

District<br />

2010 drill holes<br />

Main resource<br />

at Bull Hill<br />

HREE targets to<br />

the West<br />

22

Bear Lodge REE Geology<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Bear Lodge<br />

REE District<br />

High-grade<br />

REO shown as<br />

FMR in dark<br />

MnOx dikes<br />

Soil cover<br />

masks some<br />

geology<br />

23

Milestones<br />

• Completed<br />

√ 2004-2009: Drilled 32 core holes<br />

in REE mineralization, + 23<br />

historic holes, favorable met test<br />

results, estimated resources<br />

√ 2010: Updated resource<br />

estimate; drilled 60 holes + 40<br />

large diameter holes for bulk<br />

sample; positive Scoping<br />

Study (PEA) on oxides, $66M<br />

financings<br />

√ 2011: Updated resources<br />

estimate, drilled 63 holes,<br />

continued met testing, began<br />

pilot plant testing<br />

• Upcoming<br />

NYSE AMEX: REE<br />

TSX: RES<br />

– Q4 2011: Collect environmental<br />

baseline data; pilot plant tests<br />

on 10-ton bulk sample<br />

– Q1 2012: Complete<br />

Preliminary Feasibility Study<br />

– Q1 2012: Market products from<br />

pilot plant tests; initiate mine<br />

permitting; continue tests for<br />

extraction and separation of REEs<br />

24

Appendix<br />

Thank You<br />

NYSE AMEX: REE<br />

TSX: RES<br />

25

Proven Management Team<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Donald E. Ranta, PhD, PGeo, President, CEO & Director<br />

• 40 years of leadership in exploration and project evaluation<br />

• Previously at Echo Bay, Phelps Dodge, AMAX, Kennecott<br />

Jaye T. Pickarts, P.E., Chief Operating Officer<br />

• 25 years’ experience in project evaluation and production<br />

• Previously at Knight Piesold, Pegasus, Texasgulf, Freeport<br />

David Suleski, CPA, Chief Financial Officer<br />

• 25 years of leadership as CFO, treasurer, controller, & in financings<br />

• Previously at Atna, Golden Star, Rothschild, Apex, Cyprus-Amax,<br />

PWC, E & Y<br />

James G. Clark, PhD, LGeo, VP Exploration<br />

• <strong>Rare</strong>-<strong>earth</strong> geology expert with 30 years experience<br />

• Previously at Molycorp and Hecla Mining<br />

George G. Byers, M.A., VP Government & Community Relations<br />

• 35 years’ experience in successful project development<br />

• Previously at Santa Fe Pacific Gold, Rio Algom, Cameco<br />

26

Directors & Strategic Advisors<br />

Directors: M.N. Anderson, Chairman<br />

• M. Norman Anderson, PEng, Past Chairman & CEO, Cominco<br />

• Mark Brown, C.A., President, Pacific Opportunity Capital<br />

• Norman W. Burmeister, P.E., President & CEO, Saratoga Gold<br />

• Gregory E. McKelvey, PGeo, consullting geologist<br />

• Paul Schlauch, retired partner, Holland & Hart<br />

Advisors:<br />

• Jefferey D. Phillips, President of Global Market Development<br />

• Dr. Anthony Mariano, consulting mineralogist & geologist<br />

• Stephen P. Quin, PGeo, President & CEO, Midas Gold<br />

• Robert Bishop, investor and former newsletter writer<br />

• William H. Bird, PhD, PGeo, President of Medallion Resources Ltd.<br />

• David Beling, P.E., former Executive VP & COO of Geovic, Ltd.<br />

• Matt Bender, P.E., Senior Director, Newmont Mining Company<br />

NYSE AMEX: REE<br />

TSX: RES<br />

27

Bear Lodge Project<br />

Technical Team<br />

• Dr. Tony Mariano – Mineralogy & REE geology<br />

• Dr. Roshan Bhappu, P.E. – Metallurgy, Mountain States R&D<br />

• Dudley Kingsnorth, PEng – <strong>Rare</strong>-<strong>earth</strong> markets<br />

• Jack Lifton – Strategy and OEM contacts<br />

• John Ray – REE & Gold exploration manager<br />

• Dr. Ellie Leavitt, PGeo – REE geology & exploration<br />

• James Leavitt, PGeo – Gold geology & exploration<br />

• Alan Noble, P.E. – Resource estimation, Ore Reserves Engineering<br />

• Michael Richardson, P.E. – Mining engineering, John T Boyd Co.<br />

• William Ahrens, P.E. – Metallurgical engineering, Mountain States R&D<br />

• Dr. Richard Hammen, P.E. – Extraction & separation, Intellimet<br />

• Thomas Kerr, PEng – Geotechnical engineering, Knight Piesold<br />

• Richard DeLong – Environmental & permitting, Enviroscientists<br />

NYSE AMEX: REE<br />

TSX: RES<br />

28

What are <strong>Rare</strong>-Earth Elements?<br />

<strong>Rare</strong> <strong>Earths</strong> Commercial Use<br />

REO Price<br />

(USD/kg)<br />

Scandium Stadium Lights Not Av.<br />

Yttrium Lasers 11.30<br />

Lanthanum Electric car batteries 6.12<br />

Cerium Lens polishes 4.57<br />

Praseodymium Searchlights, aircraft parts 28.38<br />

Neodymium High-strength magnets 29.49<br />

Promethium Portable X-ray units Synthetic<br />

Samarium Glass 4.50<br />

Europium Compact fluorescent bulbs 480.00<br />

Gadolinuim Neutron radiography 8.43<br />

Terbium High-strength magnets 350.00<br />

Dysprosium High-strength magnets 129.50<br />

Holmium Glass tint Not Av.<br />

Erbium Metal alloys 30.00<br />

Thulium Lasers 790.00<br />

Ytterbium Stainless steal 132.00<br />

Lutetium None 288.42<br />

Source: Metal-Pages as at February 3, 2010 and at October 11, 2011<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• REE – an unusual group of metallic <strong>elements</strong> with unique properties: chemical,<br />

catalytic, magnetic, metallurgical and phosphorescent<br />

• REE – uses in high-strength magnets are in high demand – includes Neodymium,<br />

Praseodymium, Dysprosium and Terbium,<br />

Price<br />

11-1-11<br />

---<br />

142.50<br />

64.00<br />

59.00<br />

218.50<br />

240.00<br />

---<br />

101.50<br />

3790.00<br />

142.50<br />

3010.00<br />

2090.00<br />

---<br />

---<br />

---<br />

---<br />

---<br />

21<br />

Sc<br />

39<br />

Y<br />

57<br />

La<br />

58<br />

Ce<br />

59<br />

Pr<br />

60<br />

Nd<br />

Periodic Table of REEs<br />

61 62 63<br />

Pm Sm Eu<br />

64<br />

Gd<br />

65<br />

Tb<br />

- Heavy <strong>Rare</strong> <strong>Earths</strong><br />

- Light <strong>Rare</strong> <strong>Earths</strong><br />

- Other <strong>Rare</strong> Metals<br />

66<br />

Dy<br />

67<br />

Ho<br />

68<br />

Er<br />

69 70<br />

Tm Yb<br />

71<br />

Lu<br />

29

Where are REE Found?<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• China accounts for ~96% of the world’s current REE production<br />

• Currently believed to be operating at or near capacity<br />

• Reducing exports year-on-year<br />

• Potential importer of <strong>rare</strong> <strong>earth</strong>s in 5 - 6 years<br />

• No significant non-Chinese supply sources currently available<br />

• Small and limited production - Russia, India, and California<br />

• All REE deposits - environmentally challenging due to thorium content<br />

• Development projects currently in construction or study:<br />

• Advanced stage projects - production in late 2011 & 2012<br />

• Mt. Weld, W. Australia – Lynas Corporation<br />

• Mountain Pass, California – Molycorp<br />

• Others at earlier stages with longer lead times to production<br />

• New projects – technical, economic, and environmental hurdles<br />

30

Key Applications of REE<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• REE are critical and enabling for many emerging Green Energy technologies, High Tech<br />

applications and Defense Systems; examples include hybrid cars, plug-in hybrid electric<br />

vehicles, wind power turbines, computer hard drives, fluorescent lights, missile guidance<br />

systems, lasers and cell phones<br />

Energy<br />

Efficiency<br />

Environmental<br />

Miniaturization<br />

Technology<br />

Application Elements<br />

• Compact fluorescent lights<br />

• Weight reduction in cars<br />

• Higher oil refinery yields<br />

• Hybrid vehicles<br />

• Auto catalytic converter<br />

• Diesel additives<br />

• Disk drives<br />

• Digital cameras<br />

• Flat panel displays<br />

31

Major Applications of REE<br />

Hybrid Cars<br />

Nd-Fe-B magnets & La batteries<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Wind Turbines<br />

With Nd-Fe-B magnets<br />

32

Applications are Driving Strong<br />

Forecasted Demand<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• Total demand for REE is expected to grow from 125,000 tonnes in 2010, to 170,000<br />

tonnes by 2015, and to 255,000 tonnes in 2020; a growth rate of ~7% per year<br />

2008 Demand by Application<br />

Ceramics<br />

5%<br />

Phosphors &<br />

Pigments<br />

8%<br />

Magnets<br />

21%<br />

Other<br />

7%<br />

Metal Alloys<br />

18%<br />

Total = 124,000 tonnes<br />

Source: Dudley J Kingsnorth, IMCOA<br />

Catalysts<br />

19%<br />

Glass<br />

Additive<br />

10%<br />

Polishing<br />

Powder<br />

12%<br />

Growth Forecast by Application<br />

Application<br />

Growth rate<br />

% p.a.<br />

2015 demand<br />

tonnes<br />

Catalysts 0% 25,500<br />

Glass Additive 0% 10,000<br />

Polishing Powder 5-10% 25-30,000<br />

Metal Alloys 4-8% 36-40,000<br />

Magnets 10-15% 40-45,000<br />

Phosphors & Pigments 4-8% 13-15,000<br />

Ceramics 5-8% 9-10,000<br />

Other 8-12% 12-14,000<br />

Total 6-10% 170-190,000<br />

33