rare-earth elements - Hard Assets Rare Earths Investment Summit

rare-earth elements - Hard Assets Rare Earths Investment Summit

rare-earth elements - Hard Assets Rare Earths Investment Summit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

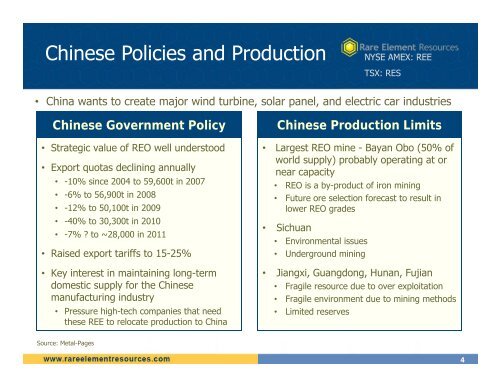

Chinese Policies and Production<br />

NYSE AMEX: REE<br />

TSX: RES<br />

• China wants to create major wind turbine, solar panel, and electric car industries<br />

Chinese Government Policy<br />

• Strategic value of REO well understood<br />

• Export quotas declining annually<br />

• -10% since 2004 to 59,600t in 2007<br />

• -6% to 56,900t in 2008<br />

• -12% to 50,100t in 2009<br />

• -40% to 30,300t in 2010<br />

• -7% ? to ~28,000 in 2011<br />

• Raised export tariffs to 15-25%<br />

• Key interest in maintaining long-term<br />

domestic supply for the Chinese<br />

manufacturing industry<br />

• Pressure high-tech companies that need<br />

these REE to relocate production to China<br />

Source: Metal-Pages<br />

Chinese Production Limits<br />

• Largest REO mine - Bayan Obo (50% of<br />

world supply) probably operating at or<br />

near capacity<br />

• REO is a by-product of iron mining<br />

• Future ore selection forecast to result in<br />

lower REO grades<br />

• Sichuan<br />

• Environmental issues<br />

• Underground mining<br />

• Jiangxi, Guangdong, Hunan, Fujian<br />

• Fragile resource due to over exploitation<br />

• Fragile environment due to mining methods<br />

• Limited reserves<br />

4