rare-earth elements - Hard Assets Rare Earths Investment Summit

rare-earth elements - Hard Assets Rare Earths Investment Summit

rare-earth elements - Hard Assets Rare Earths Investment Summit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

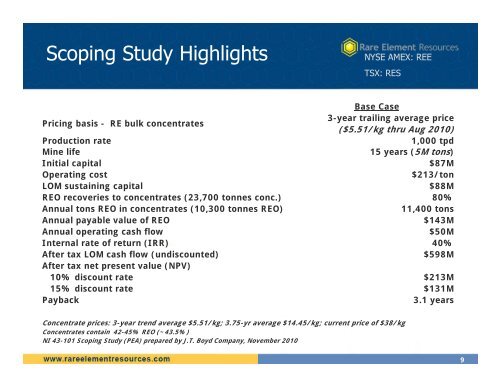

Scoping Study Highlights<br />

NYSE AMEX: REE<br />

TSX: RES<br />

Pricing basis - RE bulk concentrates<br />

Base Case<br />

3-year trailing average price<br />

($5.51/kg thru Aug 2010)<br />

Production rate 1,000 tpd<br />

Mine life 15 years (5M tons)<br />

Initial capital $87M<br />

Operating cost $213/ton<br />

LOM sustaining capital $88M<br />

REO recoveries to concentrates (23,700 tonnes conc.) 80%<br />

Annual tons REO in concentrates (10,300 tonnes REO) 11,400 tons<br />

Annual payable value of REO $143M<br />

Annual operating cash flow $50M<br />

Internal rate of return (IRR) 40%<br />

After tax LOM cash flow (undiscounted)<br />

After tax net present value (NPV)<br />

$598M<br />

10% discount rate $213M<br />

15% discount rate $131M<br />

Payback 3.1 years<br />

Concentrate prices: 3-year trend average $5.51/kg; 3.75-yr average $14.45/kg; current price of $38/kg<br />

Concentrates contain 42-45% REO (~43.5%)<br />

NI 43-101 Scoping Study (PEA) prepared by J.T. Boyd Company, November 2010<br />

9