CFA-Level-III Latest Exam BrainDumps

Test4Direct provides latest PDF questions of CFA Institute CFA-Level-III exam. You have an opportunity to pass the CFA Institute CFA-Level-III exam in one go. Test4Direct is most accurate source to prepare CFA Institute CFA-Level-III exam as your success will become site’s responsibility after purchasing CFA-Level-III exam product. There are also lots of discounts and promotion offers that you can avail. Let’s try a free demo http://www.test4direct.com/CFA-Level-III.html

Test4Direct provides latest PDF questions of CFA Institute CFA-Level-III exam. You have an opportunity to pass the CFA Institute CFA-Level-III exam in one go. Test4Direct is most accurate source to prepare CFA Institute CFA-Level-III exam as your success will become site’s responsibility after purchasing CFA-Level-III exam product. There are also lots of discounts and promotion offers that you can avail. Let’s try a free demo http://www.test4direct.com/CFA-Level-III.html

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

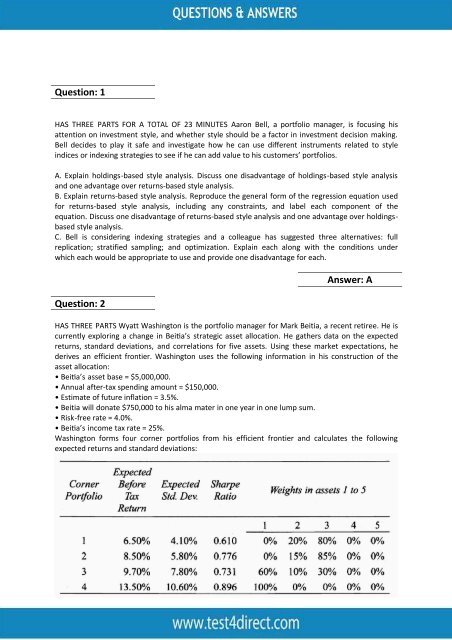

Question: 1<br />

HAS THREE PARTS FOR A TOTAL OF 23 MINUTES Aaron Bell, a portfolio manager, is focusing his<br />

attention on investment style, and whether style should be a factor in investment decision making.<br />

Bell decides to play it safe and investigate how he can use different instruments related to style<br />

indices or indexing strategies to see if he can add value to his customers’ portfolios.<br />

A. Explain holdings-based style analysis. Discuss one disadvantage of holdings-based style analysis<br />

and one advantage over returns-based style analysis.<br />

B. Explain returns-based style analysis. Reproduce the general form of the regression equation used<br />

for returns-based style analysis, including any constraints, and label each component of the<br />

equation. Discuss one disadvantage of returns-based style analysis and one advantage over holdingsbased<br />

style analysis.<br />

C. Bell is considering indexing strategies and a colleague has suggested three alternatives: full<br />

replication; stratified sampling; and optimization. Explain each along with the conditions under<br />

which each would be appropriate to use and provide one disadvantage for each.<br />

Question: 2<br />

Answer: A<br />

HAS THREE PARTS Wyatt Washington is the portfolio manager for Mark Beitia, a recent retiree. He is<br />

currently exploring a change in Beitia’s strategic asset allocation. He gathers data on the expected<br />

returns, standard deviations, and correlations for five assets. Using these market expectations, he<br />

derives an efficient frontier. Washington uses the following information in his construction of the<br />

asset allocation:<br />

• Beitia’s asset base = $5,000,000.<br />

• Annual after-tax spending amount = $150,000.<br />

• Estimate of future inflation = 3.5%.<br />

• Beitia will donate $750,000 to his alma mater in one year in one lump sum.<br />

• Risk-free rate = 4.0%.<br />

• Beitia’s income tax rate = 25%.<br />

Washington forms four corner portfolios from his efficient frontier and calculates the following<br />

expected returns and standard deviations: