FTInsight Feb 2016

The only magazine for those who do business in Sierra Leone feature: JS Koroma of Union Trust Bank The Mooc revolution 4 investment opportunities Rebecca Perlman on renewed opportunities plus polls, surveys and a look at the start up experience in Sierra Leone

The only magazine for those who do business in Sierra Leone feature:

JS Koroma of Union Trust Bank

The Mooc revolution

4 investment opportunities

Rebecca Perlman on renewed opportunities

plus polls, surveys and a look at the start up experience in Sierra Leone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

For Sierra Leone’s entrepreneurs, business<br />

people, policy makers and investors<br />

FEBRUARY <strong>2016</strong><br />

Le 55,000 / $10<br />

www.ftinsight.net<br />

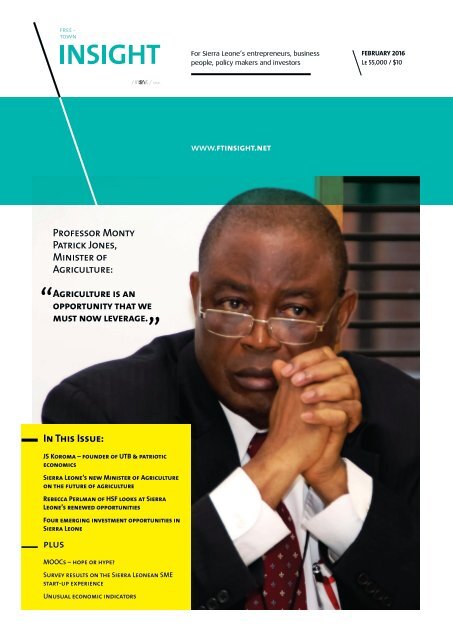

Professor Monty<br />

Patrick Jones,<br />

Minister of<br />

Agriculture:<br />

Agriculture is an<br />

opportunity that we<br />

must now leverage.<br />

“<br />

”<br />

In This Issue:<br />

JS Koroma – founder of UTB & patriotic<br />

economics<br />

Sierra Leone’s new Minister of Agriculture<br />

on the future of agriculture<br />

Rebecca Perlman of HSF looks at Sierra<br />

Leone’s renewed opportunities<br />

Four emerging investment opportunities in<br />

Sierra Leone<br />

plus<br />

MOOCs – hope or hype?<br />

Survey results on the Sierra Leonean SME<br />

start-up experience<br />

Unusual economic indicators

Editor’s Insight<br />

Welcome to the second issue of Insight magazine and thank you for all your feedback, comments and support.<br />

We have added a range of new pages to our website including a news section and of course, the change<br />

makers page – so you can go directly to the people making a difference in Sierra Leone’s business and<br />

investment sector. Our website is updated regularly with exclusive content, and I am delighted to say that<br />

we regularly achieve over 2,000 visitors to the site and have almost 1000 subscribers for the digital version<br />

of the magazine. Sign up at www.ftinsight.net.<br />

In our <strong>Feb</strong>ruary issue, we hear from Professor Monty Patrick Jones, Sierra Leone’s new Minister of<br />

Agriculture, and his plans for a sustainable agricultural industry in Sierra Leone. We look at the MOOC<br />

revolution in online education and ask if it could provide a solution to Sierra Leone’s tertiary education<br />

slump. Survive and Succeed takes a different approach and we’ve devoted a whole section to the<br />

challenges of Sierra Leone’s start up businesses – complete with a snapshot survey of our readers’<br />

experiences and two case histories. Rebecca Perlman of Herbert Smith Freehills follows up the<br />

successful launch of the firm’s investment guide with an expert’s look at Sierra Leone’s renewed<br />

focus on being an investment friendly economy. Our change maker is James Sanpha Koroma,<br />

the man who set up Sierra Leone’s only indigenously owned private bank 20 years ago and has<br />

watched his audacious vision go from strength to strength.<br />

FT<br />

Insight<br />

3<br />

38 Spur Road, Freetown | Tel: +232 77 399399 | Website: www.swissspirithotels.com/freetown<br />

Sierra Leone’s economy looks brighter this year. The Ebola epidemic has been declared over,<br />

although sporadic flare ups can be expected. Fly Salone gives us the advantage once again<br />

of direct flights to the country, which means travelers from the UK can be here in six hours;<br />

and the collapse in iron ore prices has refocused the government’s attention on diversifying<br />

the economy with agriculture as a priority. On 5 May we will be discussing Sierra Leone’s<br />

economic opportunities at an investment forum in London hosted by Herbert Smith<br />

Freehills. This is the second of what will become an annual series. Confirmed speakers<br />

include Dr Kailfala Marah, Sierra Leone’s Minister of Finance, Professor Monty Patrick<br />

Jones, Sierra Leone’s Minister of Agriculture and Dr Samura Kamara, Sierra Leone’s<br />

Minister of Foreign Affairs.<br />

38 Spur Road, Freetown | Tel: +232 77 399399 | www.swissspirithotels.com/freetown<br />

Freetown Insight<br />

+44 771 722 1023<br />

memunaforna@ftinsight.net<br />

Our April issue will also focus on investment – the opportunities, challenges, and<br />

the pioneers. Sierra Leone’s business environment is testing, it’s not for the faint<br />

hearted; and it can be a tight rope walk to find success, but the companies that<br />

emerge intact are outstanding examples of entrepreneurship. Hearing your<br />

opinions and views on the subject is important to us. We look forward to<br />

your suggestions, comments, feedback and feature ideas. Our readers are<br />

at the sharp end of business and investment and we always welcome your<br />

contributions.<br />

Editor:<br />

Memuna Forna<br />

Art Director:<br />

Erika Perez-Leon<br />

Contributors:<br />

Professor Monty Patrick Jones,<br />

Minister of Agriculture<br />

Angela Betancourt<br />

Unisa Dizo Conteh<br />

Alinah Kallon<br />

Rebecca Perlman<br />

Advertising Enquiries:<br />

memunaforna@ftinsight.net<br />

+44 771 722 1023 / +232 79953382<br />

www.ftinsight.net

Insightful<br />

Sierra Leone and Somalia both more than doubled mobile<br />

subscriptions between 2012 and 2013, with 4 million and<br />

5.2 million subscriptions respectively.<br />

The total telecom sector was worth $1.67 trillion in 2013,<br />

growing by 1-2% per year, driven mainly by expansion in<br />

China and emerging markets.<br />

Globally 3.2 billion people<br />

are using the Internet by end<br />

2015, of which 2 billion are<br />

from developing countries<br />

In Sierra Leone there were<br />

260,000 Internet users on Nov 15,<br />

2015, 4.4% of the population.<br />

www.internetworldstats.com<br />

The global mobile subscriber base increased<br />

by just over 5% in 2014. Developed markets<br />

are growing more slowly as penetration<br />

rates approach levels close to saturation.<br />

For example, in Europe and North America,<br />

unique subscriber growth was below 1% in<br />

2014. At the other end of the spectrum, Sub-<br />

Saharan Africa was still the world’s most<br />

under-penetrated region with subscriber<br />

growth at nearly 12%. www.gsmaintelligence.com<br />

Nigeria has the highest amount of internet users on the continent, with over 92 million users,<br />

which accounts for 51.1% of the country’s population. Second on the list is Egypt with over 48<br />

million internet users, which accounts for over 54% of the country’s population having access to<br />

the internet. Over 63% of the Kenyan population has access to the internet, and that amounts<br />

to over 29 million users. 49% of the South African population has access to the internet, which<br />

amounts to over 26 million people, as well as over 60% of the Moroccan population, which<br />

amounts to over 20 million people. Other countries on the continent with significant internet<br />

access include Algeria, Cote D’Ivoire, Ethiopia, Ghana, Libya, Rwanda, Senegal, Tanzania, Tunisia,<br />

Uganda, Zambia, Botswana and Zimbabwe.<br />

The mobile industry continues to scale rapidly, with a total of 3.6<br />

billion unique mobile subscribers at the end of 2014. Half of the world’s<br />

population now has a mobile subscription—up from just one in f ive 10<br />

years ago. An additional one billion subscribers are predicted by 2020,<br />

taking the global penetration rate to approximately 60%. There were<br />

7.1 billion global SIM connections at the end of 2014, and a further 243<br />

million machine-to-machine (M2M) connections. www.gsmaintelligence.com<br />

The lowest levels of internet access are mostly found in<br />

Sub-Saharan Africa, with Internet available to less than<br />

2 percent of the populations in Guinea, Somalia, Burundi<br />

and Eritrea.<br />

McKinsey predicts that by 2025,<br />

e-commerce will make up 10 per cent of<br />

total retail sales in key African markets.<br />

Smartphones now dominate mobile<br />

broadband devices, and will continue to<br />

for the foreseeable future. This means<br />

that, for many consumers in developing<br />

markets, their f irst experience of the<br />

Internet will be via a smartphone.<br />

Subscriptions for smartphones<br />

are expected to exceed those for<br />

‘basic’ phones in <strong>2016</strong>.<br />

Nigeria has Africa’s largest mobile market,<br />

with more than 148 million subscribers and<br />

a penetration of about 107%.<br />

- See more at:<br />

http://www.budde.com.au/Research Nigeria-Mobile-<br />

Infrastructure- Operators-and-Broadband-Statisticsand-<br />

Analyses.html#sthash.N6F7tspz.dpuf<br />

A large body of evidence has now been amassed that<br />

affordable and effective broadband connectivity is<br />

a vital enabler of economic growth, social inclusion<br />

and environmental protection.<br />

(The State of Broadband 2015 http://www.broadbandcommission.<br />

org/Documents/reports/bb-annualreport2015.pdf)<br />

Digital Africa – a 2014 survey by Ovum<br />

- reports that 46% of the the polls<br />

respondents believe that e-commerce<br />

will be the most important digital<br />

service generating increased revenue<br />

for African industry over the next f ive<br />

years.<br />

Share of population in sub-<br />

Saharan Africa with access to:<br />

Paved<br />

Roads<br />

Financial<br />

Services<br />

Sanitation<br />

Electricity<br />

Mobile<br />

phone access<br />

10<br />

16<br />

26<br />

29<br />

32<br />

39<br />

20 30 40 50<br />

57% of the world’s people remain<br />

off line according to the UN’s<br />

report The State of Broadband.<br />

In the world’s Least Developed<br />

Countries (LDCs) over 90 percent<br />

of people have no kind of<br />

internet connectivity. The report<br />

also highlights the continuing<br />

stubbornness of the gender<br />

digital divide.<br />

FACEBOOK’S free<br />

basics is now live in<br />

30 countries with 34<br />

operators.<br />

There are 100 million<br />

people coming to<br />

Facebook every month<br />

across the African<br />

continent, with over<br />

80% on mobile.<br />

FT<br />

Insight<br />

5<br />

www.ftinsight.net

Poll<br />

Results<br />

Mamamah Mia! Should<br />

we build Freetown’s<br />

new airport or not?<br />

The poll results are in!<br />

THE NOT-AT-ALL VIEW:<br />

66%<br />

23%<br />

9%<br />

no not now yes<br />

To put it into perspective,<br />

it is $52 (or Le 300,000) for<br />

each citizen.<br />

Simply too much!<br />

Only the misguided need<br />

f i ll in the poll.<br />

HOSPITAL SCHOOLS<br />

HOSPITAL SCHOOLS.<br />

Not at all!!!! There are more<br />

pressing issues. Hospitals, schools<br />

etc Absolutely no new airport, not<br />

a priority. Better management will<br />

suffice for now. Electricity, water,<br />

basic infrastructure. New airport,<br />

how ridiculous is that? Would be<br />

interesting, if it went ahead to see<br />

how much of the $315 million is<br />

spent of the project and how much<br />

goes missing?<br />

A bridge linking the old airport to Freetown will do a whole<br />

lot better if the money is to be spent on some vanity project.<br />

FT<br />

Insight<br />

7<br />

We asked you to take a poll on our website www<br />

ftinsight.net. Should we build the new airport or<br />

not? The poll results are in, and its fairly clear that<br />

there’s very little enthusiasm for the project.<br />

68% of respondents said no; 23% said ‘not now’ and<br />

only 9% said yes. Hospitals, schools, power, water, basic<br />

infrastructure – and a fear that a large chunk of the $315<br />

million budget would be channeled elsewhere were just<br />

some of the arguments against. We’ve summarised the<br />

comments on the following page:<br />

THE NOT-NOW VIEW:<br />

I think a proper hospital and medical staff is much more needed at this stage!!!<br />

THE SHORT-TERM-PAIN-FOR-<br />

LONG-TERM-GAIN VIEW<br />

Developing Sierra Leone’s<br />

potential as a first-class<br />

tourist destination and<br />

attracting investors means<br />

we need first class facilities.<br />

It’s a tough call. With the better airport<br />

comes more accessibility to global<br />

travellers and investors, better business<br />

opportunities. Higher GDP.... more<br />

money and more schools and hospitals.<br />

Sustainable growth. It’s the long term/<br />

short term question. If you were ever going<br />

to move it and if the land is available, now<br />

would be the time. If you want to build a f<br />

irst class tourist industry, you need f irst<br />

class facilities ... SL has the potential to be<br />

the BEST destination in Africa.<br />

www.ftinsight.net

Change Maker<br />

Audacious visionary<br />

and patriotic<br />

economist -<br />

James Sanpha Koroma<br />

By Memuna Forna<br />

James Sanpha Koroma, founder and CEO of Union Trust Bank (UTB) – Sierra Leone’s first and only indigenous<br />

private bank, is very frank about his inability to suffer fools. “If you want something done correctly, call me. If<br />

you don’t want it done correctly then don’t call me,” he says. His frankness and uncompromising approach to<br />

professional efficiency have served him extremely well in business but less well in politics, and there is a sense<br />

that successive regimes have struggled to capitalise on his undoubted intellectual value.<br />

Founded by JS Koroma in 1995, UTB is the result of one man’s<br />

audacious vision. At the time of its inception, Koroma’s dream<br />

was greeted with some scepticism. Two private banks in Sierra<br />

Leone had already folded – the Bank of Credit and Commerce<br />

and the International Bank for Trade and Industry; a third –<br />

Meridian was in its f inal throes. “No one believed me. Everyone<br />

said I was crazy,” he remembers. To say that he has proved his<br />

detractors wrong is something of an understatement. UTB<br />

has been in operation for 20 years. It is headquartered on the<br />

largest single piece of real estate in central Freetown, and a<br />

new eight storey headquarters, with underground parking,<br />

will be completed later this year.<br />

He is an economist by training – he studied at Fourah Bay College, followed by a stint at Syracuse in the US and<br />

Birmingham University in the UK. On his return to Sierra Leone, he was quickly identified as one of the country’s<br />

brightest minds and co-opted into the Ministry of Finance, where he served for 12 years. From there he went<br />

on to become the Managing Director of the National Development Bank, developing it into a strong commercial<br />

entity. It is a pattern of private sector success and a strong sense of public duty that has been repeated<br />

throughout his career.<br />

Conflict with the then President Momoh brought his tenure at NDB to an abrupt end when the hastily introduced<br />

Economic Sabotage Act was used against him. A warrant was issued for his arrest, and on the advice of the late<br />

Terence Terry who warned him that his life was in danger, he left Sierra Leone. It is a period he describes as “his<br />

time in exile” and despite well-regarded posts with the African Development Bank and as a financial advisor to<br />

the Nigerian Development Bank, he was focused on returning home. “This is my country,” he states. “I will never<br />

be forced to leave again.”<br />

The opportunity to return came in the form of a consultancy contract to research the feasibility of setting up<br />

Ecobank in Sierra Leone. More consultancy work followed – he negotiated the sale of Shell to Safecon, and was<br />

instrumental in setting up the Road Transport Authority. It was 1994 and Sierra Leone was in the midst of its<br />

period of sustained civil unrest. It was an unlikely time to start a new business, nevertheless Sanpha Koroma<br />

began to look for opportunities.<br />

The political and economic climate certainly did not appear to favour a new bank. Ecobank had decided the<br />

country’s political instability made setting up in Sierra Leone too risky, and Meridian bank was in the process<br />

of folding up. Koroma believed otherwise. His feasibility study for Ecobank had proved the opportunity was<br />

there. He had the necessary experience, understood the culture and had some savings. “I believed I knew the<br />

economy enough to know that a bank was viable,” he says.<br />

The complex and expensive process of setting up a private bank began. Registering the company, applying<br />

for a license to the Bank of Sierra Leone; providing the minimum paid up capital which at the time was Le 2.5<br />

billion equivalent to $45,000; a five-year business plan giving detailed financial projections, target market and<br />

investment strategies and the proposed risk management strategy. There was also the need for a suitable<br />

premises, computerisation, organisational structure and hiring staff. Koroma completed the initial steps and set<br />

out to raise investment. “To actually establish the bank as a going concern, I needed five times the amount<br />

I’d deposited with the Bank of Sierra Leone. I approached my contacts at the Golf Club and at the Aqua Club.<br />

Through the sale of Shell, I had learned who in the country had money to invest. I approached them. People<br />

were sceptical - some said ‘this na Salone man business, leh we wait and see’, but I carried on with those who<br />

trusted me.”<br />

The initial years were, he admits, a struggle made no easier when he was offered the position of the Governor<br />

of the Central Bank during the turbulent war years under President Kabbah. It was the second of his forays<br />

into public service and he found wearing two hats – as regulator and banking sector investor - a tricky juggling<br />

act. But he believes his tenure was a success. “I came into the role in 1999. The bank was in a mess. Both the<br />

headquarters and the Kenema branch had been looted; most of the senior staff had fled. I had the unforgiving<br />

responsibility of getting our monetary system back on track, as well as taking on the task of the physical repairs<br />

on both branches.” He took on and completed the 16 storey Sam Bangura building, which had remained in<br />

limbo since Sam Bangura’s death, which perhaps says more than anything about his period at the Bank of Sierra<br />

Leone.<br />

The end of his governorship was followed by three years of investigation by the Anti- Corruption Committee and<br />

the Serious Fraud Office for queries over his salary and expenses. It was another difficult period for his family,<br />

and could have been ruinous for his business. But he, his family and his business survived. “Most people have<br />

known me for long enough not to associate me with corruption.” The enquiry found nothing. Koroma sued the<br />

ACC and won, giving the damages to charity. President Kabbah’s apologies when they came were very public.<br />

FT<br />

Insight<br />

9<br />

www.ftinsight.net

Change Maker<br />

continued<br />

Freetown Insight<br />

Contributor<br />

And in recognition of his role and contribution towards the development of the Finance and Banking Industry in<br />

the country, he was honoured with the National Award of the Grand Commander of the Order of the Rokel in<br />

2007.<br />

In the period that followed he focused on expanding the bank. There are now 12 branches around the country<br />

and several agencies. But his sense of public duty intervened once again when President Ernest Koroma<br />

approached him to be Presidential Secretary with Cabinet rank. Unsurprisingly, given his previous experiences,<br />

his wife was opposed to his decision to accept the position. “I felt I had to oblige President Koroma, but I found<br />

the politics too difficult to handle. I’m not a politician he says. I carry no party card. I come from Tonkolili – we’re<br />

known for being troublesome and I’m always blunt – what you see is what you get,” he says with a half-smile.<br />

His commercial persona is in stark contrast to his political one. He admits that he is considered to be aloof in<br />

political spheres, but he is clearly a man who commands great loyalty. Many colleagues at UTB have worked<br />

with him since the bank’s inception, and the bank’s board is composed of very able, very successful and<br />

longstanding colleagues. I ask what his staff call him. “The boss,” he replies. He is only half-joking.<br />

He has passed his financial aptitude to all three of his sons, which I suggest indicates that economics is in his<br />

DNA. He doesn’t dispute this. He is a man who pursues the logical and most efficient solution to the problem.<br />

The problem that is currently vexing him is the country’s private sector culture: “Sierra Leoneans are risk averse.<br />

We don’t invest. We want everything today and don’t take the time to invest in building institutions. You cannot<br />

build a viable economy if you don’t invest.”<br />

Investor, sometime public servant, banker, f inancier, trail<br />

blazer – Koroma comfortably wears a number of hats, but the<br />

one that best f its is perhaps that of patriotic economist. People<br />

regularly describe him as a mentor and he has personally<br />

invested in Aureol Insurance, Rokel Bank, Standard Bank and set<br />

up a discount trading house. “This is my country,” he explains.<br />

“All I have is here. My ambition is to create an institution that<br />

is sustainable and contributes to the improvement of lives of<br />

Sierra Leoneans. I want to create jobs and opportunities in my<br />

discipline. I want to leave a business legacy.”<br />

Improving self-suff iciency<br />

in Sierra Leone through<br />

agriculture<br />

By Professor<br />

Monty Patrick Jones,<br />

Minster of Agriculture<br />

The Ministry of Agriculture’s overarching objective is to create policies for selfsufficiency<br />

that will decrease the importation of food into Sierra Leone that we<br />

can produce ourselves. We presently import a wide range of foods that we can<br />

produce locally such as rice, cassava, sweet potatoes, onions, tomatoes and chicken.<br />

For example, we import chicken wings from Brazil and cattle from Guinea. Our<br />

immediate priority is to increase production and productivity, focusing on rice and<br />

cassava and cash crops such as cocoa and oil palm. Rice imports have accounted for<br />

between 15-45 % of consumption in recent years, for a crop that we can produce<br />

locally.<br />

Agriculture employs 70% of Sierra Leone’s workforce, primarily<br />

women, the majority of whom are subsistence farmers. We can<br />

increase production and labour productivity by introducing<br />

machinery into the system, particularly small scale machinery such<br />

as power tillers and weeders that can be incorporated into the<br />

smallholdings that represent the majority of our farms.<br />

We also aim to improve the productivity of our soil by ensuring that fertilisers and other chemicals reach the<br />

farm gates. In order for that to happen, our Agribusiness Centres (ABCs) have to become more effective. There<br />

are approximately 400 around the country; if we can get 52 to be fully functional, they will serve as hubs for<br />

fertilisers and machinery. They can also support farmers to become better organised by helping them form<br />

cooperatives and encourage them to open bank accounts. Some of the challenges our agriculture sector faces,<br />

are also to do with the organisation of the Ministry of Agriculture. There is a clear need to streamline our<br />

projects and programmes, and reduce duplication and fragmentation.<br />

FT<br />

Insight<br />

11<br />

Encouraging investors in the commercial agriculture sector to work with us will be key to developing our<br />

agriculture sector, and I have already welcomed delegations from several countries on this subject. We have<br />

enough land, our weather is conducive and we have a readily available source of water through rainfall and<br />

rivers. I envisage large scale commercial farms, strategically placed, surrounded by smallholders who can serve<br />

as out growers, benefitting from the technical support and easily available market provided by the commercial<br />

agricultural operation.<br />

It is important that we begin to adopt and understand the importance of our local agricultural processing. Within<br />

Sierra Leone, we can and should be able to add value to rice and fruits, cocoa, coffee, oil palm, ginger and<br />

cashew nuts for example, creating products that will command a higher price, improve incomes and reduce the<br />

poverty of our country. We live in a world of ever diminishing resources and Africa is well poised to emerge as its<br />

future breadbasket. In Sierra Leone, we are still effectively a blank canvas and this gives us a greater advantage<br />

in the adoption of sustainable and green technologies. It is an opportunity that we must now leverage.<br />

Professor Monty Patrick Jones – Honourable Minister – Ministry of Agriculture, Forestry and Food Security is co-winner of the prestigious<br />

2004 World Food Prize based on his discovery of the genetic process to create the New Rice for Africa (NERICA). He has spent 26 years of his<br />

career life in Africa working in international agricultural research for development institutions. He returned to Sierra Leone in July 2013 to work<br />

for the Government as Special Adviser to the President. Professor Jones has received several national and international awards including the<br />

Niigata International Food Award in 2010. He received honorary doctorate degrees (Honoris Causa) from Universities in the UK, Belgium, Sierra<br />

Leone and South Africa. In 2007 he was named as one of the 100 most influential persons of the World by Time Magazine.<br />

www.ftinsight.net

“<br />

Freetown<br />

Insight<br />

by numbers<br />

You are always breaking new grounds on the private sector<br />

front. Freetown Insight sounds & feels great.<br />

”<br />

Francis Ato Brown,<br />

World Bank Country Manager for Sierra Leone (2012-2015)<br />

New and returning visitors to Freetown Insight’s website www.ftinsight.net<br />

Tech Talk<br />

Vendtech brings<br />

a new prepaid<br />

electricity solution<br />

to Sierra Leone<br />

With Vendtech, Sierra Leonean entrepreneur Victor Blell has<br />

brought a new way of buying electricity credits to the country,<br />

using mobile point of sale machines. The venture took several years<br />

to set up, but is already nationwide and is fast becoming a popular<br />

option with consumers.<br />

34%<br />

66%<br />

Returning Visitor<br />

New Visitor<br />

Victor Blell’s IT background meant he was familiar with the technology; he is the country representative for the<br />

firm African Innovators, who are behind the technology and uses their rugged point of sale machines to sell<br />

National Lottery tickets. He also has personal experience with prepaid electricity in the UK and US, and spotted<br />

a gap in Sierra Leone’s market. “Prepaid electricity is already sold via Airtel money and Splash, but these require<br />

mobile phones, phone credit and a charged phone. The Vendtech option allows consumers without access to a<br />

mobile phone to buy prepaid electricity from our vendors,” he explains.<br />

FT<br />

Insight<br />

13<br />

The company plans to employ around 150 vendors within the coming year, as it rolls out its service. The<br />

machines are simple to use, mobile and because they print out a receipt, customers experience a high level of<br />

confidence in the system.<br />

2,000 +<br />

Number of visitors to www.ftinsight.net each week<br />

1000<br />

Number of named decision makers on our database<br />

773<br />

Number of page views to www.ftinsight.net on Jan 16<br />

6<br />

Number of times a year Freetown Insight is published<br />

www.ftinsight.net

Opinion<br />

Back to Growth:<br />

Sierra Leone Has<br />

Re-opened for<br />

Business<br />

By Rebecca Perlman<br />

For the first time since Ebola struck, the slogan “Sierra Leone is open for<br />

business” appears to be more than just an uplifting soundbite. With two major<br />

trade delegation visits in the past six months, several high profile international<br />

investment forums on the Mano River Union and a Post-Ebola Recovery Strategy<br />

that prioritises private sector-led growth, the signs are certainly encouraging.<br />

Ten years on from the end of its civil war, Sierra Leone was one of the fastest<br />

growing economies in the world. And it is easy to see why. The country’s shores<br />

are lined by white sand beaches rivalling the Seychelles, mining opportunities<br />

extend well beyond the country’s famous diamond reserves, and the huge<br />

potential in renewable and non-renewable energy was beginning to be realised. Taken together with largely<br />

untapped potential in agriculture and fisheries, one need not look far for investment opportunities.<br />

As levels of inward investment grew following the end of the war, the Government increasingly found itself<br />

faced with what President Koroma has referred to as “a phalanx of lawyers and accountants on one side of<br />

the [negotiating] table, outnumbering our own side ten to one.” The impact of this imbalance between the<br />

Government and international investors has stretched beyond the boardroom to the very heart of Sierra Leone’s<br />

development agenda. Foreign investment, and the increased prosperity that comes with it, can help Sierra Leone<br />

reclaim the levels of growth enjoyed before the Ebola crisis. In the longer term however the Government’s focus<br />

on getting “a fair deal” in negotiations with international investors will be critical to translating wealth creation<br />

into sustainable, inclusive growth for the country as a whole. This was the case before the Ebola outbreak and it<br />

is all the more important as the country moves from crisis to recovery.<br />

The role of commercial contract negotiation in advancing Sierra Leone’s development lies at the heart of<br />

international law firm Herbert Smith Freehills (HSF)’s Fair Deal Sierra Leone free legal assistance programme.<br />

Set up in 2010, the programme seeks to help redress the imbalance at the negotiating table and support the<br />

Government of Sierra Leone with increasing levels of inward investment. Over the past six years, HSF has<br />

provided more than £2million worth of free legal advice to the Government on commercial contracts, disputes,<br />

legislation and policy. During the Ebola crisis, this included pro bono assistance on force majeure and material<br />

adverse change issues as well as holistic advice on investor relations and crisis management. More recently, HSF<br />

produced Sierra Leone: An Investor’s Guide together with Standard Chartered Bank and Prudential plc. The Guide<br />

provides an independent, private sector perspective on Sierra Leone’s investment landscape with the aim of<br />

rebuilding confidence in the country as an investment destination.<br />

We have seen that the right sorts of deals with the right kind of investors can support development outcomes<br />

from water supply to education and skills development. For instance, agricultural investments with smallholder<br />

programmes can both focus on skills and development training, and provide markets for smallholders,<br />

stimulating further production and helping commercial businesses reach more scale more quickly. One example<br />

is Carmanor Ltd, a UK firm which has invested in African Lion Agriculture with Sierra Rutile. Carmanor has<br />

installed a palm oil mill to mill fruits it purchases from smallholders that currently lack access to market and is<br />

developing a 13,000 hectare estate with port facilities over the next 10 years.<br />

The post-Ebola recovery effort has emphasised the need for a strong private sector in Sierra Leone and<br />

the importance of the Government’s relationship with it. The Government’s renewed focus on improving<br />

infrastructure, broadening the tax base and creating jobs for the people of Sierra Leone reveals a desire to reflect<br />

on what could have been done differently in the period leading up to the crisis and to reclaim the country’s pre<br />

crisis growth. In order to achieve this, Sierra Leone will need to rebuild investor confidence abroad and at home.<br />

Promotion of the country’s investment opportunities is a good starting point. Recent examples include an<br />

investment forum hosted by the Dutch Ministry of Foreign Affairs in November last year and the Sierra Leone<br />

Investment and Export Promotion Agency (SLIEPA)’s new “Sierra Leone Back to Growth” investment promotion<br />

video. However investors will want more than an overview of the many opportunities within Sierra Leone. The<br />

investment framework and the perceived and actual ease of doing business in the country will be critical to<br />

increasing levels of inward investment and to reclaiming the trajectory set by the Agenda for Prosperity.<br />

There does currently appear to be greater political will for reform in Sierra Leone. As one minister recently<br />

stated, “we should never waste a good crisis”. The Government seems determined not to do that. In particular,<br />

SLIEPA is looking to centralise the country’s fiscal and non-fiscal regimes into one easy-to-access investment<br />

code. The Government is also considering specific reforms to the agribusiness investment framework. Another<br />

key focus is on the standardisation of processes across different Government Ministries, Departments and<br />

Agencies, including the development of model form documents for use in tenders and deal negotiations.<br />

Sierra Leone now stands on the threshold of the next chapter<br />

in its history. Effective long-term investment will be critical<br />

to securing the country’s future and preventing history from<br />

repeating itself. International supporters stand ready to assist<br />

as the Government capitalises on the increased political will<br />

for change so that the private sector can come into its own<br />

in the long-term recovery effort, identifying and driving the<br />

opportunities that Sierra Leoneans and leading businesses stand<br />

ready to grasp.<br />

Rebecca Perlman is a lawyer at leading global law firm Herbert Smith Freehills (HSF). In 2014, Rebecca was seconded to the Office of the President<br />

of Sierra Leone through HSF’s awardwinning Fair Deal Sierra Leone pro bono programme. Rebecca represents HSF on the UK’s City Ebola Taskforce,<br />

which was formed following a private sector briefing by the UK Foreign and Commonwealth Office (FCO) on its actions to support the Government<br />

of Sierra Leone during the Ebola crisis.<br />

The Taskforce has produced a new Investor Guide for Sierra Leone, in collaboration with the FCO, UK Department for International Development<br />

(DFID) and the GoSL. The Guide was drafted by a team of Herbert Smith Freehills lawyers, together with Standard Chartered Bank and Prudential<br />

plc, and was launched by President Koroma of Sierra Leone at the United Nations International Ebola Recovery Conference in July 2015. The Guide is<br />

available for download at http://www.herbertsmithfreehills.com/insights/guides/sierra-leone-an-investors-guide.<br />

FT<br />

Insight<br />

15<br />

www.ftinsight.net

Early Years in Business<br />

Special Segment<br />

Surviving the early<br />

years in business<br />

It’s often said that the f irst few years in business are a real test<br />

of survival, and the f igures bandied about for the failure rates<br />

of new businesses can be alarming. Studies indicate that<br />

signif icant numbers fail before or by their f irst year of<br />

operation, and that nearly half will go under within f ive years.<br />

Early years in business in<br />

Sierra Leone<br />

Our readers participated in a short<br />

anonymous snapshot survey on the<br />

challenges of their early years in<br />

business in Sierra Leone. Seventy-five<br />

percent of respondents had set up or<br />

run an SME in Sierra Leone.<br />

The greatest challenge our readers<br />

faced was the skills’ gap – untrained/<br />

unskilled staff was a problem for 75%<br />

of respondents. Unreliable access to<br />

power came in second, with 54% of<br />

respondents citing it as a problem. Tied<br />

with the power problem, was disruption<br />

caused by disease or epidemic –<br />

unsurprising because of our recent<br />

Ebola epidemic. Access to finance came<br />

in at third place. A surprising number<br />

of respondents also struggled with<br />

insufficient business or management<br />

experience. Most were able to weather<br />

legislative changes, and finding suitable<br />

premises did not pose too much of a<br />

problem either.<br />

Yes<br />

No<br />

Access to<br />

Finance<br />

Untrained/<br />

Unskilled Staff<br />

Inadequate<br />

business<br />

Suitable<br />

premises<br />

Unreliable access<br />

to power<br />

Insufficient<br />

demand for<br />

Disruption<br />

caused by<br />

Disruption<br />

caused by<br />

Unexpected<br />

legistlation<br />

Social<br />

disruption<br />

Insufficient<br />

business /man<br />

None of<br />

the above<br />

10%<br />

10%<br />

20%<br />

20%<br />

30%<br />

30%<br />

40%<br />

40%<br />

50%<br />

50%<br />

60%<br />

60%<br />

70%<br />

70%<br />

80%<br />

80%<br />

90%<br />

90%<br />

100%<br />

100%<br />

“Corruption. Most Govt. ministries unwilling to co-operate unless paid a bribe.”<br />

“Please note that this was a start up business and part of the challenge was<br />

obtaining trained staff. Also, the main investors had to lower the budget as<br />

we were attempting to expand the project and this did make it a challenging<br />

experience, along with the Ebola Virus breakout.”<br />

“Employee inf idelity and theft.”<br />

Our readers proved to be a robust lot<br />

and followed a range of strategies to<br />

transcend their start up challenges.<br />

An encouraging 48% invested in staff<br />

training. The same percentage looked<br />

for alternative forms of finance. Almost<br />

22% diversified their services or markets.<br />

Thirteen percent exited from old markets<br />

and/or business activities. We did not<br />

ask whether they went on to pursue<br />

alternative forms of entrepreneurship.<br />

Making changes to the supply chain or<br />

forming a new business was a relatively<br />

popular solution at just over 17%. Almost<br />

9% reduced their range of goods and<br />

services.<br />

ANSWER CHOICES<br />

Diversified<br />

into new ...<br />

Made changes<br />

to our suppl...<br />

Reduced the<br />

number of ...<br />

Invested in<br />

staff training<br />

Exited from<br />

old markets<br />

Changed how<br />

our business ...<br />

Reduced our<br />

range of ...<br />

Moved to a<br />

more suitable ...<br />

No significant<br />

changes<br />

RESPONSES<br />

• Diversified into new markets . . 21.74%<br />

and/or business activities<br />

• Made changes to our supply. . 17.39%<br />

chain or forned new business<br />

• Reduced the number of . . . . 43.48%<br />

permanent staff<br />

• Invested in staff training . . . . 47.83%<br />

• Exited from old markets . . . . 13.04%<br />

and/or business activities<br />

10%<br />

20%<br />

30%<br />

40%<br />

50%<br />

60%<br />

70%<br />

80%<br />

90%<br />

RESPONSES<br />

• Changed how our business . . . 47.83%<br />

is financed<br />

• Reduced our range of . . . . . . 8.70%<br />

products and services<br />

• Moved to a more suitable . . . 13.04%<br />

location<br />

• No significant changes . . . . . 17.39%<br />

100%<br />

FT<br />

Insight<br />

17<br />

RESPONSES<br />

RESPONSES<br />

“One of the businesses had to be closed down because of f inancial constraints.”<br />

ANSWER CHOICES<br />

• Access to finance . . . . . . . . . . 50%<br />

• Untrained/unskilled staff. . . . . . 75%<br />

• Inadequate business . . . . . . 16.67%<br />

advice/support<br />

• Suitable premises . . . . . . . . 8.33%<br />

• Unreliable access to power . . . 54.17%<br />

• Insufficient demand for . . . . . 20.83%<br />

product or services<br />

• Disruption caused by . . . . . . 12.50%<br />

extreme weather<br />

• Disruption caused by . . . . . . 54.17%<br />

disease/epidemic<br />

• Unexpected legislation. . . . . . 8.33%<br />

• Social disruption (riots etc) . . . 12.50%<br />

• Insufficient business/. . . . . . 41.67%<br />

management experience<br />

• None of the above . . . . . . . . 12.5%<br />

“Placed business largely on a care & maintenance basis.”<br />

“Changed the business strategy and invested more in expansion and market<br />

share acquisition.”<br />

“Invested in insurance.”<br />

www.ftinsight.net

Early Years in Business<br />

Special Segment<br />

Radisson Blu Mammy Yoko -<br />

surviving an epidemic<br />

When Radisson Blu Mammy Yoko opened its doors to guests in April 2014, the hotel expected a<br />

number of challenges to their five-star standards. The Ebola epidemic was never one of them.<br />

The launch of Radisson Blu Mammy Yoko in Sierra Leone was economically significant for several reasons. It<br />

represented a huge investment of time and money. It had taken five years and $25 million to raise Freetown’s<br />

faded OAU flagship to a standard that would allow it to legitimately integrate into the Radisson Blu chain. Locally<br />

the hotel would create jobs, generate income and offer opportunities for skills development. It would provide<br />

quality business infrastructure and a venue for international conferences; and strategically, Radisson Blu’s choice<br />

of Sierra Leone as its launch pad for entry into the West African market spoke volumes about the potential of<br />

the country’s business and tourism sectors, sending a positive signal to other foreign investors.<br />

The hotel’s business objectives for the first year were straightforward enough. Daniel Sekoni, the hotel’s<br />

marketing manager explains: “We wanted to be known in the market as the place to be, and to create a<br />

signature of international quality, adding a profit margin that should grow gradually year by year. We expected to<br />

achieve this using destination marketing as the main strategy.”<br />

The EVD effect changed that and when international airlines began to stop flights into the country and several<br />

businesses were forced to shut, the team at Radisson Blu Mammy Yoko rapidly revised their business strategy.<br />

Their West African/African feeder market target was massively affected and room occupancy rate had dropped<br />

from a predicted 60% to a 5% low. Added to which the ´no public gathering rule cut off any revenue stream<br />

from events and conferences. “This was an epidemic that was unprecedented in its ferocity, and which initially<br />

almost ground the business to a halt,” explains Sekoni. “However from a business perspective it eventually<br />

created an awareness in certain sectors and markets around the world, particularly the medical, media, and<br />

international organisations.”<br />

The hotel’s new business strategy included drastically reduced room rates. Payroll was secured by cutting hours<br />

by 50% with an equivalent saving in pay. This option was better for employees, who kept their jobs; and for the<br />

business, which did not lose their valuable investment in staff training. Keeping the hotel open and maintaining<br />

morale became everyone’s responsibility. Regular training and talks conducted by the Center for Disease Control<br />

(CDC) and other medical organisations provided information, alleviated fears and restored confidence.<br />

A rigorous protocol to keep the hotel Ebola-free included<br />

chlorine solution at hotel guest and staff entrances and exits,<br />

chlorine solution fumigation and house cleaning, compulsory<br />

use of disposable gloves, temperature screening at all entrances,<br />

hand sanitisers in all off ices and outlets, no outside sales calls<br />

activities, and strictly enforcing the no handshake, no hugs, no<br />

burial attendance rules.<br />

Early years in the<br />

early years’ business<br />

Ariana Oluwule set up Freetown based Narnia Daycare in June 2013. Narnia is daycare plus. It<br />

combines daycare with an early learning centre for babies and toddlers from three months to three<br />

years. The concept was born out of Ariana’s natural aff inity with children, her longing to spend<br />

more time with her baby son and an inability to f ind childcare for him that she really wanted while<br />

she pursued a corporate career.<br />

“The nature of my job meant I was spending less and less time with my baby and apart from my mother who<br />

was retired, I could not find childcare that corresponded with my ideals. I wanted a space that was lively, homely,<br />

safe and clean, where my baby would be be looked after in a happy, learning environment.”<br />

Realising that her experiences were mirrored by other parents, she<br />

took a leap of faith, quit her job and started Narnia. “My mama<br />

is an educator with over 30 years of national and international<br />

experience and of course, I had my f irst client - my son who had just<br />

turned one. In effect I had all that I needed.”<br />

Ariana’s savings with some financial support from her husband, provided the initial capital. In common with<br />

most SMEs, finance has remained a challenge. A Brookings Institute report on the subject noted that more than<br />

25 percent of firms in Africa rate the availability and cost of finance as their most important operating obstacle,<br />

almost twice as many as outside Africa.<br />

“Our operating expenses are high - cleaning supplies, healthy meals, ensuring toys and learning materials are<br />

always available,” Ariana explains. There was also significant capital expenditure on constructing their own<br />

premises, because a suitable alternative wasn’t available. This was financed through private loans. “The bank<br />

rates are unimaginable,” she says.<br />

Trained and reliable staff has been an additional challenge which most Sierra Leonean business owners will<br />

be familiar with. Narnia’s staff now take distance learning courses with the US based Care Courses School.<br />

Continuous professional development is also a priority of Ariana’s. Her background is in Biological Sciences.<br />

Post graduate administrative skills and management experience help her run the business effectively. To<br />

these she has added a number of long-distance caregiving courses and is aiming for Certification in Child Care<br />

Development and an equivalent in Education.<br />

FT<br />

Insight<br />

19<br />

Despite the challenges the hotel successfully maintained full operations throughout, an achievement which has<br />

been widely acknowledged. It became the hotel of choice for many of the international organisations involved<br />

in the Ebola response and was recognised by the CDC for its on-going and tremendous support during the Ebola<br />

outbreak. It was awarded the Adversity Award by its parent company Carlson Rezidor and nominated for the PR<br />

world’s EU Excellence awards 2015 in the Crisis Communication category. As Sekoni observes: “It was baptism by<br />

fire, but we are still here, team members still have their jobs and I feel that we represent a sign of the country’s<br />

economic rebuilding.”<br />

www.ftinsight.net

Early Years in Business<br />

Special Segment<br />

Breaking boundaries<br />

in the cassava market<br />

By Alinah Kallon<br />

Rhoda Akinola’s business is all about cassava and its by-products. She started the Green Diamond<br />

Cassava Farmers Initiative (GDFCI) after attending a conference in Nigeria in 2006, where she was<br />

intrigued to learn about the huge potential of cassava.<br />

“I gained a wealth of knowledge about cassava and how valuable it can be to a range of industries including<br />

the textile, pharmaceutical and food sectors,” Rhoda says. “I also learned how cassava can be used to create<br />

sustainable wealth for myself and my community.” Rhoda went on to translate this knowledge into reality by<br />

setting up a Sierra Leonean based company which processes and markets cassava products including cassava<br />

flour, odorless foo foo, composite flour and gari. By applying innovative methods, such as providing mobile<br />

cassava processing machines in strategic locations across Sierra Leone and training farmers in their use, the firm<br />

has significantly improved productivity for farmers and the quality of their products.<br />

GDFCI’s business model has attracted widespread support. For example, the First Lady of Sierra Leone, Sia<br />

Nyama Koroma, donated 50 acres of land in Kono, Sierra Leone’s diamond-district. The African Foundation<br />

for Development Sierra Leone (AFFORD-SL), through its Business Bomba Competition, provided Le 25 million<br />

(approximately US$5000) of prize money to GDFCI. Business Bomba is a national business competition supported<br />

by the Ministry of Trade and Industry.<br />

The recent Ebola outbreak created an unusual expansion in the business, allowing it to create 150 jobs. During<br />

the outbreak, rice, Sierra Leone’s staple food, rose in price by about 20%. This led to increased consumption of<br />

Sierra Leone’s second staple food, cassava. The majority of the jobs created are for farmers based in the South<br />

of Sierra Leone - Moyamba and Pujehun. In addition to receiving a stable income, the farmers also benefit from<br />

training to improve efficiency and productivity, particularly in gari processing.<br />

According to Rhoda, these jobs provided the farmers with flexible working hours while bringing in a steady<br />

stream of income at a time when job and income losses were widespread across the country, due to the Ebola<br />

crisis. “The farmers have a contract that is more beneficial to them than ever before,” Rhoda says. “In the past,<br />

these cassava farmers faced huge post-harvest losses because there was no proper system in place to organise<br />

interrelated activities from the moment of harvest through to cassava processing and getting the products to<br />

the consumers.”<br />

Kadie Sesay was among GDCFI’s contracted farmers; she has also received training as a gari processor. “The<br />

training I received from GDCFI has been very useful for me,” Kadi says. “Before, I was just a basic cassava farmer<br />

and local gari processor. Now I have relevant skills to process quality gari and transform the cassava into many<br />

other products that will help the future expansion of my business.”<br />

GDCFI’s growth strategy includes market diversification, which will soon see it enter the export market. The<br />

company has already established trade links in the Gambia where it will export gari and cassava flour. It is<br />

also planning to construct a cassava processing factory at Waterloo, on the outskirts of Freetown, for cassava<br />

processing and the training of processors and marketers through a partnership with World Vision, Sierra Leone<br />

Chamber for Agribusiness and International Institute of Tropical Agriculture. As part of its longer term growth<br />

strategy, GDFCI intends to establish links with the pharmaceutical and textile industries that use cassava in their<br />

production.<br />

The Democratic Republic of Congo is the largest consumer of cassava in SSA, followed by Nigeria.<br />

Nineteen million hectares of cassava were planted worldwide in 2007, with about 63% in Africa.<br />

Apart from food, cassava is very versatile and its derivatives and starch are applicable in many types<br />

of products such as foods, confectionery, sweeteners, glues, plywood, textiles, paper, biodegradable<br />

products, monosodium glutamate, and drugs. Cassava chips and pellets are used in animal feed and<br />

alcohol production.<br />

According to the FAO, cassava has the potential to replace 400 000 metric tonnes of wheaten f lour in<br />

CARICOM countries; substitute up to 30% of the corn in poultry rations as well as a portion of other<br />

animal feeds and contribute to a reduction of the Food Import Bill by approximately 5%.<br />

Nigeria is currently the largest producer of cassava in the world with an annual output of over 34<br />

million tonnes of tuberous roots. Cassava production has been increasing for the past 20 or more years<br />

in area cultivated and in yield per hectare.<br />

Cassava and its place in the World<br />

Cassava is produced mostly by smallholders on marginal or submarginal lands of the humid and subhumid<br />

tropics. Such smallholder agricultural systems as well as other aspects of its production and use often create<br />

problems, including: unreliability of supply, uneven quality of products, low producer prices, and an often<br />

costly marketing structure. The smallholder production system also implies that producers cannot bear much<br />

of the risk associated with development of new products and markets. Thus the challenge is to create a<br />

strategy that affects production, processing and marketing in such a way that it provides an array of high<br />

quality products at reasonable prices for the consumer, while still returning a good profit for the producers<br />

without requiring them to assume the largest part of the development risk.<br />

Strengths of cassava<br />

Cassava can grow and produce dependable yields in places where cereals and other crops will not grow or<br />

produce well. It can tolerate drought and can be grown on soils with low nutrient capacity, but responds well<br />

to irrigation or higher rainfall conditions, and to use of fertilizers. Cassava is highly flexible in its management<br />

requirements, and has the potential of high-energy production per unit area of land. Once thought to be<br />

resistant to pests and diseases, the crop can be improved genetically to increase its resistance to damage<br />

from serious pests and diseases. Cassava yields can be quite high, as high as 25 to 40 t/ha, although national<br />

yields are often well below these levels. World average is about 10 t/ha.<br />

The crop has long been used as a famine reserve and food security crop. Because cassava has no definite<br />

maturation point, harvest may be delayed until market, processing or other conditions are more favourable;<br />

this flexibility means cassava may be field stored for several months or more.<br />

Although it was long considered a smallholder subsistence crop, cassava can be grown in large plantations<br />

or in more favourable conditions to produce raw materials for industrial processing. Cassava starch has some<br />

unique characteristics that favour its use in specialised market niches. In general, cassava has an ability to<br />

enter diverse markets.<br />

The Global Cassava Development Strategy and Implementation Plan (FAO/IFAD, 2001)<br />

FT<br />

Insight<br />

21<br />

As in the case with numerous businesses seeking expansion in Sierra Leone, access to finance is a major<br />

constraint. Cassava processing is labour intensive and if the company is to meet the demands of the local and<br />

international markets and succeed in the face of stiff competition, it needs the right machinery for processing<br />

and production. “There is wealth in cassava and if we explore it, it will be able to enhance food security in the<br />

nation and will create employment for thousands of people,” Rhoda says.<br />

www.ftinsight.net

Early Years in Business<br />

Special Segment<br />

In: digest<br />

Made in Sierra Leone<br />

Morvigor (Sierra Leone) Ltd<br />

eyes overseas expansion<br />

By Unisa Dizo-Conteh<br />

Although well known for its raw materials, it is not often you hear about manufactured products<br />

made in Sierra Leone. Morvigor tea is an exception. It is manufactured in Sierra Leone, and<br />

almost all the raw materials including the Moringa Oleifera plant, are sourced there too. This year<br />

the company has its eye on export, with plans to break into the UK market.<br />

Dr Eva Roberts specialises in anaesthesia and is currently head of the intensive care unit at Connaught Hospital in<br />

Freetown, Sierra Leone. Five years ago, she established Morvigor (SL) Ltd to produce Morvigor tea, a herbal tea<br />

rich in nutrients such as vitamins A and C. Since then the company has become one of the most successful small<br />

and medium-sized enterprises (SMEs) in Sierra Leone, initially creating six jobs, a figure which has increased by<br />

over 150% in the past two years.<br />

Orange agrees to buy Airtel’s<br />

operations in Burkina Faso and<br />

Sierra Leone.<br />

The Corporate Affairs<br />

Commission Sierra Leone<br />

reveals there are 12,476<br />

registered companies in<br />

Sierra Leone.<br />

Sierra Leone’s last known Ebola<br />

patient was released from hospital.<br />

Morvigor’s journey started when Eva Roberts won the African Foundation for Development’s (AFFORD SL)<br />

Business Bomba Competition - Sierra Leone’s version of Dragon’s Den. The company received a business grant<br />

of Le 75 million (approximately $15,000). In 2012 Morvigor also received $265,000 equity funding from West<br />

African Venture Funds, enabling it to scale up production and introduce four new varieties of tea. By mid-2014,<br />

the company’s turnover had increased by 20% compared to the same period in the previous year. Although this<br />

dropped during the Ebola crisis, the company has now returned to its previous growth pattern.<br />

The quirks and obstacles of Sierra Leone’s business environment<br />

presented signif icant challenges for the start-up business.<br />

Lack of reliable electricity drove up running costs and trained<br />

manpower was in short supply. “It wasn’t easy and it continues to<br />

be a challenging environment,” Dr Roberts says. “Finance, which<br />

most people focus on, wasn’t a major diff iculty for me. The main<br />

one was actually navigating all the hurdles in the environment<br />

including the off icials you have to see.”<br />

The Bolloré Group announces plans<br />

to spend $120 million to octuple<br />

the annual capacity of its container<br />

terminal in the port of Freetown,<br />

Sierra Leone, to 750,000 twentyfoot<br />

equivalents after volume rose<br />

30 percent over the last four years.<br />

The newly reconstructed and<br />

upgraded Kenema Pendembu<br />

road was off icially handed<br />

over to the Sierra Leone Roads<br />

Authority by the ISU Engineering<br />

and Construction Company.<br />

FT<br />

Insight<br />

Like most Sierra Leonean businesses, Morvigor’s bottom line was hit by the country’s recent Ebola outbreak.<br />

Emergency measures imposed by the government to restrict the movement of people and prevent the<br />

spread of the virus, inevitably curtailed business hours, and a deal with a potential foreign investor fell through<br />

as a direct consequence of the Ebola outbreak. As part of her mitigation strategy Dr Roberts reviewed and<br />

transformed key operational aspects of her business. She reduced working hours and successfully negotiated<br />

with her employees to accept pay cuts to ensure business continuity.<br />

The Sierra Leone Chinese Chamber<br />

of Commerce (SLCCC) launched<br />

at the Bintumani hotel to help<br />

strengthen Chinese business<br />

entrepreneurs and coordinate<br />

potential investors.<br />

So what’s the direction of travel for this young company? Morvigor SL Ltd is presently pursuing a strategy of<br />

market diversification, with the UK as its first target. Dr Roberts initially identified ECOWAS as a potential market<br />

but has struggled to find suitable partners. The early years are tough for most start-ups, but Dr Roberts believes<br />

in her business and is convinced of the private sector’s importance to Sierra Leone’s economy: “Micro businesses<br />

are looking to SMEs to lead the way,” she says. “Equally, SMEs, like Morvigor, are looking to strategic partners to<br />

help develop their growth potential and drive healthy economic growth and wealth creation in Sierra Leone.”<br />

Unisa Dizo-Conteh is ABC UK co-ordinator. Tel: 0203 326 3750. Email: abc@afford-uk.org Twitter: @pacdizo<br />

In Q4 2015, Sierra Rutile<br />

records the highest quarter<br />

of rutile production and the<br />

highest annual production<br />

since the operation was<br />

restarted in 2006.<br />

www.ftinsight.net

Freetown Insight<br />

Contributor<br />

Sierra Leone:<br />

The Land of Opportunity<br />

Four emerging investment<br />

opportunities for businesses/<br />

investors to embrace in <strong>2016</strong><br />

Solar & Renewable energy (small & large scale)<br />

Yvonne has shared that improved energy, among other sectors like water management, would make running<br />

her business easier.<br />

Energy is a major challenge in the country. There are currently only a handful of small, renewable energy<br />

companies in Sierra Leone. The Government of Sierra Leone and the Ministry of Energy have prioritised<br />

renewable energy investment for post-Ebola Sierra Leone. Many donors are coming to the table in support and<br />

large investments, both in terms of major infrastructure projects as well as smaller households and business<br />

needs, are expected. The government has expressed that it will provide special incentives for those who<br />

improve efficiencies in the sector.<br />

Yvonne Hamilton never closed her bakery during Ebola. Salvonne Bakery and Catering Services on Percival St in<br />

Freetown had been open since 2003 and she had no intention of shutting it down at the outbreak of Ebola in<br />

2014.<br />

“I stayed open because I wanted to help the community. People had to take care of their families,” said Yvonne.<br />

“Some businesses shut down and those that stayed open had very slow sales”.<br />

The city was almost completely devoid of any activity, liveliness or energy. Ebola quarantine measures not<br />

only brought a halt to social gatherings, they also forced many small businesses and small farmers to close<br />

down shop.<br />

Everyone wanted change. As Ebola began to dwindle down and quarantine measures were lifted around the<br />

country, things gradually began improving. Sales have recently started picking up again at the bakery. Most of<br />

the people who left the country are starting to return, businesses are starting to reopen, hotels are full, and<br />

there is an almost tangible new energy and optimism amongst the people.<br />

Despite the devastating effect on the economy, the outbreak lowered two barriers of entry to the Sierra<br />

Leonean Market:<br />

1. Now…Addressing Infrastructure Constraints<br />

Poor road and port networks infrastructure with high costs of distribution and power became the<br />

most apparent constraint in the country when Ebola Response teams operated. The outbreak highlighted<br />

the constraints that were already present but that had been ignored throughout the years. Improvements<br />

currently underway in infrastructure will no-doubt lower costs locally and increase economic and business<br />

opportunities internationally.<br />

2. International Visibility and Economic Momentum from the donor community, international agencies,<br />

corporates and investors based on the post-Ebola accelerated economic growth forecast.<br />

Ebola prompted a deeper look at the systematic, structural, and<br />

social functioning of the country. It exacerbated existing issues<br />

and created an entire new set of challenges. These very issues and<br />

challenges include major structural inadequacies that need to be<br />

addressed. But if embraced, they present tremendous private sector<br />

business and investment opportunities that can also bring about<br />

real positive change in post-Ebola Sierra Leone.<br />

New Generation Power International, an American independent renewable-based power generation company,<br />

recently announced its plan to break ground on a solar project that will be installed in increments and completed<br />

by 2018.<br />

According to The Sierra Leone Investment and Export Promotion Agency (SLIEPA), in addition to solar power,<br />

there are ripe opportunities in both hydro and biomass energy. “Current biomass and municipal waste is<br />

estimated at 656,000 MT per year with a total annual energy potential of 2,700 GWH or 308MW”.<br />

Food Processing<br />

A robust food processing sector can create food security, improve livelihoods, and support economic growth<br />

Products made from nuts, fruits, rice and vegetables can all be processed and packaged in the country. Since<br />

there are hardly any food processing activities in the country, this presents both local entrepreneurs and<br />

investors with a good opportunity. Additionally, there is a large supply of the raw materials available. Mountain<br />

Lion, a major rice processing company, saw a big gap in the market.<br />

“Rice is our staple food and a huge portion of it is imported. Most of this imported rice is very low in nutritional<br />

value. We want to meet the food needs and the health needs of the people that depend on rice,” shared Donald<br />

Smart, CEO at Mountain Lion Agriculture.<br />

Agriculture<br />

Agriculture is currently one of the leading economic drivers. It accounts for more than 45% of GDP and employs<br />

nearly two thirds of the population. Arable land, favourable climate, and adaptable topography are just some of<br />

the factors that make this sector attractive. The government has also created several incentives to attract<br />

private investments. Within this sector, opportunities exist in seed multiplication, oil palm, rice, and<br />

cassava, which is one of the most consumed crops in the country.<br />

For example, the seed industry in the country is an early stage market with little competition. Thus compared to<br />

other African countries, Sierra Leone offers an opportunity for higher margins.<br />

Currently, nearly all “improved” varieties of seeds in Sierra Leone are imported. Large commercial farmers import<br />

seeds as do the seed supply companies that service institutional and non-profit buyers. These seeds are often<br />

low in quality and not necessarily appropriate for the country. This presents an opportunity for investors<br />

interested in the agricultural sector to step in and service this gap. It is also a high-potential publicprivate<br />

partnership opportunity.<br />

Commercial seed multiplication to address poor seed quality and the importation of higher quality seeds are<br />

more specific examples of opportunities waiting for the right investor.<br />

FT<br />

Insight<br />

25<br />

Opportunities in Sierra Leone fall across many sectors. The following four emerging markets are<br />

examples of what entrepreneurs and investors can embrace for <strong>2016</strong>.<br />

www.ftinsight.net

Training<br />

Part & Repair Services<br />

Donaldson Nicols is the foreman and mechanic at Amtech, a manufacturing company on Ascension Town Road<br />

that makes wooden furniture. When something breaks on one of the machines Donaldson usually has to import<br />

parts to fix it. Spare parts are not readily available or accessible and almost always have to be shipped in. So<br />

there is a major need for parts and repair services in Sierra Leone.<br />

“It would be nice to have that type of business here. It’s a good investment,” said Donaldson.<br />

With large investments in solar technology expected, the opportunity also extends to solar parts/<br />

components, repair and installations.<br />

Entrepreneurs and investors who are interested in these markets do not have to go at it alone. The<br />

government of Sierra Leone and various organisations, such as the Sierra Leone Investment and Export<br />

Promotion Agency (SLIEPA), are doing their part to support businesses, investors and the private sector.<br />

“It is very important to create the right policies, infrastructure and regulatory environment for Small and Medium<br />

Enterprises to be successful,” said Dylan Sogie-Thomas, the Private Sector Advisor to the President. “That is<br />

why we are giving premium attention to SMEs in our investment climate, investment promotion and skills<br />

development that will create sustainable and inclusive growth.”<br />

The Sierra Leone Local Content Unit, which seeks to enhance and strengthen the local economy through the<br />

creation of sufficient linkages between Foreign Direct Investment and Sierra Leonean businesses, is working to<br />

support the private sector through capacity development and participation.<br />

“A strong local domestic economy built on a highly skilled workforce (TVET Coalition) and strong supportive<br />

industries; market linkages and local supplier development, is a game changer for private sector investment in<br />

Sierra Leone; further promoting foreign direct investment and ease of doing business,” said Emmanuel Konjoh<br />

Head of the Sierra Leone Local Content Unit.<br />

In addition to these four emerging markets, it is beneficial to note that the country is also a part of the Mano<br />

River Union, an intergovernmental institution comprising of Sierra Leone, Guinea, Liberia, and Cote D’Ivoire.<br />

It’s also a member of the Economic Community of West African States (ECOWAS). Together these two groups<br />

provide additional access to a market of hundreds of millions of people.<br />

It’s never been a better time for entrepreneurs/businesses and investors to embrace these opportunities.<br />

Parminder Brar, World Bank Group Country Manager - Sierra Leone, says it best:<br />

“In the Doing Business <strong>2016</strong> rankings, Sierra Leone was rated above<br />

the average for Sub Saharan Africa, and above Senegal, Liberia and<br />

Guinea. Ebola is over – Sierra Leone is open for business once again.<br />

Agriculture and Agribusinesses, Fisheries, Mining, Energy and<br />

Tourism offer attractive returns to investors.”<br />

Could the MOOC<br />

movement be Africa’s<br />

tertiary education lifeline?<br />

“Higher and tertiary education has an important role to play in fuelling and sustaining economic growth,<br />

international competitiveness, social development and poverty reduction in Sierra Leone, and as such much more<br />

attention needs to be directed at the sector to ensure quality and equitable provision,” says a World Bank Report<br />

from 2013.<br />

While we wait for FBC and Njala to get the attention<br />

they deserve, a steady revolution in university<br />

education throughout the world, means that with a<br />

smart phone, good WiFi and a comfy chair, anyone can<br />

take a course from Harvard, Princeton, MIT and a good<br />

number of other top universities thanks to the MOOC<br />

revolution.<br />

MOOCs or Massive Online Open Courses are made<br />

up of course content from mainstream universities<br />

offered entirely online. Most are similar to traditional<br />

online higher education courses where students watch<br />

lectures, read assigned material, participate in online<br />

discussions and forums, and complete quizzes and tests<br />

on the course material. The wonderful thing about<br />

MOOCs though is that they are very often free or if not,<br />

they are certainly thousands of dollars cheaper.<br />

For the Sierra Leonean learner, where obstacles to<br />

learning in-country or abroad, include cost, quality,<br />

visas, foreign exchange, entry requirements, family<br />

responsibilities or career/business obligations – the<br />

MOOC movement could be our saving grace.<br />

Critics argue that MOOCs won’t work in Africa because<br />

we’re plagued by intermittent power, unreliable<br />

internet, and most students need substantial learning<br />

support. But Kepler (http://www.kepler.org), a MOOC<br />

model pioneered in Rwanda, proves otherwise. Initiated<br />

by a small nonprofit called Generation Rwanda, Kepler’s<br />

goal is to use MOOCs to deliver a top-tier education to<br />

young Rwandans. The Kepler team say: “Our students<br />

get the best of online learning paired with in-person<br />

seminars — all while students work toward a US<br />

accredited degree and a great job after graduation.”<br />

Richest<br />

Rich<br />

Middle<br />

Poor<br />

Poorest<br />

Urban<br />