STRENGTH & STABILITY

6014Bw7MC

6014Bw7MC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

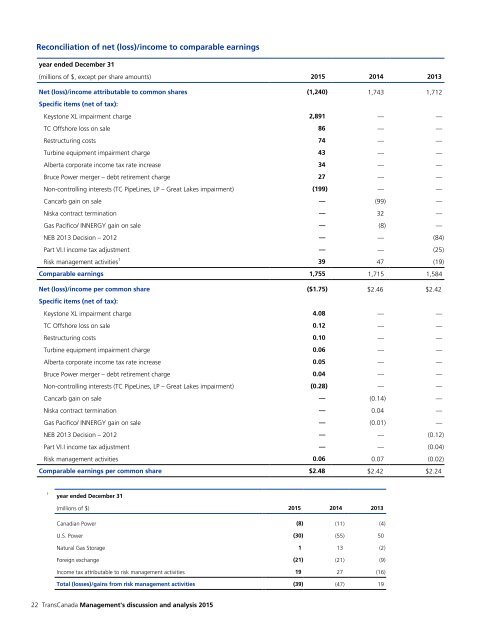

Reconciliation of net (loss)/income to comparable earnings<br />

year ended December 31<br />

(millions of $, except per share amounts) 2015 2014 2013<br />

Net (loss)/income attributable to common shares (1,240) 1,743 1,712<br />

Specific items (net of tax):<br />

Keystone XL impairment charge 2,891 — —<br />

TC Offshore loss on sale 86 — —<br />

Restructuring costs 74 — —<br />

Turbine equipment impairment charge 43 — —<br />

Alberta corporate income tax rate increase 34 — —<br />

Bruce Power merger – debt retirement charge 27 — —<br />

Non-controlling interests (TC PipeLines, LP – Great Lakes impairment) (199) — —<br />

Cancarb gain on sale — (99) —<br />

Niska contract termination — 32 —<br />

Gas Pacifico/ INNERGY gain on sale — (8) —<br />

NEB 2013 Decision – 2012 — — (84)<br />

Part VI.I income tax adjustment — — (25)<br />

Risk management activities 1 39 47 (19)<br />

Comparable earnings 1,755 1,715 1,584<br />

Net (loss)/income per common share ($1.75) $2.46 $2.42<br />

Specific items (net of tax):<br />

Keystone XL impairment charge 4.08 — —<br />

TC Offshore loss on sale 0.12 — —<br />

Restructuring costs 0.10 — —<br />

Turbine equipment impairment charge 0.06 — —<br />

Alberta corporate income tax rate increase 0.05 — —<br />

Bruce Power merger – debt retirement charge 0.04 — —<br />

Non-controlling interests (TC PipeLines, LP – Great Lakes impairment) (0.28) — —<br />

Cancarb gain on sale — (0.14) —<br />

Niska contract termination — 0.04 —<br />

Gas Pacifico/ INNERGY gain on sale — (0.01) —<br />

NEB 2013 Decision – 2012 — — (0.12)<br />

Part VI.I income tax adjustment — — (0.04)<br />

Risk management activities 0.06 0.07 (0.02)<br />

Comparable earnings per common share $2.48 $2.42 $2.24<br />

1<br />

year ended December 31<br />

(millions of $) 2015 2014 2013<br />

Canadian Power (8) (11) (4)<br />

U.S. Power (30) (55) 50<br />

Natural Gas Storage 1 13 (2)<br />

Foreign exchange (21) (21) (9)<br />

Income tax attributable to risk management activities 19 27 (16)<br />

Total (losses)/gains from risk management activities (39) (47) 19<br />

22 TransCanada Management's discussion and analysis 2015