ACCT 346 Midterm Exam 2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

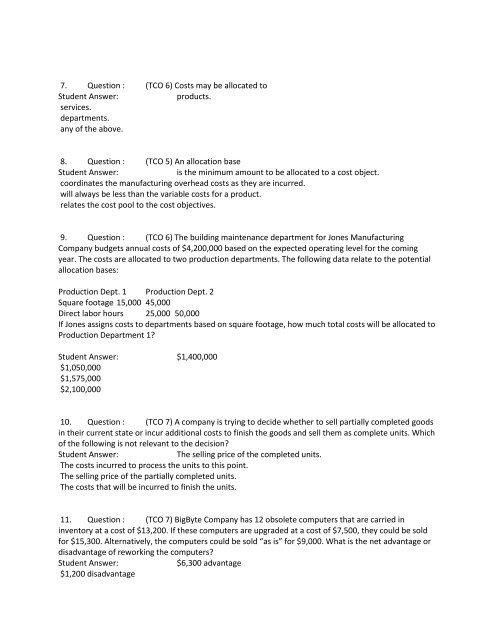

7. Question : (TCO 6) Costs may be allocated to<br />

Student Answer:<br />

products.<br />

services.<br />

departments.<br />

any of the above.<br />

8. Question : (TCO 5) An allocation base<br />

Student Answer:<br />

is the minimum amount to be allocated to a cost object.<br />

coordinates the manufacturing overhead costs as they are incurred.<br />

will always be less than the variable costs for a product.<br />

relates the cost pool to the cost objectives.<br />

9. Question : (TCO 6) The building maintenance department for Jones Manufacturing<br />

Company budgets annual costs of $4,200,000 based on the expected operating level for the coming<br />

year. The costs are allocated to two production departments. The following data relate to the potential<br />

allocation bases:<br />

Production Dept. 1 Production Dept. 2<br />

Square footage 15,000 45,000<br />

Direct labor hours 25,000 50,000<br />

If Jones assigns costs to departments based on square footage, how much total costs will be allocated to<br />

Production Department 1?<br />

Student Answer: $1,400,000<br />

$1,050,000<br />

$1,575,000<br />

$2,100,000<br />

10. Question : (TCO 7) A company is trying to decide whether to sell partially completed goods<br />

in their current state or incur additional costs to finish the goods and sell them as complete units. Which<br />

of the following is not relevant to the decision?<br />

Student Answer:<br />

The selling price of the completed units.<br />

The costs incurred to process the units to this point.<br />

The selling price of the partially completed units.<br />

The costs that will be incurred to finish the units.<br />

11. Question : (TCO 7) BigByte Company has 12 obsolete computers that are carried in<br />

inventory at a cost of $13,200. If these computers are upgraded at a cost of $7,500, they could be sold<br />

for $15,300. Alternatively, the computers could be sold “as is” for $9,000. What is the net advantage or<br />

disadvantage of reworking the computers?<br />

Student Answer:<br />

$6,300 advantage<br />

$1,200 disadvantage