Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

Cont.Note<br />

21<br />

Funded defined benefit pension plans<br />

For Group employees in Switzerland, commitments exist in the form of<br />

compulsory service pension plans funded through insurance policies in<br />

the Swiss Life Collective BVG Foundation and in Transparenta BVG<br />

Foundation. The funded commitments currently amount to SEK 268<br />

M (202), and the fair value of the assets under management is SEK<br />

181 M (148). Consequently, the net pension liability is SEK 87 M<br />

(54). The pension commitment is funded through insurance contracts.<br />

During the year Intrum Justitia paid SEK 15 M (11) to the plan,<br />

while disbursements to retirees amounted to SEK 32 M (39). In 2016<br />

payments to the plan are estimated at SEK 14 M, with disbursements<br />

to retirees of SEK 15 M. For these pension plans, a discount rate of<br />

0.75 percent is applied. An increase/decrease in the discount rate by 0.5<br />

percentage points would entail the pension liability decreasing by 8.8<br />

percent/increasing by 10.2 percent.<br />

For the Group’s employees in Norway, there are commitments for a<br />

compulsory service pension, which are secured through insurance with<br />

the insurance company Storebrand Livforsikring. The funded commitments<br />

currently amount to SEK 70 M (68), and the fair value of the<br />

assets under management is SEK 52 M (57). Consequently, the net<br />

pension liability is SEK 18 M (11). The pension commitment is funded<br />

through insurance contracts. During the year Intrum Justitia paid SEK<br />

1 M (1) to the plan, while disbursements to retirees amounted to SEK<br />

2 M (1). Even in 2016, payments to the plan are estimated at SEK 1 M,<br />

with disbursements to retirees of SEK 1 M. For these pension plans,<br />

a discount rate of 1.9 percent is applied.<br />

ITP 2 plan<br />

The commitments for retirement and family pensions for the Group’s<br />

Swedish employees are secured through insurance with Alecta according<br />

to the so-called ITP 2 plan. According to a statement from<br />

the Swedish Financial Reporting Board, UFR 10, the ITP 2 plan is a<br />

multi-employer defined benefit plan. For the fiscal year, Alecta’s clients<br />

have not been provided enough information to report the plan as defined<br />

benefit. Nor is there a contractual agreement how surpluses and<br />

deficits in the plan are to be distributed among plan participants. The<br />

ITP 2 plan secured through insurance with Alecta is therefore reported<br />

by Intrum Justitia as if it were a defined contribution plan. At year-end<br />

Alecta’s surplus in the form of the collective funding ratio amounted<br />

to 153 percent (143). The collective funding ratio consists of the market<br />

value of Alecta’s assets as a percentage of the insurance obligations<br />

calculated according to Alecta’s actuarial assumptions, which do not<br />

conform to IAS 19.<br />

Under the provisions of the ITP 2 plan, measures must be taken if<br />

the funding ratio falls below 125 percent (for example, in connection<br />

with an increase in the price of the subscription) or exceed 155 percent<br />

(for example, in connection with a premium reduction).<br />

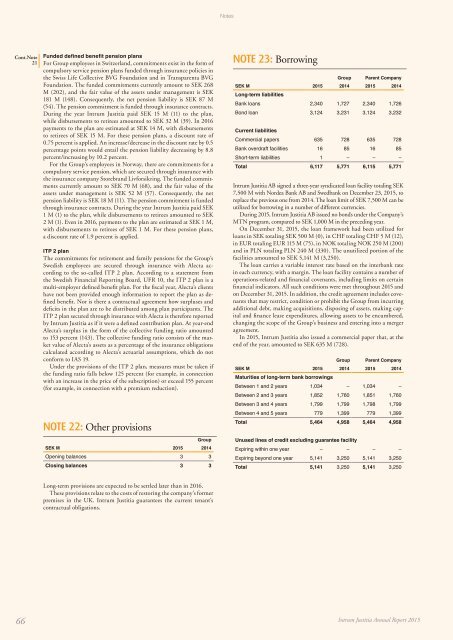

NOTE 22: Other provisions<br />

Group<br />

SEK M 2015 2014<br />

Opening balances 3 3<br />

Closing balances 3 3<br />

NOTE 23: Borrowing<br />

Group<br />

Parent Company<br />

SEK M 2015 2014 2015 2014<br />

Long-term liabilities<br />

Bank loans 2,340 1,727 2,340 1,726<br />

Bond loan 3,124 3,231 3,124 3,232<br />

Current liabilities<br />

Commercial papers 635 728 635 728<br />

Bank overdraft facilities 16 85 16 85<br />

Short-term liabilities 1 – – –<br />

Total 6,117 5,771 6,115 5,771<br />

Intrum Justitia AB signed a three-year syndicated loan facility totaling SEK<br />

7,500 M with Nordea Bank AB and Swedbank on December 23, 2015, to<br />

replace the previous one from 2014. The loan limit of SEK 7,500 M can be<br />

utilized for borrowing in a number of different currencies.<br />

During 2015, Intrum Justitia AB issued no bonds under the Company’s<br />

MTN program, compared to SEK 1,000 M in the preceding year.<br />

On December 31, 2015, the loan framework had been utilized for<br />

loans in SEK totaling SEK 500 M (0), in CHF totaling CHF 5 M (12),<br />

in EUR totaling EUR 115 M (75), in NOK totaling NOK 250 M (200)<br />

and in PLN totaling PLN 240 M (330). The unutilized portion of the<br />

facilities amounted to SEK 5,141 M (3,250).<br />

The loan carries a variable interest rate based on the interbank rate<br />

in each currency, with a margin. The loan facility contains a number of<br />

operations-related and financial covenants, including limits on certain<br />

financial indicators. All such conditions were met throughout 2015 and<br />

on December 31, 2015. In addition, the credit agreement includes covenants<br />

that may restrict, condition or prohibit the Group from incurring<br />

additional debt, making acquisitions, disposing of assets, making capital<br />

and finance lease expenditures, allowing assets to be encumbered,<br />

changing the scope of the Group’s business and entering into a merger<br />

agreement.<br />

In 2015, Intrum Justitia also issued a commercial paper that, at the<br />

end of the year, amounted to SEK 635 M (728).<br />

Group Parent Company<br />

SEK M 2015 2014 2015 2014<br />

Maturities of long-term bank borrowings<br />

Between 1 and 2 years 1,034 – 1,034 –<br />

Between 2 and 3 years 1,852 1,760 1,851 1,760<br />

Between 3 and 4 years 1,799 1,799 1,798 1,799<br />

Between 4 and 5 years 779 1,399 779 1,399<br />

Total 5,464 4,958 5,464 4,958<br />

Unused lines of credit excluding guarantee facility<br />

Expiring within one year – – – –<br />

Expiring beyond one year 5,141 3,250 5,141 3,250<br />

Total 5,141 3,250 5,141 3,250<br />

Long-term provisions are expected to be settled later than in 2016.<br />

These provisions relate to the costs of restoring the company’s former<br />

premises in the UK. Intrum Justitia guarantees the current tenant’s<br />

contractual obligations.<br />

66 Intrum Justitia Annual Report 2015