MiFID II / MiFIR Transaction Reporting A Practical Guide

e5vYF-W

e5vYF-W

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

So, what can firms do?<br />

When <strong>MiFID</strong> I was introduced in 2007, many financial institutions<br />

failed to respond correctly, resulting in expensive and inefficient<br />

‘quick fixes’, and in the cases above, significant financial penalties.<br />

The current state of play in terms of data control processes at<br />

most financial institutions, tends to be one of the following:<br />

Spreadsheets, UDAs and manual work<br />

Due to the complexities surrounding data control and<br />

reconciliation, many institutions are still using spreadsheets and<br />

manual work to fulfil their reporting obligations. However, with the<br />

vast increase in data that <strong>MiFID</strong> <strong>II</strong>/<strong>MiFIR</strong> is going to bring, such<br />

solutions will soon become impractically expensive and high risk.<br />

User-Developed Applications (UDAs), for example, generally rely<br />

on key members of staff to edit and maintain them, creating high<br />

levels of risk should they be unavailable at critical times.<br />

Also, as these UDAs are often in Excel, there are no proper audit,<br />

evidence, governance or workflow functions. This might be fine<br />

when everything is working properly, but as soon as there’s a<br />

break, or if an unaudited user changes critical matching criteria,<br />

it’s far more difficult to fix or even find the route cause of the<br />

problem – leading to resource-intensive projects and the potential<br />

for large fines.<br />

While regulators have not specifically outlawed the use of<br />

spreadsheets and UDAs, it is commonly accepted that under <strong>MiFID</strong><br />

<strong>II</strong> organisations need a much more robust and scalable approach<br />

to data control.<br />

Legacy architecture<br />

Many firms will be updating their current systems to support the<br />

new regulations. However, the majority of these systems are<br />

difficult to scale, particularly considering the large increase in<br />

reportable fields and data required.<br />

Recent research from Aite group, for example, shows that it<br />

takes over 64 days on average for financial institutions to set<br />

up a new reconciliation.<br />

Similarly, just patching up an old system to handle new data is<br />

hardly future-proofing the organisation for subsequent changes.<br />

<strong>MiFID</strong> <strong>II</strong> and <strong>MiFIR</strong> are certainly posing data challenges for<br />

financial institutions, but they’re also a great opportunity for firms<br />

to fundamentally transform their control processes, enabling them<br />

to react more quickly and more efficiently to upcoming regulations.<br />

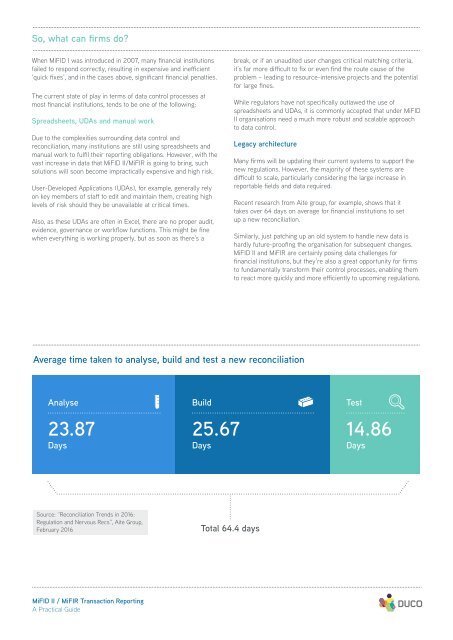

Average time taken to analyse, build and test a new reconciliation<br />

Analyse<br />

Build<br />

Test<br />

23.87 25.67 14.86<br />

Days Days Days<br />

Source: “Reconciliation Trends in 2016:<br />

Regulation and Nervous Recs”, Aite Group,<br />

February 2016<br />

Total 64.4 days<br />

<strong>MiFID</strong> <strong>II</strong> / <strong>MiFIR</strong> <strong>Transaction</strong> <strong>Reporting</strong><br />

A <strong>Practical</strong> <strong>Guide</strong>