ACC 497 Final Exam - Assignment

We specialize in providing you instant exam help to score the marks you have always dreamed. Get online help for the ACC 497 Final Exams 100 Questions with Answers (University of Phoenix).

We specialize in providing you instant exam help to score the marks you have always dreamed. Get online help for the ACC 497 Final Exams 100 Questions with Answers (University of Phoenix).

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

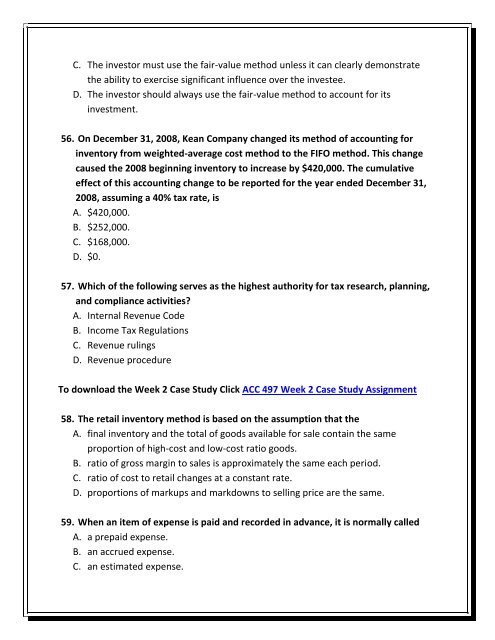

C. The investor must use the fair-value method unless it can clearly demonstrate<br />

the ability to exercise significant influence over the investee.<br />

D. The investor should always use the fair-value method to account for its<br />

investment.<br />

56. On December 31, 2008, Kean Company changed its method of accounting for<br />

inventory from weighted-average cost method to the FIFO method. This change<br />

caused the 2008 beginning inventory to increase by $420,000. The cumulative<br />

effect of this accounting change to be reported for the year ended December 31,<br />

2008, assuming a 40% tax rate, is<br />

A. $420,000.<br />

B. $252,000.<br />

C. $168,000.<br />

D. $0.<br />

57. Which of the following serves as the highest authority for tax research, planning,<br />

and compliance activities?<br />

A. Internal Revenue Code<br />

B. Income Tax Regulations<br />

C. Revenue rulings<br />

D. Revenue procedure<br />

To download the Week 2 Case Study Click <strong>ACC</strong> <strong>497</strong> Week 2 Case Study <strong>Assignment</strong><br />

58. The retail inventory method is based on the assumption that the<br />

A. final inventory and the total of goods available for sale contain the same<br />

proportion of high-cost and low-cost ratio goods.<br />

B. ratio of gross margin to sales is approximately the same each period.<br />

C. ratio of cost to retail changes at a constant rate.<br />

D. proportions of markups and markdowns to selling price are the same.<br />

59. When an item of expense is paid and recorded in advance, it is normally called<br />

A. a prepaid expense.<br />

B. an accrued expense.<br />

C. an estimated expense.