ACC 497 Final Exam - Assignment

We specialize in providing you instant exam help to score the marks you have always dreamed. Get online help for the ACC 497 Final Exams 100 Questions with Answers (University of Phoenix).

We specialize in providing you instant exam help to score the marks you have always dreamed. Get online help for the ACC 497 Final Exams 100 Questions with Answers (University of Phoenix).

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

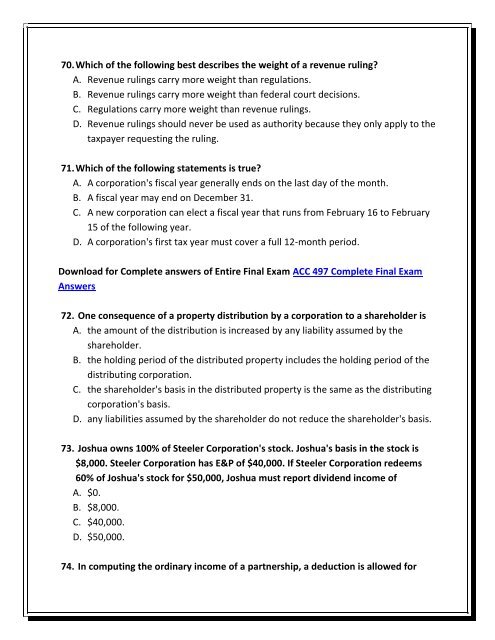

70. Which of the following best describes the weight of a revenue ruling?<br />

A. Revenue rulings carry more weight than regulations.<br />

B. Revenue rulings carry more weight than federal court decisions.<br />

C. Regulations carry more weight than revenue rulings.<br />

D. Revenue rulings should never be used as authority because they only apply to the<br />

taxpayer requesting the ruling.<br />

71. Which of the following statements is true?<br />

A. A corporation's fiscal year generally ends on the last day of the month.<br />

B. A fiscal year may end on December 31.<br />

C. A new corporation can elect a fiscal year that runs from February 16 to February<br />

15 of the following year.<br />

D. A corporation's first tax year must cover a full 12-month period.<br />

Download for Complete answers of Entire <strong>Final</strong> <strong>Exam</strong> <strong>ACC</strong> <strong>497</strong> Complete <strong>Final</strong> <strong>Exam</strong><br />

Answers<br />

72. One consequence of a property distribution by a corporation to a shareholder is<br />

A. the amount of the distribution is increased by any liability assumed by the<br />

shareholder.<br />

B. the holding period of the distributed property includes the holding period of the<br />

distributing corporation.<br />

C. the shareholder's basis in the distributed property is the same as the distributing<br />

corporation's basis.<br />

D. any liabilities assumed by the shareholder do not reduce the shareholder's basis.<br />

73. Joshua owns 100% of Steeler Corporation's stock. Joshua's basis in the stock is<br />

$8,000. Steeler Corporation has E&P of $40,000. If Steeler Corporation redeems<br />

60% of Joshua's stock for $50,000, Joshua must report dividend income of<br />

A. $0.<br />

B. $8,000.<br />

C. $40,000.<br />

D. $50,000.<br />

74. In computing the ordinary income of a partnership, a deduction is allowed for