The Voice of Southwest Louisiana

April 2016 News Magazine

April 2016 News Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SWLA<br />

LeLeux Achieves Membership in<br />

Million Dollar Round Table<br />

Prestigious Membership is Exclusive to World’s Leading Financial Pr<strong>of</strong>essionals<br />

By David J Williams<br />

<strong>The</strong> Constitution <strong>of</strong> the United<br />

States gives to Congress the<br />

right to establish uniform<br />

laws on the subject <strong>of</strong><br />

Bankruptcies. For this reason,<br />

bankruptcy cases are handled<br />

in Federal Court. In Lake<br />

Charles, the cases are handled<br />

in the Edward M. Hunter<br />

Federal Building on Broad<br />

Street.<br />

<strong>The</strong> Bankruptcy Code allows<br />

for the filing <strong>of</strong> five basic types<br />

<strong>of</strong> bankruptcy. Municipalities,<br />

such as Detroit, file under<br />

Chapter 9. Businesses and<br />

wealthy individuals can<br />

reorganize under Chapter 11.<br />

Farmers and fishermen can file<br />

under Chapter 12. Individuals<br />

and married couples can file<br />

under Chapter 7 or 13 <strong>of</strong> the<br />

Bankruptcy Code. Companies<br />

that are closing can also<br />

file under Chapter 7 <strong>of</strong> the<br />

Bankruptcy code.<br />

<strong>The</strong> majority <strong>of</strong> bankruptcy<br />

cases are Chapter 7 and<br />

Chapter 13 cases.<br />

Chapter 7 bankruptcy cases are<br />

generally completed within a<br />

few months after the cases<br />

are filed. As soon as a chapter 7<br />

case is filed, the court assigns a<br />

Chapter 7 bankruptcy trustee to<br />

the case. <strong>The</strong> trustee’s duties<br />

include presiding at a meeting<br />

<strong>of</strong> creditors and evaluating<br />

the case to determine if there<br />

are assets that can be sold or<br />

otherwise converted to cash for<br />

the benefit <strong>of</strong> creditors.<br />

Various state and federal laws<br />

determine what property that<br />

Chapter 7 trustees can take<br />

from the debtors. <strong>Louisiana</strong> law<br />

allows Chapter 7 debtors to<br />

keep their homes if there is less<br />

than thirty-five thousand<br />

dollars <strong>of</strong> equity in the home.<br />

Debtors can keep most<br />

household items.<br />

<strong>The</strong>oretically, Chapter 7 trustees<br />

can take electronic items. Most<br />

<strong>of</strong> the time the trustee will<br />

decide that these items do not<br />

have sufficient value to justify<br />

taking them from the debtors.<br />

Most retirement accounts are<br />

exempt and cannot be taken.<br />

One vehicle per case, worth<br />

less than seven-thousand five<br />

hundred dollars, is exempt. <strong>The</strong><br />

debtors do have to continue to<br />

pay the liens on secured items if<br />

they want to keep the secured<br />

property after filing a Chapter 7<br />

bankruptcy.<br />

More cases are filed under<br />

Chapter 13 in Lake Charles than<br />

under Chapter 7.<strong>The</strong>re are<br />

various reasons for this. If your<br />

income is higher than the<br />

average income for your family<br />

size, the bankruptcy laws may<br />

not allow you to discharge your<br />

debts in a Chapter 7 case. In<br />

a Chapter 13 case, the debtor<br />

has to pay the bankruptcy<br />

trustee monthly payments for<br />

a time period <strong>of</strong> at least thirtysix<br />

months, unless he can pay<br />

his creditors in full in less than<br />

thirty-six months.<br />

One reason to file under<br />

Chapter 13 is to keep items that<br />

would be taken from you if you<br />

filed a Chapter 7 bankruptcy.<br />

You also may want to file a<br />

Chapter 13 bankruptcy if you<br />

are behind with your payments<br />

on a home or a car or some<br />

other item that you wish to<br />

keep. If you file under chapter<br />

13, and you can make the<br />

required payments, you can<br />

keep the item that you<br />

would otherwise lose.<br />

Most attorneys will file a<br />

Chapter 13 case for less money<br />

up front than a Chapter 7 case.<br />

<strong>The</strong> reason is that the attorney<br />

can be paid the remainder<br />

<strong>of</strong> his fee from the payments<br />

that the client pays to the<br />

bankruptcy court. Many clients<br />

don’t mind paying more money<br />

in the long run, in order to get<br />

immediate relief from their<br />

creditor’s collection actions.<br />

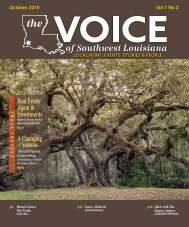

David J. Williams, located<br />

at 827 Pujo Street in Lake<br />

Charles, LA is the only Board<br />

Certified Specialist in<br />

Consumer Bankruptcy<br />

Law in Lake Charles. He is<br />

certified by the <strong>Louisiana</strong><br />

Board <strong>of</strong> Legal Specialization<br />

and the American<br />

Bankruptcy Institute.<br />

Contributed Article<br />

Outstanding client service,<br />

ethics and pr<strong>of</strong>essionalism<br />

have enabled Janet LeLeux,* <strong>of</strong><br />

Sulphur, <strong>Louisiana</strong>, to achieve<br />

membership in the prestigious<br />

Million Dollar Round Table —<br />

<strong>The</strong> Premier Association <strong>of</strong><br />

Financial Pr<strong>of</strong>essionals. ® LeLeux<br />

is a first-year member <strong>of</strong> MDRT.<br />

Attaining membership in<br />

MDRT is a distinguishing career<br />

milestone. It requires LeLeux to<br />

adhere to a strict Code <strong>of</strong> Ethics,<br />

focus on providing top-notch<br />

Janet LeLeux<br />

Investment Executive<br />

337.625.3018<br />

2250 Maplewood Dr, Sulphur<br />

client service and continue to<br />

grow pr<strong>of</strong>essionally through<br />

involvement in at least one<br />

other industry association.<br />

“MDRT is committed to helping<br />

our members reach even greater<br />

levels <strong>of</strong> pr<strong>of</strong>essional and<br />

personal success while adhering<br />

to the highest ethical standards,”<br />

said MDRT President Brian D.<br />

Heckert, CLU, ChFC. “We strive to<br />

deliver the best resources and<br />

benefits to our members so they<br />

can grow their business and<br />

better serve their clients.”<br />

MDRT also provides continuing<br />

education opportunities,<br />

informative and inspirational<br />

meetings and encourages<br />

members to support<br />

community and charitable<br />

involvement through the MDRT<br />

Foundation.<br />

For more information contact<br />

Janet LeLeux at 337-625-3018 or<br />

janet.leleux@ceterais.com.<br />

ABOUT MDRT<br />

Founded in 1927, the Million<br />

Dollar Round Table (MDRT),<br />

<strong>The</strong> Premier Association <strong>of</strong><br />

Financial Pr<strong>of</strong>essionals®, is a<br />

global, independent association<br />

<strong>of</strong> more than 43,000 <strong>of</strong> the<br />

world's leading life insurance<br />

and financial services<br />

pr<strong>of</strong>essionals from more than<br />

500 companies in 67 countries.<br />

MDRT members demonstrate<br />

exceptional pr<strong>of</strong>essional<br />

knowledge, strict ethical<br />

conduct and outstanding client<br />

service. MDRT membership is<br />

recognized internationally as<br />

the standard <strong>of</strong> excellence in<br />

the life insurance and financial<br />

services business.<br />

Life comes with a lot <strong>of</strong> “what ifs.”<br />

<strong>The</strong>re’s a solution for everyone.<br />

Let’s work together to find yours.<br />

Securities and insurance products are <strong>of</strong>fered through Cetera Investment Services LLC (doing insurance<br />

business in CA as CFGIS Insurance Agency), member FINRA/SIPC. Advisory services are <strong>of</strong>fered through Cetera<br />

Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are<br />

<strong>of</strong>fered. Investments are: *Not FDIC insured *May lose value *Not financial institution guaranteed *Not a deposit<br />

*Not insured by any federal government agency.<br />

APRIL 2016 WWW.THEVOICEOFSOUTHWESTLA.COM Volume 3 • Number 9 Volume 3 • Number 9 WWW.THEVOICEOFSOUTHWESTLA.COM APRIL 2016