BRITAIN

cityam-2016-06-28-1-5771bf66812df

cityam-2016-06-28-1-5771bf66812df

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IT’S HAPPENED<br />

AGAIN<br />

ENGLAND’S<br />

FLOPS<br />

CRASH OUT<br />

OF EUROPE<br />

P30<br />

BUSINESS WITH PERSONALITY<br />

<br />

FINTECH<br />

EEK<br />

W2016<br />

<br />

BOOK TICKETS TODAY<br />

<br />

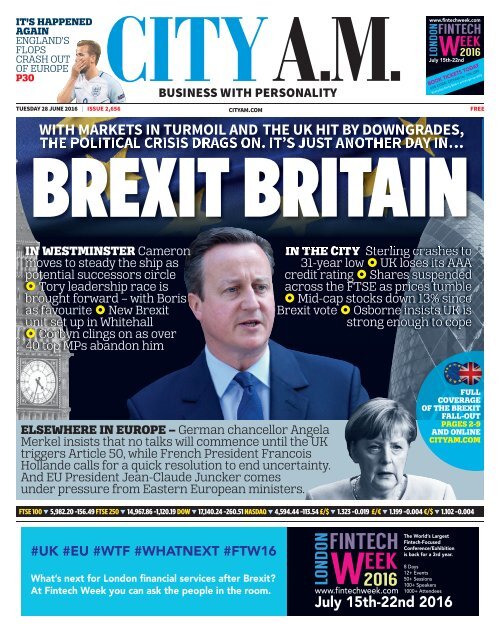

WITH MARKETS IN TURMOIL AND THE UK HIT BY DOWNGRADES,<br />

THE POLITICAL CRISIS DRAGS ON. IT’S JUST ANOTHER DAY IN…<br />

LONDON<br />

<br />

TUESDAY 28 JUNE 2016 ISSUE 2,656 CITYAM.COM<br />

FREE<br />

BREXIT <strong>BRITAIN</strong><br />

IN WESTMINSTER Cameron<br />

moves to steady the ship as<br />

potential successors circle<br />

£ Tory leadership race is<br />

brought forward – with Boris<br />

as favourite £ New Brexit<br />

unit set up in Whitehall<br />

£ Corbyn clings on as over<br />

40 top MPs abandon him<br />

IN THE CITY Sterling crashes to<br />

31-year low £ UK loses its AAA<br />

credit rating £ Shares suspended<br />

across the FTSE as prices tumble<br />

£ Mid-cap stocks down 13% since<br />

Brexit vote £ Osborne insists UK is<br />

strong enough to cope<br />

ELSEWHERE IN EUROPE – German chancellor Angela<br />

Merkel insists that no talks will commence until the UK<br />

triggers Article 50, while French President Francois<br />

Hollande calls for a quick resolution to end uncertainty.<br />

And EU President Jean-Claude Juncker comes<br />

under pressure from Eastern European ministers.<br />

FULL<br />

COVERAGE<br />

OF THE BREXIT<br />

FALL-OUT<br />

PAGES 2-9<br />

AND ONLINE<br />

CITYAM.COM<br />

FTSE 100 ▼ 5,982.20 -156.49 FTSE 250 ▼ 14,967.86 -1,120.19 DOW ▼ 17,140.24 -260.51 NASDAQ ▼ 4,594.44 -113.54 £/$ ▼ 1.323 -0.019 £/€ ▼ 1.199 -0.004 €/$ ▼ 1.102 -0.004<br />

#UK #EU #WTF #WHATNEXT #FTW16<br />

<br />

At Fintech Week you can ask the people in the room.<br />

LONDON<br />

FINTECH<br />

EEK<br />

W2016<br />

www.fintechweek.com<br />

The World’s Largest<br />

Fintech-Focused<br />

Conference/Exhibition<br />

is back for a 3rd year.<br />

8 Days<br />

12+ Events<br />

50+ Sessions<br />

100+ Speakers<br />

1000+ Attendees<br />

July 15th-22nd 2016

02 NEWS TUESDAY 28 JUNE 2016<br />

CITYAM.COM<br />

THE CITY VIEW<br />

Do not ignore activists<br />

during difficult times<br />

AS PROFITS warnings fly and share prices tank in the postreferendum<br />

world, business leaders will need to work out<br />

how to steer their companies through some choppy<br />

waters ahead.<br />

Boards will have to step up their game in terms of governance<br />

and strategy. And help may be at hand from what at first sight<br />

seems like an unlikely source: activist investors.<br />

To a board, such investors may seem like a thorn in their side.<br />

On occasions, one can see why – a common activist ploy is to<br />

vote against an M&A deal, equivalent in the corporate world to a<br />

gun to the head.<br />

In addition, high-profile activist US hedge funds run by the likes<br />

of Carl Icahn and Bill Ackman make them come across as noisy<br />

troublemakers, and some board members regard them as a<br />

distraction from getting on with the jobs they’ve been<br />

appointed to do.<br />

But as recent events at Rolls-<br />

Royce and Alliance Trust<br />

show, shareholder activists<br />

can be the catalyst for muchneeded<br />

change at<br />

underperforming companies.<br />

At Rolls-Royce, shareholder<br />

Often boards are<br />

unwilling to take<br />

what is essentially<br />

free advice<br />

ValueAct pushed for a seat on the board in exchange for not<br />

calling for a break up of the aerospace giant, which has suffered<br />

a string of profit warnings. It adopted a behind-the-scenes<br />

approach in its stalking of the boardroom, with success.<br />

Following the credit crunch, there was an increase in company<br />

engagement with activist investors because there was less<br />

money around. This is now likely to happen again as the UK<br />

heads for a period of economic uncertainty during what will<br />

presumably be the run up to Brexit.<br />

Often boards are reluctant to take what is effectively free advice<br />

from activists, but what is at stake is a company’s value.<br />

Many boards have been too sleepy and insular for too long,<br />

lunching amongst themselves. The wake up call for nonexecutives<br />

is when remuneration is set to be hit – i.e. when it is<br />

too late.<br />

So if an activist rings, board members should consider picking<br />

up the phone. It may help build trust, and even boost<br />

performance during an especially tough period.<br />

How securing passporting can help<br />

stem a flight from the Square Mile<br />

One of the biggest sources of panic<br />

post-Brexit is passporting, something<br />

previously little-heard of by those<br />

outside the financial services<br />

industry. New London mayor Sadiq<br />

Khan told City A.M. over the weekend<br />

that a loss of the provisions would be<br />

“a disaster”, while Londonheadquartered<br />

HSBC warned all the<br />

way back in February that it would<br />

consider moving as many as 1,000<br />

staff to Paris if favourable<br />

passporting rights could not be<br />

secured in the event the UK left the<br />

EU.<br />

WHAT IS PASSPORTING?<br />

In a nutshell, passporting currently<br />

allows financial services firms which are<br />

authorised in the UK to operate<br />

throughout the European Economic<br />

Area.<br />

A LOT OF BANKING<br />

REGULATION IN THE UK<br />

STEMS FROM THE EUROPEAN<br />

UNION – IS THIS THE END OF<br />

FINANCIAL SERVICES RED<br />

TAPE AS WE KNOW IT?<br />

It’s unlikely that the rules the finance<br />

sector abides by will be torn down any<br />

time soon, if at all. Firms are only<br />

granted passporting rights because<br />

they comply by single market rules, so a<br />

total scrapping is unlikely to get the best<br />

results for the sector in the UK’s<br />

negotiations to leave the EU.<br />

A statement from the Financial<br />

Conduct Authority released on Friday<br />

pointed out that all the regulation<br />

would remain in place for the time<br />

being, regardless of where it originated<br />

from.<br />

The British Bankers’ Association in its<br />

statement pointed out that the rules<br />

relating to passporting in particular<br />

“could take some time to resolve and<br />

any changes to banking would take place<br />

over a long period of time”.<br />

Barney Reynolds, partner and head of<br />

financial institutions advisory and financial<br />

regulation at Shearman & Sterling, feels it’s<br />

unlikely that financial services laws will be<br />

“washed away”, although there may be<br />

some “minor adjustments where the UK<br />

hasn’t agreed with things that have been<br />

done at a European level”, such as the<br />

bankers’ bonus cap.<br />

HOW IMPORTANT IS<br />

PASSPORTING?<br />

The rights are important enough to have<br />

many big firms already considering their<br />

options should the UK fail to secure them.<br />

Vishal Vedi, banking partner at Deloitte,<br />

told City A.M. that the rights were “of<br />

fundamental importance” adding that the<br />

passporting possibility the UK currently<br />

offers acts as a key factor for many<br />

overseas banks to establish branches in the<br />

country.<br />

However, others, while not denying that<br />

the rights are important, do not see the<br />

potential loss of passporting rights as the<br />

death knell for the City. Reynolds remarked<br />

that the rights were “not as important as<br />

most of the media coverage so far has<br />

suggested”, pointing out that a lot of<br />

activity in London’s banking arena was not<br />

cross-border at all.<br />

In addition, Arun Srivastava, Baker &<br />

McKenzie’s London head of financial<br />

services, has previously told City A.M. that<br />

“[maintaining a passporting regime] is<br />

extremely important but it’s not exactly the<br />

end of the world”.<br />

IS BANKING THE ONLY<br />

INDUSTRY AFFECTED?<br />

No, other industries are affected by<br />

passporting rules too. Clifford Chance has<br />

pointed out that those working in<br />

insurance and asset management will also<br />

face growing concerns about what access<br />

to the single market they will be able to<br />

obtain in the negotiations.<br />

WHAT HAPPENS IF GREAT<br />

<strong>BRITAIN</strong> CAN’T GET A GREAT<br />

DEAL ON PASSPORTING<br />

REGULATIONS?<br />

Although many agree that it’s far too<br />

early to even guess what the final deal<br />

will look like, if the worst did happen<br />

and the UK financial services industry<br />

lost access to the single market, banks<br />

would have to head to the drawing<br />

board.<br />

Vedi explained: “The banks that are<br />

based here will then need to think very<br />

carefully around how they structure<br />

themselves to continue to do business<br />

with the EU and in many cases that will<br />

then mean having to establish, or think<br />

about establishing separate subsidiaries<br />

or branches in the EU.”<br />

Simon Gleeson, regulatory partner at<br />

Clifford Chance, warned: “There is no<br />

prospect of UK banks maintaining a<br />

passport unless the UK agrees to,<br />

among other things, freedom of<br />

movement and full adoption of all<br />

present and forthcoming EU laws – this<br />

is exactly the discussion which has been<br />

being playing out in Switzerland. Thus<br />

things will have to change but it is too<br />

early to say how, or how significant the<br />

impact will be.”<br />

However, Thomas Donegan, partner at<br />

Shearman & Sterling, told City A.M.:<br />

“What we’re seeing at the moment is a<br />

lot of contingency planning. It makes<br />

sense as a bank to look at where you’d<br />

stand in the worst case scenario and<br />

then work out what you’d do to plan<br />

around that, but it’s not the time to start<br />

shifting half of your business to France.”<br />

HAYLEY KIRTON<br />

Follow us on Twitter @cityam<br />

FINANCIAL TIMES THE TIMES THE DAILY TELEGRAPH THE WALL STREET JOURNAL<br />

GOOGLE TO BE HIT BY NEW<br />

COMPLAINT FROM BRUSSELS<br />

Brussels is to step up the antitrust<br />

pressure against Google next month<br />

with a fresh official complaint and a<br />

sharpening of its first case against the<br />

company from last year.<br />

Margrethe Vestager, the EU’s<br />

competition commissioner, is planning<br />

to issue two separate “statements of<br />

objections” against the company for<br />

allegedly abusing its market power in<br />

online advertising and shopping, said<br />

people familiar with the case.<br />

WHAT THE<br />

OTHER<br />

PAPERS SAY<br />

THIS<br />

MORNING<br />

OAKTREE EXEC ARRESTED ON<br />

UAE THEFT CHARGES<br />

A London-based executive of Oaktree<br />

Capital, one of the biggest distresseddebt<br />

firms in the world, has been<br />

arrested in the UK at the request of<br />

authorities in the UAE after being<br />

accused of stealing $264m and now<br />

risks extradition.<br />

MORRISONS TREATS<br />

SUPPLIERS THE WORST<br />

Supermarket giant Morrisons has the<br />

worst record among major grocers for<br />

mistreating suppliers, according to a<br />

report by Christine Tacon who heads<br />

the industry watchdog Groceries Code<br />

Adjudicator (GCA). A fifth of respondents<br />

to a survey of more than 1,000 suppliers<br />

and trade associations said that<br />

Morrisons “rarely” or “never” complied<br />

with industry rules governing supply<br />

chain relations. Morrisons, Iceland and<br />

Asda were thought to be most likely to<br />

be in breach of the legally binding code<br />

of practice, while Aldi, Sainsbury’s and<br />

Lidl were most likely to comply<br />

“consistently well” with the rules. Tacon<br />

has launched a formal consultation.<br />

MICROSOFT CUSTOMER GETS<br />

$10,000 PAY-OUT<br />

Microsoft has paid a customer<br />

thousands of dollars in compensation<br />

after its new software Windows 10<br />

automatically tried and failed to<br />

download on to a computer. The<br />

company paid Teri Goldstein $10,000<br />

(£7,600) after the failed update left her<br />

computer unusable for days on end.<br />

GEORGE SOROS: I DID NOT<br />

BET AGAINST THE POUND<br />

George Soros, the billionaire who bet<br />

against the pound on Black Wednesday<br />

in 1992, did not repeat the trick during<br />

the Brexit turmoil that has so far wiped<br />

11 per cent off the value of sterling<br />

against the dollar.<br />

PRIVATE EQUITY FIRM TAKES<br />

STAKE IN SKULLCANDY<br />

Skullcandy said yesterday a privateequity<br />

firm had taken a nearly 10 per<br />

cent stake in the company and made an<br />

unsolicited buy-out offer, potentially<br />

disrupting the headphones maker’s<br />

deal to be acquired by consumertechnology<br />

provider Incipio.<br />

GE STRIKES DEALS TO SELL<br />

RESTAURANT ASSETS<br />

General Electric has struck three<br />

different deals to sell the bulk of its US<br />

restaurant finance assets, the latest deal<br />

in its broader strategic move to focus on<br />

its industrial businesses. The sale would<br />

represent an ending net investment of<br />

about $1.4bn on 31 March, GE said.

CITYAM.COM<br />

FOR MORE ON THE BREXIT FALL-OUT GO TO CITYAM.COM<br />

Corbyn fights on<br />

as party revolt<br />

hits second day<br />

MARK SANDS<br />

@mksands<br />

LABOUR leader Jeremy Corbyn vowed<br />

to fight to retain control of his party<br />

last night after almost all his front<br />

bench withdrew their support for<br />

him.<br />

Of the party’s 31 shadow cabinet<br />

members, 20 have now departed since<br />

early Sunday morning, when shadow<br />

foreign secretary Hilary Benn was<br />

sacked.<br />

Labour deputy leader Tom Watson<br />

reportedly told Corbyn that he held<br />

“no authority” among MPs.<br />

Angela Eagle, who resigned as<br />

shadow business secretary, was almost<br />

in tears when on BBC Radio 4’s World<br />

at One yesterday. She earlier wrote:<br />

“Too many of our supporters were<br />

taken in by right-wing arguments and<br />

I believe this happened, in part, because<br />

under your leadership the case<br />

to remain in the EU was made with<br />

half-hearted ambivalence rather than<br />

full-throated clarity.”<br />

Despite a stormy meeting with MPs,<br />

Corbyn vowed to fight on. Speaking to<br />

left-wing supporters outside parliament,<br />

he said:“Don’t let the media divide<br />

us, don’t let those people who<br />

wish us ill divide us. Stay together,<br />

strong and united, for the kind of<br />

world we want to live in.”<br />

Shadow chancellor John McDonnell<br />

accused a “handful of MPs” of trying<br />

to “subvert” the party.<br />

Jeremy Corbyn meets supporters of the Momentum left-wing lobby group<br />

TUESDAY 28 JUNE 2016<br />

BREXIT<br />

NEWS<br />

03<br />

Osborne puts<br />

emergency<br />

budget on hold<br />

EMMA HASLETT<br />

@emmahaslett<br />

GEORGE Osborne sought to calm<br />

markets yesterday, saying there will<br />

be no emergency Budget at least<br />

until a new Prime Minister is in<br />

place.<br />

In his first public appearance<br />

since the EU referendum result,<br />

Osborne said Britain will “confront<br />

what the future holds for us from a<br />

position of strength”.<br />

“Growth has been robust,<br />

employment is at a record high…<br />

and the Budget deficit has been<br />

brought down.<br />

“That is not the outcome I<br />

wanted… [but] now the people have<br />

spoken, we in this democracy must<br />

accept the result… I will do<br />

everything I can to make it work<br />

for Britain.”<br />

He added: “It is inevitable that<br />

Britain’s economy will have to<br />

adjust.”<br />

WELCOME TO OUR WORLD<br />

Government launches civil service<br />

Brexit unit to develop leaving plans<br />

MARK SANDS<br />

@mksands<br />

THE GOVERNMENT has set up a<br />

“Brexit unit” to develop plans for the<br />

UK’s departure from the EU ahead of<br />

the selection of a new Prime<br />

Minister.<br />

The team will be made up of civil<br />

servants from across Whitehall and<br />

will present options to the Cabinet<br />

about how the government can<br />

respond to last week’s historic vote.<br />

Chancellor of the Duchy of<br />

Lancaster Oliver Letwin will play a<br />

“facilitative role” for the project,<br />

which will see civil servants liaise<br />

with devolved authorities, including<br />

the London Assembly.<br />

Downing Street is yet to set out the<br />

numbers of staff involved, but David<br />

Cameron said the team would<br />

include the civil service’s “best and<br />

brightest”.<br />

It will consist of officials from the<br />

Treasury, Foreign Office and other<br />

departments.<br />

The unit will take no decisions on<br />

the UK’s negotiating stance, instead<br />

reporting to the core cabinet, which<br />

includes Brexit campaigner and<br />

justice secretary Michael Gove.<br />

However, this also means that<br />

Boris Johnson, the favourite to<br />

succeed Cameron, is currently<br />

excluded from exit plan research.<br />

Sajid Javid to meet business<br />

groups to discuss EU concerns<br />

MARK SANDS<br />

@mksands<br />

SAJID Javid will today meet business<br />

leaders to discuss the challenges of the<br />

UK’s Brexit vote.<br />

The business secretary – thought to<br />

be courting support for a joint Tory<br />

leadership bid with work and pensions<br />

secretary Stephen Crabb – will meet<br />

groups, including the Confederation of<br />

British Industry and the Institute of Directors.<br />

He will argue Brexit will generate<br />

risks, but add there will also be opportunities,<br />

and he will ask them to share<br />

their concerns.<br />

Ahead of the event, Javid said: “My objective<br />

now is to ensure that the<br />

negotiation of our future relationship<br />

with the EU is carried out in the interest<br />

of UK companies, investors, potential<br />

investors and workers.”<br />

An IoD spokesperson said: “George<br />

Osborne has been trying to calm the<br />

markets, but it’s thin on the detail.<br />

“We want to know about business<br />

support like lending. We know they<br />

have been planning, so we want to see<br />

how far they have got.”

04 NEWS TUESDAY 28 JUNE 2016<br />

BREXIT<br />

Britain is well<br />

placed to handle<br />

Brexit says PM<br />

MARK SANDS<br />

@mksands<br />

PRIME MINISTER David Cameron has<br />

sought to issue reassurances on the<br />

UK’s strength, after markets continued<br />

to struggle on the second day of trading<br />

since the vote to leave the EU.<br />

Speaking in the House of Commons,<br />

yesterday, Cameron said that Britain is<br />

in “a position of strength” as it seeks to<br />

confront the fall-out from the Brexit<br />

vote.<br />

“We have today one of the strongest<br />

major advanced economies in the<br />

world and we are well-placed to face<br />

the challenges ahead,” he said, citing<br />

the UK’s continued low inflation,<br />

which sits below the target of two per<br />

cent, high employment and strong capital<br />

requirements on banks.<br />

“In the coming days, the Treasury,<br />

the Bank of England and the Financial<br />

Conduct Authority will continue to be<br />

in very close contact. They have contingency<br />

plans in place to maintain finan-<br />

cial stability – and they will not hesitate<br />

to take further measures if<br />

required,” Cameron added, noting that<br />

the Bank of England has already<br />

pledged to make £250bn of funding<br />

available to support banks and markets.<br />

“It is going to be difficult. We have<br />

already seen that there are going to be<br />

adjustments within our economy,<br />

complex constitutional issues, and a<br />

challenging new negotiation to undertake<br />

with Europe,” he said.<br />

Labour leader Jeremy Corbyn<br />

responded by asking Cameron to drop<br />

fiscal rules which require a surplus by<br />

the end of the parliament, for the debtto-GDP<br />

ratio to fall in every year of the<br />

parliament and for welfare spending to<br />

be capped.<br />

“What the economy needs now is a<br />

clear plan for investment, particularly<br />

in those communities that have been<br />

so damaged by this government and<br />

that have sent such a very strong message<br />

to all of us last week,” Corbyn said.<br />

Former mayor of London Boris Johnson remains the man to beat to Downing Street<br />

Tories accelerate plans to pick<br />

the UK’s next Prime Minister<br />

MARK SANDS<br />

@mksands<br />

THE CONSERVATIVES have agreed a<br />

timetable for their leadership battle,<br />

which will crown the UK’s new Prime<br />

Minister.<br />

When David Cameron resigned, he<br />

proposed having a successor in time<br />

for the party’s conference in October.<br />

However, the party has now<br />

accelerated the process, pledging to<br />

find a new leader by 2 September.<br />

Nominations will open tomorrow<br />

evening and will close at midday on<br />

Thursday.<br />

Boris Johnson is considered to be<br />

the favourite, with bookmakers<br />

offering the former London mayor at<br />

evens this weekend.<br />

CITYAM.COM<br />

FOR MORE ON THE BREXIT FALL-OUT GO TO CITYAM.COM<br />

King hits out at<br />

Treasury over<br />

EU referendum<br />

JOSEPH MILLIS<br />

@joemillis59<br />

THE FORMER governor of the Bank<br />

of England yesterday slammed<br />

George Osborne and his Treasury<br />

team over their Brexit campaign.<br />

And Lord Mervyn King said they<br />

would now need to row back from<br />

exaggerated claims that left him<br />

“baffled”.<br />

“The Treasury is in a difficult<br />

position now because it did make<br />

forecasts that were exaggerated in<br />

terms of at least the certainty and<br />

now will have to row back,” he said.<br />

In a BBC interview, he also<br />

accused the Remain campaign of<br />

treating people considering voting<br />

Leave like “idiots”, noting that<br />

voters had not been impressed by<br />

“scaremongering tactics”.<br />

Calling for “a bit of calm now”,<br />

King, who was governor between<br />

2003 and 2013, said: “I don’t think<br />

people should be particularly<br />

worried, markets move up, markets<br />

move down. We don’t yet know<br />

where they will find their level and<br />

the whole aspect of volatility is that<br />

there is a trial and error process<br />

going on before markets discover<br />

what the right level of stock mark -<br />

ets and exchange rates actually are.”

CITYAM.COM<br />

FOR MORE ON THE BREXIT FALL-OUT GO TO CITYAM.COM<br />

S&P and Fitch downgrade Britain<br />

WILLIAM TURVILL<br />

@wturvill<br />

STANDARD and Poor’s and Fitch<br />

downgraded the UK’s credit rating<br />

last night after last week’s Brexit vote.<br />

S&P took the UK’s rating down two<br />

notches, from AAA to AA, with a negative<br />

outlook, describing the Brexit<br />

vote as “a seminal event”.<br />

Fitch downgraded the UK from AA+<br />

to AA, with a negative outlook.<br />

Markets predict<br />

BoE rates could<br />

fall below zero<br />

JAKE CORDELL<br />

@JakeCordell<br />

MARKETS are pricing in a 15 per cent<br />

chance of the Bank of England<br />

slashing interest rates below zero as<br />

financial markets continue to wobble<br />

after the UK’s historic vote to leave<br />

the EU last week.<br />

As trading was suspended on<br />

banking shares after another day of<br />

double-digit falls, the market<br />

outlook on the future path of<br />

interest rates headed south.<br />

Markets are now fully pricing in at<br />

least one cut to interest rates – which<br />

have been at their lowest level in the<br />

Bank’s 300-year history of 0.5 per<br />

cent since March 2009 – before the<br />

end of the year.<br />

That is despite all three major<br />

ratings agencies cutting their<br />

outlook on the UK’s gold standard<br />

credit rating.<br />

Analysis by traders Hargreaves<br />

Lansdown showed markets are also<br />

putting the chances of Bank<br />

governor Mark Carney cutting<br />

interest rates into negative territory<br />

at one in six. Carney has previously<br />

been dismissive of the idea of<br />

negative rates, but did warn a sharp<br />

depreciation in the value of sterling<br />

following a vote to leave would<br />

create a difficult decision for the<br />

bank.<br />

A weaker pound could see<br />

inflation jump above the Bank’s two<br />

per cent target fairly quickly, while<br />

financial instability may result in<br />

higher unemployment and weaker<br />

growth.<br />

“The Brexit vote has substantially<br />

moved the dial on interest rate<br />

expectations, with markets now<br />

pricing in a significant chance of<br />

rates going negative in the UK,” said<br />

Laith Khalaf, senior analyst at<br />

Hargreaves Lansdown.<br />

“The Bank may find itself between<br />

a rock and a hard place,” he added.<br />

Meanwhile, Sky News reported that<br />

Moody’s has signalled to a number of<br />

the UK’s largest banks that it plans to<br />

revise down the outlook for their<br />

credit ratings to negative from positive<br />

or stable.<br />

“The UK vote to leave the European<br />

Union in the referendum on 23 June<br />

will have a negative impact on the UK<br />

economy, public finances and political<br />

continuity,” Fitch said.<br />

S&P said: “In our opinion, this outcome<br />

is a seminal event, and will lead<br />

to a less predictable, stable, and effective<br />

policy framework in the UK.<br />

“We have reassessed our view of the<br />

UK’s institutional assessment and<br />

now no longer consider it a strength<br />

in our assessment of the rating.”<br />

S&P also noted that a Remain vote in<br />

the EU referendum in Scotland and<br />

Northern Ireland “creates wider constitutional<br />

issues for the country as a<br />

whole”.<br />

TUESDAY 28 JUNE 2016<br />

BREXIT<br />

NEWS<br />

GOLD STANDARD Precious metals soar<br />

Bond yields hit<br />

record lows as<br />

Brexit bites<br />

05<br />

RETAIL gold<br />

investors are<br />

booking profit<br />

on metal<br />

bought to<br />

hedge against<br />

the Brexit vote<br />

on Thursday.<br />

As investors<br />

raced to safe<br />

havens, the<br />

yellow metal<br />

hit $1,324.55<br />

an ounce, up<br />

0.7 per cent.<br />

JAKE CORDELL<br />

@JakeCordell<br />

BORROWING costs for the UK<br />

government have dropped to their<br />

lowest on record as investors flock<br />

to the safe haven of government<br />

debt amid Brexit uncertainty.<br />

Yields on the benchmark 10-year<br />

Treasury bonds plunged to 0.94 per<br />

cent, down an unprecedented 0.14<br />

percentage points – or 14 basis<br />

points.<br />

It is the first time the amount<br />

payable in interest on 10-year UK<br />

debt has fallen below one per cent,<br />

having already been at their lowest<br />

ever level in the run-up to the<br />

referendum vote.<br />

This means investors will receive<br />

just 94p in interest on every £100 of<br />

long-term government debt they<br />

own.<br />

Lower yields typically indicate<br />

investors have more faith in the<br />

ability of the issuer of that debt to<br />

pay it back. By comparison, yields<br />

on 10-year debt issued by the Greek<br />

government are currently 8.7 per<br />

cent.<br />

For Germany, they are minus 0.11<br />

per cent, meaning investors pay the<br />

government to keep their money<br />

safe.<br />

The fall in yields comes as all<br />

three major credit ratings agencies<br />

cut the outlook on the UK’s credit<br />

rating to negative and the<br />

probability of the UK government<br />

defaulting on its debt jumped to its<br />

highest level in three years.<br />

Neil Williams, chief economist at<br />

Hermes Investment Management,<br />

told City A.M.: “In the rating<br />

agencies’ eyes, Brexit is putting the<br />

UK’s credit worthiness under the<br />

spotlight. But the referendum<br />

outcome is only the latest chapter<br />

in what will prove to be a<br />

protracted story of lower-for-longer<br />

bond yields.”<br />

BHP Bilton closed<br />

down at 1.68 per<br />

cent to 841.90p<br />

Mixed fortunes for London miners<br />

JESSICA MORRIS<br />

@jssmorris<br />

THE FALL-OUT from the UK’s Brexit<br />

vote was a boon for precious metal<br />

miners yesterday, but this wasn’t the<br />

case for the whole sector.<br />

Shares in Mexican precious metals<br />

miner Fresnillo swelled seven per<br />

cent to 1,483p per share, while<br />

Randgold Resources added 9.02 per<br />

cent to 8,035p and gold miner<br />

Centamin finished the day 8.15 per<br />

cent higher at 130.10p.<br />

“In light of the UK voting for a<br />

Brexit, we expect gold to provide a<br />

haven for investors. Coupled with<br />

sterling weakness we see upgrades for<br />

all gold producers in the near term,”<br />

Kieron Hodgson, a commodity and<br />

mining analyst at Panmure Gordon,<br />

said.<br />

But BHP Billiton closed down 1.68<br />

per cent to 841.90p, while Anglo<br />

American ended 4.42 per cent lower<br />

at 629.90p.<br />

Glencore finished down 2.8 per<br />

cent at 135.55p and Lonmin slumped<br />

5.69 per cent to 161.50p per share.<br />

Copper prices rose yesterday as<br />

funds and traders reversed short-term<br />

bets of low prices on expectations of<br />

economic stimulus, Reuters reported.

06 NEWS TUESDAY 28 JUNE 2016<br />

BREXIT<br />

Red flags fly for<br />

European banks<br />

post-Brexit vote<br />

HAYLEY KIRTON<br />

@HayleyLEK<br />

LONDON is not the only city feeling<br />

the burn in the banking industry, as<br />

many other European cities are experiencing<br />

some fall-out from the referendum<br />

result.<br />

Shares in Deutsche Bank and Credit<br />

Suisse slid to their lowest level ever<br />

yesterday, before closing down 6.2 per<br />

cent and 9.2 per cent respectively.<br />

Meanwhile, Societe Generale closed<br />

down 8.4 per cent.<br />

Italian banks have fared particularly<br />

poorly, with Unicredit closing down<br />

8.1 per cent and Banca Monte dei<br />

Paschi down 13.3 per cent.<br />

According to a note from Michael<br />

Hewson, chief market analyst at CMC<br />

Markets UK, the Italian banks are not<br />

only battling through Brexit uncertainty,<br />

but also have a vast amount of<br />

non-performing loans raising questions<br />

about their solvency.<br />

Hewson highlighted that Spanish<br />

banks were also juggling two sets of<br />

uncertainty at once, after acting<br />

Prime Minister and Spain's conservative<br />

leader Mariano Rajoy failed to secure<br />

an overall majority in the<br />

elections over the weekend.<br />

Referring the banking sector at large<br />

rather than any specific company,<br />

Vishal Vedi, banking partner at Deloitte,<br />

told City A.M.: “More broadly,<br />

the European banks are having to deal<br />

with the same challenges and issues<br />

that the UK banks are going to.<br />

“There’s a currency volatility [and]<br />

they will need to take a view – investors<br />

and the banks themselves – as<br />

to what the implications are going to<br />

be for the long-term economic outlooks,<br />

both of the EU countries and<br />

the UK.”<br />

Vedi added: “Continental Europe,<br />

that has been through certain economic<br />

difficulties, seems to be recovering,<br />

and this again just creates<br />

uncertainty as to whether that can be<br />

sustained.”<br />

Virgin Money’s share<br />

price was down 25 per<br />

cent to 205p<br />

Challenger banks’ share prices<br />

struggle as Britain ditches EU<br />

WILLIAM TURVILL<br />

@wturvill<br />

CHALLENGER banks are already<br />

finding Brexit life challenging, their<br />

share prices suggest.<br />

While the likes of Barclays and<br />

Royal Bank of Scotland (RBS)<br />

experienced double-digit falls<br />

yesterday, some challenger banks<br />

have fared even worse.<br />

To begin the week, Shawbrook’s<br />

shares were down 30 per cent to<br />

163p. And this came after its price<br />

fell 21 per cent after the result of the<br />

EU vote, from 295p on Thursday to<br />

233p. Elsewhere, Virgin Money’s<br />

share price was down 25 per cent to<br />

205p after falling from 366.4p to<br />

275.3p between Thursday and Friday.<br />

CITYAM.COM<br />

FOR MORE ON THE BREXIT FALL-OUT GO TO CITYAM.COM<br />

Fund managers<br />

hard hit by the<br />

EU referendum<br />

WILLIAM TURVILL<br />

@wturvill<br />

LONDON-listed asset managers<br />

have been among the companies<br />

worst hit by Brexit on the stock<br />

market.<br />

Schroders’ share price was down<br />

by around nine per cent to 2,164p<br />

yesterday.<br />

This followed a 12 per cent fall<br />

from 2,711p on Friday after it<br />

emerged that the UK had voted to<br />

leave the European Union in the 23<br />

June referendum.<br />

Elsewhere, Legal and General<br />

Group’s price was down 11 per cent<br />

at the start of the week to 167p<br />

after a 20 per cent fall on Friday.<br />

After a 16 per cent fall to 775p at<br />

the end of last week, St James’s<br />

Place also experienced a slow start<br />

to the week, with shares down<br />

eight per cent at 712p.<br />

Aberdeen Asset Management<br />

started yesterday as it ended last<br />

week, with shares down 11 per cent<br />

to 246p after an 11 per cent dip on<br />

Friday.<br />

Hargreaves Lansdown performed<br />

better yesterday, down nine per<br />

cent to 1,069p, than on Friday,<br />

when its shares fell 13 per cent to<br />

1,211p.

CITYAM.COM<br />

FOR MORE ON THE BREXIT FALL-OUT GO TO CITYAM.COM<br />

DON’T LOSE TRACTION The boss of<br />

McLaren urges swift Brexit manoeuvring<br />

TUESDAY 28 JUNE 2016<br />

BREXIT<br />

EasyJet shares nosedive after it<br />

warns of post-Brexit turbulence<br />

NEWS<br />

07<br />

EMMA HASLETT<br />

@emmahaslett<br />

SHARES in budget airline EasyJet fell<br />

yesterday, after it warned the<br />

outcome of the EU referendum is<br />

likely to hit it where it hurts – on top<br />

of French air traffic control strikes<br />

and the EgyptAir tragedy.<br />

The airline’s share crashed 22.32<br />

per cent to close at 1,020p, after it<br />

said in a statement that it was<br />

expecting economic and consumer<br />

uncertainty thanks to the UK’s<br />

decision to ditch the EU.<br />

The airline said it expected revenue<br />

per seat to be down by “at least a midsingle-digit<br />

percentage” compared<br />

with the second half of last year, amid<br />

Brexit turmoil hitting markets.<br />

Air traffic control strikes in France<br />

led to more than 700 cancellations in<br />

June, over 300 of which took place in<br />

the past seven days.<br />

EASYJET<br />

1,600<br />

1,500<br />

1,400<br />

1,300<br />

1,200<br />

1,100<br />

1,000<br />

P<br />

27 June<br />

1,020.00<br />

21 June 22 June 23 June 24 June 27 June<br />

MCLAREN chief executive Mike Flewitt has urged the government to create stability<br />

quickly following the Brexit vote. Flewitt said the impact of the vote will be<br />

cushioned if the government can find a way to restore calm in the markets.<br />

Housebuilders<br />

are hit by Brexit<br />

vote demolition<br />

EMMA HASLETT<br />

@emmahaslett<br />

SHARES in all the FTSE 100-listed<br />

housebuilders were suspended from<br />

trading for five minutes yesterday<br />

morning as housebuilders fell for the<br />

second consecutive trading day.<br />

Taylor Wimpey was the first to trigger<br />

the London Stock Exchange’s<br />

so-called circuit breaker by falling<br />

more than eight per cent on its opening<br />

price, causing it to be suspended<br />

for five minutes, as investors showed<br />

their nerves over the outcome of last<br />

week’s EU referendum.<br />

At the close it was 14.92 per cent<br />

down at 115.80p.<br />

That was followed by Berkeley<br />

Group, the London-focused builder,<br />

which was down 13.2 per cent at<br />

2,251p in lunchtime trading. It pared<br />

its losses to close down 9.72 per cent.<br />

Barratt fell 19.42 per cent to 354.40p,<br />

and Persimmon dropped 13.82 per<br />

cent to 1,310p.<br />

The falls came after estate agent Foxtons<br />

became one of the first to issue a<br />

profit warning on the back of the<br />

vote, saying it expects “significantly<br />

lower” earnings this year.<br />

However, analysts suggested the falls<br />

were temporary, rather than part of a<br />

longer trend.<br />

“Time is relative. A week is a longer<br />

time in politics than it is housebuilding,”<br />

said Jefferies analysts.<br />

“We may start the week with many<br />

political uncertainties, but we remain<br />

certain that there is a fundamental<br />

shortage of housing.<br />

“However, the strength and length<br />

of the autumn and the following<br />

spring selling seasons will, in our<br />

view, provide a better indicator of the<br />

health of the new build housing market.<br />

We will get colour on the cancellation<br />

rates during the July/August<br />

results season but will have to wait for<br />

the autumn trading updates for news<br />

on the autumn selling season.<br />

“One theme raised in the post Brexit<br />

debate is that many voters were disillusioned<br />

with the growing inequality<br />

of wealth across the UK, asking ‘What<br />

has Europe done for me?’. For the vast<br />

majority of households, their home is<br />

their largest store of wealth and all political<br />

parties are very aware that<br />

homeownership is falling.”<br />

Foxtons issues a profit warning<br />

after EU referendum shock<br />

OUT OF EUROPE,<br />

BUT NOT OUT OF POCKET.<br />

<br />

CurrencyFair.com<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

EMMA HASLETT<br />

@emmahaslett<br />

SHARES in struggling estate agent<br />

Foxtons plummeted yesterday after it<br />

became one of the first property<br />

giants to issue a profit warning off<br />

the back of the UK’s Brexit vote.<br />

Shares closed down 22.59 per cent<br />

to 104.50p after the company put out<br />

a statement saying challenging<br />

conditions it had previously referred<br />

to “are now likely to continue for at<br />

least the remainder of the year”.<br />

“We therefore expect full-year 2016<br />

group revenues and adjusted<br />

earnings before interest, taxation,<br />

depreciation and amortisation to be<br />

significantly lower than [the] prior<br />

year.”<br />

The company has had a difficult<br />

few months, as fears over the<br />

outcome of the EU referendum<br />

combined with attempts by George<br />

Osborne to slow house price growth<br />

pushed down sales at Foxtons, which<br />

focuses on the top end of London’s<br />

property market.<br />

<br />

Authorised by the Central Bank of Ireland to provide Payment Services within the 28 member states of the European Union pursuant to

WILDFELL COLLECTION<br />

Celebrating our heritage as master<br />

silversmiths for over 240 years.<br />

FLAGSHIP BOUTIQUE<br />

132 REGENT STREET<br />

LONDON<br />

I was made and meant to<br />

look for you and wait for you<br />

and become yours forever.<br />

ROBERT BROWNING<br />

INTRODUCING OUR NEW BRAND AMBASSADOR,<br />

GABRIELLA WILDE.

CITYAM.COM<br />

TUESDAY 28 JUNE 2016<br />

NEWS<br />

09<br />

Angela Merkel rules out<br />

informal talks before<br />

Article 50 is triggered<br />

WILLIAM TURVILL<br />

@wturvill<br />

GERMANY, France and Italy have said<br />

the EU will not hold talks with the UK<br />

on Brexit until Article 50 has been<br />

triggered.<br />

Speaking alongside French President<br />

Francois Hollande and Italian<br />

Prime Minister Matteo Renzi in<br />

Berlin, German chancellor Angela<br />

Merkel described the UK’s vote for a<br />

Brexit as a “very painful and regrettable<br />

decision”.<br />

She said: “We are in agreement that<br />

article 50 of the European treaties is<br />

very clear – a member state that<br />

wishes to leave the European Union<br />

has to notify the European Council…<br />

“There can’t be any further steps<br />

until that has happened. Only then<br />

will the European Council issue<br />

guidelines under which an exit will<br />

be negotiated.<br />

“That means that, and we agree on<br />

this point, there will be neither informal<br />

nor formal talks on a British exit<br />

until the European Council has<br />

received the… request for an exit from<br />

the European Union.”<br />

Hollande spoke of the importance of<br />

negotiating the UK’s exit as quickly as<br />

possible. “There is nothing worse than<br />

uncertainty,” he said. “Our responsibility<br />

is not to lose time in dealing<br />

with the question of the UK’s exit and<br />

the new questions for the 27.”<br />

Merkel has also said “it shouldn’t<br />

take forever” for the UK to trigger<br />

Article 50. The German leader said<br />

over the weekend: “[There is] no need<br />

to be particularly nasty in any way in<br />

the negotiations; they must be conducted<br />

properly.”<br />

French, German and Italian leaders said Article 50 must be triggered before any talks<br />

Branson backs<br />

calls for a new<br />

EU referendum<br />

MARK SANDS<br />

@mksands<br />

VIRGIN founder Sir Richard<br />

Branson is urging voters to sign a<br />

petition calling for a second EU<br />

referendum, although Downing<br />

Street maintains a second vote “is<br />

not on the cards”.<br />

Branson, who campaigned for<br />

Remain, said many voters had been<br />

misled by the Leave campaign.<br />

He accused campaigners of<br />

backtracking on key pledges and<br />

bemoaned the impact of the vote on<br />

the economy. “Two years before<br />

Brexit will even become reality,<br />

according to EU rules, it is already<br />

having massive consequences on the<br />

UK economy, and on society. Brexit<br />

has fractured the country more<br />

than any other event in recent<br />

memory,” he said.<br />

The petition, signed by more than<br />

3.6m people, calls on the govern -<br />

ment to hold a second referendum<br />

based on turnout and majority.<br />

New indy vote last thing<br />

Scotland needs: No 10<br />

MARK SANDS<br />

@mksands<br />

DOWNING Street officials have<br />

rejected calls for a second Scottish<br />

independence referendum.<br />

Scottish First Minister Nicola<br />

Sturgeon said last week that,<br />

following the UK’s vote to leave the<br />

EU, a second vote on Scotland’s<br />

independence was “highly likely”<br />

due to the support for membership<br />

north of the border.<br />

However, David Cameron’s staff<br />

have noted that no formal<br />

proposals have yet been made for a<br />

second vote, adding that any plans<br />

to would be viewed dimly.<br />

“There was a legal and fairly<br />

decisive referendum nearly two<br />

years go. The reason for Scotland to<br />

be in the UK are just as strong<br />

now,” the Prime Minister’s<br />

spokesperson said yesterday.<br />

“We need to focus on<br />

getting the best deal for<br />

Scotland and the UK and<br />

the last thing that<br />

Scotland needs now is<br />

another divisive<br />

referendum.”<br />

Even before last week’s<br />

Brexit decision result, the<br />

SNP has maintained that<br />

Brexit would lead it to call for<br />

a new independence vote.<br />

In October 2015, Sturgeon was<br />

already describing a second vote as<br />

“inevitable”.<br />

And speaking in the House of<br />

Commons yesterday, SNP<br />

Westminster leader Angus<br />

Robertson again restated the<br />

nationalists’ argument.<br />

“We have no intention<br />

whatsoever of seeing<br />

Scotland taken out of<br />

Nicola Sturgeon says<br />

Scotland voted for the EU<br />

Europe,” he said.<br />

“We are a European<br />

country and we will stay a<br />

European country.<br />

“If that means we have to have an<br />

independence referendum then so<br />

be it,” Robertson said.<br />

Britain can afford no more delays on airport<br />

expansion Gatwick chief executive to warn<br />

MARK SANDS<br />

@mksands<br />

THE BOSS of Gatwick Airport is to<br />

renew calls for a new runway,<br />

arguing it is the only option<br />

suitable for expansion.<br />

Speaking at the National<br />

Infrastructure Forum, Gatwick<br />

chief executive Stewart Wingate<br />

will today say that Britain can no<br />

longer afford delays to airport<br />

expansion.<br />

Wingate will also argue that<br />

only Gatwick can balance the<br />

need for economic growth with<br />

environmental concerns.<br />

“In these uncertain times that<br />

means Gatwick can give the<br />

country certainty of delivery. And<br />

Britain cannot afford yet more<br />

delay,” he will say.<br />

“We have pledged we can<br />

deliver by 2025, at a cost that<br />

everyone can afford, without<br />

public subsidy and at a fraction of<br />

the environmental impact of<br />

Heathrow. None of that has<br />

changed.”<br />

It comes almost exactly a year<br />

after the Airports Commission<br />

recommended a new runway at<br />

Heathrow.<br />

Last July, Sir Howard Davies<br />

said that proposals for a new<br />

runway at Heathrow Airport, if<br />

combined with measures to<br />

address environmental and<br />

community impacts, offered the<br />

greatest benefits.<br />

Yesterday, 50 business leaders<br />

joined with the Let Britain Fly<br />

campaign to warn that the UK’s<br />

vote to leave the EU made the<br />

need for a decision more urgent<br />

and called for an improvement on<br />

“glacial” progress.<br />

Last year, the government<br />

delayed a decision until this<br />

summer to explore<br />

environmental issues.<br />

A Downing Street spokesperson<br />

yesterday said: “The timetable for<br />

that hasn’t changed.”

10 NEWS TUESDAY 28 JUNE 2016<br />

UK audit bosses:<br />

HS2 timetable<br />

will face delays<br />

WILLIAM TURVILL<br />

@wturvill<br />

THE DEPARTMENT for Transport set<br />

an “unrealistic timetable” for the<br />

completion of High Speed 2 (HS2), the<br />

National Audit Office (NAO) has said.<br />

A report out today says the 2026 target<br />

for the opening of phase one of<br />

HS2 is “at risk despite good progress<br />

with some major procurements”.<br />

Amyas Morse, head of the NAO, said:<br />

“HS2 is a large, complex and ambitious<br />

programme which is facing cost<br />

and time pressures.<br />

“The unrealistic timetable set for HS2<br />

Ltd by the department means they are<br />

not as ready to deliver as they hoped to<br />

be at this point. The department now<br />

needs to get the project working to a<br />

timescale that is achievable.”<br />

Last month, an academic study told<br />

how HS2 could be up to five times<br />

more expensive than its French equivalent.<br />

The academics, led by Professor<br />

Tony May from Leeds University and<br />

transport consultant Jonathan Tyler,<br />

said that France’s TGV line from Tours<br />

to Bordeaux was costing £20m per<br />

km, compared with a projected cost of<br />

around £105m per km for HS2.<br />

Transport minister Robert Goodwill<br />

said: “HS2 is on track and the NAO<br />

agrees. We have strong cross party support<br />

and are on schedule to gain the<br />

powers needed to start building HS2,<br />

which the NAO acknowledges is a significant<br />

achievement.”<br />

Dave Whelan could stretch to forking out £70m for the Fitness First gym chain<br />

JJB boss flexes muscles to snap<br />

up Fitness First’s UK operations<br />

JOSH MARTIN<br />

@JoshMartinNZ<br />

JJB SPORTS founder Dave Whelan is<br />

in talks to buy the British operations<br />

of gym chain Fitness First.<br />

The multi-millionaire business<br />

tycoon’s DW Sports is set to fork out<br />

£70m for a takeover of the business,<br />

Sky News reported yesterday.<br />

Whelan, who also owns Wigan<br />

Athletic Football Club, has been in<br />

talks with Fitness First for over a<br />

month. He reportedly wants to<br />

combine the gym chain’s outlets<br />

with the 70-strong chain of DW<br />

health clubs.<br />

A stock market float for the<br />

combined group could also be on the<br />

cards for 2018.<br />

CITYAM.COM<br />

Accounting<br />

probe for HBOS<br />

audit practices<br />

HAYLEY KIRTON<br />

@HayleyLEK<br />

THE ACCOUNTING watchdog said<br />

yesterday that it has started a probe<br />

into KPMG over the HBOS audit.<br />

More specifically, the Financial<br />

Reporting Council (FRC) is looking<br />

into the conduct of KPMG Audit<br />

relating to its audit of HBOS for the<br />

year ended December 2007.<br />

In 2008, HBOS collapsed and<br />

needed to be bailed out by Lloyds,<br />

shortly after the big four firm had<br />

given the health of the business a<br />

thumbs up.<br />

A KPMG spokesperson said that<br />

the firm had cooperated with all the<br />

inquiries and investigations relating<br />

to the matter to date and would<br />

continue to do so, but “trust and ask<br />

that the investigation be completed<br />

as quickly as possible”.<br />

The FRC had originally decided to<br />

not to open a full investigation into<br />

the auditor.<br />

First time buyer?<br />

Our Mortgage Advisors will<br />

take you through step by step.<br />

2.94%<br />

fixed until<br />

31/07/2021<br />

and then<br />

• Minimum deposit 10%<br />

• Early repayment charges: 4% of the<br />

sum repaid until 31/07/2018, then<br />

3% until 31/07/2020 and 2% until<br />

31/07/2021<br />

• £995 arrangement fee<br />

4.49%<br />

variable which is The Bank of<br />

England base rate (currently<br />

0.5%) plus 3.99% for the rest<br />

of the mortgage term<br />

The overall cost<br />

for comparison<br />

4.0% APRC<br />

• A lending fee of £195 applies which is<br />

due on completion but payment can be<br />

deferred until mortgage is fully repaid<br />

• Standard Valuation fee paid by the<br />

Lender<br />

• £300 cashback on completion<br />

Representative example:<br />

A mortgage of £175,000 payable over 18 years initially on a fixed rate for 5 years at 2.88% and then<br />

reverting to our tracker rate of 3.99% above Bank of England Base Rate for the remaining 13 years would<br />

require 57 monthly payments of £1,039 and 159 monthly payments of £1,147.<br />

The total amount payable would be £241,704 made up of the loan amount plus interest (£65,514),<br />

product fee (£995), valuation fee (£0), and lending fee (£195).<br />

The overall cost for comparison is 3.8% APRC representative.<br />

Visit us postofficemoney.co.uk Ask us in branch Call us 0330 400 6223*<br />

Post Office Money ® Mortgages are provided by Bank of Ireland UK.<br />

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP<br />

REPAYMENTS ON YOUR MORTGAGE<br />

Subject to status and lending criteria. Borrowers must be 18 or over. Bank of Ireland UK is a trading name of Bank of Ireland (UK) plc<br />

which is registered in England and Wales (no 07022885). Registered office Bow Bells House, 1 Bread Street London EC4M 9BE. Post<br />

Office Ltd is registered in England and Wales. Registered no 2154540. Registered Office Finsbury dials, 20 Finsbury Street London<br />

EC2Y 9AQ. Post Office Money and the Post Office Money logo are registered trademarks of Post Office Ltd. Rates correct as at<br />

07/06/2016 *Calls to 0330 numbers cost no more than calling a standard geographic number starting with 01 or 02 from your fixed<br />

line or mobile phone and may be included in your call package dependent on your service provider.<br />

10629160426 A<br />

Ryanair demands EU flies<br />

in to prevent French strikes<br />

JESSICA MORRIS<br />

@jssmorris<br />

BUDGET airline Ryanair is urging<br />

the EU to take action after the<br />

latest airline strike orchestrated<br />

by French air traffic control<br />

unions.<br />

It comes as the low-cost carrier<br />

was forced to cancel 166 flights<br />

to, from and over France today. It<br />

said that 30,000 Ryanair<br />

customers will have had their<br />

flights cancelled, while more<br />

than 100,000 others will suffer<br />

severe delays.<br />

It wants the European<br />

Commission to require French<br />

ATC unions to engage in binding<br />

arbitration rather than strikes,<br />

while allowing Europe’s other<br />

ATCs to operate overflights over<br />

France and protect flights over<br />

France amid the strikes.<br />

Kenny Jacobs, chief marketing<br />

officer at Ryanair, said: “It is<br />

time for action by the European<br />

Commission following this latest<br />

French ATC strike aimed at<br />

disrupting as many travel plans<br />

as possible.”<br />

He continued: “The frequency<br />

of these strikes, right in the<br />

middle of holiday season only<br />

serves to underline how urgent<br />

action is required to help reduce<br />

the impact of these strikes.<br />

“After last week’s Brexit vote in<br />

the UK, the EU Commission must<br />

begin to deliver real benefits for<br />

consumers, and urgent action to<br />

ameliorate the effects of these<br />

repeated French ATC strikes and<br />

prevent them disrupting the<br />

travel plans of millions of<br />

citizens.”<br />

Eurotunnel boss warns over<br />

migrant pressures post-Brexit<br />

PIERRE SAVARY<br />

THE HEAD of Eurotunnel yesterday<br />

warned that Britain’s decision to<br />

leave the European Union could<br />

lead to an increase in the number<br />

of migrants trying to enter Britain<br />

via Calais on the French coast.<br />

“There could be increased<br />

migrant pressure during the<br />

summer and because of Brexit as<br />

migrants will try to cross at any<br />

cost before it [Brexit] is<br />

implemented,” Jacques Gounon<br />

said.<br />

Gounon was speaking at a news<br />

conference in Calais, the main<br />

entry and exit point between<br />

Britain and France via road, sea<br />

and the Eurotunnel rail link.<br />

A migrant camp that became<br />

known as the jungle grew up there<br />

last year, becoming home to<br />

thousands hoping to head for<br />

Britain and causing transport<br />

disruption until tighter security<br />

made leaping on lorries and<br />

walking through the tunnel more<br />

difficult.<br />

Gounon was presenting extra<br />

security arrangements which<br />

include the deployment of two<br />

drones equipped with cameras to<br />

fly around its Coquelles terminal<br />

in northern France.<br />

Shares in Eurotunnel have fallen<br />

27 per cent since last Thursday’s<br />

referendum.<br />

The drop has come despite<br />

Gounon’s reassurances that the<br />

business would not suffer as a<br />

result.<br />

Reuters<br />

Connect<br />

Follow<br />

Like<br />

Share<br />

Keep informed 24/7:<br />

Don’t forget to<br />

follow us on<br />

LinkedIn, Twitter,<br />

Facebook and Google+

Volatility<br />

ahead?<br />

Take advantage with our award-winning,<br />

Next Generation trading platform*<br />

Events like Thursday’s EU referendum, next month’s US interest rate decision<br />

and ongoing unpredictable oil prices can all cause volatility in the markets.<br />

Whichever direction you think the markets are moving, take a position with<br />

our Next Generation trading platform.<br />

Switch today at cmcmarkets.co.uk<br />

Spread betting | CFDs | FX | Binaries<br />

Spread betting and CFD trading can result in losses that<br />

exceed your deposits. Volatility can increase risk.<br />

*Best Trading Platform Features among spread bettors<br />

and FX traders in the Investment Trends 2015 UK Leveraged<br />

Trading Report.

12 NEWS TUESDAY 28 JUNE 2016<br />

THECAPITALIST<br />

EDITED BY EDITH HANCOCK<br />

CITYAM.COM<br />

Got A Story? Email<br />

thecapitalist@cityam.com<br />

No love lost between<br />

Brexiting campaigns<br />

IF THE EU referendum taught us anything,<br />

it’s that the Brexiters don’t<br />

mince their words, even if they’re on<br />

the same side.<br />

“Leave.EU has upset quite a few people,”<br />

said a statement from the anti-<br />

EU group yesterday. “So far, we have<br />

managed to clock eight<br />

impending cases.”<br />

Following complaints<br />

about Leave.EU taking<br />

comments out of context<br />

to boost the Brexit<br />

movement from former<br />

Spice Girl Victoria Beckham<br />

(pictured), ex-England<br />

footballer Gary<br />

Lineker and Nasa, the<br />

group’s co-chair and Ukip<br />

donor Arron Banks issued a<br />

“heartfelt apology” to those affected.<br />

“Bring it on, luvvies,” said Banks<br />

after Remainers Lineker and Beckham<br />

complained that their negative comments<br />

on the euro were turned into<br />

promotional posters for Leave.EU.<br />

The 50-year-old millionaire also had<br />

words for the Electoral Commission<br />

after it investigated the anti-EU group<br />

for its involvement in and funding of<br />

failed Brexit concert Bpoplive. Earlier<br />

this month, Leave.EU accused the EC<br />

of trying to “shut down” the concert<br />

in Birmingham. Several acts had<br />

already cancelled after finding out<br />

who was bankrolling the event.<br />

Keeping things short and<br />

sweet, Banks told the Commission<br />

to “bite me.”<br />

Ukip donor Arron Banks<br />

told the Electoral<br />

Commission to “bite me”<br />

Even Brexit-backing<br />

Superdrug founder Peter<br />

Goldstein had grievances after<br />

the firm’s logo was used by<br />

Leave.EU without permission and was<br />

brought into association with the<br />

campaign. “Sorry about that,” said<br />

Ukipper Banks.<br />

Vote Leave responded to Banks in<br />

kind, telling The Capitalist: “An apology<br />

is a fitting way for him to end his time<br />

in politics.” Meow.<br />

REMAINERS SET THEIR TARGET<br />

Good news for Inners who are<br />

heartbroken after last week’s Brexit; two<br />

“ordinary voters” are crowdfunding to set<br />

up a dating app for europhiles. Early<br />

signups to “Remainder” will be in line for<br />

invitations to exclusive events in In-voting<br />

cities like London, Brighton, Liverpool,<br />

Manchester, Glasgow and Edinburgh. The<br />

pair say their signup target is 16,141,241.<br />

QUOTE OF THE DAY<br />

Scratching my head<br />

for an appropriate<br />

quote on the long run<br />

Economics reporter<br />

Soumaya Keynes takes<br />

inspriation from her<br />

ancestor John<br />

Maynard Keynes’<br />

saying “in the long<br />

run we are all<br />

dead” as ex-BoE<br />

chief Lord King<br />

says the UK<br />

economy won’t<br />

face long-term<br />

damage.<br />

SAFE CHIEF<br />

TAKES RISK<br />

Randgold’s<br />

boss lives on<br />

the wild side<br />

AS THE pound is still<br />

struggling after Thursday,<br />

investors have been<br />

looking to buy into gold as<br />

a safe bet. Meanwhile,<br />

mining firm Randgold’s<br />

boss Mark Bristow prefers<br />

to take risks. The boss is<br />

currently on a charity<br />

motorbiking tour of Africa.<br />

He started in Mombasa in<br />

May, and will reach the<br />

mouth of the Congo soon.<br />

HEADLINE SPONSOR<br />

THE<br />

WORSHIPFUL<br />

COMPANY OF<br />

BREWERS<br />

E<br />

VENT PARTNER<br />

MEDIA PAR<br />

TNER

CITYAM.COM<br />

TUESDAY 28 JUNE 2016<br />

NEWS<br />

13<br />

GW pharma shares flying high as<br />

cannabis-based drug hits target<br />

VIDYA L NATHAN<br />

BRITISH drug developer GW<br />

Pharmaceuticals yesterday said its<br />

experimental cannabis-derived<br />

epilepsy drug met the main goal to<br />

reduce frequency of seizures in a latestage<br />

study.<br />

The company said the drug,<br />

Epidiolex, significantly reduced the<br />

monthly frequency of short-term<br />

seizures in people suffering from a<br />

rare form of epilepsy called Lennox-<br />

Gastaut syndrome (LGS).<br />

Lennox-Gastaut syndrome is a<br />

rare kind of epilepsy that shows<br />

onset between three and five years<br />

of age.<br />

GW Pharma estimates there are<br />

about 14,000-18,500 patients with<br />

LGS in the US, and 23,000-31,000 in<br />

Europe.<br />

GW Pharma is testing Epidiolex in<br />

four different indications, three of<br />

which are forms of epilepsy and all<br />

three have been granted orphan<br />

drug designation from the US Food<br />

and Drug Administration.<br />

Orphan status is granted to<br />

drugs aimed at treating rare<br />

diseases, giving the developer<br />

incentives such as a seven-year<br />

marketing exclusivity for use in<br />

the US.<br />

Shares in GW Pharma surged<br />

11.96 per cent to close at 566.50p. Reuters<br />

PwC said it would cooperate with the Financial Reporting Council’s BHS investigation<br />

PwC in the eye<br />

of watchdog as<br />

BHS net widens<br />

HAYLEY KIRTON<br />

@HayleyLEK<br />

THE ACCOUNTANCY industry watchdog<br />

yesterday announced it will<br />

launch a probe into PwC over BHS.<br />

The Financial Reporting Council<br />

(FRC) said it will take a closer look at<br />

the professional services firm’s audit<br />

of the retailer for the year ended 30 August<br />

2014.<br />

A PwC spokesperson said: “We will<br />

cooperate fully with the FRC in its<br />

enquiries.”<br />

The FRC has previously been urged to<br />

carry out an investigation into the advisers<br />

involved in the £1 sale of BHS to<br />

Retail Acquisitions in 2015.<br />

Bedford and Kempston MP Richard<br />

Fuller wrote to the watchdog in April,<br />

not long after the troubled retailer was<br />

put into administration, while Simon<br />

Walker, director general of the Institute<br />

of Directors (IoD), approached the<br />

FRC with a similar query earlier this<br />

month.<br />

Commenting on the announcement,<br />

Fuller told City A.M. he<br />

acknowledged the FRC’s decision as<br />

“good news”. He explained that he<br />

wrote his original letter because companies<br />

involved in deals “rely on auditor’s<br />

statements” and he wanted to<br />

know if all “the rules were followed” by<br />

the advisers.<br />

Meanwhile, Oliver Parry, head of corporate<br />

governance at the IoD, told City<br />

A.M. that the business lobby group not<br />

only welcomed the investigation, but<br />

also that it had been picked up less<br />

than a month after Walker’s letter.<br />

Although the watchdog wrote back<br />

to both to say it was looking into what<br />

it could do, it did stress its powers to investigate<br />

were limited to accountants,<br />

auditors and actuaries who were members<br />

of the corresponding representative<br />

body. This essentially means it<br />

cannot investigate parties such as company<br />

directors if they are not part of<br />

the accountancy industry.<br />

Fuller is a member of the Business,<br />

Innovation and Skills committee, one<br />

of the bodies to launch an inquiry into<br />

the events surrounding the collapse of<br />

BHS. The committee inquiry is focused<br />

on the £1 sale, while the Work and Pensions<br />

committee is examining what<br />

the retailer’s demise means for pensions<br />

regulation.<br />

Select committees continue to<br />

quiz Caring on BHS connections<br />

FRANCESCA WASHTELL<br />

@fwashtell<br />

THE TWO parliamentary select<br />

committees investigating BHS have<br />

deepened their inquiries into<br />

clothing tycoon and restaurateur<br />

Richard Caring.<br />

The Work and Pensions committee<br />

and Business, Innovation and Skills<br />

(BIS) Select committee have written<br />

to Caring for a second time, asking<br />

20 further questions related to his<br />

business dealings with Sir Philip<br />

Green, Lady Green and BHS.<br />

“Why, in your expert assessment,<br />

did BHS fail?” and “What would you<br />

describe as Sir Philip’s strengths and<br />

weaknesses in running BHS?” are<br />

among the new questions posed.<br />

The committees previously wrote<br />

to Caring on 17 June as he will be<br />

unable to attend a meeting on 29<br />

June. Caring, who was a minority<br />

shareholder between 2001 and 2006,<br />

provided unpaid “general assistance”<br />

to the company but was never a<br />

director.

14 NEWS TUESDAY 28 JUNE 2016<br />

Vaping legislations<br />

shrouded in smoke in<br />

wake of Brexit vote<br />

FRANCESCA WASHTELL<br />

@fwashtell<br />

AN E-CIGARETTE industry body will<br />

seek talks with the government to discuss<br />

whether EU vaping legislation<br />

can be renegotiated in the wake of<br />

last week’s Brexit vote.<br />

The Independent British Vape Trade<br />

Association (IBVTA) told City A.M. that<br />

although the European Union’s Tobacco<br />

Products Directive (TPD) was<br />

transposed into UK law in May, the organisation<br />

will still “seek clarity” for<br />

its members on whether there could<br />

be any future changes to the law.<br />

The law was widely blasted by the vaping<br />

industry for stipulating strict<br />

clampdowns on e-cigarette advertising,<br />

banning it in print, on television<br />

and radio.<br />

It also put restrictions on the<br />

strength and flavours of nicotine that<br />

can be used.<br />

Under the legislation, manufacturers<br />

are also required to notify government<br />

bodies about new products six<br />

months before they are launched.<br />

Some argued this would stifle innovation<br />

in an industry driven by emerging<br />

product design.<br />

Nigel Quine, deputy chairman of the<br />

IBVTA, said: “As a trade association<br />

IBVTA will be meeting with government<br />

officials as a matter of priority<br />

to discuss the full implications of the<br />

referendum result and will continue<br />

to make the case for sector specific<br />

and proportionate regulations for the<br />

independent vape industry.<br />

“What happens next will depend on<br />

the wider negotiations on the exact<br />

nature of the UK’s future relationship<br />

with the EU,” Quine added.<br />

EU referendum vote causes storm in a prosecco glass<br />

Italian prosecco producers in a<br />

fizz over Britain leaving the EU<br />

FRANCESCA WASHTELL<br />

@fwashtell<br />

ITALIAN prosecco producers have<br />

been spooked by the UK’s vote to leave<br />

the EU last week, worrying that the<br />

hit to the pound could “upset” trade<br />

and send sales flat.<br />

Coldiretti, the association of Italian<br />

food producers, warned in a<br />

statement that the devaluation in<br />

sterling could disrupt Britain’s place<br />

as the number one export market for<br />

the posh tipple.<br />

Exports of prosecco to Britain grew<br />

at a rate of 38 per cent in the first<br />

quarter of 2016, according to<br />

Coldiretti.<br />

For more than a year Britons have<br />

spent more on the Italian fizz than its<br />

traditionally more popular, French<br />

cousin, champagne.<br />

CITYAM.COM<br />

Independent<br />

newspapers<br />

make £7m loss<br />

WILLIAM TURVILL<br />

@wturvill<br />

THE INDEPENDENT newspapers lost<br />

£6.97m in their last full year, new<br />

accounts from the company showed<br />

yesterday.<br />

The pre-tax loss, for the year to 27<br />

September 2015, was an<br />

improvement on an £8.54m loss the<br />

year before.<br />

The Independent and Independent<br />

on Sunday were closed by owner<br />

Evgeny Lebedev in March while cutprice<br />

sister title the i was sold to<br />

Johnston Press. The Russian<br />

billionaire bought the titles in 2010.<br />

Independent Digital News and<br />

Media, a separate company for the<br />

Independent’s website, which is still<br />

going, reported a net profit before<br />

tax of £1.27m for the year.<br />

Meanwhile, in the same period,<br />

the Evening Standard newspaper<br />

reported a pre-tax profit of £3.38m,<br />