Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 <strong>BHS</strong><br />

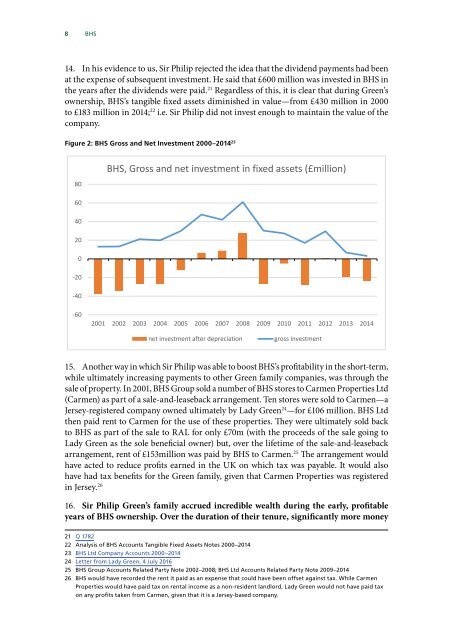

14. In his evidence to us, Sir Philip rejected the idea that the dividend payments had been<br />

at the expense of subsequent investment. He said that £600 million was invested in <strong>BHS</strong> in<br />

the years after the dividends were paid. 21 Regardless of this, it is clear that during Green’s<br />

ownership, <strong>BHS</strong>’s tangible fixed assets diminished in value—from £430 million in 2000<br />

to £183 million in 2014; 22 i.e. Sir Philip did not invest enough to maintain the value of the<br />

company.<br />

Figure 2: <strong>BHS</strong> Gross and Net Investment 2000–2014 23<br />

80<br />

<strong>BHS</strong>, Gross and net investment in fixed assets (£million)<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014<br />

net investment after depreciation<br />

gross investment<br />

15. Another way in which Sir Philip was able to boost <strong>BHS</strong>’s profitability in the short-term,<br />

while ultimately increasing payments to other Green family companies, was through the<br />

sale of property. In 2001, <strong>BHS</strong> Group sold a number of <strong>BHS</strong> stores to Carmen Properties Ltd<br />

(Carmen) as part of a sale-and-leaseback arrangement. Ten stores were sold to Carmen—a<br />

Jersey-registered company owned ultimately by Lady Green 24 —for £106 million. <strong>BHS</strong> Ltd<br />

then paid rent to Carmen for the use of these properties. They were ultimately sold back<br />

to <strong>BHS</strong> as part of the sale to RAL for only £70m (with the proceeds of the sale going to<br />

Lady Green as the sole beneficial owner) but, over the lifetime of the sale-and-leaseback<br />

arrangement, rent of £153million was paid by <strong>BHS</strong> to Carmen. 25 The arrangement would<br />

have acted to reduce profits earned in the UK on which tax was payable. It would also<br />

have had tax benefits for the Green family, given that Carmen Properties was registered<br />

in Jersey. 26<br />

16. Sir Philip Green’s family accrued incredible wealth during the early, profitable<br />

years of <strong>BHS</strong> ownership. Over the duration of their tenure, significantly more money<br />

21 Q 1782<br />

22 Analysis of <strong>BHS</strong> Accounts Tangible Fixed Assets Notes 2000–2014<br />

23 <strong>BHS</strong> Ltd Company Accounts 2000–2014<br />

24 Letter from Lady Green, 4 July 2016<br />

25 <strong>BHS</strong> Group Accounts Related Party Note 2002–2008; <strong>BHS</strong> Ltd Accounts Related Party Note 2009–2014<br />

26 <strong>BHS</strong> would have recorded the rent it paid as an expense that could have been offset against tax. While Carmen<br />

Properties would have paid tax on rental income as a non-resident landlord, Lady Green would not have paid tax<br />

on any profits taken from Carmen, given that it is a Jersey-based company.