You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

40 <strong>BHS</strong><br />

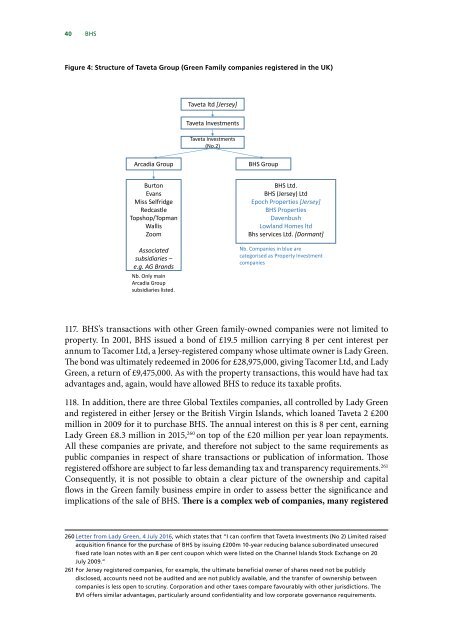

Figure 4: Structure of Taveta Group (Green Family companies registered in the UK)<br />

Taveta ltd [Jersey]<br />

Taveta Investments<br />

Taveta Investments<br />

(No.2)<br />

Arcadia Group<br />

<strong>BHS</strong> Group<br />

Burton<br />

Evans<br />

Miss Selfridge<br />

Redcastle<br />

Topshop/Topman<br />

Wallis<br />

Zoom<br />

Associated<br />

subsidiaries –<br />

e.g. AG Brands<br />

Nb. Only main<br />

Arcadia Group<br />

subsidiaries listed.<br />

<strong>BHS</strong> Ltd.<br />

<strong>BHS</strong> (Jersey) Ltd<br />

Epoch Properties [Jersey]<br />

<strong>BHS</strong> Properties<br />

Davenbush<br />

Lowland Homes ltd<br />

Bhs services Ltd. [Dormant]<br />

Nb. Companies in blue are<br />

categorised as Property Investment<br />

companies<br />

117. <strong>BHS</strong>’s transactions with other Green family-owned companies were not limited to<br />

property. In 2001, <strong>BHS</strong> issued a bond of £19.5 million carrying 8 per cent interest per<br />

annum to Tacomer Ltd, a Jersey-registered company whose ultimate owner is Lady Green.<br />

The bond was ultimately redeemed in 2006 for £28,975,000, giving Tacomer Ltd, and Lady<br />

Green, a return of £9,475,000. As with the property transactions, this would have had tax<br />

advantages and, again, would have allowed <strong>BHS</strong> to reduce its taxable profits.<br />

118. In addition, there are three Global Textiles companies, all controlled by Lady Green<br />

and registered in either Jersey or the British Virgin Islands, which loaned Taveta 2 £200<br />

million in 2009 for it to purchase <strong>BHS</strong>. The annual interest on this is 8 per cent, earning<br />

Lady Green £8.3 million in 2015, 260 on top of the £20 million per year loan repayments.<br />

All these companies are private, and therefore not subject to the same requirements as<br />

public companies in respect of share transactions or publication of information. Those<br />

registered offshore are subject to far less demanding tax and transparency requirements. 261<br />

Consequently, it is not possible to obtain a clear picture of the ownership and capital<br />

flows in the Green family business empire in order to assess better the significance and<br />

implications of the sale of <strong>BHS</strong>. There is a complex web of companies, many registered<br />

260 Letter from Lady Green, 4 July 2016, which states that “I can confirm that Taveta Investments (No 2) Limited raised<br />

acquisition finance for the purchase of <strong>BHS</strong> by issuing £200m 10-year reducing balance subordinated unsecured<br />

fixed rate loan notes with an 8 per cent coupon which were listed on the Channel Islands Stock Exchange on 20<br />

July 2009.”<br />

261 For Jersey registered companies, for example, the ultimate beneficial owner of shares need not be publicly<br />

disclosed, accounts need not be audited and are not publicly available, and the transfer of ownership between<br />

companies is less open to scrutiny. Corporation and other taxes compare favourably with other jurisdictions. The<br />

BVI offers similar advantages, particularly around confidentiality and low corporate governance requirements.