You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

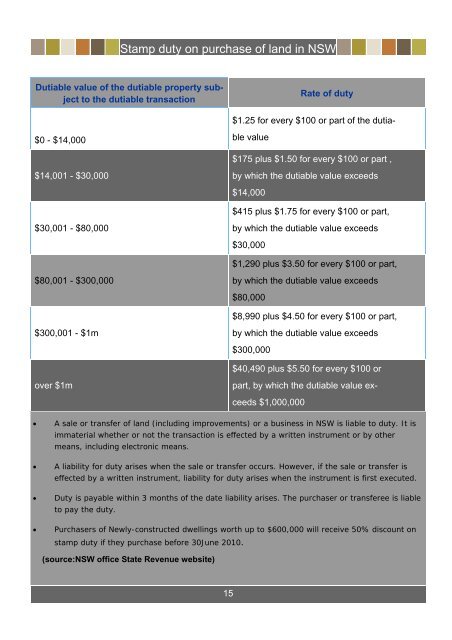

Stamp duty on purchase of land in NSW<br />

Dutiable value of the dutiable property subject<br />

to the dutiable transaction<br />

Rate of duty<br />

$0 - $14,000<br />

$1.25 for every $100 or part of the dutiable<br />

value<br />

$175 plus $1.50 for every $100 or part ,<br />

$14,001 - $30,000<br />

by which the dutiable value exceeds<br />

$14,000<br />

$415 plus $1.75 for every $100 or part,<br />

$30,001 - $80,000<br />

by which the dutiable value exceeds<br />

$30,000<br />

$1,290 plus $3.50 for every $100 or part,<br />

$80,001 - $300,000<br />

by which the dutiable value exceeds<br />

$80,000<br />

$8,990 plus $4.50 for every $100 or part,<br />

$300,001 - $1m<br />

by which the dutiable value exceeds<br />

$300,000<br />

$40,490 plus $5.50 for every $100 or<br />

over $1m<br />

part, by which the dutiable value exceeds<br />

$1,000,000<br />

<br />

<br />

<br />

<br />

A sale or transfer of land (including improvements) or a business in NSW is liable to duty. It is<br />

immaterial whether or not the transaction is effected by a written instrument or by other<br />

means, including electronic means.<br />

A liability for duty arises when the sale or transfer occurs. However, if the sale or transfer is<br />

effected by a written instrument, liability for duty arises when the instrument is first executed.<br />

Duty is payable within 3 months of the date liability arises. The purchaser or transferee is liable<br />

to pay the duty.<br />

Purchasers of Newly-constructed dwellings worth up to $600,000 will receive 50% discount on<br />

stamp duty if they purchase before 30June <strong>2010</strong>.<br />

(source:NSW office State Revenue website)<br />

14<br />

15