THREE EX-BARCLAYS BANKERS CONVICTED OVER LIBOR SCANDAL

cityam-2016-07-05-577af9476f73f

cityam-2016-07-05-577af9476f73f

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

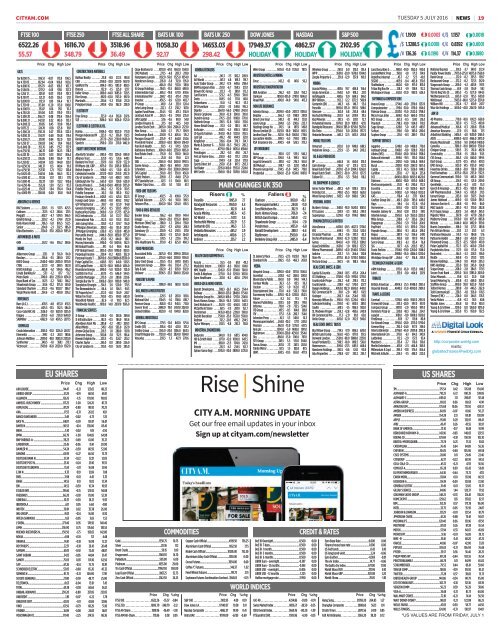

Gold............................................................1350.75 10.75<br />

Silver .............................................................20.36 1.12<br />

Brent Crude....................................................50.15 0.61<br />

Krugerrand ................................................1348.30 14.70<br />

Palladium....................................................593.00 6.00<br />

Platinum ....................................................1033.00 29.00<br />

Tin Cash Official ........................................17967.50 550.00<br />

Lead Cash Official .......................................1867.25 52.75<br />

Zinc Cash Official........................................2142.50 26.25<br />

Copper Cash Official ..................................4919.50 136.25<br />

Aluminium Cash Official ............................1652.50 7.75<br />

Nickel Cash Official ..................................10285.00 752.50<br />

Aluminium Alloy Cash Official ..................1530.00 0.00<br />

Cocoa Futures............................................3034.00 0.60<br />

Coffee 'C' Futures..........................................146.57 1.02<br />

Feed Wheat Futures .....................................119.75 2.15<br />

Soybeans Futures Continuation Contract ..1168.65 -0.15<br />

AIR LIQUIDE......................................................94.47 -0.21 123.65 88.25<br />

AIRBUS GROUP .................................................51.29 -0.19 68.50 49.51<br />

ALLIANZ N........................................................126.15 -1.15 170.00 119.05<br />

ANHEUS.-BUSCH INBEV ...................................117.25 -1.00 124.20 87.73<br />

ASML HLDG.......................................................87.29 -0.80 98.92 70.25<br />

AXA....................................................................17.55 -0.31 26.02 16.11<br />

BANCO SANTANDER ...........................................3.49 -0.02 6.73 3.15<br />

BASF N .............................................................68.87 -0.59 85.87 56.01<br />

BAYER N...........................................................90.55 -0.14 138.00 83.45<br />

BBVA...................................................................5.10 -0.02 9.15 4.50<br />

BMW................................................................66.79 -1.00 104.85 64.98<br />

BNP PARIBAS-A- ..............................................39.23 -0.69 61.00 35.27<br />

CARREFOUR......................................................22.45 -0.06 31.41 20.90<br />

DAIMLER N .......................................................54.24 -0.50 86.59 52.00<br />

DANONE ...........................................................63.93 -0.27 66.50 51.73<br />

DEUTSCHE BANK N............................................12.34 -0.22 32.31 12.05<br />

DEUTSCHE POST N.............................................25.16 -0.24 29.10 19.55<br />

DEUTSCHE TELEKOM N .......................................15.14 -0.11 16.98 12.94<br />

E.ON N................................................................9.33 0.19 12.69 7.08<br />

ENEL...................................................................3.98 0.01 4.45 3.33<br />

ENGIE ...............................................................14.55 0.13 18.12 12.34<br />

ENI ....................................................................14.52 -0.30 16.34 10.93<br />

ESSILOR INTL ...................................................119.40 -0.15 123.92 94.08<br />

FRESENIUS .......................................................66.20 -0.03 70.00 52.39<br />

GENERALI..........................................................10.37 -0.30 18.27 9.93<br />

IBERDROLA..........................................................6.11 0.05 6.60 4.80<br />

INDIT<strong>EX</strong> ............................................................30.01 0.02 35.38 26.00<br />

ING GROUP.........................................................9.03 -0.14 16.00 8.30<br />

INTESA SANPAOLO ..............................................1.63 -0.05 3.65 1.52<br />

L'OREAL...........................................................173.40 0.95 178.95 140.40<br />

LVMH ..............................................................136.90 0.75 176.60 130.55<br />

MUENCH RUECKVERS N...................................150.50 -1.75 193.65 142.80<br />

NOKIA ................................................................4.98 -0.10 7.11 4.48<br />

ORANGE.............................................................14.41 -0.18 16.98 12.21<br />

ROY.PHILIPS ......................................................22.31 -0.18 26.10 20.48<br />

SAFRAN ............................................................60.15 -0.92 72.45 48.87<br />

SAINT GOBAIN...................................................34.12 -0.85 44.84 31.47<br />

SANOFI .............................................................75.05 0.03 101.10 62.50<br />

SAP...................................................................67.26 -0.14 75.75 53.91<br />

SCHNEIDER ELECTRIC........................................53.05 -0.68 65.26 45.32<br />

SIEMENS N ........................................................91.75 -0.31 100.90 77.91<br />

SOCIETE GENERALE...........................................27.80 -0.59 48.77 25.00<br />

TELEFONICA........................................................8.63 -0.04 13.91 7.45<br />

TOTAL................................................................43.38 -0.38 44.64 34.21<br />

UNIBAIL-RODAMCO ........................................230.20 -0.80 257.85 212.05<br />

UNICREDIT ...........................................................1.81 -0.07 6.22 1.78<br />

UNILEVER CERT ................................................42.05 -0.11 42.84 32.86<br />

VINCI ...............................................................63.56 -0.79 68.29 51.10<br />

VIVENDI............................................................16.89 -0.08 24.83 14.87<br />

VOLKSWAGEN VZ..............................................111.40 -2.25 214.55 86.36<br />

Price Chg High Low<br />

EU SHARES<br />

3M...................................................................175.54 0.42 176.08 134.00<br />

ALPHABET-A...................................................710.25 6.72 810.35 539.85<br />

ALPHABET-C ...................................................699.21 7.11 789.87 515.18<br />

ALTRIA GROUP.................................................69.02 0.06 69.63 47.41<br />

AMAZON.COM.................................................725.68 10.06 731.50 425.57<br />

AMERICAN <strong>EX</strong>PRESS ........................................60.69 -0.07 81.66 50.27<br />

AMGEN ...........................................................154.28 2.13 181.81 130.09<br />

APPLE ..............................................................95.89 0.29 132.97 89.47<br />

AT&T.................................................................43.47 0.26 43.55 30.97<br />

BANK OF AMERICA ............................................13.10 -0.17 18.48 10.99<br />

BERKSHIRE HATHAWY-B ................................143.96 -0.83 148.03 123.55<br />

BOEING CO......................................................129.69 -0.18 150.59 102.10<br />

BRISTOL-MYERSSQUIBB....................................73.78 0.23 75.12 51.82<br />

CATERPILLAR....................................................76.45 0.64 84.89 56.36<br />

CHEVRON ........................................................104.15 -0.68 105.00 69.58<br />

CISCO SYSTEMS ................................................28.80 0.11 29.49 22.46<br />

CITIGROUP .......................................................42.17 -0.22 60.95 34.52<br />

COCA-COLA CO ..................................................45.12 -0.21 47.13 36.56<br />

COMCAST-A......................................................65.28 0.09 65.42 50.01<br />

DU PONT NEMOURS&CO ..................................64.36 -0.44 75.72 47.11<br />

<strong>EX</strong>XON MOBIL...................................................93.84 0.10 93.98 66.55<br />

FACEBOOK-A ....................................................114.19 -0.09 121.08 72.00<br />

GENERAL ELECTRIC ...........................................31.49 0.01 32.05 19.37<br />

GILEAD SCIENCES .............................................84.86 1.44 120.37 77.92<br />

GOLDMAN SACHS GROUP ...............................148.25 -0.33 214.61 138.20<br />

HOME DEPOT ..................................................129.62 1.93 137.82 92.17<br />

IBM..................................................................152.35 0.57 173.78 116.90<br />

INTEL ................................................................32.75 -0.05 35.59 24.87<br />

JOHNSON & JOHNSON.....................................121.29 -0.01 121.54 81.79<br />

JPMORGAN CHASE............................................61.26 -0.88 70.61 50.07<br />

MCDONALD'S..................................................120.40 0.06 131.96 87.50<br />

MEDTRONIC ......................................................87.03 0.26 87.38 55.54<br />

MERCK..............................................................57.94 0.33 60.07 45.69<br />

MICROSOFT........................................................51.16 -0.01 56.85 39.72<br />

NIKE -B- ...........................................................55.61 0.41 68.20 47.25<br />

ORACLE............................................................40.86 -0.07 42.00 33.13<br />

PEPSICO..........................................................105.63 -0.31 106.94 76.48<br />

PFIZER ..............................................................35.57 0.36 36.46 28.25<br />

PHILIP MRRS INT .............................................101.28 -0.44 102.55 76.54<br />

PROCTER&GAMBLE ..........................................84.78 0.11 84.99 65.02<br />

SCHLUMBERGER...............................................79.52 0.44 86.61 59.60<br />

TRAVLR COMP..................................................118.85 -0.19 119.30 95.21<br />

TWITTER............................................................17.28 0.37 38.82 13.73<br />

UNITEDHEALTH GROUP .................................140.86 -0.34 141.79 95.00<br />

UTD TECHNOLOGIES ........................................102.73 0.18 112.36 83.39<br />

VERIZON COMM ...............................................56.23 0.39 56.29 38.06<br />

VISA-A..............................................................74.48 0.31 81.73 60.00<br />

WAL-MART STORES...........................................72.81 -0.21 74.14 56.30<br />

WALT DISNEY-DISNEY......................................98.03 0.21 122.08 86.25<br />

WELLS FARGO ..................................................47.03 -0.30 58.77 44.50<br />

WILLIS TOWERS..............................................124.00 -0.31 130.97 104.11<br />

COMMODITIES<br />

CREDIT & RATES<br />

BoE IR Overnight.........................................0.500 0.00<br />

BoE IR 7 days..............................................0.500 0.00<br />

BoE IR 1 month...........................................0.500 0.00<br />

BoE IR 3 months.........................................0.500 0.00<br />

BoE IR 6 months ........................................0.500 0.00<br />

<strong>LIBOR</strong> Euro - overnight ..............................-0.397 0.00<br />

<strong>LIBOR</strong> Euro - 12 months .............................-0.061 0.00<br />

<strong>LIBOR</strong> USD - overnight................................0.406 0.00<br />

<strong>LIBOR</strong> USD - 12 months ................................1.225 0.00<br />

Halifax mortgage rate ................................3.990 0.00<br />

Euro Base Rate ...........................................0.000 0.00<br />

Finance house base rate .............................1.000 0.00<br />

US Fed funds .................................................0.42 0.10<br />

US long bond yield........................................2.24 -0.06<br />

Euro Euribor...............................................-0.369 -0.01<br />

The vix index................................................14.77 -0.86<br />

The baltic dry index...................................677.00 17.00<br />

Markit iBoxx EUR .......................................231.96 0.10<br />

Markit iBoxx GBP.......................................320.08 1.20<br />

Markit iTraxx................................................78.05 -1.81<br />

Price Chg High Low<br />

US SHARES<br />

€/$ 1.1157 0.0018<br />

€/£ 0.8392 0.0001<br />

€/¥ 114.37 0.1880<br />

/€ 1.1909 0.0003<br />

/$ 1.3288.5 0.0018<br />

/¥ 136.26 0.1190<br />

BAE Systems . . . . . . . . .528.5 -1.5 537.5 425.5<br />

Cobham . . . . . . . . . . . . .157.5 -0.3 260.4 127.5<br />

Meggitt . . . . . . . . . . . . .402.7 -4.7 509.5 346.5<br />

QinetiQ Group . . . . . . . .220.2 -4.2 274.4 212.0<br />

Rolls-Royce Holdi . . . . .706.5 -5.0 876.5 512.5<br />

Senior . . . . . . . . . . . . . .204.0 -2.1 302.5 186.0<br />

Ultra Electronics . . . . .1724.0 -37.0 2026.0 1595.0<br />

GKN . . . . . . . . . . . . . . . .267.2 -8.6 336.2 248.6<br />

Aldermore Group . . . . . .123.1 1.1 316.0 114.0<br />

Barclays . . . . . . . . . . . . .136.6 -3.5 289.0 127.2<br />

BGEO Group . . . . . . . .2540.0 -84.0 2630.0 1570.0<br />

CYBG . . . . . . . . . . . . . . .223.3 -9.1 289.5 182.8<br />

HSBC Holdings . . . . . . .463.8 -6.1 594.6 416.2<br />

Lloyds Banking Gr . . . . . .53.1 -1.2 87.7 51.2<br />

Metro Bank . . . . . . . . .1740.0 -18.0 2250.0 1634.0<br />

Royal Bank of Sco . . . . .167.5 -2.2 366.1 166.2<br />

Shawbrook Group . . . . .161.4 -12.2 375.0 140.0<br />

Standard Chartere . . . .572.0 -9.6 1002.7 386.7<br />

Virgin Money Hold . . . .254.6 -2.1 450.8 205.2<br />

Barr (A.G.) . . . . . . . . . . .478.5 -4.8 633.0 455.3<br />

Britvic . . . . . . . . . . . . . .605.5 -13.5 742.5 584.0<br />

Coca-Cola HBC AG . . .1526.0 -3.0 1629.0 1255.0<br />

Diageo . . . . . . . . . . . . .2101.0 -6.0 2131.0 1640.0<br />

SABMiller . . . . . . . . . .4362.0 -5.0 4376.5 2877.5<br />

Croda Internation . . . .3165.0 -31.0 3216.0 2657.7<br />

Elementis . . . . . . . . . . . .199.1 -2.3 261.3 180.6<br />

Johnson Matthey . . . .2939.0 -18.0 3083.0 2230.0<br />

Synthomer . . . . . . . . . .340.5 -1.0 368.1 275.1<br />

Victrex plc . . . . . . . . . .1509.0 -16.0 2020.0 1367.0<br />

AA . . . . . . . . . . . . . . . . .241.3 -7.3 382.2 209.9<br />

AO World . . . . . . . . . . . .147.3 4.8 189.3 119.7<br />

Auto Trader Group . . . .341.2 -17.4 449.6 298.4<br />

B&M European Valu . . .251.0 -6.7 358.5 233.1<br />

Brown (N.) Group . . . . .172.3 -7.1 389.1 172.2<br />

Card Factory . . . . . . . . .323.2 -4.3 399.0 310.0<br />

Darty . . . . . . . . . . . . . . .168.5 -0.2 171.8 68.0<br />

Debenhams . . . . . . . . . .55.0 -1.2 90.3 53.3<br />

DFS Furniture . . . . . . . .201.0 -7.5 349.0 195.2<br />

Dignity . . . . . . . . . . . .2667.0 -56.0 2748.0 2142.0<br />

Dixons Carphone . . . . .310.0 -12.8 500.0 310.0<br />

Dunelm Group . . . . . . .776.5 -20.5 1018.0 770.0<br />

Halfords Group . . . . . . .319.5 -12.8 561.0 313.0<br />

Home Retail Group . . . . .151.1 -2.0 181.5 89.7<br />

Inchcape . . . . . . . . . . . .634.5 -4.5 836.5 581.0<br />

JD Sports Fashion . . . .1143.0 -14.0 1332.0 705.5<br />

Just Eat . . . . . . . . . . . . .419.2 -19.1 494.9 329.1<br />

Kingfisher . . . . . . . . . . .319.6 -10.4 379.7 314.7<br />

Marks & Spencer G . . . .303.8 -16.3 550.5 285.2<br />

Next . . . . . . . . . . . . . . .4779.0-136.0 8015.0 4384.0<br />

Pendragon . . . . . . . . . . .28.2 -0.3 49.0 26.7<br />

Pets at Home Grou . . . .230.0 -8.0 311.2 223.8<br />

Saga . . . . . . . . . . . . . . .194.9 -3.8 221.4 173.9<br />

Sports Direct Int . . . . . .297.0 -13.8 817.5 295.3<br />

Ted Baker . . . . . . . . . .2295.0-100.0 3555.0 2124.0<br />

WH Smith . . . . . . . . . .1549.0 -59.0 1878.0 1455.0<br />

Balfour Beatty . . . . . . . .211.8 -8.0 272.5 190.8<br />

CRH . . . . . . . . . . . . . . .2158.0 -33.0 2207.0 1637.0<br />

Galliford Try . . . . . . . . .894.0 -39.5 1813.0 858.5<br />

Ibstock . . . . . . . . . . . . . .132.9 -1.5 225.0 127.7<br />

Keller Group . . . . . . . . .880.0 -44.0 1085.0 728.5<br />

Kier Group . . . . . . . . . . .987.0 -63.0 1513.0 987.0<br />

Marshalls . . . . . . . . . . . .230.4 -5.3 370.8 213.0<br />

Polypipe Group . . . . . .240.4 -12.6 362.0 238.0<br />

Drax Group . . . . . . . . . .323.9 -0.4 363.8 207.6<br />

SSE . . . . . . . . . . . . . . . .1586.0 16.0 1626.0 1321.0<br />

Halma . . . . . . . . . . . . .1004.0 -13.0 1023.0 713.0<br />

Morgan Advanced M . .223.5 -9.2 356.8 192.3<br />

Renishaw . . . . . . . . . . .2177.0 -29.0 2269.0 1600.0<br />

Spectris . . . . . . . . . . . .1799.0 -37.0 2111.0 1442.0<br />

Aberforth Smaller . . . .895.0 -17.0 1234.0 849.0<br />

Alliance Trust . . . . . . . . .521.0 -9.5 531.6 440.1<br />

Bankers Inv Trust . . . . .597.0 -9.0 657.0 522.0<br />

BH Macro Ltd. GBP . . . .1975.0 17.0 2103.0 1930.0<br />

British Empire Tr . . . . .508.0 -0.5 511.0 412.0<br />

Caledonia Investm . . .2257.0 -30.0 2511.0 2112.0<br />

City of London In . . . . .378.0 -5.0 408.3 341.5<br />

Edinburgh Inv Tru . . . .665.0 -12.0 728.0 620.0<br />

Electra Private E . . . . .3546.0-134.0 4019.0 3155.0<br />

Fidelity China Sp . . . . . .146.2 0.2 152.0 110.5<br />

Fidelity European . . . . .161.2 -3.8 183.0 151.2<br />

Finsbury Growth & . . . .608.5 -6.5 621.4 532.5<br />

Foreign and Colon . . . .448.5 -9.0 459.2 391.2<br />

GCP Infrastructur . . . . . .118.7 -1.8 123.9 114.8<br />

Genesis Emerging . . . .545.5 0.5 550.5 400.5<br />

HarbourVest Globa . . .900.0 -5.0 1377.5 825.0<br />

HICL Infrastructu . . . . . .170.5 0.1 172.7 150.2<br />

International Pub . . . . .152.5 0.0 153.5 130.3<br />

John Laing Infras . . . . . .128.5 -0.3 129.7 114.0<br />

JPMorgan American . . .308.3 -4.6 315.0 243.0<br />

JPMorgan Emerging . .636.0 -8.5 650.0 483.0<br />

Mercantile Invest . . . .1444.0 -50.0 1838.0 1375.0<br />

Monks Inv Trust . . . . . . .431.0 -8.2 444.0 361.1<br />

Murray Internatio . . . .990.0 -7.0 1009.6 742.5<br />

NB Global Floatin . . . . . . .91.1 0.4 98.4 84.6<br />

P2P Global Invest . . . . .805.0 -29.0 1090.0 803.5<br />

Perpetual Income . . . .359.4 -11.2 428.5 332.0<br />

Personal Assets T . . .38700.0 -50.0 38894.8 33130.0<br />

Polar Capital Tec . . . . . .608.5 -15.5 641.0 503.5<br />

RIT Capital Partn . . . . .1627.0 -30.0 1690.0 1436.0<br />

Riverstone Energy . . . .890.0 -5.0 1020.0 720.0<br />

Scottish Inv Trus . . . . . .637.5 -7.5 646.0 544.5<br />

Scottish Mortgage . . . .273.0 -2.0 280.8 220.6<br />

Temple Bar Inv Tr . . . .1006.0 -30.0 1180.0 940.0<br />

Templeton Emergin . . .514.5 3.0 520.0 371.5<br />

The Renewables In . . . .96.6 0.1 106.3 90.3<br />

TR Property Inv T . . . . .272.5 -8.0 314.9 241.7<br />

Witan Inv Trust . . . . . . .750.5 -12.5 814.5 683.0<br />

Woodford Patient . . . . .82.6 -1.1 119.3 82.5<br />

Worldwide Healthc . . .1910.0 14.0 2097.0 1596.0<br />

3i Group . . . . . . . . . . . .559.0 -7.0 583.8 389.8<br />

3i Infrastructure . . . . . . .182.5 -0.5 184.0 163.6<br />

Aberdeen Asset Ma . . .285.8 -7.2 410.1 209.3<br />

Allied Minds . . . . . . . . . .345.1 -15.8 563.0 267.0<br />

Arrow Global Grou . . . .201.5 1.0 288.0 187.8<br />

Ashmore Group . . . . . .300.8 -7.8 312.5 196.4<br />

Brewin Dolphin Ho . . . .233.5 -7.5 324.7 210.2<br />

Charles Taylor . . . . . . . .245.0 0.0 289.0 226.0<br />

City of London In . . . . . .310.5 -11.0 367.5 285.0<br />

Close Brothers Gr . . . .1070.0 -67.0 1563.0 1041.0<br />

CMC Markets . . . . . . . . .271.5 -4.8 283.3 219.0<br />

Hargreaves Lansdo . . .1192.0 -56.0 1525.0 1054.0<br />

Henderson Group . . . . .205.8 -5.8 312.0 195.0<br />

ICAP . . . . . . . . . . . . . . .406.0 -13.0 533.0 381.8<br />

IG Group Holdings . . . .784.5 -15.5 840.0 690.0<br />

Intermediate Capi . . . .485.2 -19.8 671.0 459.6<br />

International Per . . . . .284.7 -10.3 471.4 219.0<br />

Investec . . . . . . . . . . . .456.5 -9.9 621.0 402.7<br />

IP Group . . . . . . . . . . . . .141.9 -3.4 259.1 120.4<br />

John Laing Group . . . . .222.1 -3.3 230.2 187.0<br />

Jupiter Fund Mana . . . .354.5 -13.1 475.1 336.9<br />

Liontrust Asset M . . . . .265.5 -9.5 374.8 235.0<br />

LMS Capital . . . . . . . . . . .57.6 -0.6 80.0 54.8<br />

London Finance & . . . . .37.5 0.0 40.5 34.0<br />

London Stock Exch . . .2493.0 -30.0 2906.0 2123.0<br />

Man Group . . . . . . . . . . .114.8 -2.7 175.7 109.9<br />

OneSavings Bank . . . . .203.8 -11.2 405.6 176.2<br />

Paragon Group Of . . . .235.9 -9.7 444.8 234.6<br />

Provident Financi . . . .2338.0 -63.0 3634.0 2164.0<br />

PureTech Health . . . . . . .151.5 -1.5 170.5 120.0<br />

Rathbone Brothers . . .1694.0 -60.0 2359.0 1665.0<br />

Real Estate Credi . . . . . .155.8 -3.0 183.0 146.0<br />

Record . . . . . . . . . . . . . . .25.8 0.0 39.0 22.1<br />

S&U . . . . . . . . . . . . . . .2265.0 -15.0 2610.0 1992.5<br />

Sanne Group . . . . . . . . .386.3 -16.5 449.0 251.0<br />

Schroders . . . . . . . . . .2349.0 -73.0 3209.0 2049.0<br />

SVG Capital . . . . . . . . . .510.0 -10.5 550.0 436.0<br />

Tullett Prebon . . . . . . . .299.8 -3.7 414.8 275.0<br />

VPC Specialty Len . . . . . .82.3 -1.5 104.0 80.5<br />

Walker Crips Grou . . . . . .47.4 1.0 53.8 41.3<br />

BT Group . . . . . . . . . . . .402.5 -7.1 499.8 375.9<br />

TalkTalk Telecom . . . . .225.5 -9.0 391.0 189.5<br />

Telecom Plus . . . . . . . .1043.0 -30.0 1214.0 815.5<br />

Booker Group . . . . . . . .166.2 -6.6 190.0 149.4<br />

Greggs . . . . . . . . . . . . .964.0 -23.0 1355.0 884.0<br />

Morrison (Wm) Sup . . .188.0 -1.2 209.4 139.0<br />

Ocado Group . . . . . . . . .220.7 -3.3 470.8 208.1<br />

Sainsbury (J) . . . . . . . .230.9 -5.2 292.5 217.8<br />

SSP Group . . . . . . . . . . .282.4 -7.5 325.0 264.0<br />

Tesco . . . . . . . . . . . . . . .178.5 1.3 221.6 139.2<br />

UDG Healthcare Pu . . . .579.0 -8.5 625.0 460.3<br />

Associated Britis . . . . .2675.0 -57.0 3599.0 2350.0<br />

Cranswick . . . . . . . . . .2134.0 -66.0 2538.0 1536.0<br />

Dairy Crest Group . . . . .555.5 -15.5 697.0 504.5<br />

Greencore Group . . . . .308.4 -11.6 392.4 273.2<br />

Tate & Lyle . . . . . . . . . .682.0 -8.5 693.0 502.0<br />

Unilever . . . . . . . . . . .3596.5 -23.5 3649.0 2524.0<br />

Mondi . . . . . . . . . . . . .1398.0 -34.0 1611.0 1124.0<br />

Centrica . . . . . . . . . . . . .229.3 0.3 283.0 183.6<br />

National Grid . . . . . . . .1104.5 -1.0 1118.0 818.7<br />

Pennon Group . . . . . . .928.0 -13.5 945.5 713.0<br />

Severn Trent . . . . . . . .2448.0 19.0 2457.0 2024.0<br />

United Utilities . . . . . .1029.0 -1.0 1041.0 828.0<br />

RPC Group . . . . . . . . . . .779.5 -12.0 843.0 575.6<br />

Smith (DS) . . . . . . . . . .385.4 -10.5 421.0 331.2<br />

Smiths Group . . . . . . . .1145.0 -20.0 1206.0 863.5<br />

Smurfit Kappa Gro . . .1720.0 -42.0 2824.0 1584.0<br />

Vesuvius . . . . . . . . . . . .293.3 1.3 427.1 270.6<br />

Price Chg High Low<br />

Assura . . . . . . . . . . . . . . .55.5 -0.5 61.8 49.2<br />

Mediclinic Intern . . . . .1087.0 -8.0 1191.0 814.0<br />

NMC Health . . . . . . . . .1245.0 -57.0 1304.0 700.0<br />

Smith & Nephew . . . . .1271.0 -11.0 1293.0 1051.0<br />

Spire Healthcare . . . . . .321.8 -8.2 401.6 279.9<br />

Barratt Developme . . . .388.3 -26.7 662.5 354.4<br />

Bellway . . . . . . . . . . . .1849.0 -123.0 2848.0 1734.0<br />

Berkeley Group Ho . . .2485.0-169.0 3757.0 2341.0<br />

Bovis Homes Group . . .706.0 -56.5 1201.0 642.5<br />

Crest Nicholson H . . . . .362.9 -32.1 604.0 343.3<br />

McCarthy & Stone . . . . .161.5 -7.0 287.0 152.7<br />

Persimmon . . . . . . . . .1435.0-105.0 2219.0 1310.0<br />

Reckitt Benckiser . . . .7510.0 -35.0 7633.0 5510.0<br />

Redrow . . . . . . . . . . . . .312.2 -20.3 499.2 294.5<br />

Taylor Wimpey . . . . . . .130.5 -8.8 210.3 115.8<br />

Bodycote . . . . . . . . . . .540.0 11.0 687.5 494.0<br />

Hill & Smith Hold . . . . .877.0 -12.0 1000.0 643.5<br />

IMI . . . . . . . . . . . . . . . . .969.0 -21.5 1174.0 742.0<br />

Rotork . . . . . . . . . . . . . .215.3 -6.7 234.5 152.7<br />

Spirax-Sarco Engi . . . .3745.0 -30.0 3809.0 2725.0<br />

St James's Place . . . . . .792.5 -27.5 1023.0 716.0<br />

Standard Life . . . . . . . .286.5 -13.5 466.3 265.8<br />

4Imprint Group . . . . . .1290.0 -40.0 1377.0 1100.0<br />

Ascential . . . . . . . . . . . .243.8 -6.2 268.0 200.0<br />

Bloomsbury Publis . . . .160.0 0.0 174.0 144.3<br />

Centaur Media . . . . . . . .36.3 -5.5 85.5 36.3<br />

Creston . . . . . . . . . . . . . .86.5 1.0 162.0 85.3<br />

Entertainment One . . . .171.0 -4.0 326.3 130.0<br />

Euromoney Institu . . . .878.0 -52.0 1230.0 852.5<br />

Future . . . . . . . . . . . . . . . .9.2 0.2 11.5 7.9<br />

Haynes Publishing . . . .103.5 0.0 129.5 99.0<br />

Informa . . . . . . . . . . . . .719.0 -7.0 733.5 534.0<br />

ITE Group . . . . . . . . . . . .143.5 -0.3 184.8 128.8<br />

ITV . . . . . . . . . . . . . . . . . .175.1 -5.8 280.7 154.0<br />

Johnston Press . . . . . . . .16.3 -1.3 148.0 16.3<br />

Moneysupermarket. . .244.8 -30.2 377.1 243.0<br />

Pearson . . . . . . . . . . . .962.0 -13.0 1275.0 657.5<br />

Relx plc . . . . . . . . . . . .1390.0 -5.0 1408.0 1011.0<br />

Rightmove . . . . . . . . .3500.0-238.0 4250.0 3154.0<br />

Sky . . . . . . . . . . . . . . . .860.0 -13.0 1141.0 797.0<br />

STV Group . . . . . . . . . . .318.5 5.5 515.0 304.0<br />

Tarsus Group . . . . . . . . .267.0 7.3 267.5 202.0<br />

Trinity Mirror . . . . . . . . . .92.5 1.5 182.8 87.5<br />

UBM . . . . . . . . . . . . . . . .630.5 -19.5 655.0 477.9<br />

Weir Group . . . . . . . . .1435.0 -15.0 1726.0 787.5<br />

Evraz . . . . . . . . . . . . . . .142.2 0.1 147.6 56.2<br />

BBA Aviation . . . . . . . . .216.2 -8.3 226.1 150.2<br />

Clarkson . . . . . . . . . . .1850.0-355.0 2797.0 1696.0<br />

Royal Mail . . . . . . . . . . .490.0 -14.0 541.0 413.3<br />

Admiral Group . . . . . .2009.0 -40.0 2057.3 1385.0<br />

Beazley . . . . . . . . . . . . .366.2 -3.5 398.9 297.8<br />

Direct Line Insur . . . . . .348.3 -3.1 414.3 333.1<br />

esure Group . . . . . . . . .284.8 -3.3 290.6 223.7<br />

Hastings Group Ho . . . .176.5 1.4 187.9 149.8<br />

Hiscox Limited (D . . . .1023.0 -18.0 1061.0 855.5<br />

Jardine Lloyd Tho . . . . .922.0 -16.0 1063.0 778.0<br />

Lancashire Holdin . . . . .589.5 -6.5 759.0 518.5<br />

RSA Insurance Gro . . . .490.5 -8.4 526.5 373.2<br />

Aviva . . . . . . . . . . . . . . .391.0 -12.7 535.5 346.2<br />

JRP Group . . . . . . . . . . .109.0 -1.6 199.5 96.0<br />

Legal & General G . . . . .187.0 -4.2 276.3 165.0<br />

Old Mutual . . . . . . . . . . .198.7 -3.5 229.1 149.4<br />

Phoenix Group Hol . . . .794.5 -15.0 943.5 719.0<br />

Prudential . . . . . . . . . .1260.0 -23.0 1634.0 1087.0<br />

Wireless Group . . . . . . .310.0 0.0 310.3 135.4<br />

WPP . . . . . . . . . . . . . . .1601.0 -29.0 1678.0 1304.0<br />

Zoopla Property G . . . . .251.8 -12.9 337.8 199.3<br />

Acacia Mining . . . . . . . .483.6 19.7 484.8 156.6<br />

Anglo American . . . . . .764.0 6.0 918.2 221.1<br />

Antofagasta . . . . . . . . .480.6 11.0 684.5 346.1<br />

BHP Billiton . . . . . . . . . .952.2 12.2 1272.5 580.9<br />

Centamin (DI) . . . . . . . .146.3 4.6 146.7 53.6<br />

Fresnillo . . . . . . . . . . . .1895.0 135.0 1917.0 588.0<br />

Glencore . . . . . . . . . . . .162.8 6.8 255.8 68.6<br />

Hochschild Mining . . . .202.9 6.4 209.9 39.5<br />

Kaz Minerals . . . . . . . . .130.5 -1.5 203.1 72.7<br />

Polymetal Interna . . . .1079.0 20.0 1087.0 427.1<br />

Randgold Resource . .9160.0 385.0 9250.0 3625.0<br />

Rio Tinto . . . . . . . . . . .2356.0 11.0 2635.0 1577.5<br />

Vedanta Resources . . .445.2 12.5 603.5 205.8<br />

Inmarsat . . . . . . . . . . . .812.0 0.0 1148.0 689.5<br />

Vodafone Group . . . . . .225.9 -3.3 246.1 200.2<br />

BP . . . . . . . . . . . . . . . . .446.8 1.4 450.0 310.3<br />

Cairn Energy . . . . . . . . .216.0 -1.7 231.5 127.2<br />

Royal Dutch Shell . . . .2051.0 -25.0 2094.5 1266.0<br />

Royal Dutch Shell . . . .2065.5 -30.0 2117.0 1277.5<br />

Tullow Oil . . . . . . . . . . . .257.6 -5.3 350.0 118.2<br />

Amec Foster Wheel . . .487.2 -6.9 839.5 327.6<br />

Petrofac Ltd. . . . . . . . . .749.0 -25.5 982.0 663.0<br />

Wood Group (John) . . .683.5 -11.0 698.0 534.5<br />

Burberry Group . . . . . .1148.0 -18.0 1620.0 1041.0<br />

PZ Cussons . . . . . . . . . .324.9 -3.3 369.2 249.3<br />

Supergroup . . . . . . . . .1229.0 -11.0 1714.0 1184.0<br />

AstraZeneca . . . . . . . .4474.0 -28.5 4627.5 3774.0<br />

BTG . . . . . . . . . . . . . . . .699.5 -7.5 722.0 520.5<br />

Circassia Pharmac . . . . .98.2 -3.6 353.5 82.3<br />

Dechra Pharmaceut . .1169.0 -12.0 1228.0 912.0<br />

Genus . . . . . . . . . . . . .1646.0 -4.0 1735.3 1281.0<br />

GlaxoSmithKline . . . . .1601.0 1.0 1616.5 1237.5<br />

Hikma Pharmaceuti . .2489.0 -41.0 2546.0 1704.0<br />

Indivior . . . . . . . . . . . . .255.7 5.5 266.4 130.8<br />

Shire Plc . . . . . . . . . . . .4717.0 45.0 5730.0 3480.0<br />

Vectura Group . . . . . . . .160.5 -1.4 188.5 146.6<br />

Capital & Countie . . . . .284.8 -10.3 473.4 264.4<br />

CLS Holdings . . . . . . . .1358.0 -31.0 1970.0 1275.0<br />

Countryside Prope . . . .216.2 -6.8 278.5 173.2<br />

Countrywide . . . . . . . . .238.9 -6.2 570.0 237.7<br />

Daejan Holdings . . . . .4953.0 102.0 6595.0 4411.0<br />

F&C Commercial Pr . . . . .110.1 -2.9 148.7 102.1<br />

Grainger . . . . . . . . . . . .206.7 -6.4 254.0 193.1<br />

Kennedy Wilson Eu . . .930.0 -19.5 1220.0 901.5<br />

Safestore Holding . . . .359.0 -6.1 400.5 281.0<br />

Savills . . . . . . . . . . . . . .618.5 -1.5 986.5 582.0<br />

St. Modwen Proper . . .259.2 -12.8 493.6 240.9<br />

UK Commercial Pro . . . . .71.3 -2.0 91.0 65.0<br />

Unite Group . . . . . . . . .605.0 -12.0 702.5 560.0<br />

Big Yellow Group . . . . .734.5 -17.0 886.5 620.0<br />

British Land Comp . . . .565.0 -43.5 877.0 551.5<br />

Derwent London . . . . .2501.0 -98.0 3880.0 2257.0<br />

Great Portland Es . . . . .598.5 -18.0 889.5 536.0<br />

Hammerson . . . . . . . . .509.0 -23.5 685.5 468.6<br />

Hansteen Holdings . . . .100.5 -0.6 124.1 95.8<br />

Intu Properties . . . . . . .278.8 -12.7 353.2 255.7<br />

Land Securities G . . . . .980.0 -59.0 1352.0 910.0<br />

LondonMetric Prop . . . .150.0 -1.8 171.5 134.9<br />

Redefine Internat . . . . . .43.7 -1.2 57.5 40.5<br />

SEGRO . . . . . . . . . . . . . .405.9 -9.4 463.8 370.5<br />

Shaftesbury . . . . . . . . .862.0 -8.0 971.0 813.0<br />

Tritax Big Box Re . . . . . .128.3 -1.9 138.9 112.2<br />

Workspace Group . . . .652.0 -33.0 987.0 624.5<br />

Aveva Group . . . . . . . .1734.0 -41.0 2319.0 1237.0<br />

Computacenter . . . . . .709.0 -30.0 879.0 694.0<br />

Fidessa Group . . . . . . .2023.0 -15.0 2522.0 1758.0<br />

Micro Focus Inter . . . . .1614.0 -16.0 1641.0 1175.0<br />

NCC Group . . . . . . . . . . .263.3 -0.5 324.1 216.3<br />

Playtech . . . . . . . . . . . .798.5 -10.0 924.0 710.5<br />

Sage Group . . . . . . . . . .628.0 3.0 645.5 489.7<br />

Softcat . . . . . . . . . . . . . .319.0 -11.0 383.0 280.0<br />

Sophos Group . . . . . . . .211.0 -8.3 289.7 175.0<br />

Aggreko . . . . . . . . . . . .1248.0 -8.0 1488.0 770.0<br />

Ashtead Group . . . . . .1068.0 -11.0 1128.0 769.0<br />

Atkins (WS) . . . . . . . . .1306.0 -28.0 1656.0 1158.0<br />

Babcock Internati . . . .909.0 -19.5 1111.0 854.0<br />

Berendsen . . . . . . . . . .1207.0 -14.0 1246.8 969.0<br />

Bunzl . . . . . . . . . . . . . .2307.0 -10.0 2347.0 1671.0<br />

Capita . . . . . . . . . . . . . .933.5 -16.5 1326.0 848.5<br />

Carillion . . . . . . . . . . . . .237.0 -1.7 362.4 233.8<br />

DCC . . . . . . . . . . . . . . .6490.0-160.0 6695.0 4620.0<br />

Diploma . . . . . . . . . . . .800.0 -38.0 853.0 608.0<br />

Electrocomponents . . . .253.1 -8.1 290.4 172.5<br />

Essentra . . . . . . . . . . . . .551.5 -1.0 1029.0 467.7<br />

Experian . . . . . . . . . . .1430.0 -5.0 1456.0 1022.0<br />

G4S . . . . . . . . . . . . . . . . .178.4 -6.1 277.1 164.0<br />

Grafton Group Uni . . . . .461.5 -28.0 785.0 440.0<br />

Hays . . . . . . . . . . . . . . . .98.6 -1.4 172.8 95.0<br />

Homeserve . . . . . . . . . .505.0 -17.0 527.0 363.2<br />

Howden Joinery Gr . . . .365.1 -12.8 531.0 341.1<br />

Intertek Group . . . . . .3505.0 6.0 3553.0 2323.0<br />

Mitie Group . . . . . . . . . .238.8 -7.7 335.6 234.3<br />

Pagegroup . . . . . . . . . .290.6 -5.9 559.0 264.9<br />

PayPoint . . . . . . . . . . . .913.0 6.5 1091.0 720.0<br />

Paysafe Group . . . . . . . .381.0 -11.1 432.4 219.0<br />

Regus . . . . . . . . . . . . . .287.9 -5.2 354.6 249.1<br />

Rentokil Initial . . . . . . . .195.8 0.8 197.0 141.0<br />

Serco Group . . . . . . . . . .108.5 -6.1 133.4 76.8<br />

SIG . . . . . . . . . . . . . . . . .107.7 -6.6 209.5 105.3<br />

Travis Perkins . . . . . . .1394.0 -59.0 2260.0 1348.0<br />

Wolseley . . . . . . . . . . .3898.0 -76.0 4384.0 3230.0<br />

Worldpay Group (W . .266.6 -7.7 316.8 255.9<br />

ARM Holdings . . . . . . . .1115.0 -16.0 1135.0 848.5<br />

Laird . . . . . . . . . . . . . . . .313.9 -11.0 404.9 297.9<br />

British American . . . .4904.5 25.5 4948.0 3355.5<br />

Imperial Brands . . . . .4049.5 -13.0 4090.0 2991.0<br />

Carnival . . . . . . . . . . . .3376.0 -49.0 3907.0 2957.0<br />

Cineworld Group . . . . . .533.5 -20.0 597.0 457.0<br />

Compass Group . . . . . .1437.0 -2.0 1455.0 991.0<br />

Domino's Pizza Gr . . . .320.8 -18.3 366.3 254.7<br />

easyJet . . . . . . . . . . . . .1081.0 -11.0 1808.0 1020.0<br />

FirstGroup . . . . . . . . . . . .97.8 -3.7 119.8 80.8<br />

Go-Ahead Group . . . .1950.0 -28.0 2713.0 1790.0<br />

Greene King . . . . . . . . .782.5 -24.0 977.5 749.0<br />

InterContinental . . . .2796.0 -45.0 2939.8 2192.8<br />

International Con . . . . .375.0 -6.1 614.5 343.9<br />

Ladbrokes . . . . . . . . . . . .112.5 -2.9 137.3 93.4<br />

Marston's . . . . . . . . . . . .133.4 -3.7 176.0 130.0<br />

Merlin Entertainm . . . . .451.8 -2.3 466.8 365.9<br />

Millennium & Copt . . . .395.5 -17.8 576.5 366.4<br />

Mitchells & Butle . . . . . .224.5 -7.5 458.3 222.0<br />

National Express . . . . .301.5 -3.7 349.3 272.4<br />

Paddy Power Betfa . .7975.0-275.0 14275.0 7560.0<br />

Rank Group . . . . . . . . . .212.0 -8.2 295.5 199.7<br />

Restaurant Group . . . . .272.2 -8.2 723.5 267.0<br />

Stagecoach Group . . . .209.0 -4.1 403.9 197.5<br />

Thomas Cook Group . . . .61.9 -2.8 134.9 58.1<br />

TUI AG Reg Shs (D . . . . .895.5 -7.5 1271.0 844.5<br />

Wetherspoon (J.D. . . . .695.0 -12.0 795.5 609.0<br />

Whitbread . . . . . . . . .3503.0 -88.0 5275.0 3391.0<br />

William Hill . . . . . . . . . .252.4 -5.7 410.9 247.7<br />

Wizz Air Holdings . . . .1650.0 -43.0 2047.0 1415.0<br />

4D Pharma . . . . . . . . . .770.0 -10.0 1012.5 660.0<br />

Abcam . . . . . . . . . . . . . .763.0 0.5 772.5 499.0<br />

Advanced Medical . . . .196.8 0.3 200.8 139.8<br />

Amerisur Resource . . . . .27.0 0.5 38.8 17.3<br />

Arbuthnot Banking . .1406.5 4.0 1630.0 1265.0<br />

ASOS . . . . . . . . . . . . . .4089.0 -62.0 4166.0 2473.0<br />

Brooks Macdonald . . .1570.0 9.0 2040.0 1400.0<br />

Camellia . . . . . . . . . . .7981.0 -19.0 9800.0 7510.0<br />

Clinigen Group . . . . . . .599.5 -3.5 761.0 492.8<br />

Conviviality . . . . . . . . . .178.8 -1.5 238.0 151.5<br />

CVS Group . . . . . . . . . . .746.5 -2.0 840.0 599.5<br />

Dart Group . . . . . . . . . . .527.5 -12.5 676.5 403.3<br />

EMIS Group . . . . . . . . . .923.0 14.5 1155.0 841.5<br />

Fevertree Drinks . . . . . .698.0 -31.0 738.0 280.0<br />

First Derivatives . . . . .1675.0 -115.0 2113.0 1312.5<br />

Gamma Communicati .390.0 5.0 463.0 268.5<br />

GB Group . . . . . . . . . . . .274.3 -0.5 321.0 209.0<br />

Gemfields . . . . . . . . . . . .35.8 -0.3 67.3 35.3<br />

Gooch & Housego . . . . .872.5 -13.5 929.0 816.5<br />

GW Pharmaceutical . . .594.0 6.5 693.0 211.5<br />

Iomart Group . . . . . . . .263.0 0.0 307.5 214.0<br />

James Halstead . . . . . .409.0 -1.0 520.0 385.5<br />

Johnson Service G . . . . .88.8 -1.0 99.5 84.0<br />

M&C Saatchi . . . . . . . . .283.0 -9.3 370.0 282.8<br />

M. P. Evans Group . . . . .407.5 2.4 445.9 345.5<br />

Majestic Wine . . . . . . . .387.8 -1.0 477.8 296.0<br />

Mulberry Group . . . . .1050.0 0.0 1075.0 883.8<br />

Nichols . . . . . . . . . . . .1444.0 40.0 1492.0 1119.0<br />

Numis Corporation . . . .198.0 3.8 273.5 189.8<br />

Pan African Resou . . . . .20.3 2.3 20.3 6.3<br />

Pantheon Resource . . . .141.3 -5.5 184.8 17.6<br />

Patisserie Holdin . . . . .288.0 -3.0 450.0 272.3<br />

Pinewood Group . . . . . .532.5 -12.5 580.0 419.9<br />

Polar Capital Hol . . . . . .312.5 -12.5 460.0 270.0<br />

Purplebricks Grou . . . . .137.5 0.0 175.0 73.0<br />

Redcentric . . . . . . . . . . .164.5 -2.3 203.3 158.0<br />

Redde . . . . . . . . . . . . . .160.8 -1.5 210.3 137.5<br />

Renew Holdings . . . . . .344.0 9.0 410.0 295.3<br />

RWS Holdings . . . . . . . .233.0 13.8 245.0 124.8<br />

Scapa Group . . . . . . . . .268.0 -2.8 284.5 179.3<br />

Secure Trust Bank . . . .2015.0 16.0 3385.0 2001.0<br />

Sirius Minerals . . . . . . . . .19.8 0.3 23.0 10.8<br />

Smart Metering Sy . . . .410.8 -3.3 449.0 305.5<br />

Staffline Group . . . . . .800.0 39.0 1623.0 750.0<br />

Telford Homes . . . . . . .289.8 -7.0 446.5 262.0<br />

Telit Communicati . . . .238.5 -1.8 356.0 178.3<br />

Thorpe (F.W.) . . . . . . . .224.0 0.0 244.5 176.5<br />

Vertu Motors . . . . . . . . . .41.8 -0.3 78.5 40.8<br />

Watkin Jones . . . . . . . .104.8 1.8 115.0 100.3<br />

Young & Co's Brew . . . .1219.0 0.0 1260.0 1075.0<br />

Young & Co's Brew . . . .925.0 17.5 950.0 792.5<br />

Fresnillo . . . . . . . . . . . . . . . . . .1895.0 7.7<br />

Randgold Resources . . . . . . . .9160.0 4.4<br />

Glencore . . . . . . . . . . . . . . . . . . .162.8 4.4<br />

Acacia Mining . . . . . . . . . . . . . . .483.6 4.3<br />

AO World . . . . . . . . . . . . . . . . . . .147.3 3.4<br />

Hochschild Mining . . . . . . . . . . .202.9 3.3<br />

Centamin (DI) . . . . . . . . . . . . . . .146.3 3.3<br />

Vedanta Resources . . . . . . . . . .445.2 2.9<br />

Antofagasta . . . . . . . . . . . . . . . .480.6 2.3<br />

Indivior . . . . . . . . . . . . . . . . . . . .255.7 2.2<br />

Clarkson . . . . . . . . . . . . . . . . . .1850.0 -16.1<br />

Moneysupermarket.c . . . . . . . .244.8 -11.0<br />

Crest Nicholson Ho . . . . . . . . . . .362.9 -8.1<br />

Bovis Homes Group . . . . . . . . . .706.0 -7.4<br />

British Land Compa . . . . . . . . . .565.0 -7.2<br />

Shawbrook Group . . . . . . . . . . . .161.4 -7.0<br />

Persimmon . . . . . . . . . . . . . . . .1435.0 -6.8<br />

Barratt Developmen . . . . . . . . .388.3 -6.4<br />

Rightmove . . . . . . . . . . . . . . . .3500.0 -6.4<br />

Berkeley Group Hol . . . . . . . . .2485.0 -6.4<br />

Risers<br />

Fallers<br />

MAIN CHANGES UK 350<br />

Price Chg High Low Price Chg High Low Price Chg High Low Price Chg High Low Price Chg High Low Price Chg High Low Price Chg High Low<br />

Price Chg High Low Price Chg High Low<br />

GILTS<br />

http://corporate.webfg.com<br />

mailto:<br />

globaltechsales@webfg.com<br />

%<br />

%<br />

AUTOMOBILES & PARTS<br />

AEROSPACE & DEFENCE<br />

BANKS<br />

BEVERAGES<br />

CHEMICALS<br />

ELECTRICITY<br />

ELECTRONIC & ELECTRICAL EQ.<br />

EQUITY INVESTMENT INSTRUM.<br />

FINANCIAL SERVICES<br />

FIXED LINE TELECOMS<br />

FOOD & DRUG RETAILERS<br />

FOOD PRODUCERS<br />

FORESTRY & PAPER<br />

GAS, WATER & MULTIUTILITIES<br />

GENERAL INDUSTRIALS<br />

HEALTH CARE EQUIPMETN & S.<br />

OIL & GAS PRODUCERS<br />

OIL EQUIPMENT & SERVICES<br />

PERSONAL GOODS<br />

PHARMACEUTICALS & BIOTECH<br />

REAL ESTATE INVEST. & SERV.<br />

REAL ESTATE INVEST. TRUSTS<br />

SUPPORT SERVICES<br />

TECHNOLOGY HARDW. & EQUIP.<br />

TOBACCO<br />

TRAVEL & LEISURE<br />

AIM 50<br />

Tsy 8.000 15 . . . . . . .106.51 -0.07 113.8 106.5<br />

Tsy 4.750 15 . . . . . . .102.64 -0.04 106.8 102.6<br />

Tsy 4.000 16 . . . . . .105.79 -0.03 108.3 105.7<br />

Tsy 2.500 16 . . . . . . .327.52 -0.01 339.1 327.3<br />

Tsy 1.250 17 . . . . . . . .107.61 0.03 110.9 107.3<br />

Tsy 8.750 17 . . . . . . . .121.21 0.05 126.3 121.1<br />

Tsy 5.000 18 . . . . . . .113.51 0.10 114.4 111.7<br />

Tsy 3.750 19 . . . . . . .113.00 0.20 113.0 108.0<br />

Tsy 4.500 19 . . . . . . .115.07 0.16 115.1 111.2<br />

Tsy 4.750 20 . . . . . .119.04 0.23 119.0 113.5<br />

Tsy 2.500 20 . . . . . .366.72 0.08 370.4 359.4<br />

Tsy 8.000 21 . . . . . .142.92 0.32 143.0 135.7<br />

Tsy 4.000 22 . . . . . .119.85 0.45 119.8 110.4<br />

Tsy 1.875 22 . . . . . . .124.78 0.18 125.8 119.1<br />

Tsy 2.500 24 . . . . . .350.74 0.27 353.6 322.5<br />

Tsy 5.000 25 . . . . . .134.70 0.68 134.8 119.4<br />

Tsy 4.250 27 . . . . . . .131.90 0.84 132.0 112.1<br />

Tsy 1.250 27 . . . . . . .130.83 0.42 131.4 116.0<br />

Tsy 6.000 28 . . . . . .155.76 0.85 155.7 132.9<br />

Tsy 4.750 30 . . . . . . .142.51 0.89 142.5 118.3<br />

Tsy 4.125 30 . . . . . . .347.31 0.33 350.7 304.4<br />

Tsy 4.250 32 . . . . . .136.85 0.98 136.9 111.7<br />

Tsy 1.250 32 . . . . . . .143.94 0.53 144.8 120.7<br />

Tsy 4.250 36 . . . . . .140.37 1.13 140.4 111.6<br />

Tsy 4.750 38 . . . . . .153.30 1.21 153.2 120.4<br />

Tsy 0.625 40 . . . . . .144.56 0.66 146.5 112.2<br />

Tsy 4.500 42 . . . . . . .153.16 1.33 153.1 117.1<br />

Tsy 3.500 45 . . . . . . .132.31 1.50 132.2 100.6<br />

Tsy 4.250 46 . . . . . .152.26 1.50 152.3 113.3<br />

Tsy 4.025 49 . . . . . . .156.13 1.64 156.4 114.4<br />

Tsy 4.000 99 . . . . .100.00 0.00 101.8 94.9<br />

WORLD INDICES<br />

FTSE 100 . . . . . . . . . . . . . . . . . . . . . 6522.26 -55.57 -0.84<br />

FTSE 250. . . . . . . . . . . . . . . . . . . . . 16116.70 -348.79 -2.12<br />

FTSE All-Share . . . . . . . . . . . . . . . . 3518.96 -36.49 -1.03<br />

FTSE AIM All-Share . . . . . . . . . . . . . . 713.86 0.38 0.05<br />

S&P 500 . . . . . . . . . . . . . . . . . . . . . 2102.95 4.09 0.19<br />

Dow Jones I.A. . . . . . . . . . . . . . . . 17949.37 19.38 0.11<br />

Nasdaq Composite . . . . . . . . . . . . 4862.57 19.90 0.41<br />

Xetra DAX . . . . . . . . . . . . . . . . . . . 9709.09 -67.03 -0.69<br />

CAC 40 . . . . . . . . . . . . . . . . . . . . . . 4234.86 -39.10 -0.91<br />

Swiss Market Index . . . . . . . . . . . . 8056.71 -28.50 -0.35<br />

ISEQ Overall Index. . . . . . . . . . . . . 5669.76 -80.20 -1.39<br />

FTSEurofirst 300. . . . . . . . . . . . . . . 1305.96 -6.90 -0.53<br />

Hang Seng . . . . . . . . . . . . . . . . . . 21059.20 264.83 1.27<br />

Shanghai Composite . . . . . . . . . . 2988.60 56.13 1.91<br />

Straits Times . . . . . . . . . . . . . . . . . 2870.56 24.19 0.85<br />

ASX All Ordinaries . . . . . . . . . . . . . 5365.20 38.20 0.72<br />

Price Chg %chg Price Chg %chg Price Chg %chg Price Chg %chg<br />

LIFE INSURANCE<br />

MOBILE TELECOMS<br />

INDUSTRIAL ENGINEERING<br />

MEDIA<br />

MINING<br />

SOFTWARE & COMPUTER SERV.<br />

HHOLD GDS & HOME CONSTR.<br />

NON LIFE INSURANCE<br />

INDUSTRIAL TRANSPORTATION<br />

FTSE 100<br />

6522.26<br />

55.57<br />

FTSE 250<br />

16116.70<br />

348.79<br />

FTSE ALL SHARE<br />

3518.96<br />

36.49<br />

DOW JONES<br />

17949.37<br />

HOLIDAY<br />

NASDAQ<br />

4862.57<br />

HOLIDAY<br />

S&P 500<br />

2102.95<br />

HOLIDAY<br />

BATS UK 100<br />

11058.30<br />

92.17<br />

BATS UK 250<br />

14653.03<br />

298.42<br />

CONSTRUCTION & MATERIALS<br />

GENERAL RETAILERS<br />

INDUSTRIAL METALS & MINING<br />

*US VALUES ARE FROM FRIDAY, JULY 1<br />

Rise | Shine<br />

CITY A.M. MORNING UPDATE<br />

Get our free email updates in your inbox<br />

Sign up at cityam.com/newsletter<br />

19<br />

TUESDAY 5 JULY 2016<br />

NEWS<br />

CITYAM.COM