You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

III. Emerging Technology Landscape<br />

Automated Onboarding<br />

Recent and upcoming financial regulations, such as the US Department of Labor’s fiduciary rule,<br />

Canada’s CRM 2 and POS, and MiFID II in the EU, have contributed to making onboarding one of<br />

the top three initiatives wealth management executives prioritized for the next 6-12 months. Firms<br />

are looking to provide their advisors with content management, workflow, and digital signature<br />

capabilities to ensure detailed tracking for audit purposes, automate compliance process decisions,<br />

and immediately capture investor consent. Emerging competition in the automated advice market<br />

has also forced firms to examine their current onboarding experience, and add competitive features<br />

like check image capture.<br />

Goal-Based Features (Reporting/Tracking/Proposal Generation)<br />

As a goal-based approach becomes the standard for firms, technology must be updated to generate<br />

a goal-based proposal and then monitor and track client progress toward goals. With the emergence<br />

of robo-advisors, firms need to enhance their advisors’ tools by adding capabilities like on-demand<br />

reporting, automated rebalancing, and an aggregation of accounts to see their clients’ entire<br />

financial picture. These features are key to providing advisors with the ability to monitor and adjust<br />

their clients’ goal progress in near real-time.<br />

Digital Collaboration<br />

While the wealth industry has recently focused on client mobility, half of wealth management<br />

executives indicate that they will work on developing a mobile technology solution or platform for<br />

advisors this year. Although developing on-the-go capabilities will boost advisor productivity by<br />

providing access to client account activity, high-level book-of-business statistics, and real-time<br />

market information, there is also potential for enhanced advisor-client collaboration. For example,<br />

enabling an advisor to have an in-person discussion with the client using a tablet or utilizing features<br />

that allow an advisor to see what their client is looking at in the client portal to better answer<br />

questions and solve problems.<br />

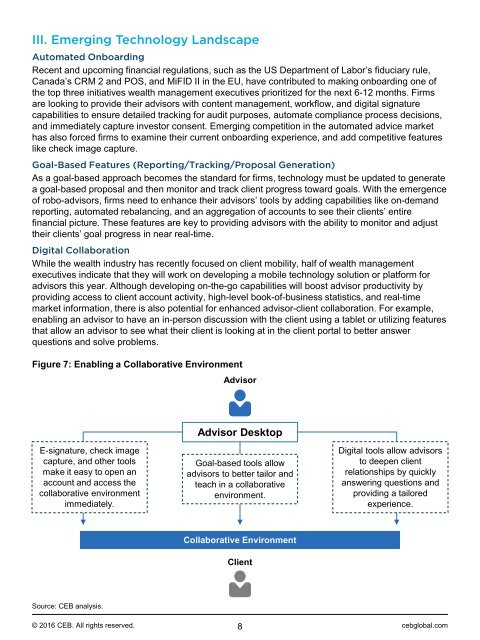

Figure 7: Enabling a Collaborative Environment<br />

Advisor<br />

Advisor Desktop<br />

E-signature, check image<br />

capture, and other tools<br />

make it easy to open an<br />

account and access the<br />

collaborative environment<br />

immediately.<br />

Goal-based tools allow<br />

advisors to better tailor and<br />

teach in a collaborative<br />

environment.<br />

Digital tools allow advisors<br />

to deepen client<br />

relationships by quickly<br />

answering questions and<br />

providing a tailored<br />

experience.<br />

Collaborative Environment<br />

Client<br />

Source: CEB analysis.<br />

© <strong>2016</strong> CEB. All rights reserved. 8<br />

cebglobal.com