Platforms and Consumer / PFM Market Analysis

2cfJGdh

2cfJGdh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

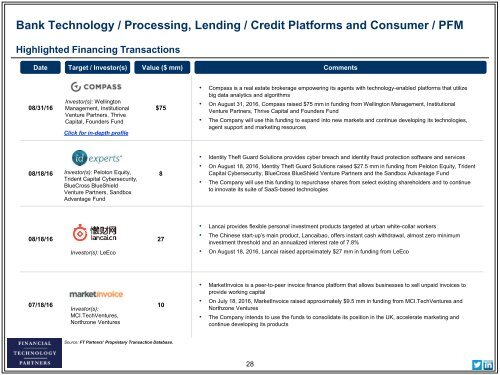

Bank Technology / Processing, Lending / Credit <strong>Platforms</strong> <strong>and</strong> <strong>Consumer</strong> / <strong>PFM</strong><br />

Highlighted Financing Transactions<br />

Date<br />

Target / Investor(s)<br />

Value ($ mm)<br />

Comments<br />

Investor(s): Wellington<br />

08/31/16 Management, Institutional $75<br />

Venture Partners, Thrive<br />

Capital, Founders Fund<br />

Click for in-depth profile<br />

• Compass is a real estate brokerage empowering its agents with technology-enabled platforms that utilize<br />

big data analytics <strong>and</strong> algorithms<br />

• On August 31, 2016, Compass raised $75 mm in funding from Wellington Management, Institutional<br />

Venture Partners, Thrive Capital <strong>and</strong> Founders Fund<br />

• The Company will use this funding to exp<strong>and</strong> into new markets <strong>and</strong> continue developing its technologies,<br />

agent support <strong>and</strong> marketing resources<br />

08/18/16 Investor(s): Peloton Equity,<br />

Trident Capital Cybersecurity,<br />

8<br />

BlueCross BlueShield<br />

Venture Partners, S<strong>and</strong>box<br />

Advantage Fund<br />

• Identity Theft Guard Solutions provides cyber breach <strong>and</strong> identity fraud protection software <strong>and</strong> services<br />

• On August 18, 2016, Identity Theft Guard Solutions raised $27.5 mm in funding from Peloton Equity, Trident<br />

Capital Cybersecurity, BlueCross BlueShield Venture Partners <strong>and</strong> the S<strong>and</strong>box Advantage Fund<br />

• The Company will use this funding to repurchase shares from select existing shareholders <strong>and</strong> to continue<br />

to innovate its suite of SaaS-based technologies<br />

08/18/16 27<br />

Investor(s): LeEco<br />

• Lancai provides flexible personal investment products targeted at urban white-collar workers<br />

• The Chinese start-up’s main product, Lancaibao, offers instant cash withdrawal, almost zero minimum<br />

investment threshold <strong>and</strong> an annualized interest rate of 7.8%<br />

• On August 18, 2016, Lancai raised approximately $27 mm in funding from LeEco<br />

07/18/16<br />

Investor(s):<br />

10<br />

MCI.TechVentures,<br />

Northzone Ventures<br />

• <strong>Market</strong>Invoice is a peer-to-peer invoice finance platform that allows businesses to sell unpaid invoices to<br />

provide working capital<br />

• On July 18, 2016, <strong>Market</strong>Invoice raised approximately $9.5 mm in funding from MCI.TechVentures <strong>and</strong><br />

Northzone Ventures<br />

• The Company intends to use the funds to consolidate its position in the UK, accelerate marketing <strong>and</strong><br />

continue developing its products<br />

Source: FT Partners’ Proprietary Transaction Database.<br />

28