You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Euler</strong> <strong>Hermes</strong><br />

24<br />

IT services:<br />

constra<strong>in</strong>ed by their clientele<br />

Major clients have the strong suit <strong>in</strong> their<br />

negotiations with IT services providers, result<strong>in</strong>g<br />

for the latter <strong>in</strong> large cash flow requirements that<br />

weaken bus<strong>in</strong>esses <strong>in</strong> the sector. Indeed, this is the<br />

sector hit hardest by the weight of its accounts<br />

receivable. As a result, it faces a large or very large<br />

scissors effect <strong>in</strong> every country apart from Sweden.<br />

Moreover, we see rigidity to a reduction <strong>in</strong> client<br />

payment <strong>periods</strong>.<br />

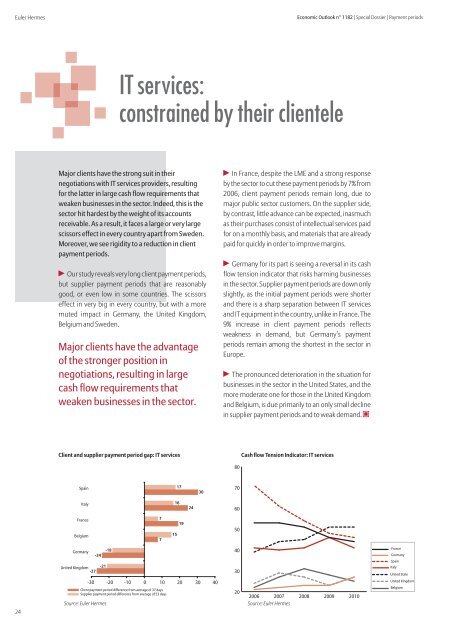

▶ Our study reveals very long client payment <strong>periods</strong>,<br />

but supplier payment <strong>periods</strong> that are reasonably<br />

good, or even low <strong>in</strong> some countries. The scissors<br />

effect <strong>in</strong> very big <strong>in</strong> every country, but with a more<br />

muted impact <strong>in</strong> Germany, the United K<strong>in</strong>gdom,<br />

Belgium and Sweden.<br />

Major clients have the advantage<br />

of the stronger position <strong>in</strong><br />

negotiations, result<strong>in</strong>g <strong>in</strong> large<br />

cash flow requirements that<br />

weaken bus<strong>in</strong>esses <strong>in</strong> the sector.<br />

Client and supplier payment period gap: IT services<br />

Spa<strong>in</strong><br />

Italy<br />

France<br />

Belgium<br />

Germany<br />

-24<br />

United K<strong>in</strong>gdom -21<br />

-27<br />

-18<br />

-30 -20 -10 0 10 20 30 40<br />

Client payment period difference from average of 37 days<br />

Supplier payment period difference from average of 53 days<br />

Source: <strong>Euler</strong> <strong>Hermes</strong><br />

7<br />

7<br />

15<br />

17<br />

16<br />

19<br />

24<br />

30<br />

Economic Outlook n° 1182 | Special Dossier | <strong>Payment</strong> <strong>periods</strong><br />

▶ In France, despite the LME and a strong response<br />

by the sector to cut these payment <strong>periods</strong> by 7% from<br />

2006, client payment <strong>periods</strong> rema<strong>in</strong> long, due to<br />

major public sector customers. On the supplier side,<br />

by contrast, little advance can be expected, <strong>in</strong>asmuch<br />

as their purchases consist of <strong>in</strong>tellectual services paid<br />

for on a monthly basis, and materials that are already<br />

paid for quickly <strong>in</strong> order to improve marg<strong>in</strong>s.<br />

▶ Germany for its part is see<strong>in</strong>g a reversal <strong>in</strong> its cash<br />

flow tension <strong>in</strong>dicator that risks harm<strong>in</strong>g bus<strong>in</strong>esses<br />

<strong>in</strong> the sector. Supplier payment <strong>periods</strong> are down only<br />

slightly, as the <strong>in</strong>itial payment <strong>periods</strong> were shorter<br />

and there is a sharp separation between IT services<br />

and IT equipment <strong>in</strong> the country, unlike <strong>in</strong> France. The<br />

9% <strong>in</strong>crease <strong>in</strong> client payment <strong>periods</strong> reflects<br />

weakness <strong>in</strong> demand, but Germany’s payment<br />

<strong>periods</strong> rema<strong>in</strong> among the shortest <strong>in</strong> the sector <strong>in</strong><br />

Europe.<br />

▶ The pronounced deterioration <strong>in</strong> the situation for<br />

bus<strong>in</strong>esses <strong>in</strong> the sector <strong>in</strong> the United States, and the<br />

more moderate one for those <strong>in</strong> the United K<strong>in</strong>gdom<br />

and Belgium, is due primarily to an only small decl<strong>in</strong>e<br />

<strong>in</strong> supplier payment <strong>periods</strong> and to weak demand. ▣<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

Cash flow Tension Indicator: IT services<br />

2006 2007<br />

Source: <strong>Euler</strong> <strong>Hermes</strong><br />

2008<br />

2009<br />

2010<br />

France<br />

Germany<br />

Spa<strong>in</strong><br />

Italy<br />

United State<br />

United K<strong>in</strong>gdom<br />

Belgium