You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Euler</strong> <strong>Hermes</strong><br />

Annex II<br />

30<br />

▶ <strong>Payment</strong> defaults <strong>in</strong> Italy<br />

A close exam<strong>in</strong>ation of payment defaults of Italian<br />

bus<strong>in</strong>esses reveals great disparities between<br />

regions and sectors via two key <strong>in</strong>dicators: the rate<br />

of non-payment and the severity (average<br />

amount) of missed payments.<br />

On the domestic market, the victims of the crisis <strong>in</strong><br />

consumption, of <strong>in</strong>ternational competition (e.g.,<br />

footwear) or of the rise <strong>in</strong> energy prices (e.g., paper<br />

manufactur<strong>in</strong>g) saw default amounts <strong>in</strong>crease.<br />

Chemicals also saw a rise <strong>in</strong> these amounts.<br />

Exports, a key element <strong>in</strong> the Italian economy <strong>in</strong> 2011,<br />

now are a matter of great concern over the rate of<br />

payment defaults <strong>in</strong> <strong>in</strong>dustry, agriculture, foods,<br />

chemicals and mechanical eng<strong>in</strong>eer<strong>in</strong>g.<br />

Italy’s strong exports to troubled economies such as<br />

Spa<strong>in</strong>, Greece and Portugal have a considerable<br />

impact on the severity of non-payments. We also see<br />

an <strong>in</strong>crease <strong>in</strong> the average payment default amount <strong>in</strong><br />

the steel, footwear and construction sectors.<br />

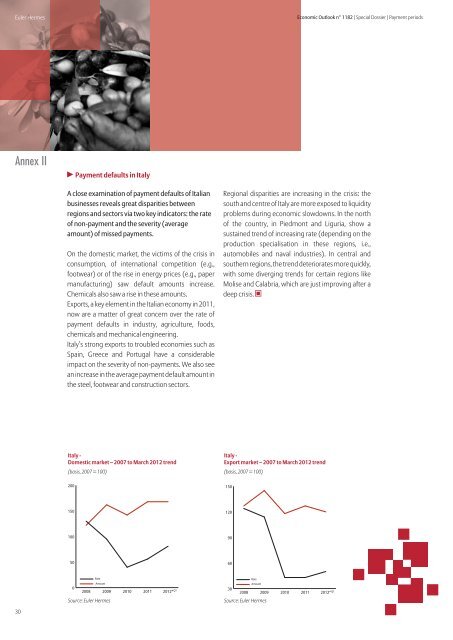

Italy -<br />

Domestic market – 2007 to March 2012 trend<br />

(basis, 2007 = 100) (basis, 2007 = 100)<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2008<br />

Rate<br />

Amount<br />

2009<br />

Source: <strong>Euler</strong> <strong>Hermes</strong><br />

2010<br />

2011<br />

Q1 2012*<br />

Regional disparities are <strong>in</strong>creas<strong>in</strong>g <strong>in</strong> the crisis: the<br />

south and centre of Italy are more exposed to liquidity<br />

problems dur<strong>in</strong>g economic slowdowns. In the north<br />

of the country, <strong>in</strong> Piedmont and Liguria, show a<br />

susta<strong>in</strong>ed trend of <strong>in</strong>creas<strong>in</strong>g rate (depend<strong>in</strong>g on the<br />

production specialisation <strong>in</strong> these regions, i.e.,<br />

automobiles and naval <strong>in</strong>dustries). In central and<br />

southern regions, the trend deteriorates more quickly,<br />

with some diverg<strong>in</strong>g trends for certa<strong>in</strong> regions like<br />

Molise and Calabria, which are just improv<strong>in</strong>g after a<br />

deep crisis. ▣<br />

Italy -<br />

Export market – 2007 to March 2012 trend<br />

150<br />

120<br />

90<br />

60<br />

30<br />

2008<br />

Rate<br />

Amount<br />

2009<br />

Source: <strong>Euler</strong> <strong>Hermes</strong><br />

2010<br />

Economic Outlook n° 1182 | Special Dossier | <strong>Payment</strong> <strong>periods</strong><br />

2011<br />

Q1 2012*