ZaraAnnual-English2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26.<br />

RISK MANAGEMENT<br />

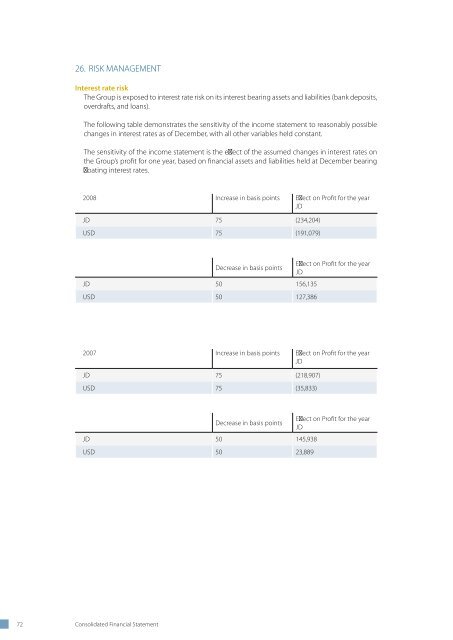

Interest rate risk<br />

The Group is exposed to interest rate risk on its interest bearing assets and liabilities (bank deposits,<br />

overdrafts, and loans).<br />

The following table demonstrates the sensitivity of the income statement to reasonably possible<br />

changes in interest rates as of December, with all other variables held constant.<br />

The sensitivity of the income statement is the effect of the assumed changes in interest rates on<br />

the Group’s profit for one year, based on financial assets and liabilities held at December bearing<br />

floating interest rates.<br />

2008 Increase in basis points Effect on Profit for the year<br />

JD<br />

JD 75 (234,204)<br />

USD 75 (191,079)<br />

Decrease in basis points<br />

JD 50 156,135<br />

USD 50 127,386<br />

Effect on Profit for the year<br />

JD<br />

Equity price risk<br />

The following table demonstrates the sensitivity of the income statement and the cumulative<br />

change in fair value to reasonably possible changes in equity prices, with all other variables held<br />

constant.<br />

2008 2007<br />

Change in<br />

equity price<br />

Effect on<br />

profit of the<br />

year<br />

Effect on<br />

equity<br />

Change in<br />

equity price<br />

Effect on<br />

profit of the<br />

year<br />

Effect on<br />

Equity<br />

% JD JD % JD JD<br />

Amman Stock Exchange 10 - 2,171,813 10 7,250 1,942,404<br />

The effect of decreases in equity prices is expected to be equal and opposite to the effect of the<br />

increases shown.<br />

Credit risk<br />

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation<br />

and cause the other party to incur a financial loss. The Group is exposed to credit risk on its bank<br />

balances, receivables and certain other assets as reflected in the balance sheet.<br />

The Group seeks to limit its credit risk with respect to banks by only dealing with reputable banks<br />

and with respect to customers by setting credit limits for individual customers and monitoring<br />

outstanding receivables.<br />

The Group provides services to large number of customers. No single customer accounts for more<br />

than 10% of outstanding accounts receivable at 31 December 2008.<br />

2007 Increase in basis points Effect on Profit for the year<br />

JD<br />

JD 75 (218,907)<br />

USD 75 (35,833)<br />

Decrease in basis points<br />

JD 50 145,938<br />

USD 50 23,889<br />

Effect on Profit for the year<br />

JD<br />

72 Consolidated Financial Statement Annual Report 2008 73