ZaraAnnual-English2013

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

23. Income Tax<br />

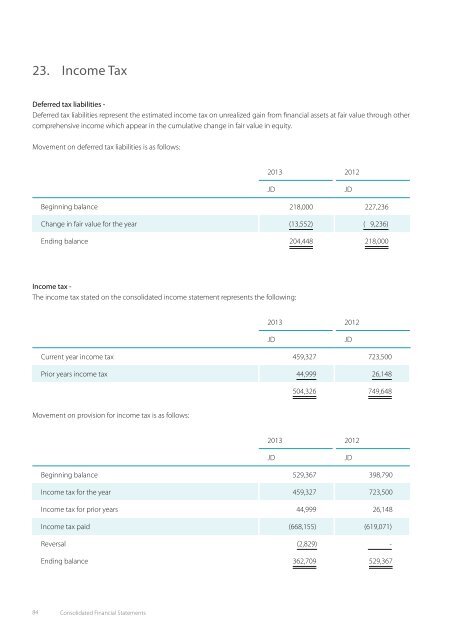

Deferred tax liabilities -<br />

Deferred tax liabilities represent the estimated income tax on unrealized gain from financial assets at fair value through other<br />

comprehensive income which appear in the cumulative change in fair value in equity.<br />

Movement on deferred tax liabilities is as follows:<br />

2013 2012<br />

Beginning balance 218,000 227,236<br />

Change in fair value for the year (13,552) ( 9,236)<br />

Ending balance 204,448 218,000<br />

JD<br />

JD<br />

Below table shows the reconciliation between the accounting profit before income tax and taxable income:<br />

2013 2012<br />

JD<br />

JD<br />

Accounting (loss) profit before tax (545,937) 2,297,538<br />

Losses of the Company and other subsidiaries 4,020,870 5,303,932<br />

Carried forward losses 73,937 (1,135,935)<br />

Non-taxable income (55,984) (62,150)<br />

Non-deductible expenses 458,540 402,083<br />

Taxable income 3,951,426 6,805,468<br />

Income tax expense for the year 459,327 723,500<br />

Statutory tax rate 5% - 14% 5% - 14%<br />

Effective tax rate - 31.5%<br />

Income tax -<br />

The income tax stated on the consolidated income statement represents the following:<br />

2013 2012<br />

Current year income tax 459,327 723,500<br />

Prior years income tax 44,999 26,148<br />

Movement on provision for income tax is as follows:<br />

JD<br />

JD<br />

504,326 749,648<br />

2013 2012<br />

Beginning balance 529,367 398,790<br />

Income tax for the year 459,327 723,500<br />

Income tax for prior years 44,999 26,148<br />

Income tax paid (668,155) (619,071)<br />

JD<br />

JD<br />

The income tax provision represents income tax due on the results of operations of some of the Company’s subsidiaries. No<br />

income tax provision was calculated for the Company and a number of its subsidiaries for 2013 due to the excess of deductible<br />

expenses over taxable revenues, or due to accumulated losses from prior years, in accordance with the Temporary Income Tax<br />

Law No. (28) of 2009.<br />

The Income Tax Department has not reviewed the Company’s and its subsidiaries records, except for Levant Hotels and Tourism<br />

Company and Amman Tourism Investment Company for 2012, up to the date of these consolidated financial statements.<br />

The Income Tax Department has reviewed the accounting records of Amman Tourism Investment Company for 2012.<br />

The Company, Red Sea Hotels Company, and Zara South Coast Development Company have obtained final clearances from<br />

the Income Tax Department for all years up to 31 December 2009.<br />

Jordan Himmeh Mineral Company, Nabatean Hotels Company, Rum Hotels and Tourism Company, Oasis Hotels Company,<br />

Zara Agricultural Company, and South Coast Real Estate Development Company have obtained final clearances from the<br />

Income Tax Department up to 2010.<br />

Jordan Hotels and Tourism Company, Amman Tourism Investment Company, National Hotels and Tourism Company, and<br />

South Coast Hotels Company have obtained final clearances from the Income Tax Department up to 2011.<br />

Levant Hotels and Tourism Company has obtained a final clearance from the Income Tax Department up to 2012.<br />

Reversal (2,829) -<br />

Ending balance 362,709 529,367<br />

84 Consolidated Financial Statements Annual Report 2013 85