ZaraAnnual-English2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Credit risk<br />

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other<br />

party to incur a financial loss. The Group is exposed to credit risk on its bank balances, receivables and certain other<br />

assets as reflected in the consolidated statement of financial position.<br />

The Group seeks to limit its credit risk with respect to banks by only dealing with reputable banks and with respect to<br />

customers by setting credit limits for individual customers and monitoring outstanding receivables.<br />

The Group provides services to large number of customers. No single customer accounts for more than 10% of<br />

outstanding accounts receivable at 31 December 2012.<br />

31. Fair Value of Financial Instruments<br />

Financial instruments comprise of financial assets and financial liabilities.<br />

Financial assets consist of cash and bank balances, accounts receivable and some other current assets. Financial liabilities<br />

consist of due to banks, loans, accounts payable, and some other current liabilities.<br />

The fair values of financial instruments are not materially different from their carrying values.<br />

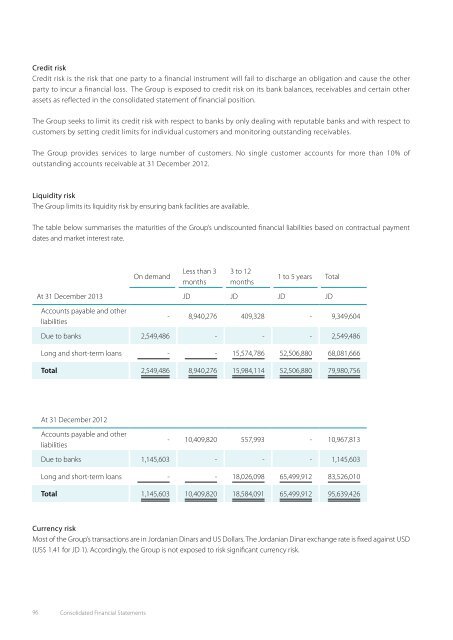

Liquidity risk<br />

The Group limits its liquidity risk by ensuring bank facilities are available.<br />

The table below summarises the maturities of the Group’s undiscounted financial liabilities based on contractual payment<br />

dates and market interest rate.<br />

On demand<br />

Less than 3<br />

months<br />

3 to 12<br />

months<br />

1 to 5 years Total<br />

At 31 December 2013 JD JD JD JD<br />

Accounts payable and other<br />

liabilities<br />

- 8,940,276 409,328 - 9,349,604<br />

Due to banks 2,549,486 - - - 2,549,486<br />

32. Capital Management<br />

The primary objective of the Group’s capital management is to ensure that it maintains capital ratios in order to support its<br />

business and maximize shareholder value.<br />

The Group manages its capital structure and makes adjustments to it in light of changes in business conditions. No changes<br />

were made in the objectives, policies or processes during the current and previous year.<br />

Capital comprises of paid-on capital, advance payment on capital increases, statutory reserve, voluntary reserve, cumulative<br />

change in fair value and retained earnings (accumulated losses), and is measured at JD 167,198,311 as at 31 December 2013<br />

(2012: JD 169,435,715).<br />

Long and short-term loans - - 15,574,786 52,506,880 68,081,666<br />

Total 2,549,486 8,940,276 15,984,114 52,506,880 79,980,756<br />

At 31 December 2012<br />

Accounts payable and other<br />

liabilities<br />

- 10,409,820 557,993 - 10,967,813<br />

Due to banks 1,145,603 - - - 1,145,603<br />

Long and short-term loans - - 18,026,098 65,499,912 83,526,010<br />

Total 1,145,603 10,409,820 18,584,091 65,499,912 95,639,426<br />

Currency risk<br />

Most of the Group’s transactions are in Jordanian Dinars and US Dollars. The Jordanian Dinar exchange rate is fixed against USD<br />

(US$ 1.41 for JD 1). Accordingly, the Group is not exposed to risk significant currency risk.<br />

96 Consolidated Financial Statements Annual Report 2013 97