GNFR Unlock hidden value in your P&L

GNFR%2BUnlock%2Bhidden%2Bvalue%2Bin%2Byour%2BP%2526L

GNFR%2BUnlock%2Bhidden%2Bvalue%2Bin%2Byour%2BP%2526L

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The unfortunate consequence of bus<strong>in</strong>esses treat<strong>in</strong>g <strong>GNFR</strong><br />

as someth<strong>in</strong>g of a backwater, is that talented buyers often<br />

choose to move away from <strong>GNFR</strong> towards other roles with<br />

a higher profile<br />

Under<strong>in</strong>vestment <strong>in</strong> <strong>GNFR</strong> teams not only impacts<br />

the people, but also the way they operate.<br />

Best-<strong>in</strong>-class <strong>GNFR</strong> procurement teams will have<br />

clearly def<strong>in</strong>ed processes for <strong>in</strong>teract<strong>in</strong>g with<br />

suppliers and technology to support them optimise<br />

results. These tools provide the ability to work<br />

consistently, maximise sav<strong>in</strong>gs and track benefits<br />

which <strong>in</strong> turn helps to mitigate risks and provide a<br />

clear cost-benefit for the team.<br />

When a major multi-channel retailer assembled<br />

and tra<strong>in</strong>ed a new <strong>in</strong>-house <strong>GNFR</strong> procurement<br />

team, they were able to help the bus<strong>in</strong>ess<br />

deliver cost reduction worth £8m <strong>in</strong> their first<br />

12 months, with average sav<strong>in</strong>gs of 11% across<br />

the categories covered.<br />

In cases where a well-resourced <strong>GNFR</strong> team is <strong>in</strong><br />

place, issues may still arise. Organisational structure<br />

and report<strong>in</strong>g l<strong>in</strong>es can be problematic and <strong>in</strong> some<br />

cases serve to limit the remit of the <strong>GNFR</strong> team and<br />

the level of results achieved. Whether the <strong>GNFR</strong><br />

team report <strong>in</strong>to the CFO, Commercial Director,<br />

Procurement Director or Property Director, the<br />

relative <strong>in</strong>fluence of these stakeholders with<strong>in</strong> the<br />

bus<strong>in</strong>ess will impact on the team’s ability to do a<br />

good job and ga<strong>in</strong> senior support.<br />

Report<strong>in</strong>g l<strong>in</strong>es and team structure can also<br />

compromise the scope and control of the <strong>GNFR</strong><br />

team. Many bus<strong>in</strong>esses exclude certa<strong>in</strong> spend<br />

categories from the remit of the <strong>GNFR</strong> team,<br />

often where they are seen to be of a “specialist”<br />

nature, such as media buy<strong>in</strong>g, purchase of shopfit<br />

equipment or IT service contracts. <strong>GNFR</strong> spend<br />

then becomes fragmented, often with reduced<br />

scrut<strong>in</strong>y and accountability for efficiency of spend.<br />

THE SAME BUT DIFFERENT<br />

With<strong>in</strong> retail, there appears to be very little<br />

cross-poll<strong>in</strong>ation of <strong>GNFR</strong> staff with their<br />

counterparts from other higher profile commercial<br />

functions, despite the clear crossover between the<br />

roles of buyer with<strong>in</strong> <strong>GNFR</strong> and buyer with<strong>in</strong> GFRS.<br />

More shar<strong>in</strong>g of personnel, skills and processes<br />

would be advantageous to both sides as the<br />

typical areas of strength/focus are quite different<br />

and therefore complementary. For example, while<br />

<strong>GNFR</strong> buyers can be experienced <strong>in</strong> develop<strong>in</strong>g<br />

contractual terms, manag<strong>in</strong>g tenders and onl<strong>in</strong>e<br />

auctions, their counterparts <strong>in</strong> GFRS are often more<br />

comfortable deal<strong>in</strong>g with new supplier <strong>in</strong>tegration,<br />

off-<strong>in</strong>voice fund<strong>in</strong>g discussions and top-to-top<br />

negotiations (see Exhibit 3).<br />

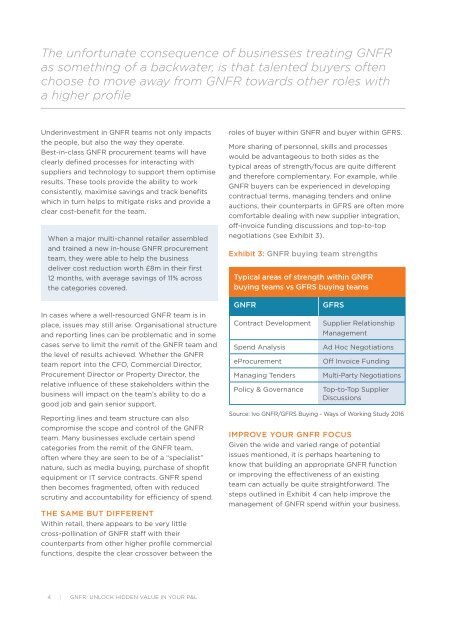

Exhibit 3: <strong>GNFR</strong> buy<strong>in</strong>g team strengths<br />

Typical areas of strength with<strong>in</strong> <strong>GNFR</strong><br />

buy<strong>in</strong>g teams vs GFRS buy<strong>in</strong>g teams<br />

<strong>GNFR</strong><br />

Contract Development<br />

Spend Analysis<br />

eProcurement<br />

Manag<strong>in</strong>g Tenders<br />

Policy & Governance<br />

GFRS<br />

Supplier Relationship<br />

Management<br />

Ad Hoc Negotiations<br />

Off Invoice Fund<strong>in</strong>g<br />

Multi-Party Negotiations<br />

Top-to-Top Supplier<br />

Discussions<br />

Source: Ivo <strong>GNFR</strong>/GFRS Buy<strong>in</strong>g - Ways of Work<strong>in</strong>g Study 2016<br />

IMPROVE YOUR <strong>GNFR</strong> FOCUS<br />

Given the wide and varied range of potential<br />

issues mentioned, it is perhaps hearten<strong>in</strong>g to<br />

know that build<strong>in</strong>g an appropriate <strong>GNFR</strong> function<br />

or improv<strong>in</strong>g the effectiveness of an exist<strong>in</strong>g<br />

team can actually be quite straightforward. The<br />

steps outl<strong>in</strong>ed <strong>in</strong> Exhibit 4 can help improve the<br />

management of <strong>GNFR</strong> spend with<strong>in</strong> <strong>your</strong> bus<strong>in</strong>ess.<br />

4 | <strong>GNFR</strong>: UNLOCK HIDDEN VALUE IN YOUR P&L