You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TRENDS & INTEL<br />

Digital cash<br />

World goes<br />

cashless<br />

A<br />

ccording to the third Annual Digital Money<br />

report released in 2016, a partnership<br />

between Citi and Imperial College<br />

of London, emerging markets<br />

governments have a big role to<br />

play in entrenching the drive<br />

towards a cashless society since up to two-thirds of state<br />

disbursements are still done through cash or cheques.<br />

Citi estimates $150bn<br />

could be saved globally<br />

every year by digitising<br />

The abundancy of<br />

cashless payment<br />

systems in the region<br />

has also had a positive<br />

effect for many who<br />

prefer the convenient<br />

alternative method of<br />

payment.<br />

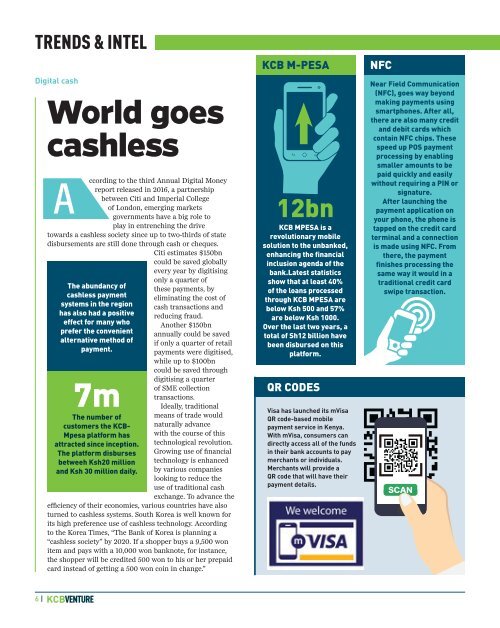

7m<br />

The number of<br />

customers the <strong>KCB</strong>-<br />

Mpesa platform has<br />

attracted since inception.<br />

The platform disburses<br />

betweeh Ksh20 million<br />

and Ksh 30 million daily.<br />

only a quarter of<br />

these payments, by<br />

eliminating the cost of<br />

cash transactions and<br />

reducing fraud.<br />

Another $150bn<br />

annually could be saved<br />

if only a quarter of retail<br />

payments were digitised,<br />

while up to $100bn<br />

could be saved through<br />

digitising a quarter<br />

of SME collection<br />

transactions.<br />

Ideally, traditional<br />

means of trade would<br />

naturally advance<br />

with the course of this<br />

technological revolution.<br />

Growing use of financial<br />

technology is enhanced<br />

by various companies<br />

looking to reduce the<br />

use of traditional cash<br />

exchange. To advance the<br />

efficiency of their economies, various countries have also<br />

turned to cashless systems. South Korea is well known for<br />

its high preference use of cashless technology. According<br />

to the Korea Times, “The Bank of Korea is planning a<br />

“cashless society” by 2020. If a shopper buys a 9,500 won<br />

item and pays with a 10,000 won banknote, for instance,<br />

the shopper will be credited 500 won to his or her prepaid<br />

card instead of getting a 500 won coin in change.”<br />

<strong>KCB</strong> M-PESA<br />

12bn<br />

<strong>KCB</strong> MPESA is a<br />

revolutionary mobile<br />

solution to the unbanked,<br />

enhancing the financial<br />

inclusion agenda of the<br />

bank.Latest statistics<br />

show that at least 40%<br />

of the loans processed<br />

through <strong>KCB</strong> MPESA are<br />

below Ksh 500 and 57%<br />

are below Ksh 1000.<br />

Over the last two years, a<br />

total of Sh12 billion have<br />

been disbursed on this<br />

platform.<br />

QR CODES<br />

Visa has launched its mVisa<br />

QR code-based mobile<br />

payment service in Kenya.<br />

With mVisa, consumers can<br />

directly access all of the funds<br />

in their bank accounts to pay<br />

merchants or individuals.<br />

Merchants will provide a<br />

QR code that will have their<br />

payment details.<br />

NFC<br />

Near Field Communication<br />

(NFC), goes way beyond<br />

making payments using<br />

smartphones. After all,<br />

there are also many credit<br />

and debit cards which<br />

contain NFC chips. These<br />

speed up POS payment<br />

processing by enabling<br />

smaller amounts to be<br />

paid quickly and easily<br />

without requiring a PIN or<br />

signature.<br />

After launching the<br />

payment application on<br />

your phone, the phone is<br />

tapped on the credit card<br />

terminal and a connection<br />

is made using NFC. From<br />

there, the payment<br />

finishes processing the<br />

same way it would in a<br />

traditional credit card<br />

swipe transaction.<br />

6 |