Trust Truth and Transparency

Headwateres-Food-Transparency-FINAL

Headwateres-Food-Transparency-FINAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WINTER 2017<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE:<br />

<strong>Trust</strong>, <strong>Truth</strong> <strong>and</strong> <strong>Transparency</strong><br />

HeadwatersMB.com

Many concerns are weighing heavily on the minds <strong>and</strong> hearts of<br />

consumers today, <strong>and</strong> among them are the availability of healthy<br />

foods <strong>and</strong> the impact food has on their health <strong>and</strong> wellbeing. In this<br />

environment, one concern has surged in importance – the dem<strong>and</strong> for<br />

greater transparency from food companies.<br />

Today’s food industry is in the midst of an extraordinary revolution that is as disruptive as it is dynamic.<br />

As outlooks <strong>and</strong> lifestyles veer further away from questionable diets <strong>and</strong> unrealistic weight-loss fads,<br />

consumers have become increasingly aware of the importance of transparency <strong>and</strong> the food choices they<br />

<strong>and</strong> their families are making.<br />

Consumer priorities now range from clean eating <strong>and</strong> labeling to farming, processing <strong>and</strong> sourcing<br />

practices, as well as the humane treatment of animals. Additional influences that are awakening new<br />

consumer values include the mounting distrust of legacy Big Food companies <strong>and</strong> the importance of<br />

serving as citizens of the planet. The cumulative effect is a measurable <strong>and</strong> unmistakable impact on the<br />

dem<strong>and</strong> for healthy food products, <strong>and</strong> changing consumer shopping behaviors <strong>and</strong> purchase decisions:<br />

• Nearly all consumers (94 percent) believe it is important that the br<strong>and</strong>s <strong>and</strong> manufacturers they<br />

purchase products from are transparent about what is in their food <strong>and</strong> how it is made. 1<br />

• Only 12 percent of consumers rank br<strong>and</strong>s as<br />

their most trusted source of food-ingredient<br />

information. Yet, nearly 70 percent believe<br />

the br<strong>and</strong> or manufacturer is responsible<br />

for providing consumers with ingredient<br />

information. 2<br />

• Sixty-five percent of consumers purchased<br />

goods or services from socially responsible<br />

br<strong>and</strong>s in the past 12 months. Additionally, 32<br />

percent are planning to spend more with socially<br />

responsible br<strong>and</strong>s in 2016, including 41 percent<br />

of 18- to 24-year-olds <strong>and</strong> 38 percent of 25- to<br />

34-year-olds. 3<br />

“Today’s food industry is in the midst<br />

of an extraordinary revolution that is as<br />

disruptive as it is dynamic. As outlooks<br />

<strong>and</strong> lifestyles veer further away from<br />

questionable diets <strong>and</strong> unrealistic weightloss<br />

fads, consumers have become<br />

increasingly aware of the importance of<br />

transparency <strong>and</strong> the food choices they<br />

<strong>and</strong> their families are making.”<br />

– BILL HARRISON, MANAGING DIRECTOR,<br />

HEAD OF CONSUMER INVESTMENT BANKING,<br />

HEADWATERS MB<br />

Food companies large <strong>and</strong> small that recognize <strong>and</strong><br />

support consumers’ priorities can win their longterm<br />

loyalty <strong>and</strong> capitalize on the competitive advantages of consumer-focused business strategies <strong>and</strong><br />

leadership. They also have a genuine opportunity to become part of the massive consumer shift that is<br />

dramatically transforming the food industry <strong>and</strong> ultimately, br<strong>and</strong> performance <strong>and</strong> marketplace position.<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY | 1

Road to <strong>Transparency</strong><br />

Authenticity, sustainability <strong>and</strong> transparency have never been more important for<br />

consumers <strong>and</strong> for the food br<strong>and</strong>s they look to when making purchase decisions across<br />

product categories.<br />

As these priorities have become more strongly embraced<br />

by mainstream consumers, the dem<strong>and</strong> for <strong>and</strong> sales of<br />

healthy products have climbed to record levels.<br />

a number of industry studies indicates that consumer<br />

concern regarding food consumption spans age<br />

brackets, geographic regions <strong>and</strong> income levels.<br />

In a recent Acosta survey, The Why? Behind the Dine,<br />

US diners affirmed the importance of feeling good<br />

about the food they are eating.<br />

These widespread consumer attitudes <strong>and</strong> behaviors<br />

have transformed a once niche advocacy group into<br />

a powerful marketplace force that dem<strong>and</strong>s food<br />

companies offer not only healthy products but also<br />

product <strong>and</strong> process transparency. Also, while in many<br />

cases Millennial voices are resonating strongest when<br />

proclaiming their food-related positions <strong>and</strong> opinions,<br />

“Forty percent of consumers believe<br />

the food system is headed in the right<br />

direction, up from 30 percent in 2012.<br />

Those who believe the food system is<br />

on the wrong track has dropped by 11<br />

percent in the last two years.”<br />

– A CLEAR VIEW OF TRANSPARENCY AND HOW IT<br />

BUILDS CONSUMER TRUST (2015), THE CENTER FOR<br />

FOOD INTEGRITY (CFI)<br />

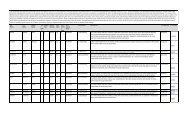

% US DINERS – EATING HEALTHY ATTITUDES<br />

Thinking about the last year, please indicate how much you agree with each of the following statements.<br />

(% Agree Strongly/Agree)<br />

It’s important for me to feel good about<br />

the food I’m putting into my body<br />

65%<br />

I actively seek out nutritious<br />

foods that are good for me<br />

I usually look for healthy options<br />

when ordering at restaurants<br />

I’m very health conscious<br />

I’m eating smaller portions than<br />

I was last year<br />

I eat healthy meals, even though they<br />

may be more expensive<br />

I’d like to eat healthier, but I can’t afford it<br />

49%<br />

47%<br />

45%<br />

43%<br />

37%<br />

31%<br />

Source: The Why? Behind the Dine (2nd edition), Acosta<br />

2 | THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY

A 2015 Deloitte survey, Capitalizing on the Shifting<br />

Consumer Food Value Equation, analyzes both<br />

Traditional <strong>and</strong> Evolving drivers of consumer behavior.<br />

Traditional drivers include taste, price <strong>and</strong> convenience,<br />

while Evolving drivers focus on health <strong>and</strong> wellness,<br />

safety, social impact, <strong>and</strong> transparency.<br />

The survey shows that approximately one-half of<br />

consumers weigh Evolving drivers more heavily than<br />

Traditional drivers. It also reveals that Evolving drivers,<br />

when compared with Traditional drivers, equally<br />

represent geographic regions (Midwest, Northeast,<br />

South <strong>and</strong> West), ages (18 to 34, 35 to 49 <strong>and</strong> 50 to 80)<br />

<strong>and</strong> annual income brackets (less than $25K, $25K to<br />

$75K, more than $75K to $100K <strong>and</strong> more than $100K).<br />

Notably, the survey found slightly higher Evolving-driver<br />

levels among survey participants located in the West<br />

<strong>and</strong> earning more than $100,000 per year.<br />

The diverse consumer demographic uncovered by the<br />

Deloitte survey is of paramount significance for food<br />

companies. It demonstrates that consumers, regardless<br />

of their geographic location, age <strong>and</strong> income, are now<br />

prioritizing the Evolving drivers of health <strong>and</strong> wellness,<br />

safety, <strong>and</strong> other factors that extend beyond taste, price<br />

“Forty-seven percent of US consumers<br />

look at the ingredients list before<br />

purchasing a packaged-food item in<br />

2015, compared to 40 percent who<br />

made a similar claim in 2014.”<br />

– INTERNATIONAL FOOD INFORMATION COUNCIL<br />

(IFIC)<br />

<strong>and</strong> convenience. What this means for food companies<br />

is that in order for them to maintain market share <strong>and</strong><br />

grow, they will need to address these new consumer<br />

priorities.<br />

Among the ways food br<strong>and</strong>s are responding to<br />

health-driven consumers, <strong>and</strong> in the process moving<br />

progressively closer to transparency <strong>and</strong> consumer<br />

engagement, is by proactively informing consumers<br />

of food ingredients. In some cases, br<strong>and</strong>s are also<br />

advising consumers on why specific products are good<br />

for them nutritionally, <strong>and</strong> setting new st<strong>and</strong>ards for<br />

quality in research, consumer advocacy <strong>and</strong> disclosure.<br />

Additional approaches are company website sections<br />

dedicated to nutrition <strong>and</strong> ingredient information.<br />

EVOLVING DRIVERS ARE STILL HIGHLY RELEVANT ACROSS<br />

INCOME GROUPS<br />

TRADITIONAL<br />

DRIVERS<br />

Taste, price <strong>and</strong> convenience<br />

EVOLVING<br />

DRIVERS<br />

Health <strong>and</strong> wellness, safety,<br />

social impact, <strong>and</strong> transparency<br />

$75k-$100k 49%<br />

51%<br />

>$100k 46%<br />

54%<br />

Source: Capitalizing on the Shifting Consumer Food Value Equation, Deloitte<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY | 3

Platform of <strong>Trust</strong><br />

<strong>Trust</strong> is food companies’ anchor for success, making its pursuit <strong>and</strong> retention a missioncritical<br />

goal.<br />

According to a recent survey performed by The Center<br />

for Food Integrity (CFI), A Clear View of <strong>Transparency</strong><br />

<strong>and</strong> How It Builds Consumer <strong>Trust</strong>, the responsibility<br />

for demonstrating trust-building transparency in the<br />

most important food-production areas rests first <strong>and</strong><br />

foremost on the shoulders of food manufacturers –<br />

not farmers, grocery stores or restaurants. Areas of<br />

greatest concern to survey participants are food’s<br />

impact on health, food safety, the environment, labor<br />

<strong>and</strong> human rights, animal wellbeing, <strong>and</strong> business ethics.<br />

Food companies earn trust when they consistently,<br />

authentically <strong>and</strong> proactively live up to their healthyproducts<br />

commitment in all aspects of their business,<br />

<strong>and</strong> remain in lockstep with consumers’ evolving<br />

priorities. In the process, they can positively influence<br />

purchase decisions <strong>and</strong> become strategically positioned<br />

to excel in the healthy-food sector.<br />

However, with the rise of technology <strong>and</strong> social media,<br />

<strong>and</strong> the empowerment they bestow on consumers,<br />

particularly on Millennials, maintaining consumer<br />

trust requires more than tried-<strong>and</strong>-true engagement<br />

strategies. Here are three top reasons why:<br />

1.<br />

There is greater consumer diligence when<br />

investigating the extent to which food<br />

companies live up to their healthy-product claims.<br />

Consumers are also being more empowered in their<br />

research each year by the Internet, social-media<br />

networks <strong>and</strong> smart-phone apps that can range from<br />

HarvestMark <strong>and</strong> ShopNoGMO to True Food <strong>and</strong><br />

GoPure.<br />

2.<br />

Consumers’ investigative efforts are reaching<br />

beyond food company backgrounds to<br />

include product ingredients, labeling, sourcing<br />

methods, consumer feedback, <strong>and</strong> other social <strong>and</strong><br />

environmental issues.<br />

3.<br />

Digital “soap boxes” now serve as vocal <strong>and</strong><br />

influential platforms from which consumers<br />

are broadcasting their own opinions as well as those<br />

of public-health activists, watchdog groups, media<br />

pundits, celebrity nutritionists, <strong>and</strong> self-appointed gurus<br />

<strong>and</strong> evangelists. The outcomes are rewards for food<br />

companies’ perceived “good behavior” <strong>and</strong> punishment<br />

for perceived “bad behavior.”<br />

“Br<strong>and</strong>s that meet customer<br />

expectations for product information,<br />

<strong>and</strong> deliver that information instantly,<br />

develop a new dynamic of convenience,<br />

trust <strong>and</strong> long-term value.”<br />

– 2016 LABEL INSIGHT FOOD REVOLUTION STUDY<br />

Best practices for building consumer trust in an<br />

environment seemingly overrun with skepticism <strong>and</strong><br />

doubt are founded on both the security consumers<br />

experience from full ingredient disclosure <strong>and</strong> a kinship<br />

with the company that is formed through shared values.<br />

In fact, internal sustainability groups are winning as<br />

much applause from food companies as they are from<br />

consumers. These groups respond directly to consumer<br />

diligence <strong>and</strong> help guide food companies as they<br />

continually meet health <strong>and</strong> sustainability commitments.<br />

Additionally, food companies are exp<strong>and</strong>ing their<br />

compliance departments to ensure they are in sync<br />

with regulatory dem<strong>and</strong>s <strong>and</strong> marketplace changes, <strong>and</strong><br />

offering more consumer-engagement opportunities to<br />

demonstrate transparency.<br />

4 | THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY

Good for Business, People <strong>and</strong><br />

the Environment<br />

Each year, food br<strong>and</strong>s launch better-for-you products that gain both significant consumer<br />

traction <strong>and</strong> loyalty as well as br<strong>and</strong> awareness.<br />

These br<strong>and</strong>s are usually mission-driven in their<br />

marketing <strong>and</strong> consumer messaging, which often<br />

resonates with consumers. In the process, br<strong>and</strong>s are<br />

able to grow from the competitive opportunities <strong>and</strong><br />

financial rewards that the healthy-food sector has to<br />

offer.<br />

Though each food company is unique in its product<br />

offerings, market-entry strategy <strong>and</strong> goals, they all<br />

share a universal DNA – the ability to underst<strong>and</strong> <strong>and</strong><br />

meet the complete range of consumer expectations,<br />

from health <strong>and</strong> nutrition claims to animal <strong>and</strong><br />

environmental protection.<br />

The following three companies st<strong>and</strong> as real-life<br />

examples of how transparency, <strong>and</strong> the consumer trust<br />

that follows, can be catalysts for growth, success <strong>and</strong><br />

corporate citizenry.<br />

KIND<br />

KIND, whose products are better-for-you fruit <strong>and</strong> nutsnack<br />

bars, was founded in 2004 with eight bar varieties<br />

<strong>and</strong> now offers more than 22 bars <strong>and</strong> six Healthy<br />

Grains snackable clusters.<br />

KIND has taken a number of steps that have led to<br />

strong performance <strong>and</strong> market differentiation,<br />

including using transparent packaging so that<br />

consumers can see the contents of the product when<br />

displayed on store shelves. The company also focuses<br />

its br<strong>and</strong>ing <strong>and</strong> marketing efforts around the KIND<br />

belief that “there’s more to business than just profit.”<br />

For example, rather than rolling out a traditional<br />

product-sampling strategy, KIND selected br<strong>and</strong><br />

ambassadors who distributed coupons to the public in<br />

a wide range of US cities. Members of the public could<br />

then redeem their coupons for KIND bars as a reward<br />

for their r<strong>and</strong>om acts of kindness. The marketing<br />

strategy was an unequivocal success. It not only<br />

honored kindness, a principle on which the company<br />

was founded <strong>and</strong> named, but also emboldened the<br />

authenticity of the KIND br<strong>and</strong>.<br />

Although KIND remains privately held, in 2012 it<br />

reportedly generated $120 million in revenue, with<br />

private equity investor VMG Partners selling its minority<br />

position for approximately $200 million in 2014.<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY | 5

Honest Tea<br />

Honest Tea was founded in 1998 with a mission to bring<br />

to market a bottled-tea beverage that was less sweet<br />

than its competitors <strong>and</strong> used organic ingredients,<br />

all while adhering to fair trade practices of improved<br />

trading conditions, sustainability, <strong>and</strong> social <strong>and</strong><br />

environmental st<strong>and</strong>ards.<br />

By 2006, Honest Tea had revenue of $13.5 million <strong>and</strong><br />

was selling approximately 1.5 million cases of product<br />

per year. In 2008, Coca-Cola purchased a 40 percent<br />

stake in the company for $43 million. Coca-Cola<br />

purchased the remainder of the company in 2011 for an<br />

undisclosed amount. It is estimated that Honest Tea’s<br />

2015 sales were $160 million.<br />

Freedom Foods<br />

Freedom Foods is an Australian food company that for<br />

more than 30 years has been producing nutritious <strong>and</strong><br />

allergen-free food. Today, its better-for-you product line<br />

includes cereals, bars, snacks, spreads <strong>and</strong> beverages.<br />

In 2009, Freedom Foods solidified its position as a leader<br />

in its region in the GMO- <strong>and</strong> allergen-free segment by<br />

constructing a 25,000-square foot production facility<br />

in New South Wales, Australia that is completely free<br />

of wheat, barley, triticale, peanuts, soy, dairy, eggs <strong>and</strong><br />

sesame seeds. Additionally, most of the company’s<br />

product ingredients are carefully sourced from family<br />

farmers in the Murrumbidgee River basin area.<br />

Freedom Foods’ 2016 revenues reached $127 million<br />

USD, 81 percent greater than the company’s total sales<br />

of $70 million USD in 2015. The company’s impressive<br />

growth <strong>and</strong> presence in Australia demonstrate that the<br />

dem<strong>and</strong> for better-for-you foods is increasing globally.<br />

Today, over 80 countries around the world have organic<br />

regulations <strong>and</strong> the US accounts for only five percent of<br />

the world’s organic acreage.<br />

6 | THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY

<strong>Truth</strong> behind the Talk<br />

Establishing <strong>and</strong> maintaining consumer trust is a never-ending priority, <strong>and</strong> requirement,<br />

for br<strong>and</strong>s that are leading in the healthy-food sector.<br />

However, there are hot-button concerns that provide<br />

fertile ground for discussion <strong>and</strong> debate, from the most<br />

heated <strong>and</strong> divisive to the most rational <strong>and</strong> inclusive,<br />

by the media <strong>and</strong> general public. These often spirited<br />

exchanges can confuse consumers <strong>and</strong>, in some cases,<br />

undermine their confidence in the sector.<br />

The following is a discussion of four top consumer<br />

concerns <strong>and</strong> the influence they are having on today’s<br />

healthy-food sector.<br />

“Natural” Claims<br />

The healthy-food sector includes unregulated “natural”<br />

products. However, “natural” has yet to be defined by<br />

the US Food <strong>and</strong> Drug Administration (FDA) or any other<br />

authoritative organization, leading to research-supported<br />

consumer uncertainty <strong>and</strong> skepticism over product<br />

claims. Consumer Reports’ National Research Center<br />

discovered that 62 percent of consumers already buy<br />

natural products <strong>and</strong> the group would also be willing to<br />

pay more for these items if they understood <strong>and</strong> trusted<br />

the natural claims. A clear majority of this group – 87<br />

percent – agreed they would pay a higher price if the<br />

natural label met their expectations.<br />

In comparison, the US Department of Agriculture<br />

(USDA) has created strict certification requirements<br />

<strong>and</strong> a national, uniform qualification st<strong>and</strong>ard for<br />

organic products, though organic products have<br />

historically generated a less positive consumer<br />

response than natural products. Despite general<br />

skepticism, there has been tremendous growth in<br />

the organic market, with sales of organic products<br />

surpassing $40 billion annually. Additionally, a 2016<br />

Organic Trade Association survey reveals that 47<br />

percent of US families are “very familiar” with the USDA<br />

organic logo, up from 27 percent in 2010.<br />

“Non-GMO is the fastest-growing food-label claim, with 15.7 percent of new products<br />

introduced in 2015 making “Non-GMO” or “GMO-free” claims – an increase from<br />

10.7 percent in 2014 <strong>and</strong> 2.8 percent in 2012. Similar strong growth is seen in organic<br />

products, with 13.5 percent of new products making organic claims in 2015, up from<br />

10.7 percent in 2014.”<br />

– MINTEL’S GLOBAL NEW PRODUCT DATABASE (GNPD)<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY | 7

<strong>Truth</strong> in Labeling<br />

In the midst of a “We Want to Know What’s in Our<br />

Food” movement, where consumers are dem<strong>and</strong>ing<br />

more product information, labeling has become a<br />

greater concern. Market Research Group’s recent<br />

Packaged Facts Consumer Survey found that 39 percent<br />

of consumers actively purchase grocery products with<br />

“GMO-free” on the labels. However, during a time when<br />

food companies are not required by law to list every<br />

ingredient, some companies use misleading claims to<br />

convince health- <strong>and</strong> socially conscious consumers to<br />

purchase their “healthy” products.<br />

For example, some br<strong>and</strong>s are committing Economically<br />

Motivated Adulteration (EMA), or Food Fraud, that<br />

involves an undeclared substitution or addition of an<br />

ingredient(s) for financial advantage. Other companies<br />

are using more specific “free of” claims in product<br />

packaging that often identify certain unwanted<br />

ingredients while including other ingredients that<br />

consumers want to avoid.<br />

MANY NEW ATTRIBUTES ARE NOW PART OF CONSUMERS’<br />

DEFINITION OF SAFETY<br />

62%<br />

Criteria not traditionally considered as part<br />

of “safety” definition<br />

51%<br />

47%<br />

42%<br />

41%<br />

Free of harmful<br />

elements<br />

Clear <strong>and</strong> accurate<br />

labeling<br />

Clear information<br />

(ingredients/<br />

sourcing)<br />

Fewer ingredients,<br />

processing,<br />

no artificial<br />

Nutritional<br />

content<br />

Source: Capitalizing on the Shifting Consumer Food Value Equation, Deloitte<br />

8 | THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY

“More than one-third of<br />

consumers (37 percent)<br />

would switch br<strong>and</strong>s if<br />

another br<strong>and</strong> shared<br />

more detailed product<br />

information.”<br />

– 2016 LABEL INSIGHT FOOD REVOLUTION<br />

STUDY<br />

Mistrust<br />

A measurable level of mistrust clouds the opinions of<br />

consumers across demographics, which undermines<br />

the credibility of food-product health <strong>and</strong> safety claims,<br />

<strong>and</strong> results in consumer reluctance to purchase healthy<br />

products. The roots of consumer mistrust can be<br />

traced to a number of causes.<br />

For example, although Genetically Modified<br />

Organisms (GMOs) were generally viewed as safe<br />

by food manufacturers, <strong>and</strong> not disclosed in food<br />

products’ ingredient labeling when introduced in 1990,<br />

controversy <strong>and</strong> consumer outrage began to occur in<br />

2013 when safety concerns heightened. Also, a 2016<br />

Stanford University study, a first-of-its-kind national<br />

sample <strong>and</strong> published in Environmental Research,<br />

unveiled a link between canned foods <strong>and</strong> exposure to<br />

hormone-disrupting chemical Bisphenol A (BPA). The<br />

highest BPA levels, in descending order, were found in<br />

canned soups, canned pasta, <strong>and</strong> canned vegetables<br />

<strong>and</strong> fruit, otherwise seemingly healthy choices.<br />

Marketplace Identity<br />

The benefits of healthy products can become diluted,<br />

or in some cases even lost, due to a large selection of<br />

similarly labeled products, such as “natural,” “green”<br />

<strong>and</strong> “organic,” among others. What follows is confusion<br />

for consumers <strong>and</strong> a lack of product differentiation for<br />

food companies.<br />

Among the ways companies can bring clarity, identity<br />

<strong>and</strong> transparency to their product offerings are through<br />

unique ingredients, specific target marketing <strong>and</strong><br />

br<strong>and</strong>ing. Companies that are focused on sustainability<br />

<strong>and</strong> community-improvement differentiate themselves<br />

by increasing their authenticity <strong>and</strong> aligning values with<br />

today’s consumers, who seek companies that offer<br />

more than low-priced better-for-you foods.<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY | 9

Big Food Dilemma<br />

Each year, food br<strong>and</strong>s launch better-for-you products that gain both significant consumer<br />

traction <strong>and</strong> loyalty as well as br<strong>and</strong> awareness.<br />

Consumer mistrust of the food system is giving rise to<br />

a number of new marketplace perceptions, trends <strong>and</strong><br />

behavior. Among the most prominent is consumers’<br />

growing belief that their food health <strong>and</strong> safety<br />

priorities would best be met not by the Big Food br<strong>and</strong>s<br />

that have been relied on, in many cases for generations,<br />

but rather by smaller br<strong>and</strong>s.<br />

Big Food companies are often laboring under<br />

monolithic, outdated legacy supply systems that were<br />

developed decades ago, while smaller companies’<br />

systems are generally newer <strong>and</strong> more aligned with<br />

consumers’ dem<strong>and</strong> for transparency. The result is<br />

nimble systems that can better accommodate the rising<br />

market for better-for-you foods.<br />

A large <strong>and</strong> growing number of consumers are br<strong>and</strong>ing<br />

Big Food companies as less in tune with their voices <strong>and</strong><br />

overly profit-driven. According to the Natural Marketing<br />

Institute, a comm<strong>and</strong>ing 72 percent of Americans<br />

believe that most food <strong>and</strong> beverage manufacturers are<br />

focused on profit rather than on health.<br />

“In the last five years, the top 10 br<strong>and</strong>ed<br />

food manufacturers lost 4.3 percent of<br />

market share mainly to smaller <strong>and</strong> midsized<br />

companies.”<br />

– COMPANIES STEP UP EFFORTS TO REVEAL MORE<br />

DETAILS ON FOOD YOU EAT, THE WALL STREET<br />

JOURNAL, MARCH 13, 2016<br />

Conversely, smaller food companies are being lauded<br />

for their strong devotion to consumer advocacy <strong>and</strong><br />

health, <strong>and</strong> for their commitment to shared values<br />

<strong>and</strong> the public interest. A recent New Hope Network<br />

survey indicates that 67 percent of consumers had a<br />

“great deal” or “quite a lot” of trust in small companies,<br />

while only 21 percent had the same degree of trust<br />

in big businesses. One of the leading reasons for this<br />

perception can be traced back to supply systems.<br />

Acceleration in Acquisitions<br />

While Big Food br<strong>and</strong>s continue to dominate sales, a<br />

recent Fortune Special Report: The War on Big Food<br />

shows that some may be struggling, with the top 25 US<br />

food <strong>and</strong> beverage companies having lost an equivalent<br />

of $18 billion in market share since 2009. What has<br />

followed is a strengthening migration to, <strong>and</strong> a host of<br />

new opportunities for, small companies, <strong>and</strong> a flurry<br />

of mergers <strong>and</strong> acquisitions by Big Food companies of<br />

smaller br<strong>and</strong>s that allows for market entry with more<br />

convenience <strong>and</strong> less risk.<br />

Dealogic reports that in 2015, food merger <strong>and</strong><br />

acquisition activity was responsible for more than<br />

$116 billion worth of deals between US companies,<br />

which st<strong>and</strong>s as the largest dollar amount in at least<br />

two decades. Also, by the middle of 2016, disclosed<br />

food <strong>and</strong> beverage deals were valued at more than $43<br />

billion, which although less than the $74 billion worth of<br />

deals during the same period in 2015, nonetheless ranks<br />

as the second-highest level overall since 2008.<br />

There are a number of food-industry acquisitions that<br />

have captured the attention <strong>and</strong> interest of large <strong>and</strong><br />

small companies alike, both within <strong>and</strong> outside the food<br />

sector, as well as among investors <strong>and</strong> members of<br />

the media.<br />

10 | THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY

GROWTH BY ACQUISITION<br />

Danone’s Acquisition of WhiteWave Foods<br />

In July 2016, Danone announced the acquisition of<br />

WhiteWave Foods for $12.6 billion, or 26.6x EBITDA.<br />

The acquisition represents a 24 percent premium over<br />

WhiteWave’s 30-day average closing price of $45.43,<br />

<strong>and</strong> the largest deal to date in the natural <strong>and</strong> organic<br />

foods industry.<br />

Danone believes the acquisition will create a unique<br />

global leader strongly aligned with consumer dem<strong>and</strong><br />

for healthier <strong>and</strong> more sustainable food <strong>and</strong> beverage<br />

options. The acquisition also provides Danone with a<br />

foothold in the fast-growing plant-based sector through<br />

the WhiteWave Silk, Alpro <strong>and</strong> Vega br<strong>and</strong>s.<br />

The company estimates that the acquisition would likely<br />

make Danone, with its Stonyfield, Horizon <strong>and</strong> Wallaby<br />

br<strong>and</strong>s, the largest buyer (by tons) of organic milk in<br />

the US. Plant-based alternatives to milk <strong>and</strong> yogurt are<br />

growing at an 11 percent Compound Annual Growth<br />

Rate (CAGR) in the US, while organic dairy is growing at<br />

eight percent.<br />

Pinnacle Foods’ Acquisition of Boulder Br<strong>and</strong>s<br />

Pinnacle Foods announced in November 2015 that it<br />

would acquire Boulder Br<strong>and</strong>s, a US food company<br />

based in Boulder, Colorado. Boulder Br<strong>and</strong>s is known<br />

for its better-for-you br<strong>and</strong>s such as Smart Balance,<br />

Udi’s, Glutino, Earth Balance, EVOL <strong>and</strong> Best Life.<br />

Pinnacle paid $967 million for Boulder Br<strong>and</strong>s, or 22.1x<br />

EBITDA. Pinnacle’s health <strong>and</strong> wellness portfolio was<br />

further exp<strong>and</strong>ed by the acquisition, <strong>and</strong> the company<br />

plans to increase EBITDA by approximately 50 percent.<br />

General Mills’ Acquisition of Annie’s<br />

In September 2014, General Mills announced its<br />

acquisition of Annie’s, a Berkeley, California-based<br />

maker of natural <strong>and</strong> organic pastas, meals <strong>and</strong> snacks.<br />

General Mills paid $821 million for Annie’s, or 38.6x<br />

EBITDA. The acquisition is expected to exp<strong>and</strong> General<br />

Mills’ presence in the US br<strong>and</strong>ed organic <strong>and</strong> naturalfoods<br />

industry, with General Mills planning to use its<br />

scale to further strengthen the Annie’s br<strong>and</strong>.<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY | 11

Hormel’s Acquisition of Justin’s<br />

In May 2016, Hormel announced its $286 million<br />

acquisition of Justin’s, a maker of natural <strong>and</strong> organic<br />

nut butter <strong>and</strong> nut butter snacks. Hormel was drawn to<br />

the company’s authentic position in the better-for-you<br />

snack category, strong management team <strong>and</strong> healthconscious<br />

customer base.<br />

Hormel expects Justin’s to grow at low doubledigit<br />

rates from a starting point of approximately<br />

$100 million in 2017 net sales. Justin’s complements<br />

Hormel’s SKIPPY br<strong>and</strong> <strong>and</strong> Hormel plans to apply<br />

its key resources, supply chain, finance <strong>and</strong> R&D<br />

capabilities to further grow the Justin’s br<strong>and</strong>.<br />

<strong>Transparency</strong> M<strong>and</strong>ate<br />

A new reality has dawned on store shelves across the US <strong>and</strong> it reflects a level of truth <strong>and</strong><br />

openness that has yet to be seen in the food sector.<br />

Coveted consumer audiences across demographics are<br />

looking to food br<strong>and</strong>s for products that meet their<br />

ever-rising st<strong>and</strong>ards for transparency, better-for-you<br />

ingredients <strong>and</strong> global citizenry. The result is a m<strong>and</strong>ate<br />

for food companies to factor those st<strong>and</strong>ards into their<br />

formulations, production, marketing <strong>and</strong> management<br />

decisions. Only then will they achieve the br<strong>and</strong><br />

recognition, repeat customers <strong>and</strong> pricing power to<br />

achieve genuine competitive advantage <strong>and</strong> long-term<br />

growth.<br />

Contact Us<br />

To learn more about how the Headwaters MB team can help you grow from the food industry’s strengthening<br />

transparency m<strong>and</strong>ate, please contact:<br />

Bill Harrison<br />

Managing Director<br />

Head of Consumer Investment Banking<br />

(917) 596.5533<br />

wharrison@headwatersmb.com<br />

Leigh Hudson<br />

Managing Director<br />

Consumer Investment Banking<br />

(415) 850.3729<br />

lhudson@headwatersmb.com<br />

Tyler Comann<br />

Managing Director<br />

Consumer Investment Banking<br />

(415) 272.2463<br />

tcomann@headwatersmb.com<br />

Shaun Kalnasy<br />

Director<br />

Consumer Investment Banking<br />

(404) 502.2946<br />

skalnasy@headwatersmb.com<br />

12 | THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY

Endnotes<br />

1<br />

2016 Label Insight Food Revolution Study<br />

2<br />

2016 Label Insight Food Revolution Study<br />

3<br />

Is GOOD Still Growing, 2015 Conscious Consumer Spending Index (Good Must Grow)<br />

About Headwaters MB<br />

Headwaters MB is an independent, middle-market investment banking firm providing strategic merger <strong>and</strong><br />

acquisition, capital-raising, <strong>and</strong> special-situations advisory services. Named Investment Bank of the Year by major<br />

industry organizations in 2014 <strong>and</strong> 2015, Headwaters MB is headquartered in Denver, CO, with six regional offices<br />

across the United States <strong>and</strong> partnerships with 18 firms covering 30 countries. For more information, visit<br />

HeadwatersMB.com.<br />

Disclosure: This newsletter is a periodic compilation of certain economic <strong>and</strong> corporate information as well as completed <strong>and</strong> announced<br />

merger <strong>and</strong> acquisition activity. Information contained in this newsletter should not be construed as a recommendation to sell or buy any<br />

security. Any reference to or omission of any reference to any company in this newsletter should not be construed as a recommendation to<br />

buy, sell or take any other action with respect to any security of any such company.<br />

We are not soliciting any action with respect to any security or company based on this newsletter. The newsletter is published solely for the<br />

general information of clients <strong>and</strong> friends of Headwaters MB, LLC. It does not take into account the particular investment objectives, financial<br />

situation or needs of individual recipients.<br />

Certain transactions, including those involving early-stage companies, give rise to substantial risk <strong>and</strong> are not suitable for all investors. This<br />

newsletter is based upon information that we consider reliable, but we do not represent that it is accurate or complete, <strong>and</strong> it should not be<br />

relied upon as such.<br />

Prediction of future events is inherently subject to both known <strong>and</strong> unknown risks <strong>and</strong> other factors that may cause actual results to vary<br />

materially. We are under no obligation to update the information contained in this newsletter. Opinions expressed are our present opinions<br />

only <strong>and</strong> are subject to change without notice. Additional information is available upon request.<br />

The companies mentioned in this newsletter may be clients of Headwaters MB, LLC. The decisions to include any company in this newsletter<br />

is unrelated in all respects to any service that Headwaters MB, LLC may provide to such company.<br />

This newsletter may not be copied or reproduced in any form or redistributed without the prior written consent of Headwaters MB, LLC. The<br />

information contained herein should not be construed as legal advice.<br />

THE RISE OF A NEW FOOD INDUSTRY MANDATE: TRUST, TRUTH AND TRANSPARENCY | 13

14 | LOHAS GOES MAINSTREAM<br />

HeadwatersMB.com