You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SPECIAL REPORT<br />

THE WORLD ECONOMY<br />

Deregulation and competition<br />

A lapse in<br />

concentration<br />

A dearth of competition among firms helps explain<br />

wage inequality and a host of other ills<br />

IN “THE FUGITIVE”, a 1960s television drama, David Janssen<br />

plays Richard Kimble, a doctor wrongly convicted of<br />

murdering his wife who escapes on the way to his execution. He<br />

claims, but cannot prove, that he encountered a one-armed man<br />

minutes before he discovered his wife’s dead body. After his escape<br />

he drifts from town to town trying to find the ghostly figure<br />

and to elude the man obsessed with recapturing him.<br />

<strong>The</strong> damage that globalisation has done to America’s economy<br />

is as obvious to some as Dr Kimble’s guilt was to his pursuers.<br />

Careful academic studies have linked competition by Chinese<br />

manufacturers to the growing propensity of prime-aged<br />

men to drop out of the labour force. A pillar of trade theory says<br />

thatincreased commerce with labour-rich countrieswill depress<br />

the pay ofthe low-skilled; and some reckonings ofwage inequality<br />

in America pin part ofthe blame on trade and migration. GDP<br />

growth has been sluggish during the long hangover from the financial<br />

crisis. <strong>The</strong> globalisation offinance provided the kindling<br />

for America’s subprime crisis and spread its effects around the<br />

world. Globalisation is on the run. But might there be another<br />

brigand who bears responsibility for its alleged crimes?<br />

An intriguing line of research identifies an increase in the<br />

incidence of economic “rents” (profits over and above the levels<br />

needed to justify investment or input of work) as a possible villain.<br />

A study last year by Jason Furman, of the Council for EconomicAdvisers(CEA),<br />

and PeterOrszag, a formerbudgetdirector<br />

for Barack Obama, found that the top 10% of firms by profit have<br />

pulled away sharply from the rest (see chart). <strong>The</strong>ir return on<br />

capital invested rose from more than three times that of the median<br />

firm in the 1990s to eight times. This is way above any plausible<br />

cost of capital and likely to be pure rent. Those high returns<br />

are persistent. More than four-fifths of the firms that made a return<br />

of25% or more in 2003 were still doing so ten years later.<br />

Otherresearch suggests that this increasingly skewed distribution<br />

ofprofits goes a longway to explainingthe rise in wage inequality.<br />

A paper in 2014 by Erling Bath, Alex Bryson, James Davis<br />

and Richard Freeman found that most of the growing<br />

Well-fed top dogs<br />

US publicly traded non-financial firms, return on invested capital*, %<br />

By percentile<br />

90th<br />

75th<br />

50th<br />

25th<br />

1963 70 75 80 85 90 95 2000 05 10 14<br />

Sources: McKinsey Solutions; Council of Economic Advisers<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

*Excluding goodwill<br />

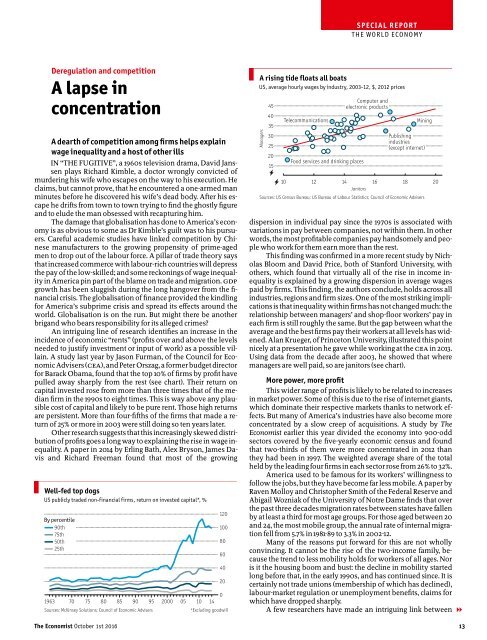

A rising tide floats all boats<br />

US, average hourly wages by industry, 2003-12, $, 2012 prices<br />

Managers<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

Internet service providers Chemical and manufacturing<br />

data pro<br />

Management Utilities of<br />

Transportation<br />

companies and<br />

equipment<br />

enterprises Petroleum manufacturing and coal products<br />

Professional<br />

Machinery Miscellaneous manufacturing<br />

Electrical Insurance and equipment@ and Technical<br />

not specified appliance services<br />

manufac manufac<br />

Beverage and tobacco products Plastics Hospitals and rubber products<br />

Primary Wholesale metals Nonmetallic and fabricated mineral metal products<br />

Textile@ apparel@ and Food Paper leather manufacturing<br />

and trade<br />

Broadcasting (except internet)<br />

Finance<br />

printing<br />

Mining<br />

Furniture and Waste fixtures management manufacturing<br />

Construction and remediation<br />

Retail trade Transportation and Wood Other<br />

warehousing products information servic services<br />

Administrative Educational Health and support care services @ except hospitals<br />

Rental and leasing services Membership associations and organizatio<br />

Telecommunications<br />

Arts@ entertainment@<br />

Motion picture and sound recording indu Real and Estate recreation<br />

Personal Repair and maintenance<br />

laundry services<br />

Social assistance Private Accomodation households<br />

Food services and drinking places<br />

Computer and<br />

electronic products<br />

Publishing<br />

industries<br />

(except internet)<br />

x=10, y=24.3<br />

x=20, y=43.9<br />

10 12 14 16 18 20<br />

Janitors<br />

Sources: US Census Bureau; US Bureau of Labour Statistics; Council of Economic Advisers<br />

dispersion in individual pay since the 1970s is associated with<br />

variations in pay between companies, not within them. In other<br />

words, the most profitable companies pay handsomely and people<br />

who workfor them earn more than the rest.<br />

This finding was confirmed in a more recent study by Nicholas<br />

Bloom and David Price, both of Stanford University, with<br />

others, which found that virtually all of the rise in income inequality<br />

is explained by a growing dispersion in average wages<br />

paid by firms. This finding, the authors conclude, holds across all<br />

industries, regions and firm sizes. One ofthe most striking implications<br />

is that inequality within firms has not changed much: the<br />

relationship between managers’ and shop-floor workers’ pay in<br />

each firm is still roughly the same. But the gap between what the<br />

average and the best firms pay their workers at all levels has widened.<br />

Alan Krueger, ofPrinceton University, illustrated this point<br />

nicely at a presentation he gave while workingat the CEA in 2013.<br />

Using data from the decade after 2003, he showed that where<br />

managers are well paid, so are janitors (see chart).<br />

More power, more profit<br />

This wider range ofprofits is likely to be related to increases<br />

in market power. Some ofthis is due to the rise ofinternet giants,<br />

which dominate their respective markets thanks to network effects.<br />

But many of America’s industries have also become more<br />

concentrated by a slow creep of acquisitions. A study by <strong>The</strong><br />

<strong>Economist</strong> earlier this year divided the economy into 900-odd<br />

sectors covered by the five-yearly economic census and found<br />

that two-thirds of them were more concentrated in 2012 than<br />

they had been in 1997. <strong>The</strong> weighted average share of the total<br />

held by the leadingfourfirms in each sectorrose from 26% to 32%.<br />

America used to be famous for its workers’ willingness to<br />

follow the jobs, but they have become farless mobile. A paperby<br />

Raven Molloy and Christopher Smith ofthe Federal Reserve and<br />

Abigail Wozniak of the University of Notre Dame finds that over<br />

the past three decades migration rates between states have fallen<br />

by at least a third for most age groups. For those aged between 20<br />

and 24, the most mobile group, the annual rate ofinternal migration<br />

fell from 5.7% in 1981-89 to 3.3% in 2002-12.<br />

Many of the reasons put forward for this are not wholly<br />

convincing. It cannot be the rise of the two-income family, because<br />

the trend to less mobility holds for workers ofall ages. Nor<br />

is it the housing boom and bust: the decline in mobility started<br />

long before that, in the early 1990s, and has continued since. It is<br />

certainly not trade unions (membership of which has declined),<br />

labour-market regulation or unemployment benefits, claims for<br />

which have dropped sharply.<br />

A few researchers have made an intriguing link between<br />

1<br />

<strong>The</strong> <strong>Economist</strong> October 1st 2016 13