You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SWLA business<br />

Creative Financing<br />

for HOME IMPROVEMENT<br />

By Tori Hebert<br />

W<br />

hen Henry Mancuso started<br />

Project Build a Future (PBAF)<br />

in 2001 he never thought it<br />

would still be a prosperous non-pr<strong>of</strong>it<br />

organization 15 years later. Henry says,<br />

“When I first started this, I thought we<br />

would build a few houses and then<br />

we could pat ourselves on the back<br />

for a job well done”. When <strong>The</strong> <strong>Voice</strong><br />

<strong>of</strong> SWLA first published about PBAF<br />

in August 2014, VOL.2, NUM.1, the<br />

organization had built almost two<br />

dozen homes and had no foreclosures.<br />

<strong>The</strong> non-pr<strong>of</strong>it has now built well over<br />

100 homes and still has seen zero<br />

foreclosures. PBAF has brought a new<br />

and creative way <strong>of</strong> financing not only<br />

to their homes, but also to the three<br />

community charter schools.<br />

To begin the process <strong>of</strong> the Lease-to-<br />

Purchase Program with PBAF, every<br />

family is required to go through a<br />

process <strong>of</strong> education to help them build<br />

financially stable practices. One <strong>of</strong> the<br />

first steps in moving toward having<br />

their first home, is for each family to<br />

meet with Home Buyer Counselor.<br />

This counselor works with the family<br />

to set a working monthly budget, and<br />

the counselor also helps the family<br />

understand their credit score and assist<br />

them in creating a Credit Repair Action<br />

Plan. This action plan helps families on<br />

their journey to repairing their credit<br />

score in order to financially help them<br />

in the long run.<br />

Once families have been able to make<br />

improvements to their credit score<br />

and they are close to being mortgage<br />

ready, families are then eligible to be a<br />

part <strong>of</strong> the Lease-to-Purchase Program.<br />

During this time, families continue to<br />

save money for their home with the<br />

help <strong>of</strong> Asset Builders. Asset Builders<br />

is a program that assist families in the<br />

down payment they can deposit at the<br />

bank towards purchasing their home.<br />

For every $1 the family saves, Asset<br />

Builders gives $4 to the family towards<br />

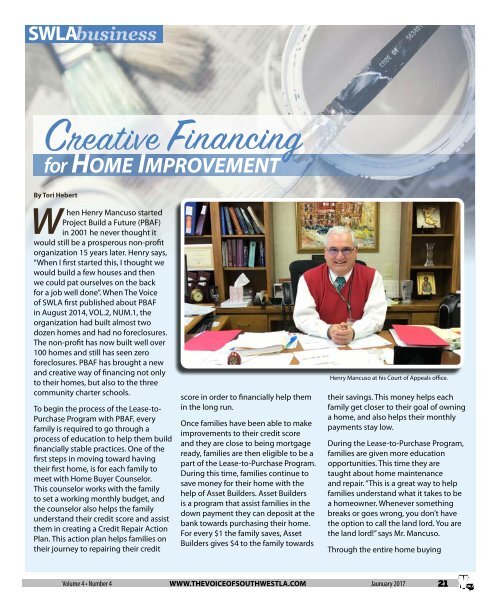

Henry Mancuso at his Court <strong>of</strong> Appeals <strong>of</strong>fice.<br />

their savings. This money helps each<br />

family get closer to their goal <strong>of</strong> owning<br />

a home, and also helps their monthly<br />

payments stay low.<br />

During the Lease-to-Purchase Program,<br />

families are given more education<br />

opportunities. This time they are<br />

taught about home maintenance<br />

and repair. “This is a great way to help<br />

families understand what it takes to be<br />

a homeowner. Whenever something<br />

breaks or goes wrong, you don’t have<br />

the option to call the land lord. You are<br />

the land lord!” says Mr. Mancuso.<br />

Through the entire home buying<br />

Volume 4 • Number 4 WWW.THEVOICEOFSOUTHWESTLA.COM Jaunuary 2017 21