Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>AIMS</strong> <strong>ASSET</strong> <strong>MANAGEMENT</strong> <strong>SDN</strong> <strong>BHD</strong> (Co.Reg. 395862-P)<br />

Suite 10.3, 10 th Floor, West Wing, Rohas PureCircle, 9 Jalan P. Ramlee, 50450 Kuala Lumpur, Malaysia<br />

Tel: +603-2381-1660 / 2161-8722 Fax: +603-2381-1770 / 2161-8730<br />

14 October 2016<br />

Kuala Lumpur<br />

Market & Portfolio Review<br />

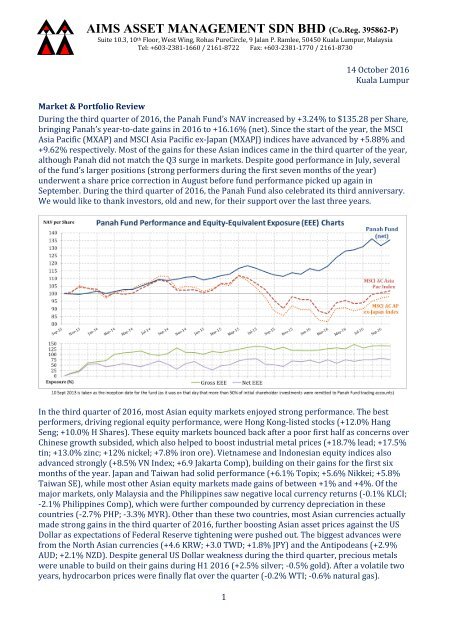

During the third quarter of 2016, the Panah Fund’s NAV increased by +3.24% to $135.28 per Share,<br />

bringing Panah’s year-to-date gains in 2016 to +16.16% (net). Since the start of the year, the MSCI<br />

Asia Pacific (MXAP) and MSCI Asia Pacific ex-Japan (MXAPJ) indices have advanced by +5.88% and<br />

+9.62% respectively. Most of the gains for these Asian indices came in the third quarter of the year,<br />

although Panah did not match the Q3 surge in markets. Despite good performance in July, several<br />

of the fund’s larger positions (strong performers during the first seven months of the year)<br />

underwent a share price correction in August before fund performance picked up again in<br />

September. During the third quarter of 2016, the Panah Fund also celebrated its third anniversary.<br />

We would like to thank investors, old and new, for their support over the last three years.<br />

In the third quarter of 2016, most Asian equity markets enjoyed strong performance. The best<br />

performers, driving regional equity performance, were Hong Kong-listed stocks (+12.0% Hang<br />

Seng; +10.0% H Shares). These equity markets bounced back after a poor first half as concerns over<br />

Chinese growth subsided, which also helped to boost industrial metal prices (+18.7% lead; +17.5%<br />

tin; +13.0% zinc; +12% nickel; +7.8% iron ore). Vietnamese and Indonesian equity indices also<br />

advanced strongly (+8.5% VN Index; +6.9 Jakarta Comp), building on their gains for the first six<br />

months of the year. Japan and Taiwan had solid performance (+6.1% Topix; +5.6% Nikkei; +5.8%<br />

Taiwan SE), while most other Asian equity markets made gains of between +1% and +4%. Of the<br />

major markets, only Malaysia and the Philippines saw negative local currency returns (-0.1% KLCI;<br />

-2.1% Philippines Comp), which were further compounded by currency depreciation in these<br />

countries (-2.7% PHP; -3.3% MYR). Other than these two countries, most Asian currencies actually<br />

made strong gains in the third quarter of 2016, further boosting Asian asset prices against the US<br />

Dollar as expectations of Federal Reserve tightening were pushed out. The biggest advances were<br />

from the North Asian currencies (+4.6 KRW; +3.0 TWD; +1.8% JPY) and the Antipodeans (+2.9%<br />

AUD; +2.1% NZD). Despite general US Dollar weakness during the third quarter, precious metals<br />

were unable to build on their gains during H1 2016 (+2.5% silver; -0.5% gold). After a volatile two<br />

years, hydrocarbon prices were finally flat over the quarter (-0.2% WTI; -0.6% natural gas).<br />

1

Panah’s +3.24% gain in Q3 2016 was achieved while running a net market exposure 1 of ~70-85%.<br />

This was slightly higher than has been the case historically, primarily because of a relatively large<br />

position in a Papua New Guinea LNG stock which was subject to a takeover bid (the investment<br />

case for this stock is described in the Q2 2016 letter to investors). This LNG company contributed<br />

around one-third of Q3 gains for the fund, as did the fund’s long-term holding in a Korean semiconductor<br />

equipment. Stocks in Vietnam also made a strong contribution to performance in the<br />

third quarter. Panah’s positions in Japan in aggregate made no overall contribution to returns over<br />

the quarter: smaller gainers were offset by a steep though healthy correction in one of the fund’s<br />

larger Japanese holdings (to which we added on weakness). The fund trimmed some of its<br />

outperforming gold stock positions earlier in Q3 (reallocating capital to less popular companies),<br />

so despite the violent sell-off in many gold stocks over the summer, Panah’s gold losers offset<br />

winners almost exactly over the quarter. The fund lost some money in HK-China, where the fund’s<br />

long value holdings came under pressure while short positions were squeezed.<br />

During the third quarter of the year, we made incremental rather than dramatic adjustments to the<br />

fund’s positioning. Early in Q3, Panah exited a modest position in a Hong Kong-listed value stock<br />

operating in the China retail sector; our divestment followed the resignation of the CEO and a loss<br />

of confidence in the company’s strategy. We also exited a small investment in a Thai financial<br />

company where we judged that management had been slow to deliver on turnaround plans, and<br />

that it would still take quite some time to set the company back on the right path. Although these<br />

stocks seemed cheap, the outlook for both was uncertain nonetheless, and we simply saw other<br />

investment opportunities as more compelling. We continued to add to core Vietnamese stock<br />

positions as lines of stock became available, increasing our position in a jewellery retailer after a<br />

correction in the stock price (this firm is described in our Q2 2016 letter to investors). We also<br />

doubled the size of our position in a well-managed Vietnamese conglomerate which operates in<br />

several sectors: as a mechanical and electrical engineering contractor, an air-con manufacturer, a<br />

real estate developer and landlord, and an investor in power and water infrastructure.<br />

In Japan, we continued to trim back the fund’s real estate stock holdings as the property cycle<br />

approaches a peak (as set out in our Q1 2016 letter to investors). Instead, we added to a<br />

longstanding holding in a Japanese consultancy company which also leverages its business<br />

expertise to make early-stage investments in smaller firms. Over the last year we have met several<br />

representatives of the company (in Japan and abroad), and are impressed by the ‘strength-indepth’<br />

of this firm’s employees, as well as their planning and execution ability. We also added to the<br />

fund’s largest Japanese holding, a power plant service company (described in the Q2 2016 letter to<br />

investors); the share price tumbled in August as the scandal-ridden parent company sold down<br />

part of its 60% stake in the firm. Although the market reaction was negative, we saw this partial<br />

divestment as good news, so added to our position at more attractive valuations.<br />

Later in the third quarter, after extremely strong liquidity-driven rallies in Asian and Emerging<br />

Markets, which seemed to be driven to a large degree by passive equity flows, 2 Panah increased its<br />

short positions in Hong Kong- and Japan-listed stocks. Many of these single stock shorts are on<br />

companies which operate in sectors subject to cyclical pressure and increasing competition, or<br />

with aggressive accounting policies which distort the economic fundamentals of these firms. (We<br />

have shorted several of these stocks before, in 2014 and 2015, before covering the positions in late<br />

2015 and early 2016 as stock markets fell.) As market volatility subsided towards the end of the<br />

third quarter, Panah also bought several cheap, out-of-the-money put options on individual stocks<br />

and indices with 3-6 months to expiry; this puts at risk ~80bps of NAV in return for substantial<br />

downside protection for the portfolio during a period when the market faces numerous risk events.<br />

1 Market exposure is stated in net ‘Equity-Equivalent Exposure’ (EEE) terms, which aggregates equity positions<br />

and adjusts non-equity positions (i.e. commodities, bonds, FX) for volatility and correlation to equities, to give a<br />

risk measure showing the Panah Fund’s equivalent exposure to equity markets.<br />

2 EM fund inflows hit a 58-week high in August: https://www.ft.com/content/4ff6670a-65c3-11e6-a08ac7ac04ef00aa.<br />

2

Portfolio Positioning<br />

In the Q1 2016 letter to investors we introduced the ‘Panah Portfolio Mind Map’, designed to help<br />

investors visualise the fund’s portfolio exposures. This received a positive reception, so we have<br />

updated the diagram and have appended it to the end of this letter. The fund’s three largest<br />

positions (each accounting for 6.5-8.5% of NAV) were described in the fund’s Q2 quarterly letter to<br />

investors: a Papua New Guinean LNG explorer; a Vietnamese jewellery retailer; and a Japanese<br />

plant service company. The top five holdings for the fund are rounded out by a Vietnamese<br />

conglomerate, and by a Japanese home centre retailer. We expect the LNG explorer will exit the<br />

portfolio sometime in the next month as a result of a successful takeover bid, although we do not<br />

anticipate any other major changes in the fund’s top holdings in the near future.<br />

At the end of the third quarter of 2016, there were no significant changes to the Panah Fund’s<br />

largest country exposures: Japan (34.2% gross, 26.4% net; consisting of ten stocks long and two<br />

stocks short), and Vietnam (33.8% gross + net; consisting of long positions in seven stocks and two<br />

closed-end funds). We presented the investment case for Japan in our Q1 2016 letter to investors…<br />

In summary, we think that despite an unenviable macro-economic backdrop – exacerbated by<br />

unpredictable and experimental monetary policy 3 – Japan has various redeeming features for<br />

equity investors. First, Japanese stocks tend to be less-widely covered by the sell-side compared to<br />

other countries in Asia, leading to more inefficiencies and thus opportunities for stock-pickers.<br />

Second, we think that the most important contribution of Abenomics might well have been the<br />

company stewardship and corporate governance codes; while progress has been slower than<br />

hoped, there have nonetheless been real improvements. Third, although foreigners have tended to<br />

be the swing equity market investors over the last decade, there is now much more involvement<br />

from domestic buyers, including the Bank of Japan and pension funds. Going forward, we expect<br />

this domestic constituency to provide more of a stabilising influence at times of market weakness,<br />

and also to get more involved in corporate governance issues. Finally, equities in Japan are cheap,<br />

and positive corporate governance pressure should help to unlock this value in coming years.<br />

The macro and investment outlook for Vietnam was set out in our Q2 2016 letter to investors…<br />

After runaway inflation, a credit bust followed in the period 2010-12; the bank recapitalisation<br />

process is now well underway, and Vietnam’s credit cycle is at a much earlier stage than in larger<br />

neighbouring SE Asian countries. Favourable demographics, cheap labour costs, and a good<br />

location near well-established trade routes mean that Vietnam is well placed to capture market<br />

share in low-end manufacturing. The recent surge in FDI and trade exports underline that over the<br />

coming decades, the country is well-placed to pursue the ‘Asian tiger’ export-manufacturing<br />

growth and urbanisation model. Vietnam’s recently signed international trade treaties provide a<br />

solid base, but it will be necessary for external conditions to remain stable in order for the country<br />

to fulfil its potential. Vietnam has been prone to boom-bust cycles in the past, and policymakers<br />

will have to work hard to maintain monetary and financial stability in the future.<br />

The size of Vietnam’s fiscal deficit is a concern, but the willingness of the new government to<br />

embrace reform is encouraging. In particular, we are impressed by the recent government<br />

decisions to divest of its 45% Vinamilk stake (shortly after the Foreign Ownership Limit for this<br />

stock was lifted), and to sell its stakes in the two SOE beer companies (Sabeco and Habeco) to the<br />

highest bidder. 4 This will not only reduce the fiscal deficit, but these brewers should also be run<br />

3 The latest policy initiatives from the Bank of Japan (announced on 21 September) involve: further equity<br />

purchases; enhanced ‘yield curve control’ (i.e. holding short rates negative but the 10yr bond at ~0%, presumably<br />

to reduce pressure on financial firms); and the removal of a time constraint for hitting a 2% CPI target (the<br />

monetary base will keep expanding until such time as the CPI target is exceeded). There has been a fairly subdued<br />

market reaction to such a radical announcement, perhaps because these initiatives present an uncertain path for<br />

monetary policy. Indeed, one could imagine a scenario of unlimited bond purchases (i.e. if bond yield rise) which<br />

might threaten currency stability, or even the tapering of bond purchases (e.g. in a higher inflation environment).<br />

4 http://www.scmp.com/business/companies/article/2012798/vietnam-sell-stake-prized-beer-companiessabeco-and-habeco.<br />

3

more efficiently with involvement from professional managers. Vietnam’s stock market valuations<br />

were extremely low last year; after a strong rally, multiples have now increased towards average<br />

valuations for Asian regional markets. Although certain areas of the Vietnamese market now do<br />

look frothy (e.g. real estate and certain small caps), the secular growth outlook remains strong.<br />

Given limited market liquidity and availability of stock, it makes sense to retain positions in<br />

attractive franchises with good long-term growth potential. New IPOs and SOE divestments will<br />

likely mean a reasonably strong supply of new stock hitting the market in 2017, which will require<br />

new investors to step up. If handled properly, increased liquidity should attract more international<br />

institutional investors, and help move Vietnam from MSCI Frontier status towards the MSCI<br />

Emerging Market Index. A virtuous cycle?<br />

With around one third of the portfolio in Japan, and another third in Vietnam, investors may be<br />

forgiven for asking whether Panah is pursuing a “barbell” strategy of ‘Japan value’ v ‘Vietnam<br />

growth’? This might seem a slick description of Panah’s allocations, though in reality this is not an<br />

accurate characterisation of portfolio positioning. In Japan, Vietnam, and indeed throughout our<br />

investment universe, we prioritise investing in well-managed companies with solid balance sheets,<br />

strong cash flows and respectable long-term growth prospects. Low valuations provide a necessary<br />

though not sufficient margin of safety, as it is also important to have an appreciation of why such<br />

market inefficiencies exist. While we favour ‘compounder’ companies which are able to reinvest<br />

their cash flows at a high rate of return over the long-haul, Panah also occasionally makes ‘deep<br />

value’ investments in companies with substantial ‘balance sheet protection’ (e.g. when net cash or<br />

net-net working capital exceed market cap) and where we are also fairly confident that a catalyst is<br />

imminent. We have made such deep value investments in various markets, including Japan,<br />

Vietnam, Taiwan, Hong Kong, and Papua New Guinea, and have also invested in compounders<br />

throughout the region. (On the Panah Fund Mind Map, dark green circles indicate stock positions<br />

with a deep value-catalyst investment thesis, whereas lighter green circles represent the similarly<br />

geographically-diversified ‘compounders’. However, note this classification is not always clear-cut!)<br />

There are no other major country concentrations in the portfolio; most other holdings are spread<br />

fairly evenly across other Asian markets. There is one notable sector allocation towards a selection<br />

of precious metal companies (accounting for 7.1% of NAV at end-Sept 2016, in five stocks). Since<br />

Panah started investing in the gold sector (in late 2015), we have become increasingly disillusioned<br />

with the quality of management in the sector. The managers of many gold-miners apparently find it<br />

hard to resist the siren song of avaricious investment bankers, hurrying to issue shares after any<br />

significant rally in their stock price, almost regardless of whether this is necessary or advisable<br />

from a business perspective. For long-suffering shareholders, all too often this means unnecessary<br />

dilution. As one experienced gold investor so memorably commented: “Gold companies issue more<br />

paper than the Fed!” Or, for that matter, any of the G3 central banks.<br />

We have little patience for weak gold mine managers and their ballooning share counts. Of the<br />

seven precious metal companies in which Panah has invested in 2016, the managers of three firms<br />

have displayed symptoms of premature issuance. In each case, our response has been to make our<br />

displeasure known, and then reduce and eventually divest of each holding, reallocating our profits<br />

towards positions in companies with a more attractive outlook, run by managers who demonstrate<br />

more restraint (we hope). As always, it helps if management also owns a reasonable amount of<br />

stock to give them ‘skin in the game’. Despite recent volatility in real interest rates and gold prices,<br />

we believe that there is a strong valuation and macro case for allocating a small part of the fund to<br />

precious metal stocks. However, we do not anticipate that the fund’s total allocation towards this<br />

sector will exceed the size of a single ‘conviction holding’ within the portfolio (i.e.

China: How I Learned to Stop Worrying and Love the Debt<br />

China is currently undergoing a brief cyclical upturn amid a longer-term structural slowdown in<br />

the economy. The most salient features of this upturn have been a sharp spike in real estate prices,<br />

and aggressive credit growth since the economy bottomed out in Q1 2015. After critical comments<br />

from an ‘authoritative person’ in May concerning unsustainable debt accumulation driving<br />

investment and growth, 5 foreign investors questioned whether the authorities would move to<br />

tighten macro policy, thereby crimping growth and increasing the probability of volatility in<br />

financial markets. A few months on, however, it is clear that President Xi Jinping’s ambitious 6.5%<br />

GDP growth target is intact. Apparently the most certain way to reach this goal is by keeping the<br />

credit taps turned on, regardless of the long-term costs of such a policy. Indeed, credit growth is<br />

still running at ~2.5x the pace of GDP growth, and so aggregate debt levels continue to increase. It<br />

is now widely accepted that China’s debt-to-GDP ratio has reached ~250%, a rise of more than<br />

100% since 2009. 6 There is no deleveraging in sight. Interest rates are being held at low levels to<br />

keep debt service costs under control.<br />

In the past we have likened the debt game in China to ‘whack-a-mole’, with the authorities<br />

struggling to keep up with the latest innovative forms of credit which pop up everywhere. Over the<br />

last two years, there has been a rapid increase in ‘non-loan assets’ on the balance sheets of the city<br />

commercial and joint stock banks, and in many cases these now exceed the size of these banks’ loan<br />

books. 7 These non-loan assets mostly take the form of ‘investments’ and ‘receivables’, and have<br />

often been created with help from Trusts and other Non-Bank Financial Institutions (NBFIs).<br />

Although these ‘non-loan assets’ might not be loans by name, by nature they are remarkably similar<br />

to loans. Unsurprisingly, the regulatory-mandated levels of disclosure regarding these quasi-loans,<br />

as well as recognition of impairments and required provisioning, are much less than for official<br />

loans. This presumably explains why China’s lower tier banks have been so keen to reclassify loans<br />

as instruments such as ‘Trust Beneficiary Rights’ and ‘Directional Asset Management Plans’. As a<br />

result, China’s weaker banks seem to be presenting a flattering view of their own asset quality,<br />

which also has implications for system-wide Non-Performing Loan (NPL) numbers.<br />

While China’s ‘big four’ state-owned commercial banks do not appear to have significant issues in<br />

this regard, many lower tier banks do appear to have problems. We recently identified one small<br />

bank with a shrinking loan book and an NPL ratio as low as 0.5%, but which has seen runaway<br />

growth of +73% in financial investments over the last year (exposed to real estate and resources in<br />

the north-east of China), which now account for ~50% of total assets (i.e. larger than the loan<br />

book). At the same time, this city commercial bank is experiencing funding issues and was recently<br />

forced to access an emergency liquidity line from the central bank. Despite these red flags, this<br />

institution (listed in Hong Kong) was recently trading at a price-to-book ratio of more than 1.0x. No<br />

matter what happens to the broader banking sector in China, we expect that it will be necessary for<br />

this bank to raise significant equity in the near-term, likely causing a substantial dilution for<br />

existing shareholders. The Panah Fund has recently established a short position on the stock.<br />

The Market-Cycle Diaries<br />

In previous letters to investors, we noted that China’s real estate cycle bottomed out in early 2015.<br />

So far this year (to the end of August), a record 875m sq m of property floor space has been sold in<br />

China, a year-on-year increase of +25.5% (this growth rate was as high as +36.5% at the end of<br />

April). House prices in Tier 1 cities, where supply has been tightest, have been rising at an average<br />

pace of ~30% year-on-year (with even more rapid rises in certain cities such as Shenzhen and<br />

Shanghai), while house prices in Tier 2 cities have been approaching double-digit average y-o-y<br />

5 This ‘authoritative person’ (presumed to be Liu He, an advisor to President Xi) published an article in the<br />

People’s Daily on 9 May. For highlights, see: http://www.bloomberg.com/news/articles/2016-05-09/china-sauthoritative-warning-on-debt-people-s-daily-excerpts.<br />

6 The experts differ on the exact numbers, but all of them now seem to agree that there is a problem:<br />

http://ftalphaville.ft.com/2016/10/12/2177069/in-search-of-chinas-hidden-credit/.<br />

7 Jason Bedford at UBS has been the most assiduous analyst of such developments within China’s banking system.<br />

5

gains. The price advances in Tier 3 cities have been much slower, only just creeping into positive y-<br />

o-y territory in Q2 2016, apparently reflecting higher inventory levels in China’s regional cities.<br />

During the last month there have been targeted tightening announcements in some Tier 1 cities<br />

where price advances have been most extreme (e.g. higher down-payments, and restrictions on<br />

buying second and third properties), but not across the entire country.<br />

Given elevated inventory levels in China’s lower tier cities, the rebound in housing starts has been<br />

much slower compared to previous real estate cycles, which in turn has been reflected in lacklustre<br />

demand for raw materials. Indeed, this seems to have been one of the main reasons that Chinese<br />

growth has been so slow to pick up despite the massive credit impulse over the last 18 months.<br />

Policymakers are still actively promoting inventory destocking across the country, and households<br />

have been encouraged to take on more debt to buy housing. More than 70% of new bank loans<br />

made in July and August were for new mortgages. 8 Such developments seem to imply that China’s<br />

authoritative person and his concerns over rapidly rising debt are being disregarded. Indeed,<br />

statements from other policymakers have emphasised that deleveraging is too risky, and even if<br />

corporate indebtedness seems high, there is still room for the central government and households<br />

to pick up the slack. 9 With such a view apparently gaining ascendancy, we see no reason that<br />

China’s credit-driven stimulus should stop any time soon.<br />

Even if China’s real estate market is now past its peak (with selective tightening measures being<br />

implemented in the frothiest regions), economic activity still seems likely to pick up in coming<br />

quarters in a ‘delayed reaction’, as property inventories finally fall and real estate developers get<br />

back to work. This should support demand for raw materials and support Chinese growth in the<br />

coming months. To some extent – given high valuations in onshore stocks, as well as the recent<br />

rally in HK stocks and most industrial metals – it might be said that China-related markets are<br />

already pricing in a cyclical rebound scenario. Indeed, the rally in commodity prices this year does<br />

seem to reflect a tighter supply-demand dynamic, and we would be unsurprised to see resource<br />

stocks make further gains in coming months. However, China’s wild stock market gyrations have<br />

seemed increasingly detached from fundamentals in recent years –how much sense does it make to<br />

ask whether equities reflect underlying economic growth and liquidity conditions?<br />

China’s domestic equity markets went on a tear from mid-2014, rallying aggressively for the next<br />

12 months even as most measures of Chinese activity and credit fell precipitously into early 2015.<br />

Towards the peak of this bubble, domestic markets also exerted a gravitational pull on Hong Kong<br />

stocks, which spiked in Q2 2015. Note that this does not seem to have been a case of equity prices<br />

moving ahead of the economy: stocks in China and HK peaked at the end of Q2 2015 before<br />

plunging over the next nine months, even as economic growth turned up. Part of the collapse in<br />

stock prices reflected a sudden loss of confidence in policymaker competence, given their role in<br />

inflating and supporting the 2015 stock bubble and then their notable lack of communication<br />

during the sudden Renminbi devaluation. Nonetheless, all too often China’s domestic stocks are led<br />

by sentiment and speculation (driving multiple expansion and contraction), rather than by<br />

earnings and fundamental data. Perhaps this is unsurprising given that broader monetary<br />

aggregates still dwarf the country’s equity market capitalisation, allowing money flows to reign<br />

supreme. Will Hong Kong now have to get used to this ‘casino’ dynamic as more channels open up<br />

for onshore capital to flow south? Maybe, but we hope that over time, the growing onshore<br />

institutional investor base will succeed in taming the market’s wildest excesses.<br />

Apocalypse When?<br />

Those predicting an imminent debt bust and a financial crisis in China have been frustrated by<br />

recent developments. When will the unsustainable debt accumulation come to an end? What will<br />

force a ‘final reckoning’? In most debt crises, it is not just the absolute level of debt which causes a<br />

8 http://www.reuters.com/article/us-china-economy-loans-idUSKCN11K15T.<br />

9 http://www.bloomberg.com/news/articles/2016-06-23/china-rapid-deleveraging-can-bring-new-risks-says-<br />

government.<br />

6

meltdown, but rather a rapid increase in debt over a short period of time, funded by liability<br />

positions which prove to be unstable and trigger a crisis when they are unwound. Many Emerging<br />

Market debt crises have involved a massive rise in external liabilities (i.e. foreign currency debt),<br />

but when these lenders realise that this debt cannot be serviced, the withdrawal of foreign capital<br />

causes a collapse in the exchange rate and domestic asset prices (e.g. the 1997 Asian Crisis).<br />

Although China’s authorities came close to triggering widespread capital flight early in 2016, on<br />

balance this sort of crisis seems less likely for China in the near-term given the substantial fall in<br />

the country’s cross-border net liabilities from late 2014 to early 2016, 10 as well as the substantial<br />

tightening of capital controls since earlier this year. 11 (However, that is not to say that banks and<br />

other financial institutions in US Dollar-pegged Hong Kong won’t suffer as the credit quality of their<br />

cross-border debt exposures to mainland China deteriorates, and as the Renminbi weakens.)<br />

Another flavour of debt crisis involves an unsustainable build-up in domestic debt, increasingly<br />

funded by short-term and unstable liabilities, until a ‘Minsky Moment’ arrives to trigger the crisis<br />

(e.g. the 2008 Lehman Crisis, characterised by a mismatch between longer-term poor quality<br />

mortgage-assets, and short-term wholesale financing liabilities). We would not rule out such a<br />

crisis in China at some point, given the recent proliferation of short-term liabilities within NBFIs,<br />

together with their complex and growing links to China’s lower tier banks. A lack of reliable data<br />

means that it is difficult to predict in advance exactly when a crisis of this sort might occur, and so<br />

we think it makes more sense to focus on early-warning signs. 12 Real estate serves as collateral for<br />

most loans, so property prices are an important determinant of asset quality. Given the vital role<br />

that debt plays in greasing the wheels of the economy (and allowing property prices to levitate), a<br />

contraction in credit presents serious risks, and we are extremely sensitive to potential policy<br />

errors arising from ‘overtightening’. It is thus important to keep an eye on broader credit<br />

aggregates and regulatory initiatives (e.g. to rein in NBFIs or bring quasi-debt back on bank balance<br />

sheets), and monitor the more vulnerable and opaque parts of the system, e.g. corporate bond<br />

yields and default rates, as well as asset quality and funding stress among weaker banks and NBFIs.<br />

If these are the risks, we also see plenty of things to be optimistic about as long-term equity<br />

investors in the Greater China region. The opening up of the Shanghai and Shenzhen stock markets<br />

to foreign investors should, over time, provide numerous interesting investment opportunities. The<br />

Shanghai-Hong Kong Stock Connect currently allows northbound investors to access 686 stocks<br />

with a total market capitalisation of US ~$3.9t, while the Shenzhen-Hong Kong Connect launch,<br />

slated for late 2016, will bring more investment opportunities. 13 We have started to do our<br />

homework on various China domestic-listed stocks that match the fund’s quality criteria. It is still<br />

early days, but as yet we have not found any quality domestic China stocks trading at sufficiently<br />

attractive valuations for us to get involved. Our work continues nonetheless, and we are cautiously<br />

confident that in the coming months and years we will be able to find good quality domesticallylisted<br />

China stocks trading at valuations which also provide a sufficient margin of safety.<br />

In the meantime, our long exposure to China consists of two ‘deep value’ positions in China stateowned<br />

enterprises (in shipping and telecoms) where we are also hopeful of imminent stockspecific<br />

catalysts. We also have a small position in a niche Taiwanese consumer company which has<br />

10 Many Chinese companies paid down their US Dollar loans over this period, exchanging them for Renminbi debt.<br />

For more details, see: http://www.bis.org/publ/qtrpdf/r_qt1603u.htm.<br />

11 Despite the tightening of capital controls, it is interesting to note that capital outflows still continue (albeit in<br />

smaller size since the Renminbi panic subsided). China has a current account surplus and should be accumulating<br />

US ~$250b in foreign exchange reserves a year. However, forex reserves have been flat (rather than rising) since<br />

the Renminbi panic subsided in Q1 2016, which suggests that outflows continue, albeit in smaller size.<br />

12 Some commentators have predicted that a crisis is still many years away, as the Loan-to-Deposit Ratio (LDR) for<br />

China’s financial system is substantially lower than for other countries which have experienced debt crises in the<br />

past. However, we do not have strong confidence in this approach, not least because there is wide variation in the<br />

figures for system-wide LDRs calculated by different economists (presumably because of data issues), and since<br />

China also has somewhat unusual and convoluted financial market ‘plumbing’.<br />

13 This compares to 3,905 listed stocks in Japan with a combined market cap of US $5.8t.<br />

7

ecently launched what we anticipate will be a successful expansion to Mainland China. Offsetting<br />

these long positions, we have various single stock shorts on HK-listed firms which we think will<br />

come under pressure as the credit cycle progresses, and which in some cases have also adopted<br />

aggressive accounting policies which we think do not reflect the underlying economic<br />

fundamentals of their businesses.<br />

Thoughts on the last three years, and what to expect for the next three…<br />

Panah’s recent birthday has been a time for reflection on what has changed in the markets and in<br />

our investment approach over the last three years. I moved to Malaysia to set up the Panah Fund in<br />

May 2013, which was also the month when Asian equities tumbled by ~15% – the so-called ‘Taper<br />

Tantrum’ – as investors panicked that the Federal Reserve was about to tighten monetary policy<br />

aggressively. By the time that Panah was born in September 2013, Asian equity markets were in<br />

the midst of a sharp rebound. Since that time, the Fed has only succeeded in raising interest rates<br />

on one occasion (by a meagre 0.25%), and the regional MSCI Asian equity index is flat. Instead, the<br />

big global investment stories have instead been all about the dominance of US Dollar-denominated<br />

assets, as well as the extraordinary central bank-fuelled rally in G3 bonds. That’s not to say it has<br />

been impossible to make money in Asia during this period. Since 2013, the notable Asian equity<br />

market outperformers have been the Indian stock market (from late-2013 to early-2015), China’s<br />

Shenzhen index (from mid-2014 to mid-2015), and Vietnam (in 2016), all of which have returned<br />

more than 35% in USD-terms. In an uncertain world, it pays to be selective.<br />

One of our recurring concerns over the last three years has been that overly loose monetary policy,<br />

in all so-called Developed Markets and many Emerging Markets too, has managed to inflate asset<br />

prices and also perpetuate excess capacity in numerous industries by delaying the exit of<br />

overleveraged and uncompetitive firms. Looking out of the window here in Kuala Lumpur as I<br />

write, this point is forcefully illustrated by the preponderance of empty tower blocks and cranes<br />

dotting the horizon. It is also true of other sectors in other countries. But this has been the case for<br />

quite some time, so when will these imbalances correct? What to expect for the next three years?<br />

Perhaps the best investment scenario we can hope for is ‘more of the same’, with loose monetary<br />

allowing equity valuations to drift slowly higher, even if growth disappoints. However, there are<br />

various reasons that such a benign outlook might prove to be too optimistic. Even if the current US<br />

expansion approaches the length of the previous longest post-war expansion on record (1991-<br />

2001), a US recession at some point in the next three years does not seem unlikely. Such a<br />

downturn might well be triggered by more monetary tightening from the Federal Reserve, which<br />

seems likely to increase interest rates again within the next couple of quarters. A resurgence in<br />

stagflation (i.e. a combination of higher inflation and lacklustre growth) would present serious<br />

challenges to monetary policymakers, with the potential to trigger a more aggressive tightening<br />

cycle than markets are currently expecting. The fragile nature of China’s debt-fuelled expansion<br />

raises the stakes, and increases the likelihood of a global downturn when imbalances do start to<br />

correct. More generally, increases in inequality around the world are fuelling scepticism about<br />

globalisation. Increased geopolitical tensions further increase uncertainty.<br />

Whereas the response to the Great Financial Crisis of 2008 has been dominated by aggressive<br />

action from central banks, there is now a growing perception that the negative side-effects of their<br />

policies are unacceptable. The response to a future downturn will likely involve more heavy-lifting<br />

from G3 fiscal authorities (if indeed this does not begin before the next recession), with a<br />

reasonable chance of seeing an attempt at coordinated fiscal and monetary policy. The key question<br />

would then be whether sovereign bond markets respond favourably to such developments, which<br />

will probably vary country-by-country depending on perceptions of fiscal sustainability.<br />

Given the uncertain and potentially hostile investment outlook, we reaffirm Panah’s bias towards<br />

investing in well-run companies with solid balance sheets, strong cash flows, respectable long-term<br />

growth prospects, and reasonable valuations. Over the last three years, it has struck us how hard it<br />

is to find firms which genuinely fit these criteria. When we do find such companies, and as we get to<br />

8

know management better and build conviction in our investment thesis, we have become<br />

increasingly comfortable to build larger position sizes. As for stock-specific shorts, Panah has had<br />

mixed success since inception. We have made money from ‘capital cycle’ shorts on companies<br />

operating in excess capacity industries. However, we have lost money by shorting expensive stocks<br />

with strong investor followings; even negative catalysts rarely seem to do much damage for long, as<br />

these stocks tumble briefly before trading back up to higher multiples. Over the last year, we have<br />

put more effort into finding single stock shorts on companies with questionable accounting<br />

techniques which we think misrepresent the economic realities of the business. We have had some<br />

initial modest success in this area, and will continue to persevere in the expectation that the size of<br />

the ‘bezzle’ 14 will become apparent in the next downturn. The fund’s small allocation towards gold<br />

stocks should be seen as a tail-hedge with substantial portfolio utility. Finally, we have found that<br />

well-placed macro hedges not only provide capital protection, but can also pay off at just the right<br />

time, allowing Panah to reinvest hedging profits into core long positions during a market<br />

correction when many of these core holdings are trading at more attractive valuations.<br />

No matter what the next three years hold, we have little doubt that the investment journey will be<br />

an interesting one with plenty of unexpected twists and turns along the way. Panah will proceed<br />

with prudence.<br />

Andrew Limond<br />

Disclaimer… This document contains general information on <strong>AIMS</strong> Asset Management Sdn Bhd (“<strong>AIMS</strong>”) and the Panah Fund (“the Fund”). This<br />

presentation is not an offer to sell nor a solicitation of an offer to purchase interests of the Fund. <strong>AIMS</strong> reserves the right to change any terms of the<br />

offering at any time. Offers and sales of interests in the Fund will be made only pursuant to a confidential Private Offering Memorandum, complete<br />

documentation of the relevant Fund and in accordance with the applicable securities laws, and this presentation is qualified in its entirety by reference<br />

to such documentation, including the risk factors and conflicts of interest disclosure set forth therein. This presentation is strictly confidential and<br />

intended exclusively for the use of the person to whom it was delivered by the Manager. This presentation may not be reproduced or redistributed in<br />

whole or in part.<br />

The content of this presentation is for information purposes only and is directed at institutional, professional and sophisticated investors able to<br />

understand and accept the risks involved. It has been prepared using publicly available information, internally developed data and other sources<br />

believed to be reliable. It does not constitute an offer or solicitation to any person in any jurisdiction to purchase or sell any investment, nor does it<br />

constitute investment advice. Whilst <strong>AIMS</strong> has used all reasonable endeavours to ensure that the information in this presentation is accurate and up-todate,<br />

it gives no warranties or representations as to the reliability, accuracy and completeness of any such information. <strong>AIMS</strong> accepts no liability for<br />

any damage or loss, whether direct, indirect or consequential, in respect of any use of or reliance on the content of this presentation. The views<br />

expressed and the information contained in this presentation may be subject to change at any time without notice. This document is intended for the<br />

sole use of the intended recipients and its content may not be copied, published or otherwise distributed.<br />

Investment risks… An investment in the Fund is speculative and involves a high degree of risk. Past performance of a fund is no indication of future<br />

performance. Investment results may vary substantially over time and there can be no certainty that the investment objectives of the Fund will be<br />

achieved. The Fund discussed in this presentation may not be suitable for all investors. The value of investments and the income from them cannot be<br />

guaranteed. Investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. The assets of the<br />

Fund mentioned in this presentation may be in a variety of currencies and currency fluctuations may therefore affect the value of an investor’s holding.<br />

Please refer to the Private Offering Memorandum for a more comprehensive statement of risks associated with the Fund. If you require information<br />

about the suitability of the Fund, you are advised to seek independent financial advice.<br />

Jurisdictional notice… The material in this presentation is directed only at entities or persons in jurisdictions or countries where access to and use of<br />

this information is not contrary to local laws or regulations. It is the responsibility of each individual investor to be aware of and to observe all<br />

applicable laws and regulations of any relevant jurisdiction.<br />

Information for investors in the United Kingdom… In the UK, this communication is only available to and directed at persons who are “investment<br />

professionals” or “high net worth companies, unincorporated associations, etc.”, as defined in Article 19 and Article 49 of the FSMA 2000 (Financial<br />

Promotion) Order 2005 (as amended). Only persons falling within these definitions are able to invest in the Panah Fund. If you do not fall within these<br />

definitions, you should alert <strong>AIMS</strong> Asset Management of this, and should not place any reliance on this communication or act upon it. This<br />

communication has not been approved by an authorised person in the UK.<br />

Information for investors in Switzerland… Representative: The representative in Switzerland is PVB Pernet von Ballmoos AG, Bellerivestrasse 20,<br />

8008 Zurich.Paying Agent: The paying agent in Switzerland is Neue Helvetische Bank, Seefeldstrasse 215, 8008 Zurich. Reference point of important<br />

documents: The fund’s legal documents (e.g. private offering memorandum, articles of association) as well as its audited financial statements may be<br />

obtained free of charge from the representative. Place of performance and court of jurisdiction: In respect of the units sold in and distributed from<br />

Switzerland, the place of performance and the court of jurisdiction have been established at the registered office of the representative. Domicile of the<br />

fund: Cayman Islands.<br />

14 https://www.project-syndicate.org/commentary/asset-bubbles-price-boom-by-john-kay-1-2015-<br />

10?barrier=true.<br />

9

Panah Portfolio Mind Map<br />

Q3 2016<br />

Digitalisation<br />

of automobiles<br />

Smartphone<br />

Commoditisation<br />

TECH<br />

Ageing<br />

society<br />

JAPAN<br />

Corporate<br />

governance reforms<br />

Retail<br />

Power<br />

Electricity market<br />

liberalisation<br />

Closedend<br />

Funds<br />

VIETNAM<br />

Power &<br />

Utilities<br />

Trade treaties<br />

Construction<br />

& Real Estate<br />

FDI<br />

Infrastructure<br />

Investment<br />

Semi-con<br />

Evolution<br />

Security<br />

concerns<br />

Real Estate<br />

Consulting<br />

VC<br />

IT<br />

Positive<br />

demographics<br />

Japan QE & NIRP<br />

Shipping<br />

CHINA<br />

SOE reform<br />

Telco<br />

Long position<br />

DM Monetary<br />

Policy<br />

Precious Metals<br />

Real Estate, Banks,<br />

Retail<br />

Pharma<br />

Jewellery<br />

Retail<br />

Long (deep value)<br />

SINGAPORE & HK<br />

Short position<br />

Size of bubbles represents<br />

approximate size of position<br />

Consolidation<br />

in oil and gas<br />

LNG<br />

M&A<br />

RESOURCES<br />

Renminbi<br />

China Structural<br />

Slowdown<br />

US Interest<br />

Rates<br />

Thematic<br />

stocks with<br />

problems<br />

EM GROWTH<br />

Mature<br />

credit cycle<br />

Consumption<br />

growth