nex-ar2015-full

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statements<br />

Notes to the Consolidated Accounts continued<br />

For the year ended 31 December 2015<br />

13 Intangible assets continued<br />

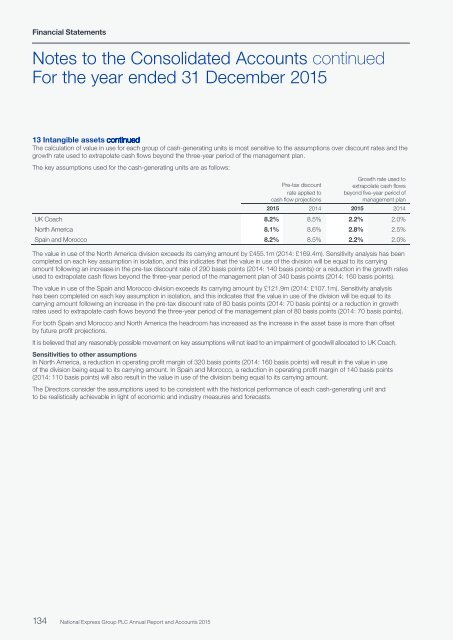

The calculation of value in use for each group of cash-generating units is most sensitive to the assumptions over discount rates and the<br />

growth rate used to extrapolate cash flows beyond the three-year period of the management plan.<br />

The key assumptions used for the cash-generating units are as follows:<br />

Pre-tax discount<br />

rate applied to<br />

cash flow projections<br />

Growth rate used to<br />

extrapolate cash flows<br />

beyond five-year period of<br />

management plan<br />

2015 2014 2015 2014<br />

UK Coach 8.2% 8.5% 2.2% 2.0%<br />

North America 8.1% 8.6% 2.8% 2.5%<br />

Spain and Morocco 8.2% 8.5% 2.2% 2.0%<br />

The value in use of the North America division exceeds its carrying amount by £455.1m (2014: £169.4m). Sensitivity analysis has been<br />

completed on each key assumption in isolation, and this indicates that the value in use of the division will be equal to its carrying<br />

amount following an increase in the pre-tax discount rate of 290 basis points (2014: 140 basis points) or a reduction in the growth rates<br />

used to extrapolate cash flows beyond the three-year period of the management plan of 340 basis points (2014: 160 basis points).<br />

The value in use of the Spain and Morocco division exceeds its carrying amount by £121.9m (2014: £107.1m). Sensitivity analysis<br />

has been completed on each key assumption in isolation, and this indicates that the value in use of the division will be equal to its<br />

carrying amount following an increase in the pre-tax discount rate of 80 basis points (2014: 70 basis points) or a reduction in growth<br />

rates used to extrapolate cash flows beyond the three-year period of the management plan of 80 basis points (2014: 70 basis points).<br />

For both Spain and Morocco and North America the headroom has increased as the increase in the asset base is more than offset<br />

by future profit projections.<br />

It is believed that any reasonably possible movement on key assumptions will not lead to an impairment of goodwill allocated to UK Coach.<br />

Sensitivities to other assumptions<br />

In North America, a reduction in operating profit margin of 320 basis points (2014: 160 basis points) will result in the value in use<br />

of the division being equal to its carrying amount. In Spain and Morocco, a reduction in operating profit margin of 140 basis points<br />

(2014: 110 basis points) will also result in the value in use of the division being equal to its carrying amount.<br />

The Directors consider the assumptions used to be consistent with the historical performance of each cash-generating unit and<br />

to be realistically achievable in light of economic and industry measures and forecasts.<br />

134 National Express Group PLC Annual Report and Accounts 2015<br />

134