nex-ar2015-full

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

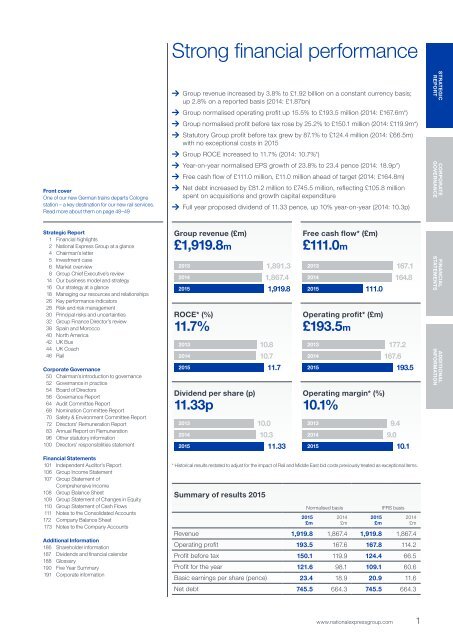

Strong financial performance<br />

Front cover<br />

One of our new German trains departs Cologne<br />

station – a key destination for our new rail services.<br />

Read more about them on page 48–49<br />

Group revenue increased by 3.8% to £1.92 billion on a constant currency basis;<br />

up 2.8% on a reported basis (2014: £1.87bn)<br />

Group normalised operating profit up 15.5% to £193.5 million (2014: £167.6m*)<br />

Group normalised profit before tax rose by 25.2% to £150.1 million (2014: £119.9m*)<br />

Statutory Group profit before tax grew by 87.1% to £124.4 million (2014: £66.5m)<br />

with no exceptional costs in 2015<br />

Group ROCE increased to 11.7% (2014: 10.7%*)<br />

Year-on-year normalised EPS growth of 23.8% to 23.4 pence (2014: 18.9p*)<br />

Free cash flow of £111.0 million, £11.0 million ahead of target (2014: £164.8m)<br />

Net debt increased by £81.2 million to £745.5 million, reflecting £105.8 million<br />

spent on acquisitions and growth capital expenditure<br />

Full year proposed dividend of 11.33 pence, up 10% year-on-year (2014: 10.3p)<br />

STRATEGIC<br />

REPORT<br />

CORPORATE<br />

GOVERNANCE<br />

Strategic Report<br />

1 Financial highlights<br />

2 National Express Group at a glance<br />

4 Chairman’s letter<br />

5 Investment case<br />

6 Market overview<br />

8 Group Chief Executive’s review<br />

14 Our business model and strategy<br />

16 Our strategy at a glance<br />

18 Managing our resources and relationships<br />

26 Key performance indicators<br />

28 Risk and risk management<br />

30 Principal risks and uncertainties<br />

32 Group Finance Director’s review<br />

38 Spain and Morocco<br />

40 North America<br />

42 UK Bus<br />

44 UK Coach<br />

46 Rail<br />

Corporate Governance<br />

50 Chairman’s introduction to governance<br />

52 Governance in practice<br />

54 Board of Directors<br />

56 Governance Report<br />

64 Audit Committee Report<br />

68 Nomination Committee Report<br />

70 Safety & Environment Committee Report<br />

72 Directors’ Remuneration Report<br />

83 Annual Report on Remuneration<br />

96 Other statutory information<br />

100 Directors’ responsibilities statement<br />

Financial Statements<br />

101 Independent Auditor’s Report<br />

106 Group Income Statement<br />

107 Group Statement of<br />

Comprehensive Income<br />

108 Group Balance Sheet<br />

109 Group Statement of Changes in Equity<br />

110 Group Statement of Cash Flows<br />

111 Notes to the Consolidated Accounts<br />

172 Company Balance Sheet<br />

173 Notes to the Company Accounts<br />

Additional Information<br />

186 Shareholder information<br />

187 Dividends and financial calendar<br />

188 Glossary<br />

190 Five Year Summary<br />

191 Corporate information<br />

Group revenue (£m)<br />

£1,919.8m<br />

Free cash flow* (£m)<br />

£111.0m<br />

2013<br />

1,891.3 2013<br />

2014<br />

1,867.4 2014<br />

2015 1,919.8 2015<br />

111.0<br />

ROCE* (%)<br />

11.7%<br />

Operating profit* (£m)<br />

£193.5m<br />

167.1<br />

164.8<br />

2013<br />

10.8<br />

2013<br />

177.2<br />

2014<br />

10.7<br />

2014<br />

167.6<br />

2015 11.7 2015<br />

193.5<br />

Dividend per share (p)<br />

11.33p<br />

2013<br />

2014<br />

10.0<br />

10.3<br />

11.33<br />

Operating margin* (%)<br />

10.1%<br />

9.4<br />

9.0<br />

2015 2015<br />

10.1<br />

* Historical results restated to adjust for the impact of Rail and Middle East bid costs previously treated as exceptional items.<br />

Summary of results 2015<br />

2013<br />

2014<br />

Normalised basis<br />

2015<br />

£m<br />

2014<br />

£m<br />

2015<br />

£m<br />

IFRS basis<br />

Revenue 1,919.8 1,867.4 1,919.8 1,867.4<br />

Operating profit 193.5 167.6 167.8 114.2<br />

Profit before tax 150.1 119.9 124.4 66.5<br />

Profit for the year 121.6 98.1 109.1 60.6<br />

Basic earnings per share (pence) 23.4 18.9 20.9 11.6<br />

Net debt 745.5 664.3 745.5 664.3<br />

2014<br />

£m<br />

FINANCIAL<br />

STATEMENTS<br />

ADDITIONAL<br />

INFORMATION<br />

www.nationalexpressgroup.com<br />

1