20312_circle_ara15_150807_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

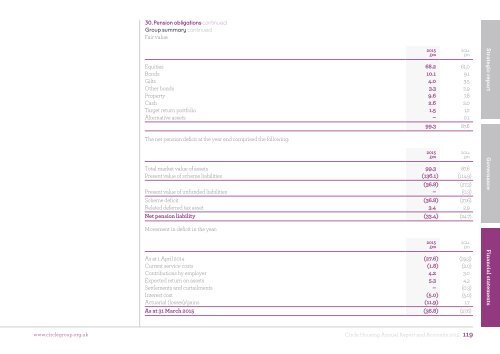

30. Pension obligations continued<br />

Group summary continued<br />

Fair value:<br />

Equities 68.2 61.0<br />

Bonds 10.1 9.1<br />

Gilts 4.0 3.5<br />

Other bonds 3.3 2.9<br />

Property 9.6 7.8<br />

Cash 2.6 2.0<br />

Target return portfolio 1.5 1.2<br />

Alternative assets – 0.1<br />

99.3 87.6<br />

The net pension deficit at the year end comprised the following:<br />

Total market value of assets 99.3 87.6<br />

Present value of scheme liabilities (136.1) (114.9)<br />

(36.8) (27.3)<br />

Present value of unfunded liabilities – (0.3)<br />

Scheme deficit (36.8) (27.6)<br />

Related deferred tax asset 3.4 2.9<br />

Net pension liability (33.4) (24.7)<br />

Movement in deficit in the year:<br />

As at 1 April 2014 (27.6) (29.3)<br />

Current service costs (1.8) (2.0)<br />

Contributions by employer 4.2 3.0<br />

Expected return on assets 5.3 4.3<br />

Settlements and curtailments – (0.3)<br />

Interest cost (5.0) (5.0)<br />

Actuarial (losses)/gains (11.9) 1.7<br />

As at 31 March 2015 (36.8) (27.6)<br />

2015<br />

£m<br />

2015<br />

£m<br />

2015<br />

£m<br />

2014<br />

£m<br />

2014<br />

£m<br />

2014<br />

£m<br />

Strategic report Governance Financial statements<br />

www.<strong>circle</strong>group.org.uk<br />

Circle Housing Annual Report and Accounts 2015 119