20312_circle_ara15_150807_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

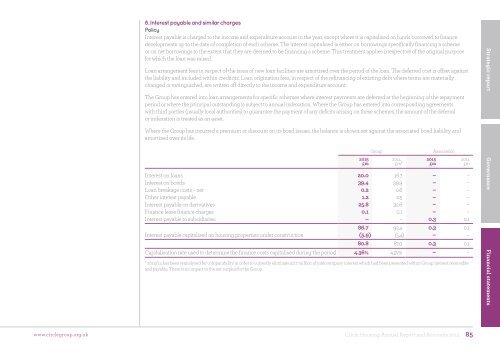

8. Interest payable and similar charges<br />

Policy<br />

Interest payable is charged to the income and expenditure account in the year, except where it is capitalised on funds borrowed to finance<br />

developments up to the date of completion of each scheme. The interest capitalised is either on borrowings specifically financing a scheme<br />

or on net borrowings to the extent that they are deemed to be financing a scheme. This treatment applies irrespective of the original purpose<br />

for which the loan was raised.<br />

Loan arrangement fees in respect of the issue of new loan facilities are amortised over the period of the loan. The deferred cost is offset against<br />

the liability and included within creditors. Loan origination fees, in respect of the refinancing of existing debt where terms are materially<br />

changed or extinguished, are written off directly to the income and expenditure account.<br />

The Group has entered into loan arrangements for specific schemes where interest payments are deferred at the beginning of the repayment<br />

period or where the principal outstanding is subject to annual indexation. Where the Group has entered into corresponding agreements<br />

with third parties (usually local authorities) to guarantee the payment of any deficits arising on these schemes, the amount of the deferral<br />

or indexation is treated as an asset.<br />

Where the Group has incurred a premium or discount on its bond issues, the balance is shown net against the associated bond liability and<br />

amortised over its life.<br />

Group<br />

2015<br />

£m<br />

2014<br />

£m*<br />

Association<br />

2015<br />

£m<br />

Interest on loans 20.0 16.7 – –<br />

Interest on bonds 39.4 39.9 – –<br />

Loan breakage costs – net 0.2 0.6 – –<br />

Other interest payable 1.2 2.5 – –<br />

Interest payable on derivatives 25.8 32.6 – –<br />

Finance lease finance charges 0.1 0.1 – –<br />

Interest payable to subsidiaries – – 0.3 0.1<br />

86.7 92.4 0.3 0.1<br />

Interest payable capitalised on housing properties under construction (5.9) (5.4) – –<br />

80.8 87.0 0.3 0.1<br />

Capitalisation rate used to determine the finance costs capitalised during the period 4.36% 4.97% – –<br />

* 2013/14 has been reanalysed for comparability in order to correctly eliminate £3.7 million of intercompany interest which had been presented within Group interest receivable<br />

and payable. There is no impact to the net surplus for the Group.<br />

2014<br />

£m<br />

Strategic report Governance Financial statements<br />

www.<strong>circle</strong>group.org.uk<br />

Circle Housing Annual Report and Accounts 2015 85