- Page 1 and 2: Helvetia Group Annual Report 2010

- Page 3: Contents 4 Letter to Shareholders C

- Page 7 and 8: 2010 also saw the conclusion of the

- Page 10 and 11: Helvetia Group‘s ambition is to s

- Page 12 and 13: Company profile › Board of Direct

- Page 14 and 15: Company profile › Board of Direct

- Page 16 and 17: Company profile › Executive Manag

- Page 18 and 19: The Executive Management (from left

- Page 20 and 21: Company profile › Executive Manag

- Page 22 and 23: Company profile › Group strategy

- Page 24 and 25: Company profile › Group structure

- Page 26: Helvetia‘s success is driven by t

- Page 29 and 30: In individual life, the broad range

- Page 31 and 32: The risk management process and the

- Page 33 and 34: Investment management Helvetia purs

- Page 35 and 36: “We support your development” G

- Page 37: Social responsibility Part of Helve

- Page 40 and 41: Helvetia is committed to responsibl

- Page 42 and 43: Governance › Corporate governance

- Page 44 and 45: Governance › Corporate governance

- Page 46 and 47: Governance › Corporate governance

- Page 48 and 49: Governance › Corporate governance

- Page 50 and 51: Governance › Corporate governance

- Page 52 and 53: Governance › Corporate governance

- Page 54 and 55:

Governance › Compensation report

- Page 56 and 57:

Governance › Compensation report

- Page 58:

Helvetia makes life easy for broker

- Page 61 and 62:

Business development 60 Group resul

- Page 63 and 64:

which was fully consolidated for a

- Page 65 and 66:

Combined Ratio in % Gruppe Group Di

- Page 67 and 68:

Business units The business units o

- Page 69 and 70:

Life business shows dynamic growth

- Page 71 and 72:

field with a strong growth rate of

- Page 73 and 74:

Dynamic life insurance business Hel

- Page 75 and 76:

Assumed reinsurance The strong perf

- Page 78 and 79:

We communicate openly, comprehensib

- Page 80 and 81:

Investor information 78 Investor in

- Page 82 and 83:

Investor information In 2010 Helvet

- Page 85:

The opinion of every employee is im

- Page 88 and 89:

Financial report Consolidated incom

- Page 90 and 91:

Financial report Consolidated balan

- Page 92 and 93:

Financial report Consolidated state

- Page 94 and 95:

Financial report Consolidated Cash

- Page 96 and 97:

Financial report › General inform

- Page 98 and 99:

Financial report › Summary of sig

- Page 100 and 101:

Financial report › Summary of sig

- Page 102 and 103:

Financial report › Summary of sig

- Page 104 and 105:

Financial report › Summary of sig

- Page 106 and 107:

Financial report › Summary of sig

- Page 108 and 109:

Financial report › Summary of sig

- Page 110 and 111:

108 Notes to the Consolidated finan

- Page 112 and 113:

Financial report › Segment inform

- Page 114 and 115:

Financial report › Segment inform

- Page 116 and 117:

Financial report › Segment inform

- Page 118 and 119:

Financial report › Segment inform

- Page 120 and 121:

Financial report › Segment inform

- Page 122 and 123:

Financial report › Property and e

- Page 124 and 125:

Financial report › Goodwill and o

- Page 126 and 127:

Financial report › Investments 7.

- Page 128 and 129:

Financial report › Investments 7.

- Page 130 and 131:

Financial report › Investments 7.

- Page 132 and 133:

Financial report › Investments 7.

- Page 134 and 135:

Financial report › Investments 7.

- Page 136 and 137:

Financial report › Investments 7.

- Page 138 and 139:

Financial report › Financial liab

- Page 140 and 141:

Financial report › Financial liab

- Page 142 and 143:

Financial report › Insurance busi

- Page 144 and 145:

Financial report › Insurance busi

- Page 146 and 147:

Financial report › Insurance busi

- Page 148 and 149:

Financial report › Income taxes 1

- Page 150 and 151:

Financial report › Income taxes 1

- Page 152 and 153:

Financial report › Equity 11.2 Re

- Page 154 and 155:

Financial report › Equity 11.2.5

- Page 156 and 157:

Financial report › Equity 11.7 Ca

- Page 158 and 159:

Financial report › Provisions and

- Page 160 and 161:

Financial report › Employee benef

- Page 162 and 163:

Financial report › Employee benef

- Page 164 and 165:

Financial report › Share-based pa

- Page 166 and 167:

Financial report › Related party

- Page 168 and 169:

Financial report › Compensation p

- Page 170 and 171:

Financial report › Compensation p

- Page 172 and 173:

Financial report › Risk managemen

- Page 174 and 175:

Financial report › Risk managemen

- Page 176 and 177:

Financial report › Risk managemen

- Page 178 and 179:

Financial report › Risk managemen

- Page 180 and 181:

Financial report › Risk managemen

- Page 182 and 183:

Financial report › Risk managemen

- Page 184 and 185:

Financial report › Risk managemen

- Page 186 and 187:

Financial report › Risk managemen

- Page 188 and 189:

Financial report › Risk managemen

- Page 190 and 191:

Financial report › Risk managemen

- Page 192 and 193:

Financial report › Events after t

- Page 194 and 195:

Financial report › Scope of conso

- Page 196 and 197:

Financial report › Scope of conso

- Page 198:

Financial report › Report of the

- Page 202 and 203:

Financial report 200 Financial stat

- Page 204 and 205:

Financial report 202 6. Additional

- Page 206 and 207:

Financial report › Report of the

- Page 208 and 209:

Financial reportt › Kapiteltitel

- Page 211 and 212:

Embedded value 210 Embedded value

- Page 213 and 214:

in CHF million Embedded value after

- Page 215 and 216:

Service 214 Glossary 217 Important

- Page 217 and 218:

account of changes in proportional

- Page 219 and 220:

Important addresses Group Head Offi

- Page 221 and 222:

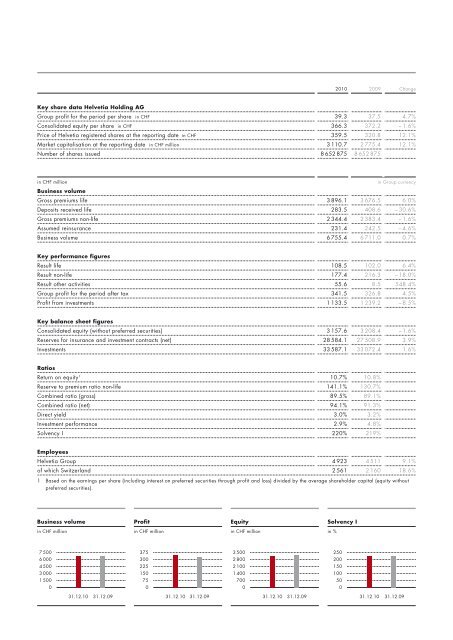

Multi-year overview Key share data

- Page 223 and 224:

Photo captions Cover photo Helvetia